Author: Tao Yanyan

This year, the situation of domestic power battery companies has taken a drastic turn. Last year, the prices skyrocketed, but due to overcapacity this year, Ning Wang led the charge in price reductions, prompting other companies to follow suit in order to gain market share and even fight for survival. However, the situation of foreign companies is completely different.

We have selected ten power battery companies based on different data criteria for the year 2022 to see the future development of the market, and also made some systematic summaries of these companies’ situation in the past few years. In this inventory series, we will start with the overseas battery companies without much controversy.

◎ LG: Its aggressive cost reduction strategy on Volkswagen MEB did not yield particularly great returns. Currently, after going public, the company is focusing on the American and European markets, mainly the latter.

◎ SK on: It is building production bases in the United States around its two major customers, Hyundai and Ford, and exploring different customers.

◎ Panasonic: After Toyota’s slow pace of electrifying its cars, only following Tesla’s North American demand for All in 4680.

◎ SDI: A differentiated high-performance power battery strategy.

Different technological paths have led to different development speeds for companies. For power battery companies, the key to competition is how to increase production while satisfying the demand for scale that is constrained by the prices of upstream resources and the demand for downstream automotive products.

Today’s first review is on LG Energy Solution (LGES).

LG’s Review of 2022

Financial situation

In 2022, the company’s full-year operating income was 2.56 trillion won (RMB 133.458 billion), a year-on-year increase of 43%, which is LGES’s highest historical sales figure. In response to market demand for electric vehicles and energy storage products, the battery product line achieved growth in shipments. Operating profit increased by 58% year-on-year to 1.2 trillion won (RMB 6.256 billion), and the company’s net profit for the year was 800 billion won (RMB 4.171 billion), with a net profit margin of 3%.

Shipment and Main Customers

LG Energy mainly has two product lines, supplying batteries for soft packs to major automobile manufacturers such as General Motors, Hyundai Motor Group, Renault, Ford, Volkswagen, Porsche, and Volvo.

The cylindrical product line is currently 21700, mainly supplied to Tesla for its long-range version in China, and the next development direction is the 4680 series of products. The specific installation and teardown figures are still being compared among several databases, and a version will be released when appropriate.

LG’s Capacity Layout and Development Direction

Technical Development Direction

The thermal runaway protection of soft pack has always been a difficult problem to solve. The thermal runaway protection in the direction of high nickel is the core consideration for future electric vehicle safety. Currently, LG can achieve 25-120 minutes in this field, and the solution around lithium iron phosphate is relatively easier to achieve, with lower probability of catching fire.

The efficiency of soft pack grouping is also a very challenging problem. LG has two solutions: one is Module to Pack, and the other is soft pack’s CTP design.

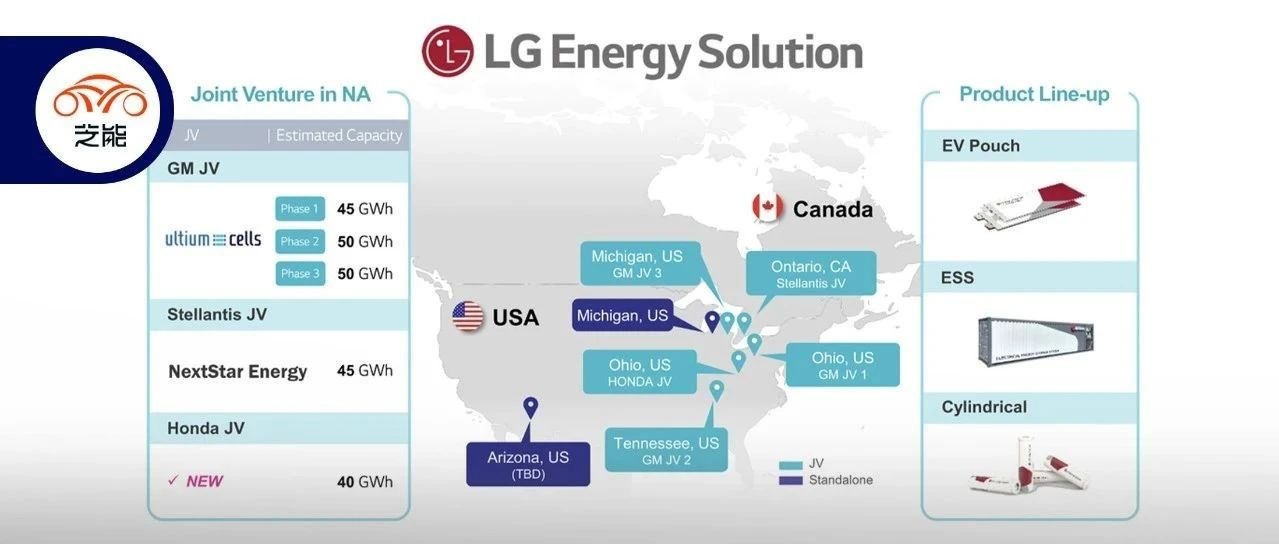

Capacity Layout

LG’s global battery and energy storage capacity will total 200GWh by the end of 2022, expanding capacity in three regions and different application directions, with 300GWh in 2020 and 520GWh by 2025.“`

◎North America: joint venture plant in Ohio starts production, and the Tennessee plant will enter operation phase.

◎Europe: construction of soft pack capacity in Poland, with expected capacity expansion to 90GWh.

◎Asia: construction of cylindrical and soft pack capacity, with expected capacity of 155GWh.

From the current point of view, there will be further expansion, with planned capital expenditures increasing by more than 50%. The incremental demand in the US is very certain, which also makes automotive and battery companies invest in building factories in the US together.

Especially in the US, investment is needed in the upstream segment of the industry chain to realize the independence of the battery industry chain, which is a relatively large part of the investment.

Conclusion: Overall, LG is basically developing without relying on the Chinese market. Except for its achievements in supplying Tesla, there are no particularly great gains from establishing production bases in China. The current status of LG may become an important means of domestic and international battery games, so the investment in the US is very large.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.