Financial Information Summary

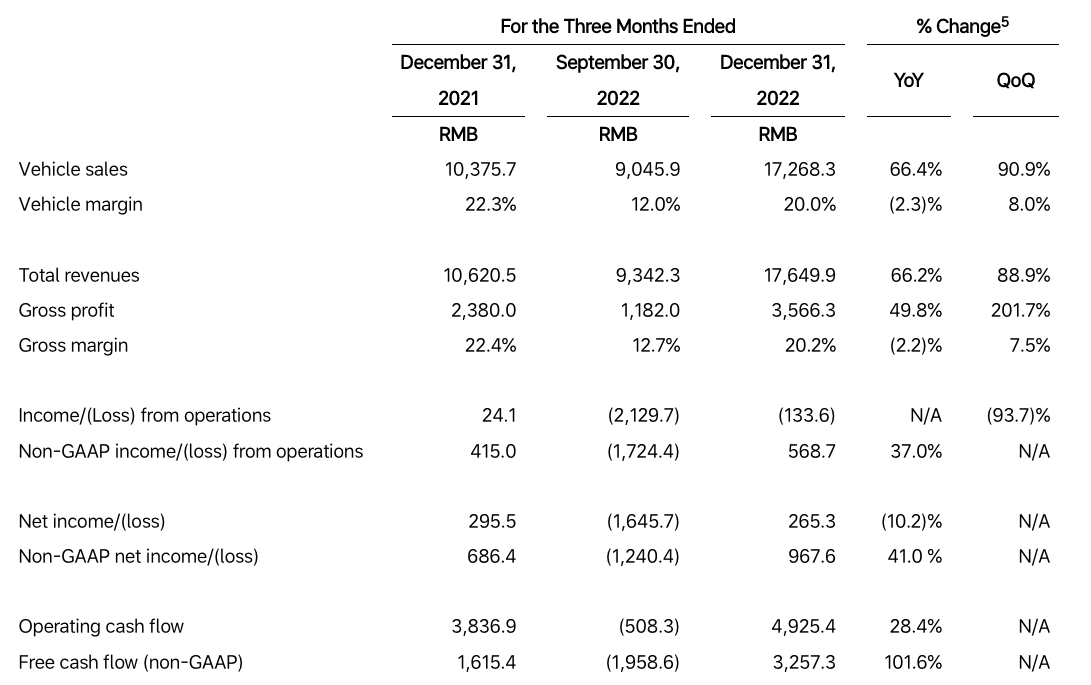

In the Ideal Q4 2022 financial report, the three most outstanding figures are operating cash flow of 4.925 billion yuan, free cash flow of 3.257 billion yuan, and net profit of 265 million yuan.

In 2022, under the pressure of COVID-19, shortage of parts supply, and soaring prices of battery raw materials, China’s new energy market, especially new car manufacturers, went through an unforgettable baptism.

“The greater the storm, the more expensive the fish.” The more difficult the situation, the more precious the good products.

In 2022, L9 and L8 were two big fish in the 300,000 to 500,000 market segment in China. These two family SUVs hardly have any horizontal competitors. They have helped Ideal to quickly emerge from the shadow of the pandemic in the later stage, opening up a new phase of development. Q4 2022 is the starting point of this phase.

Q4 2022: The best quarter in history

“The turning of loss into profit” is the keyword of Ideal’s Q4 2022 financial report, the most direct reason for which is the record-high delivery volume:

- A total of 46,319 vehicles were delivered in Q4 2022, a year-on-year increase of 31.5% and within the delivery guidance (45,000 to 48,000 vehicles);

- In December, 21,233 units were delivered, an increase of 50.7% year-on-year, making Ideal the first new force enterprise to achieve monthly sales exceeding 20,000 units;

- In December, both L9 and L8 achieved monthly deliveries exceeding 10,000 units.

When Ideal ONE was launched, Li Xiang, the founder, said more than once that Ideal’s product strategy was a “hot-selling strategy”. With the delivery of the L series, Ideal has completed the transition from single product hot selling to multi-product hot selling, and has not only achieved quarterly profits again, but the financial report also has multiple data reflecting this positive transformation. The following is a summary of the information for Q4 2022:

- Total revenue of 17.65 billion yuan, an increase of 66.2% year-on-year and 88.9% quarter-on-quarter.- Revenue from automotive business was RMB 17.27 billion, with a year-on-year growth of 66.4\% and a quarter-on-quarter growth of 90.9\%.

- Total gross profit was RMB 3.566 billion, with an overall gross margin of 20.2\% and a single vehicle gross margin of 20\%.

- Free cash flow was RMB 3.257 billion and operating cash flow was RMB 4.925 billion.

- Net profit was RMB 0.2653 billion.

- General sales and administrative expenses were RMB 1.63 billion, accounting for 9.2\% of total revenue.

- R&D investment was RMB 2.07 billion, accounting for 11.7\% of total revenue.

- Cash and cash equivalents (cash reserves) were RMB 58.45 billion.

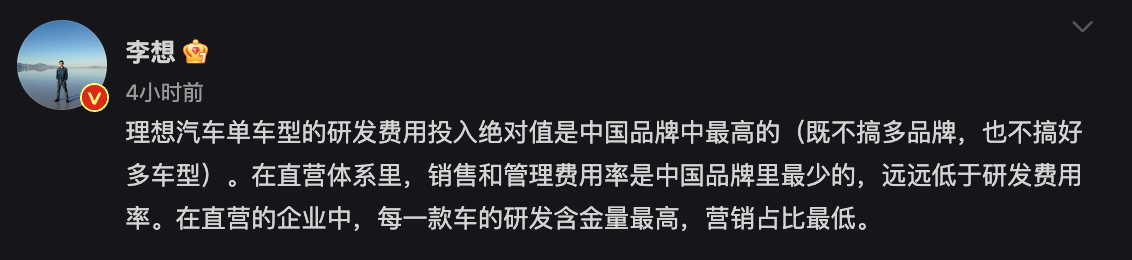

Regarding the key interpretation of Q4 financial report data, the CEO personally summarized it as “when allocated to the cost of the model, the sales and marketing ratio is the lowest, and the research and development ratio is the highest”. This is completely opposite to the ideal reputation in the current market and social media. It is hard to say who is right or wrong, but the CEO has financial data to support this claim.

The price reduction of the new generation of Ideal ONE directly affected the gross profit in Q3 2022, with a single vehicle gross profit of that quarter plummeting to 12\%. The single vehicle gross profit of Ideal will return to normal levels in Q4 2022 after the completion of the Ideal ONE and L series product upgrades, which is within expectations.

The increase in R&D expenses is mainly due to the increase in the Ideal product spectrum, as well as the increase in the number of personnel and corresponding salaries. As of December 31, 2022, the total number of Ideal employees was 19,396.

For comparison, NIO’s R&D investment in Q3 2022 was RMB 2.94 billion, XPeng was RMB 1.5 billion, and Tesla’s R&D investment in Q4 2022 was USD 800 million, or approximately RMB 6.96 billion.

As of January 31, 2023, the company has 296 retail stores covering 123 cities, in addition to 320 service centers and authorized Ideal Auto institutions and 222 authorized city body spray shops.

For reference, in January of this year, Tesla had 265 stores, and NIO had 393 stores.### 2022 Report: Normal but Reasonable

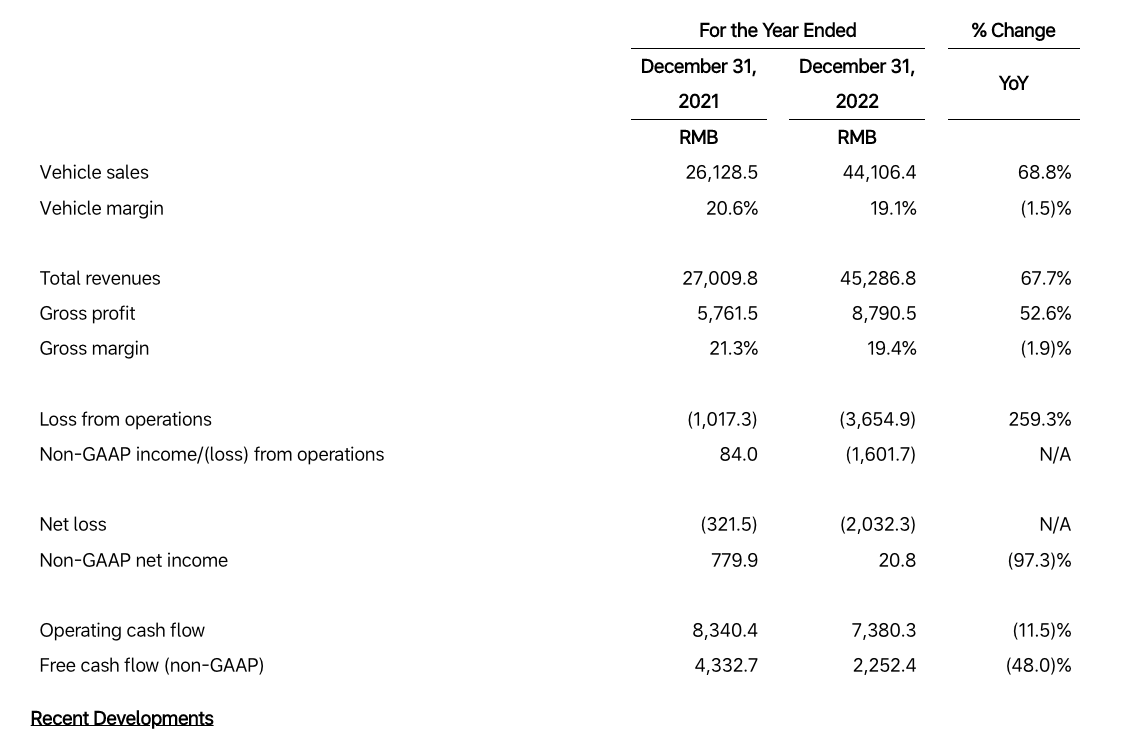

Next is the data for the entire year of 2022:

- Total revenue of 45.29 billion yuan, a year-on-year increase of 67.7%;

- Automotive revenue of 44.11 billion yuan, a year-on-year increase of 68.8%;

- A total of 133,246 vehicles were delivered in 2022, a year-on-year increase of 31.5%;

- Total gross profit of 8.79 billion yuan, with an overall gross margin of 19.4%, and a per vehicle gross margin of 19.1%;

- Free cash flow is 2.25 billion yuan;

- Net loss of 2.03 billion yuan;

- R&D investment was 6.78 billion yuan, accounting for 15% of total revenue;

- General sales and management expenses were 5.67 billion yuan, accounting for 12.5% of total revenue.

Despite the fact that the ideal gross margin for the whole year 2022 was below 20% due to the epidemic, it is still ahead of its peers by comparison.

For reference, NIO’s per vehicle gross margin was 16.4% in 2022Q3, XPeng’s was 11.6% in 2022Q3, and Tesla, the benchmark of the industry, had a per vehicle gross margin of 28.5% in the full year of 2022.

Regarding the significance of the gross margin of 20%, Li Xiang said in a previous interview:

The business model of manufacturing industry should have a gross margin of about 10 percentage points. For consumer goods, such as cars, a gross margin of 10 to 20 percentage points is already high. The third type is to become a technology company, for which you need a gross margin of over 20 percentage points to support research and development.

The financial report also disclosed the delivery guidance for 2023Q1 as usual:

- It is expected that the vehicle delivery volume for 2023Q1 will be between 52,000 and 55,000, a year-on-year increase of 64.0% to 73.4%;

- The total revenue is expected to be between 17.45 billion and 18.45 billion yuan, a year-on-year increase of 82.5% to 93.0%.

In the subsequent conference call, Li Xiang also indirectly disclosed the company’s sales target for 2023: to achieve a 20% market share of 300,000 to 500,000 SUVs in 2023, with an expected market size of 1.4 to 1.5 million, which means the ideal delivery target for 2023 is 280,000 to 300,000 vehicles.## Embracing the 100-Billion Revenue

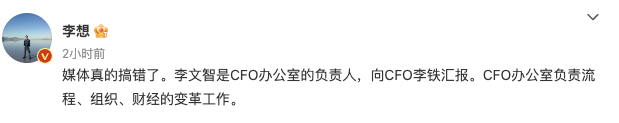

New phases of enterprise always come with corresponding organizational adjustments. On February 22nd, Li Xiang confirmed on Weibo that Li Wenzhi had joined as the head of the CFO Office at the Ideal Auto.

This employee with a strong background, who had been announced publicly by Li Xiang, was the former Global HRBP Managing Director at Huawei and one of the important builders of the Huawei organization system.

Last December, Ideal Auto conducted a new round of organizational restructuring, which was believed to be a necessary adjustment for the company to move towards 100 billion annual revenue.

After the adjustment, the new organizational structure of the Ideal Auto’s high-level is:

- Li Xiang, CEO, is responsible for “Product and Business Group”, including strategy, product, brand, three-end (retail, delivery, maintenance), charging network, and other departments.

- Ma Donghui, the original Chief Engineer of Ideal Auto, as well as newly appointed President and Board Member, is in charge of “R&D and Supply Group”, and responsible for R&D and supply chain management.

- Xie Yan, CTO, is responsible for “System and Calculation Group”, and is responsible for the construction of computing platforms, operating systems, system security, intelligent clouds, and other departments.

- Li Tie, CFO, is in charge of the “Organizational and Financial Group”, which includes departments such as finance, administration, and processes, and Li Wenzhi serves as the head of the CFO Office.

Under this structure, there are 7 entities: strategy department, product department, business department, supply department, process department, organization department, and financial department.

Finally, within these 7 horizontal management departments, 7 primary processes are set respectively:

- DSTE (from strategy to execution)

- IPD (Integrated Product Development)

- IPMS (Integrated Product Marketing & Sales)- ISC (Integrated Supply Chain)

- BT&IT、LTD、IFS (Integrated Financial Transformation)

The upper-level adjustment of the ideal organizational structure has been basically completed, and subsequent adjustments to the middle and lower-level personnel within the organization will continue. Ultimately, the organization will become a matrix structure similar to Huawei, achieving the smallest operational loop.

Regarding the data aspect, quantifying the revenue target of hundreds of billions is not difficult. With an average price of 350,000 RMB per car, the sales target of 280,000 to 300,000 units by 2023 can enter the ranks of hundreds of billions in revenue.

As of January this year, Ideal delivered 15,141 vehicles. After the delivery of the L7 series and the non-air suspension version of Air, the delivery volume of the L789 series of models has been consistently over 20,000 units.

During the evening financial report conference, Ideal’s officials provided further answers to the questions of investors, including revelations about new cars and product strategies.

Financial report conference: 8,295 new cars by year-end, with a target of 30,000 monthly sales in Q2.

Q1. My first question is about supply quantity. The management team has mentioned before that after L7 is delivered, the monthly supply can reach a minimum of 25,000 units. After the delivery of the Air version, the target can reach 30,000 units. The delivery speed is impressive. Can the management team please share whether the overall judgment of Ideal’s L7, L8, and L9 deliveries is based on the current volume, or is it based on the judgment of the current market size? Or are there other influencing factors? How long will it take to reach this monthly delivery target? Previously, there was close cooperation with suppliers. Can they fully cooperate with such delivery growth? Because last year we also saw some bottleneck problems with some components such as the frame and air suspension. Can you share more about this?

Li Xiang: The internal forecast of the monthly delivery volume of 25,000 and 30,000 units aims to achieve it in the second quarter. This is because April will be the first complete delivery month of Ideal L7 Pro and Ideal L7 Max, and May will be the first complete delivery month of Ideal L7 Air.

Regarding our capacity ramp-up in 2022, we did encounter some problems in the second half of last year. For example, the entire delivery plan was too aggressive. We believed that if we sold so many orders, we should deliver such a volume. In fact, this imposes tremendous pressure and challenges on the entire supply chain. On the other hand, in the second half of last year, our sales changed from a single model to multiple models, and the system support of the entire sales and service network also faced great challenges. Therefore, in the fourth quarter of last year and the first quarter of this year, we have started to upgrade the process to ensure that our product research and development, sales services, and supply manufacturing achieve high-quality full-process. This includes planning, operational plans, and the entire actual delivery process. This brings us three practical benefits. Firstly, the allocation of resources is more reasonable. Secondly, employees’ work is more fulfilling. Thirdly, it will significantly improve the efficiency of our supplier partners. Therefore, compared to simply making a model in the past, we have made fundamental changes and upgrades in the overall process and capabilities.#### Q2. The second question is about the contribution of battery procurement to the overall vehicle profit margin. We have seen that a significant reduction in battery prices is probable this year. The market has recently seen news of major battery manufacturers reducing prices, and we expect long-term strategic partnerships to be signed with market-leading new energy brands including Ideal. We would like to ask management about their views on battery price reductions and such long-term strategic partnerships in terms of their contribution to new car gross profit margins. Based on judgment of battery costs and prices, when can we expect a significant increase in new car gross profit margins compared to now? What is the forecast for the potential contribution to the overall year?

Ma Donghui: Whether it is the “lithium mining rebate” or the link between raw materials and battery prices, we believe that allowing battery prices to return to a rational range is good news for improving the competitiveness and market share of the new energy vehicle market, as well as for power battery and new energy vehicle manufacturers. As we have more and more new models and sales expansion, power batteries will become a very important system component of new energy vehicles. In the long term, Ideal will also increase the diversity of supply strategies for suppliers, on the one hand, to meet supply security, and on the other hand, to meet project development schedules. In the long run, the rationalization of the entire power battery market is an inevitable trend. As an important raw material for batteries, the price of lithium carbonate has already reached 400,000 yuan/ton in the past two days, and the drop in battery prices is inevitable. Currently, we are still negotiating prices with partners.

Q3. This quarter’s gross margin is 20%, slightly lower than the gross margin at the end of the first and second quarters of Ideal ONE deliveries. Although Mr. Li Tie mentioned earlier that this was due to changes in the product structure, I understand that more than half of the contribution in each quarter comes from L9, and the gross margin of L9 should be higher than the overall gross margin average. Is this because we are still in the early stages of delivering the second-generation products and have not yet reached the expected level? Or is it because the gross margin of the second-generation platform has not improved compared to the first-generation platform?

Li Tie: First of all, our gross margin is healthy and consistent with the guidance we have issued. From the first quarter, our revenue, gross margin, and profit reflect the overall situation of different products. Currently, the majority of sales come from L9 and L8, both of which are in the production ramp-up stage. As you all know, our supply chain requires a certain amount of time to complete production ramp-up, and gross margin and cost reduction will be announced in the next quarter. In the future, considering the monthly delivery of materials, the overall gross margin level of our L-Series products will be around 25%.#### Q4. Currently, Ideal has achieved great success in extending range. As for pure electric vehicles, how can we maintain product competitiveness while achieving a similar gross profit level to extended range products, from the perspective of positioning? Additionally, some peers have invested in mid-to-large-sized SUVs with 800 V ultra-high voltage fast charging, but have not seen surprising market situations. How will Ideal Motors ensure that MPV models with ultra-high voltage fast charging have good competitiveness?

Li Xiang: First, let’s look at what problems extended range products solve. In fact, there are two core problems: first, difficult and slow charging; second, high battery costs. Therefore, we have adopted a large battery extending strategy to achieve “city electric use, long-distance power generation”.

When it comes to the pure electric products we want to launch, the problems to be solved are essentially the same. First, whether we can achieve 400 kilometers of charging in 10 minutes to realize an experience similar to fuel vehicles is very critical. The key point behind this is similar to that of mobile phones. If we provide a mobile phone that supports 4G networks, we cannot let users operate on 2G networks. Therefore, infrastructure follow-up is essential for us. Ultra-high voltage fast charging solves the problem of “difficult and slow charging”. Second, why do we need to use 800 volts and why do we need to build our own silicon carbide module factory? It is because we need to improve efficiency in the entire power drive system while promoting the research and development of our car models. Currently, the measured results show that compared with the same product with 400 volts and mainstream IGBTs driven in the same way, we can save about 15% of battery power, which is a very significant advantage in terms of cost, solving the problem of “high costs, heavy batteries”. Finally, we believe that every pure electric vehicle product we launch can bring users an experience that surpasses their needs, and it will not be inferior to any of our L-series products.

Q5. Previously, a schedule was given for the delivery of 25,000 and 30,000 units per month respectively. Can we understand that the order quantity for the L7 Air model is around 5,000 units? Has the order quantity for L7 exceeded the total of L8 and L9?

Li Tie: For the new Ideal L7 model, it will take some time, as usual, for its sales to grow. As for the first quarter sales guidance, we expect to include a few thousand L7s, with most deliveries still focused on L8 and L9. As mentioned earlier, May will be the first complete delivery month for our L-series models, including the Air model. We already have some orders for the Air model, but the test drive cars have not yet arrived in stores, and many consumers will wait until after the test drive to place orders.#### Q6. The profit margin in the fourth quarter of 2022 is consistent with that of the third quarter. I speculate that the main reason behind this is due to the increase in the price of lithium mines, which rose from over 400,000 yuan to over 500,000 yuan per ton; secondly, we sold over 1,000 Ideal ONE vehicles each month, with several tens of thousands of yuan in promotional discounts per vehicle if we want to clear inventory; thirdly, the cost of new products is usually at its highest in the first 50,000 units and will decrease afterwards. So, I’d like to ask you, is the situation like this? can you provide guidance on the trend of gross profit margin in the first quarter of 2023, and how much is the change likely to be?

Li Tie: All the factors you mentioned above have some impact on our gross profit margin in the fourth quarter. Overall, they have a roughly 2% impact on Ideal’s profit margin. Our gross margin guidance for this year as a whole will still be maintained at above 20%.

Q7. Regarding the license plate restrictions and green plates in Shanghai. It was mentioned last year that the sales of Ideal Automobile in the entire Shanghai region were approximately 5%. I would like to know, under the new green plate policy, what is the proportion of sales volume in Shanghai now? Based on the orders in January and February, how many customers are using their old license plates to exchange for new ones?

Li Xiang: From the perspective of Shanghai, order volumes will be relatively low in January. This is because the main sales volume was released ahead of schedule in November and December last year. Order performance in February has shown a clear rebound. Our target setting and actual achievement mainly depend on market share. So, according to our own judgment, Shanghai will be very similar to Beijing. In the market outside of green plate indicators, we predict that the Shanghai region will gain a market share similar to that of Beijing. That is, we will achieve a market share similar to that of Beijing within the group of buyers who purchase fuel vehicles.

Q8. The second question is about the company’s product strategy for this year and next year. Previously, management mentioned that it might not be able to launch L6 this year. Will a pure electric MPV be launched this year? Also, could the management introduce the general product launch plan? If it is range-extending, will it be L6, L7, L8, L9, and then all electric products afterwards? Will electric products also include sedan models?

Li Xiang: In fact, the specific time for the release and delivery of our flagship products is bound to some of the most critical technologies. Sometimes we may experience delays, which are mainly due to the need to bind the most advanced technologies. For example, Qualcomm’s 8295 chip will undergo an important upgrade at the end of this year. Since our development progress and strategy with the Qualcomm 8295 chip are closely related to the overall software release progress, we cannot release a flagship product that is equipped with the previous generation flagship chip that has reached the end of its product life cycle. This actually makes us very uncomfortable. So, this is the reason behind our reasonable product release time. We must use the most advanced and flagship-grade chip products and chip technologies. Another aspect is that we will also launch a product series similar to the L series for pure electric vehicle models. This will effectively meet the needs of a wide range of household users with prices ranging from 200,000 to 500,000 yuan.#### Q9. Previously, it was mentioned that the goal of NIO is to capture 20% of the 300k-500k SUV market. Can we estimate that this corresponds to a monthly sales volume close to 35,000? How does NIO plan to achieve its expected sales volume of 20%? In addition, how does management view the 200k-300k market?

Li Xiang: In 2022, NIO’s market share in the 300k-500k SUV market is expected to be 9.5%, and our forecast for the market this year is expected to be between 1.4 million and 1.5 million vehicles. Our requirement for ourselves is to double our market share. When we reach a 20% market share, we will be relatively stable in becoming the best-selling UV in the segmented market. This is one way we set our goals. The 200k-300k market is relatively challenging for us, and we need to have stronger economies of scale before entering this price range.

Q10. Recently, I have seen that AI products driven overseas have also received a lot of attention in China. This pre-trained AI system has had an impact on many industries. I want to know specifically about the potential long-term impact on our track, including autonomous driving, cabin intelligence, and the user experience. Will there be any specific changes in the consumer experience that can be expected in the short to medium term?

Xie Yan: We have been investing in research and development of AI-based cognitive technology for a long time, especially cognitive AI and gesture recognition. We believe that these technologies are very important in the smart space and can bring a good user experience to customers. Recently, we have been closely following ChatGPT and believe that the technology behind it, including large language models and pre-trained models, has a lot in common with our work in the smart space. Therefore, we believe that these technologies have great potential for application in visual tasks such as autonomous driving, and related research and development are constantly making progress.

Q11. Actually, many questions have already been discussed before, and I just want to ask one last question. There is some overlap in the version prices of our three SUV models. How do we view the potential mutual cannibalization between these products? If the steady-state sales volume of the three models is in the range of 20,000 to 30,000, in what range is our profit margin likely to be? Considering that these three products account for a relatively high proportion of the cost, will the profit margin be very good above 20,000 steady-state sales, and even better at 30,000? What is the possible fluctuation range in the middle? Is it two or five percentage points? Can you give us some guidance in this direction?## Translation:

Li Xiang: Let me answer the first question. In fact, the user groups targeted by Ideals L7 and L8 are very clear in our actual delivery process, and the number of users with cross-over demands is not as many as we imagined. L7 users tend to be families with three or two members; L8 is either second-born or three generations living together. The attention received by L7 even drives the increase in L8 orders. Through effective pricing coverage of L7, L8, and L9, we are not only building a product line, but also a product network. We hope to meet the needs of any SUV user between 300,000 and 500,000, and do not want users to come and see our cars, but ultimately choose another brand. This is our most core product line strategy.

Li Tie: Regarding the gross profit margin, the overall gross profit margin we set for all products on the L-series platform is 25%. Considering the battery prices and macroeconomic situation this year, we have lowered the gross profit margin to 20%.

Conclusion

Achieving profitability and positive cash flow is an important sign that a company’s business model has been proven. The 2022 Q4 financial report is an impressive answer sheet submitted by Ideal Automotive, but it did not surprise anyone.

The high gross profit of 20%, hot-selling strategy, efficient direct sales system, and extremely low sales and management expense ratio make the “profitability” of Ideals appear classic and reasonable.

What we see now, the L789 series, is to some extent the product that Ideal planned about 3 years ago, which is the most worth thinking about hidden under the “Ideal achieved profitability in 2022 Q4”.

The technical route of extended-range electric vehicles has been questioned since the birth of Ideal ONE, but with the market performance of Ideal soaring, more and more enterprises are following suit.

“Seeing is believing.” Most people are like this, but Ideals are the opposite.

Why does Ideal want to do extended-range vehicles?

Because the electric drive experience is better than that of fuel vehicles, but the three major mountains of difficult charging, slow charging, and high battery costs will limit the electric vehicle market. Therefore, extended-range is a reasonable solution to these problems.

Why doesn’t Ideal go below the 200,000 yuan market?

Because the cost of intelligent + electric cannot be controlled below 200,000 yuan. At the same time, to have reasonable profits below 200,000 yuan, extremely large scale effects are needed. Compared with traditional automobile giants, Ideal does not have such economies of scale.Why do we need to develop the household market?

Because household users are the largest user group in the Chinese car market with over 200,000 users, and household cars are the most rigid demand for car consumption in China.

Similar questions have been asked in Ideal Cars and in the public sharing of Li Xiang himself not just once. However, most people tend to “believe it only when they see it.” So what Ideal Cars has done over the years is to verify cognition, and the continuously rising sales have gained more recognition for Ideal Cars’ cognition.

Therefore, when Li Xiang said in the past year or two that the company will continue to invest heavily in R&D (R&D accounts for more than 10% of total revenue) and will prepare fully in the high-voltage pure electric field (building a self-built supplementary power system which is available when high-voltage pure electric products are launched), he probably didn’t just say it casually.

By then, sales will, as always, become the best witness to this process.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.