Today, Ideal Automotive released its Q4 and full-year 2022 financial report. Let’s take a look together.

Profit Data

-

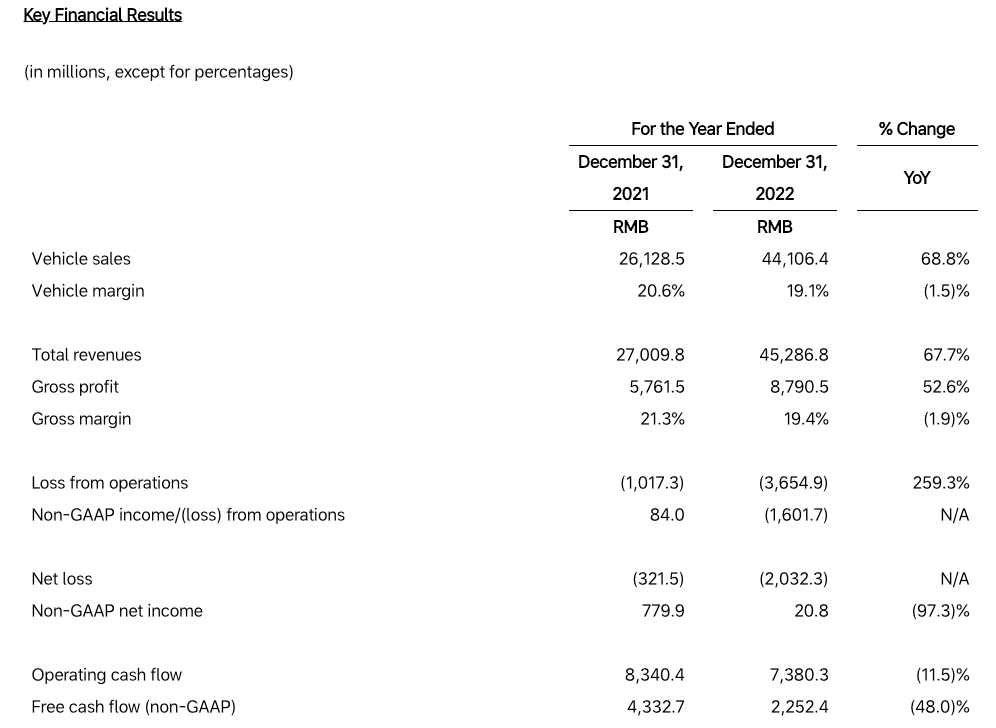

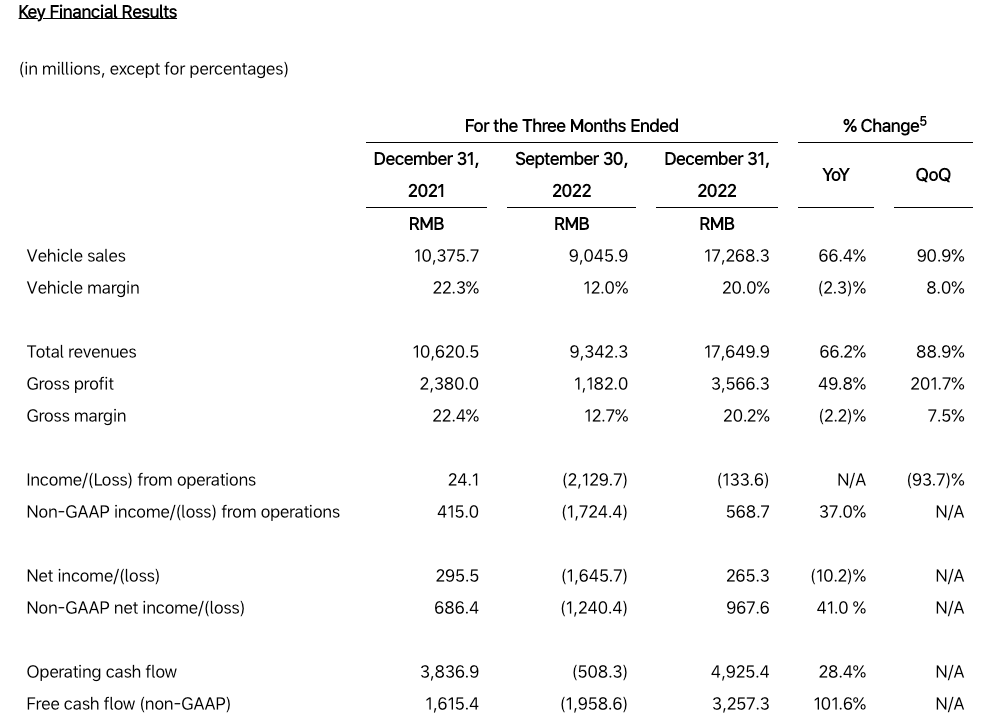

Ideal Automotive achieved a total revenue of CNY 45.29 billion for the full year, a year-on-year increase of 67.7%, with vehicle sales revenue of CNY 44.11 billion, a year-on-year increase of 68.8%; Revenue for the fourth quarter of 2022 was CNY 17.65 billion, a year-on-year increase of 66.2%, with vehicle sales revenue of CNY 17.27 billion, a year-on-year increase of 66.4%, and a quarter-on-quarter increase of 90.9%;

-

The total gross profit for the full year was CNY 8.79 billion, a year-on-year increase of 52.6%. The total gross profit for the fourth quarter was CNY 3.57 billion, a year-on-year increase of 49.8% and a quarter-on-quarter increase of 201.7%;

-

The gross profit margin for the full year reached 19.4%, a year-on-year decrease of 1.9%. The gross profit margin for the fourth quarter was 20.2%, a year-on-year decrease of 2.2% compared with the same period last year and an increase of 7.5% quarter-on-quarter;

-

The operating loss for the full year was CNY 3.65 billion, a year-on-year increase of 259.3%. The operating loss for the fourth quarter was CNY 0.13 billion, a significant decrease from the previous quarter’s loss of CNY 2.13 billion, a quarter-on-quarter decrease of 93.7%;

-

The non-GAAP operating loss for the full year was CNY 1.6 billion, and for the fourth quarter, the non-GAAP operating income was CNY 0.57 billion, a significant increase from the previous quarter’s loss of CNY 1.72 billion, a year-on-year increase of 37%;

-

The net loss for the full year was CNY 2.03 billion, a considerable increase from last year’s CNY 0.32 billion. The net income for the fourth quarter was CNY 0.265 billion, a year-on-year decrease of 10.2%, but a significant increase from the previous quarter’s loss of CNY 1.65 billion.

-

Non-GAAP net income for the full year was CNY 0.02 billion, a year-on-year decrease of 97.3%. Non-GAAP net income for the fourth quarter was CNY 0.97 billion, a year-on-year increase of 41% and a significant increase from the previous quarter’s loss of CNY 1.24 billion.

# Cash Data

# Cash Data

- The full-year operating cash flow was RMB 7.38 billion, a year-on-year decrease of 11.5%. The operating cash flow in the fourth quarter was RMB 4.93 billion, a year-on-year increase of 28.4%. Compared with the previous quarter, it increased significantly by RMB 0.51 billion.

- The full-year free cash flow was RMB 2.25 billion, a year-on-year decrease of 48%. The operating cash flow in the fourth quarter was RMB 3.26 billion, a year-on-year increase of 101.6%. Compared with the previous quarter, it increased significantly by RMB 1.96 billion.

- As of December 31, 2022, the company’s cash reserve was RMB 58.45 billion; of which cash and cash equivalents were RMB 38.48 billion, an increase of 38.2% year-on-year compared with RMB 27.85 billion last year.

[Image]

Other Data

The full-year R&D investment of Li Auto reached RMB 6.78 billion, a year-on-year increase of 106.3%; R&D investment in the fourth quarter reached RMB 2.07 billion, a year-on-year increase of 68.3%, and a quarter-on-quarter increase of 14.7%.

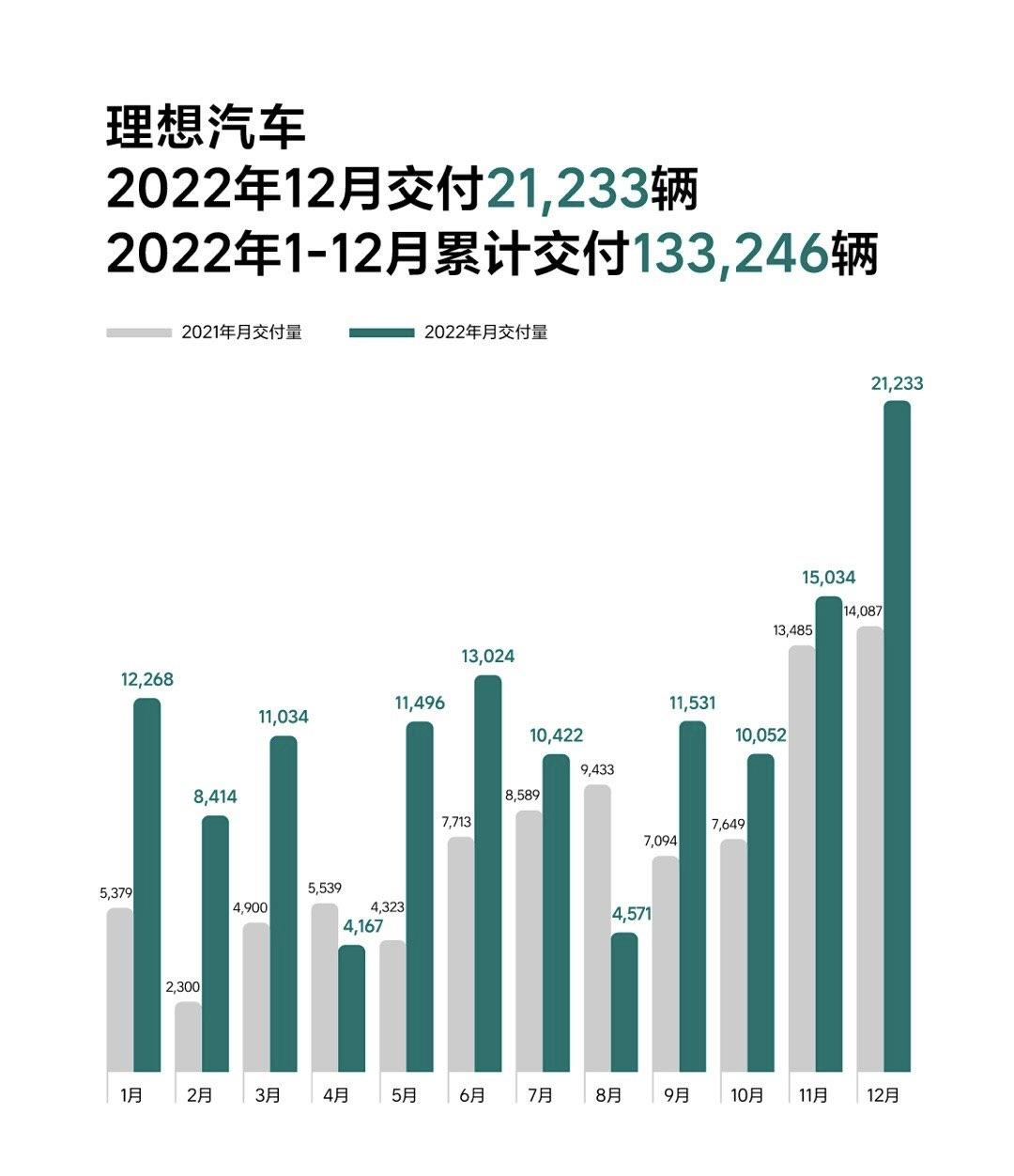

The delivery volume of Li Auto reached 133,246 units for the full year, a year-on-year increase of 47.2%; The delivery volume in the fourth quarter reached 46,319 units, a year-on-year increase of 31.5%.

From September 2022 to January 2023, Li Auto has delivered over 10,000 vehicles for five consecutive months. Among them, the delivery volume in December 2022 reached 21,233 units, breaking the record of the highest monthly delivery volume, and a year-on-year increase of 11.5%. Li Auto is also the first among the top three new forces to achieve a monthly delivery volume of over 20,000 units.

At the financial report meeting, Li Xiang stated that since September 2022, Li Auto L9 has maintained its leading position in the monthly sales chart of China’s large SUVs, while Li Auto L8 has also successfully taken over from Li ONE and won the sales champion of mid-size SUVs in December 2022.

### Translation

### Translation

For the outlook on the first quarter of 2023, Ideal Auto will challenge to capture 20% market share in the entire luxury SUV market between 300,000 and 500,000 yuan and is expected to achieve a delivery volume of 52,000 to 55,000 units, a year-on-year growth of 64.0% to 73.4%. The total revenue is expected to be between 17.45 billion yuan and 18.45 billion yuan, a year-on-year increase of 82.5% to 93.0%, once again refreshing the quarterly delivery guidance record.

In the future, Ideal will continue to independently develop both plug-in hybrid and high-voltage pure electric core technologies in parallel and continuously improve the intelligence level of products. In addition to R&D and investment in the industrial chain, as of January 31, 2023, Ideal Auto has 296 retail centers covering 123 cities nationwide, with 320 after-sales service centers and authorized body and spray centers covering 222 cities.

Regarding the development of advanced driving assistance, Li Xiang said at the financial report meeting that more than 220,000 household users could use the high-speed NOA function, and the high-speed NOA navigation assisted driving mileage is close to 100 million kilometers. Only during the Spring Festival period in 2023, the high-speed NOA driving mileage of all vehicle models has already approached 8 million kilometers.

This year, Basic will further expand its navigation assisted driving capabilities to urban areas, and plans to open the early bird user internal test of urban NOA on Ideal AD Max in the fourth quarter of this year.

Conclusion

Although the financial data of Ideal Auto for the whole year of 2022 was not excellent due to the impact of the epidemic over several months, with the gradual relaxation of epidemic policies in the fourth quarter and Ideal completing the transition from the ONE series to the L8 series, the fourth-quarter data of Ideal Auto is better than that of other quarters in 2022.

With the official release of the Ideal L7 series in February, once the L7 series has completed its production capacity ramp-up, it is probably not a big problem for Ideal to achieve a monthly delivery volume of more than 20,000 units again. With the end of the epidemic in 2023, Ideal is bound to present a better answer than in 2022.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.