Author: Tao Yanyan

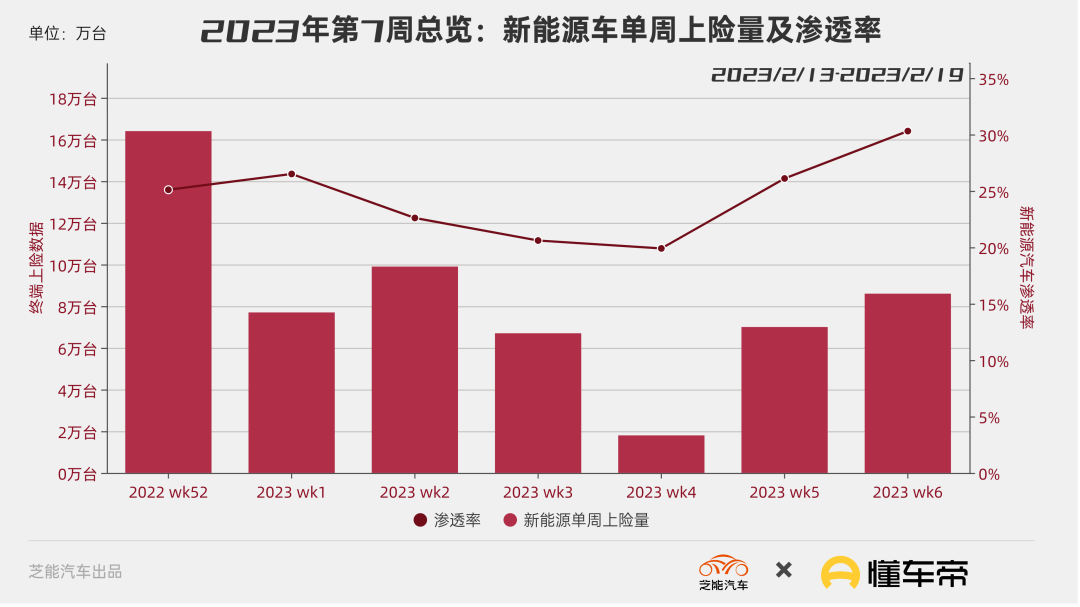

Tracking the insurance data of passenger cars in China, this week’s analysis is the 3rd week of February 2023, specifically from February 13, 2023 to February 19, 2023.

Industry Situation

This is the second week after the Spring Festival. From the current data, it can be seen that as the pandemic ends, automobile sales have entered a low period instead. This reflects that as durable consumer goods, cars are still difficult to stimulate at this stage. After policy tools are used, consumption is squeezed for a period of time. To stimulate it, a greater policy effort is required, which is not a good choice.

Looking at the overall data of passenger car insurances in China, the total sales volume this week is 308,000 vehicles, up 8.7% compared to the previous week, down 11.7% year-on-year. The overall numbers are very poor.

This week, new energy vehicle sales were 100,000 vehicles, up 17.5% compared to the previous week and up 34.0% year-on-year. Many models have followed Tesla’s pace and started to lower prices, which is still very attractive to consumers. However, the automobile industry is currently under great pressure. Based on the current first quarter, many companies still need to wait and see for a while.

Key Automobile Companies

Although the comparative data of the following key companies are high, the actual absolute values in the first week of February, which is still in the New Year atmosphere, are not particularly good.

-

BYD: this week’s sales volume was 37,000 vehicles, an increase of 64.2% year-on-year and an increase of 17.9% compared to the previous week;

-

Tesla: this week’s sales volume was 5,913 units, an increase of 18.3% year-on-year and a decrease of 15.1% compared to the previous week;

-

NIO: this week’s sales volume was 3,174 vehicles, an increase of 75.4% year-on-year and an increase of 4.2% compared to the previous week;

-

XPeng: this week’s sales volume was 1,463 vehicles, an increase of 8.1% year-on-year and an increase of 4.8% compared to the previous week;

-

Li Auto: this week’s sales volume was 4,238 vehicles, an increase of 10.2% year-on-year and an increase of 4.3% compared to the previous week;

-

WM Motor: this week’s sales volume was 878 vehicles, an increase of 5.8 times year-on-year and an increase of 14.9% compared to the previous week (the base number last year was relatively low).

From the current situation, the effect of Tesla’s price reduction is not good, and car companies may choose to withstand February or even March and take a large-scale promotion after the Shanghai Auto Show.

Let’s take a closer look:

- Tesla

The effect of Tesla’s price reduction is not good. All consumers are expecting Model 3 to be upgraded soon, so even if the price of Model 3 is low, no one buys it. Consumers are afraid of buying a Tesla and being cut leeks. I estimate that Tesla may also have to hold on in the short term.

- New energy vehicle brands

NIO, XPeng, and Li Auto have already differentiated:

Li Auto: L7 has brought in a huge amount of traffic and boosted sales of L9 and L8. L7 is indeed a high sales volume model, and competition is fierce.

NIO: Except for ET5, terminal discounts for ES6 have worked. The next growth driver for NIO needs to be observed.

XPeng: After the phase delivery of G9, there are no strong new cars. After P7’s price reduction, everyone is looking forward to the redesign, so XPeng’s overall sales are in a recovery period.

AITO Automobile: At present, we do need some ways to stimulate the sales of AITO. The price reduction measures taken before did not bring significant effects. The endorsement from Huawei is not enough, and we need greater support.

AITO Automobile: At present, we do need some ways to stimulate the sales of AITO. The price reduction measures taken before did not bring significant effects. The endorsement from Huawei is not enough, and we need greater support.

- BYD

BYD’s sales are indeed the best in the entire Chinese automobile market. The word of mouth effect brought by this wave of new energy vehicles has also brought huge dividends. The continuous increase in production capacity will also put pressure on BYD’s sales, so it is expected that BYD will have price adjustments in March.

- Volkswagen

The problem that Volkswagen currently needs to solve is still the core competitiveness of its products. If the cabin experience problem is not resolved, the difficulties cannot be alleviated by relying solely on price cuts.

Conclusion: According to the current industry data, it is very likely that auto sales will be sluggish in February and March, leaving space for subsequent policies.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.