Author: Tao Yanyan

Editor’s Note: The article “The Basic Trends of Global Automotive Chips” from two days ago is our preface to the intelligent automotive chip manufacturers. Today we start with the first one, Infineon, a traditional giant.

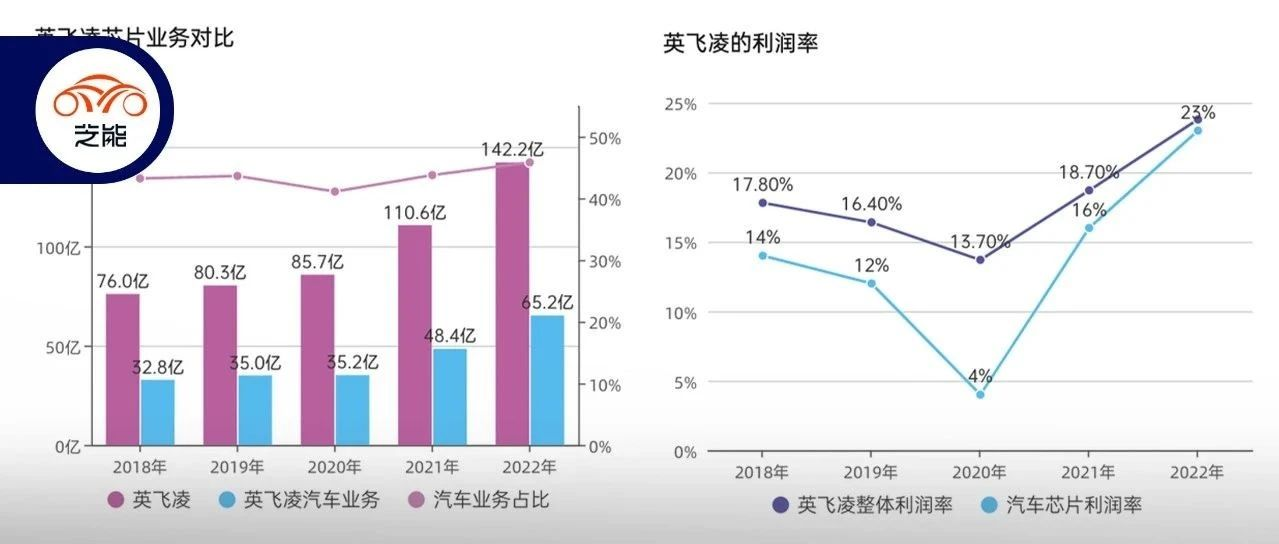

Infineon’s Q4 revenue in 2022 was 3.95 billion euros, a 5% decrease compared to the previous quarter. This may also signify the turning point of the revenue of most chip companies (the memory ones have already taken a hit). Meanwhile, Infineon’s revenue in 2022 was 14.22 billion euros, with the automotive business revenue being 6.52 billion euros, which is a very high number. At present, the proportion of the automotive business is 45%.

Looking at the global macro economy in 2023, there are uncertainties, and the weak consumer application demand is also lowering the demand. However, the automotive department’s production capacity has sold out for the fiscal year 2023. Of course, this is normal as it has more than doubled from 7.6 billion euros in 2018. Also, the automotive chip revenue has increased from 3.28 billion euros in 2018 to the current 6.52 billion euros.

From the perspective of the entire industry, Infineon is indeed a power semiconductor company that focuses on automotive and industrial applications. As mentioned in “The Basic Trends of Global Automotive Chips,” Infineon is the leader in the automotive chip field.

Infineon’s Business Structure

Looking at the automotive product line, Infineon’s business structure includes:

- Automotive (ATV) 45%. From the product line perspective, power semiconductors account for more than half, while automotive logic and connectivity account for more than 30%.

- Industrial Power Control (IPC). This is purely a power semiconductor product.## English Translation in Markdown Format with HTML tags

The Power Management System (PSS) is also based on power.

The Connectivity and Security System (CSS) is centered around the embedded departments.

Essentially, Infineon’s business growth is still focused on the expansion of power semiconductors, in other words, the infiltration and promotion of semiconductor demand in the field of electrical and new energy around the world.

Infineon’s growth has indeed positioned itself well in the major track, and has cooperated with the rapid growth of demand.

The driving force for growth comes from: the electrification of cars, demand for renewable energy, ADAS, and the growth of data centers and IoT.

The traditional market mainly consists of: body power semiconductors, conventional powertrain, chassis, and safety.

This time, Infineon has placed a heavy emphasis on SiC business growth, including:

In the automobile industry: global automotive companies are deploying around the 800V system.

Starting to use extensively in charging stations and power supply.

However, from the current perspective, Infineon’s competitive position in the field of silicon carbide is far less profound than that of IGBT. For example, players like ST are running ahead, and Rohm and Onsemi have also emerged. At this stage, the market indeed has a great deal of variation.

## Automotive Electronics

## Automotive Electronics

After the advancement in the intelligence and electrification of automobiles, one visible change is the increase in demand for chips. Infineon’s business in automotive chips is half in power semiconductors, and others include MCUs, storage, and perception chips. Looking at 2023, there are several risks:

◎The overall scale of the automobile is limited.

◎Electrification rate continues to increase.

◎The demand for chips brought by L1 active safety and L2+ is still considerable.

It is the driving effect of power semiconductors that has given Infineon an advantage over its competitors in this field. However, objectively speaking, whether it is a sensor or an MCU, the increase in value for the next generation of intelligent cars is limited.

We understand that the business scale of MCUs may not shrink particularly, but the overall demand will shift from low- and mid-performance MCUs to high-performance MCUs with more computing power. In intelligent cars, the perception and execution nodes do not require as many general-purpose MCUs, and a more likely path is the regional path. In this regard, we can conduct realistic thinking, especially to analyze and judge the demand for Zonal controllers under the Zonal architecture.

As the level of automobile modularization continues to improve, the strategy of selling the entire technical solution may indeed be effective.

“`

“`

Summary: Infineon, the automotive chip company, has indeed made great progress in the past few years. However, we also see that 55% of the achievements are concentrated in power semiconductors. With so many Chinese companies and funds entering the SiC field, including domestication of power semiconductors, long-term impacts objectively exist. With the changes of EE architecture, new computing core units revolve around Qualcomm, Nvidia, and AMD, which has created a gap between them and traditional automotive MCU enterprises. We need to continue to pay attention to the product matrices of these traditional automotive chip companies and think about their transformation and changes.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.