On the first day of March 23rd, leading EV manufacturer Lingzhi announced the annual versions of its three models and their prices during a new product release conference. At the same conference, the Lingzhi C11 extended range version was launched. The changes to the products themselves were not significant, but the way Lingzhi conveyed its intention to engage in a price war was by lowering prices.

Three pure EV models have been significantly discounted

Since 2022, with the continuous increase in the price of battery raw materials, car companies have been forced to raise the price of their pure EV products. With the reduction of national subsidies for pure EVs in 2023, Lingzhi also raised prices.

C11 price after adjusting in 2022

For Lingzhi, whether it is the A00 level T03 or the medium-sized SUV C11, the price has risen significantly. With the stabilization of battery prices in recent times and the price cuts of the Tesla Model 3/Y, Lingzhi was caught off guard by its competitors of the same level.

Therefore, the first thing Lingzhi did in the pure EV market in 2023 was to lower prices across the board and re-establish its reputation for good value.

Lingzhi T03

The 2023 Lingzhi T03 has four configurations with three battery capacities priced at RMB 59,900 – RMB 89,900.

The new versions include a more entry-level 200 km range version and a 310 km version, equipped with 21.6 kWh and 31.9 kWh lithium iron phosphate batteries, respectively. The 403 km version remains unchanged with a 41.3 kWh battery. Looking back, a T03 equipped with a 40 kWh lithium-ion battery could be purchased for RMB 70,000. That era has passed.

In terms of motor, the 200 km range version is only equipped with a 40 kW motor, targeting daily commuting. The 310 km version has slightly improved to 55 kW, and the 403 km version still uses 80 kW. It is worth mentioning that only the two versions of 403 km have DC fast charging.

In terms of motor, the 200 km range version is only equipped with a 40 kW motor, targeting daily commuting. The 310 km version has slightly improved to 55 kW, and the 403 km version still uses 80 kW. It is worth mentioning that only the two versions of 403 km have DC fast charging.

In addition, the positioning of the LI T03 is more inclined towards the female market, with the addition of glacier blue, sky black, and a 15-inch wheel hub. The interior also has two new pink color schemes, which are more pleasing.

Therefore, the 23 models of the LI T03 have officially returned to the range of 60,000 yuan, and the lowest configuration version uses a 21.6 kWh battery and a 40 kW motor to compete with hatchback cars such as the Baojun KiWi and Wuling Air. It is more for commuting, but driving it is a serious car, using this differentiation to further increase the sales volume of the T03.

Since its launch, the T03 has always been LI’s flagship product, but LI does not think so. The higher-end C11 and C01 are the ones with high expectations, so let’s take a look at C11 next.

LI C11

The 23 C11 models are priced between RMB 155,800 and RMB 219,800, almost returning to the price when the C11 was first released in 2021, and it feels like sincerity has returned.

Prices for the 23 models

Launch prices

The mid-to-low range has a range of 500 km, a battery capacity of 69.2 kWh, and the material is lithium iron phosphate. The 89.55 kWh three-element lithium battery is only available on two high-end models.

The changes to the C11 in 23 models are mainly focused on the wheel hub color matching. Three new gray-black toned 20-inch wheel hubs have been added, as well as an update to the entry-level 18-inch wheel hub style.

The most popular continuous light strip is also here. The details of the cockpit have also been updated accordingly, following the C01. Changed to the same model seats as CO1, rear touch buttons, 3.0 cockpit system, etc.

At the same time, the sales price of the extended-range version of the C11 remains the same as the pre-sale price and is officially launched, with a price range of 149,800 to 185,800 yuan.

The range extender uses a 1.2T range extender from Dongan Power, which is the same company that supplies the 1.2T three-cylinder range extender on the LI ONE. The maximum net power of this range extender on the ORA Black Cat C11 is 96 kW, and the maximum speed is 5,500 rpm. The parameters are exactly the same as those of the LI ONE.

According to ORA’s official claim, the C11 has a WLTC-rated all-electric mileage consumption of 6.8L per 100 kilometers and can be fueled with 92 gasoline, while the electricity consumption is 19.7 kWh per 100 kilometers.

As for why ORA chose to develop a range-extender, Zhu Jiangming gave his answer: “Only 3.4% of the 160,000 ORA car owners drive at speeds above 80 km/h, and even micro cars like T03 cars also have 10%; more than 68% of users drive less than 50 km per day, and about 70% of users have home charging.”

The extended-range version of the C11 with a pure electric range of 180 km and 285 km can meet the needs of most users. Moreover, compared with the pure electric version, it can effectively control the cost of batteries. In terms of strategic layout, the C11 extended-range version is expected to be delivered in mid-March, and the C01 extended-range version will be delivered in July and August. The B series of pure electric products will be launched at the Munich Motor Show in mid-2022.

To be honest, if we only look at the pre-sale price of the C11 extended-range version of 159,800 to 200,000 yuan, it is very competitive. Putting aside brand factors, the size and level of the battery, and the chassis material of the C11 are all more advantageous than BYD Song PLUS DM-i, and it is also currently the cheapest extended-range product.

However, sales cannot be determined solely based on configurations, and efforts are needed in terms of brand establishment, maintenance, and other aspects. The C11 extended-range version will inject new vitality into the sales of Zero Run.

Zero Run C01

Finally, the price of the 23 models of the C01 ranges from 149,800 yuan to 228,800 yuan. The price reduction of the 23 models of the C01 is very drastic, compared with the 22 models’ price range of 193,800 yuan to 286,800 yuan, it can be said to have experienced a cliff-like drop.

23 models’ prices

21 models’ prices

At this point, Zero Run has also entered the price range of 150,000 yuan for mid to large-sized pure electric models, directly competing with mid-size cars. Finally, the cost-effectiveness has returned. Since the launch of the C01 is not long, the overall configuration remains largely unchanged.

Media group interview

After the launch event, Zero Run Technology founder and chairman Zhu Jiangming, Zero Run Auto Senior Vice President Cao Li, and Zero Run Auto Marketing Department General Manager Zhou Ying held a media group interview on the launch of 23 models and the price reduction.

Q: Hello, Mr. Zhu. Just now, the new products of the 2023 Zero Run car have all been officially discounted. After the official discount, does Zero Run have any rights and measures for old users?

Zhou Ying: So with regard to the entire product upgrade of the 2023 models, we have also provided new benefits to the old car owners, especially those who have recently received their cars. First of all, for C01, we will give 20,000 energy points to those car owners who have been receiving their cars from September last year until October 7th.

In addition, for the C01 car owners who have already been delivered this year, they will be given the lifetime quality assurance for the whole car. At the same time, for the car owners who have received the T03 and C11 models in January and February this year, they will also be given the lifetime quality assurance for the whole car. This is also the greatest sincerity Zero Run shows to the old car owners.

Q: With a focus on extreme cost-effectiveness, will it put pressure on the overall upward trend of the brand in the future?

Zhu Jiangming: In the future, we understand that the price range of 150,000 to 200,000 yuan belongs to an important segment, where fuel and electric vehicles will be the same price. So the next segment is the same, this is not a very low price, which also includes 100,000 yuan and below, as well as small cars, the range of A-class cars from 100,000 to 150,000 yuan, and the segment between A and B in the future, whether it is fuel or electric cars, will be from 150,000 to 200,000 yuan.

Q: What is Zero Run Auto’s sales target for this year?

Zhu Jiangming: Now that we are a listed company, it is not convenient to disclose our plans. We sold 8,000 cars in 2020, 43,000 cars in 2021, and 110,000 cars in 2022. I think we must have significant growth this year at least.Q: What is our choice when we need to focus on both quantity and profit?

Zhu Jiangming: For a company, in a growing market like this, quantity is undoubtedly more important. The first goal is to ensure that you have a market share. Of course, we also need to pursue less loss. So far, LI has the least amount of losses in this aspect. We have a history of seven or eight years in entrepreneurship. Among the new forces in car manufacturing, LI has spent the least amount of money and has the least amount of losses.

Q: In 2023, we need to continue optimizing costs. Could you please give us some strategies on cost optimization?

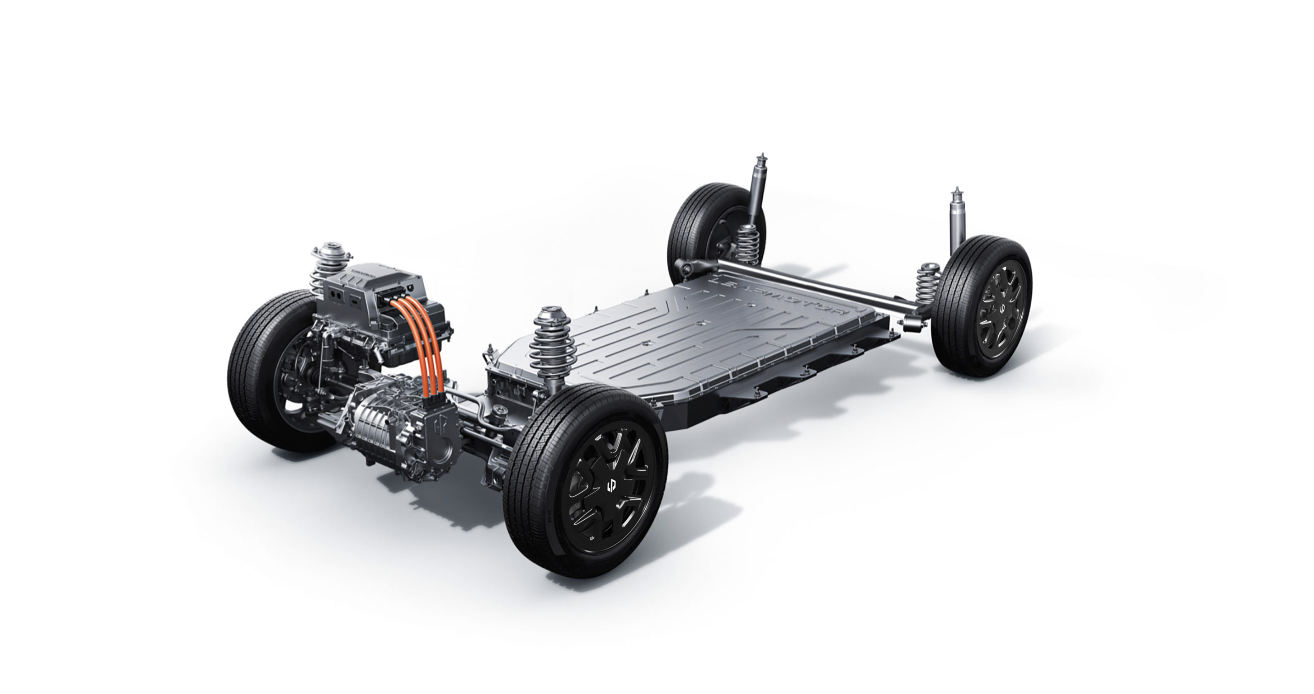

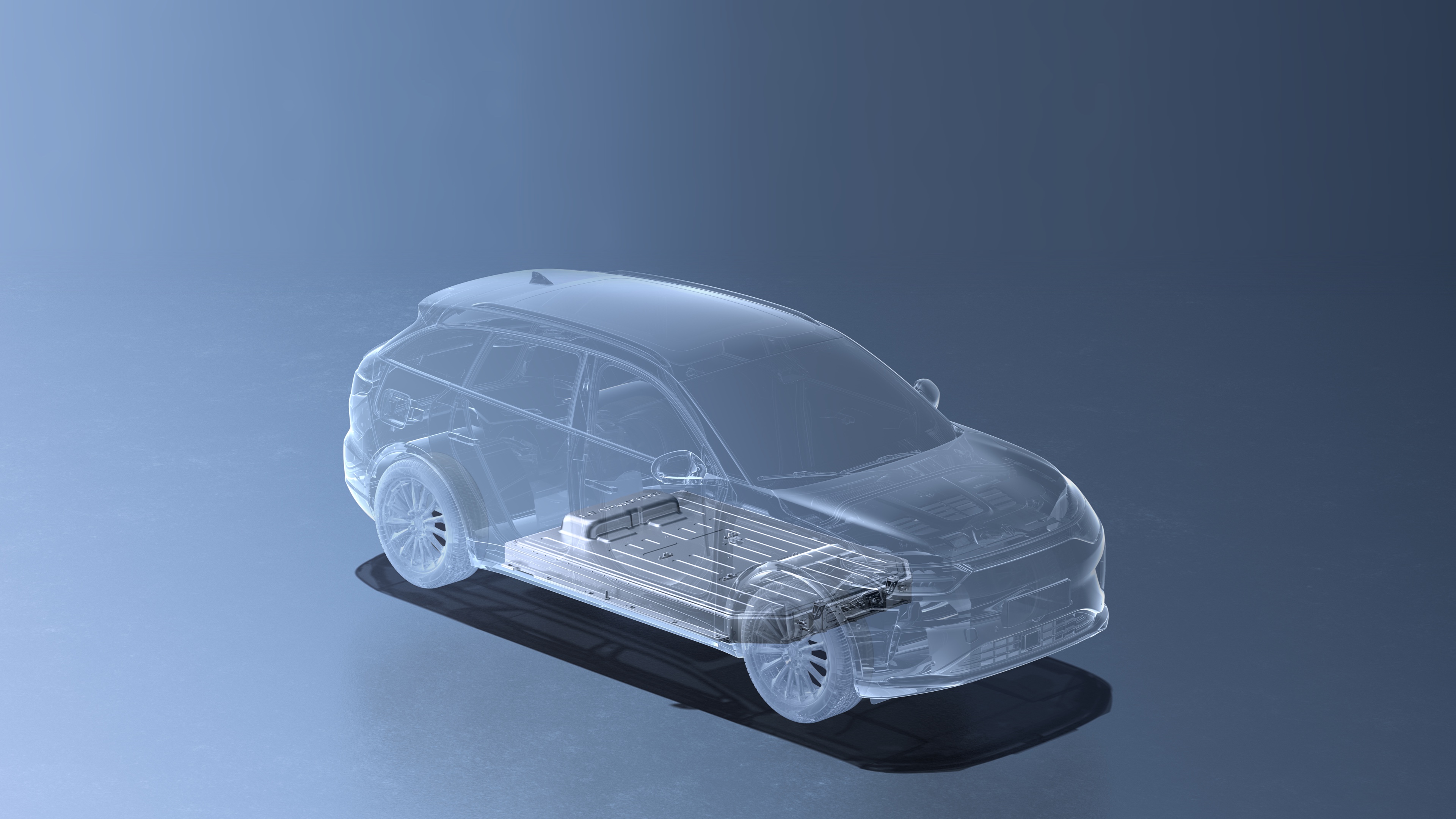

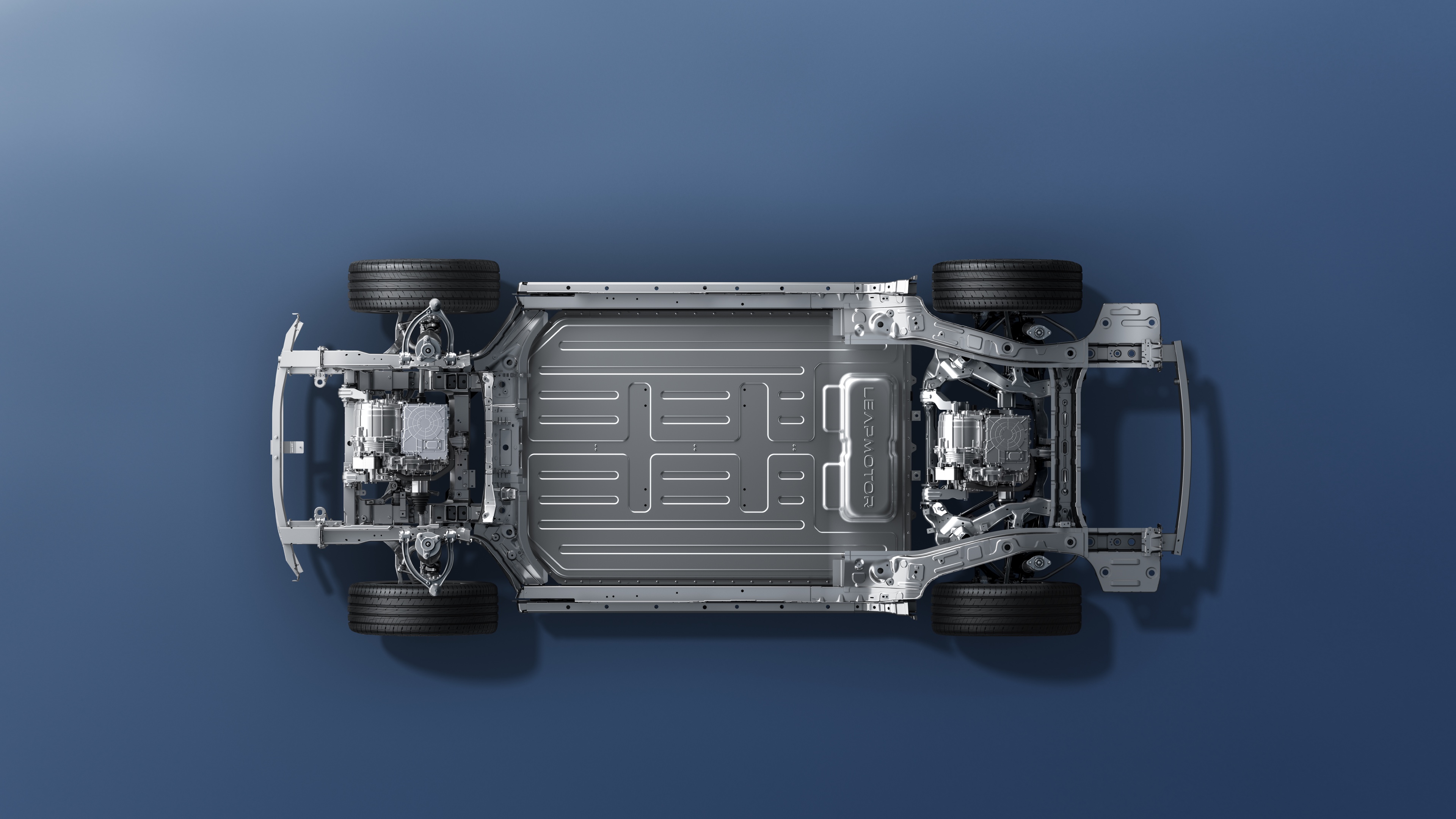

Zhu Jiangming: In the future, as we scale up, our cost advantage will become more and more prominent. For example, our cockpit will only have one platform in the future, even if we have ABC several product series. The same is true for our electric drive, and the entire architecture of the CTC battery is also platformized. All of these can bring cost reduction of scale effects in the future.

Q: There are many cars with a range of around 300,000 RMB, such as the Arcfox M5 and a new extended-range version of a Changan car that costs less than 200,000 RMB. What is your evaluation of these two cars?

Cao Li: Just now, we mentioned the M5 and Changan products. From the perspective of vehicle differentiation, we still have many of our own advantages in terms of the extended-range. Of course, these two products are also very good products, which cannot be denied, because they have been recognized by many users.

In terms of differentiation, such as our space and intelligentization, we can quickly iterate and develop to meet user needs. And the most intuitive advantage is that the price of M5 is nearly 30% higher than that of C11. Taking these advantages together, I think we still have the confidence to face direct competition with them.

Conclusion

The entry-level prices of 23 LI C01 and C11 pure electric versions have dropped to around 150,000 RMB. One is a mid-size SUV, and the other is a C sedan. This raises doubts about whether LI is betting that lithium battery prices will fall in the future and is exchanging market share for price.

In addition, the price of the LINGPAI C11 extended range version is also very competitive, ranging from RMB 149,800 to RMB 185,800. The base model comes with a 30.1 kWh battery and the high-end model has a 43.7 kWh battery. It would be great if they could deliver the car before the policy change in Shanghai.

In addition, the price of the LINGPAI C11 extended range version is also very competitive, ranging from RMB 149,800 to RMB 185,800. The base model comes with a 30.1 kWh battery and the high-end model has a 43.7 kWh battery. It would be great if they could deliver the car before the policy change in Shanghai.

However, there is no problem as the current price competitiveness is too strong, and BYD and Bluepark S7 are likely to feel the pressure. At the same time, LINGPAI has a good expectation for hybrid growth as well.

In addition to the current four products, LINGPAI will also launch an A-class compact car, which is the main city commuter with a range of 400-500 km. In the second half of the year, they will release their B product line and will subsequently launch two power forms, extended range and pure electric. The specific models will be mostly SUVs and sedans on the same platform, even cross-border vehicles.

Finally, let’s turn back to the sales volume. The price increase in 2022 has affected LINGPAI’s sales volume, which has become tepid, and with the reduction of government subsidy in 2023, LINGPAI’s sales volume seems to have faded from everyone’s view.

With the release of the 2023 models, LINGPAI, whose prices have almost collectively dropped, seems to have once again reinforced its cost-effectiveness label. This round of price cuts has become the key to whether sales can achieve a rapid recovery.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.