Mercedes-Benz Group’s Performance Highlights in the 2022 Fiscal Year

Mercedes-Benz Group achieved significant growth in pretax profit, increasing by 28% to €20.5 billion (2021: €16 billion), and a 12% year-on-year increase in revenue to €150 billion (2021: €133.9 billion) in the 2022 fiscal year. This was achieved through a focus on luxury passenger car and light commercial vehicle businesses, as well as strict cost-cutting measures.

Key highlights of Mercedes-Benz Group’s 2022 fiscal year performance include:

- Profitability growth: Pretax profit grew significantly by 28% to €20.5 billion (2021: €16 billion), and revenue grew by 12% to €150 billion (2021: €133.9 billion).

- Resilient operations: Despite facing macro challenges, Mercedes-Benz Passenger Cars’ adjusted sales profit margin reached 14.6% (2021: 13.1%), Mercedes-Benz Vans’ adjusted sales profit margin reached 11.2% (2021: 8.3%), and Mercedes-Benz Mobility’s adjusted net asset return was 16.8% (2021: 22.0%).

- Continued transformation: Mercedes-Benz announced plans to build a global charging network, adjust its production network to expand electric vehicle production, obtain L3 conditional autonomous driving system certification in Nevada, USA, and establish new partnerships in the procurement of raw materials and semiconductors.

- Increased dividend: Mercedes-Benz proposed to increase the dividend per share to €5.20 (2021: €5.00).

- Share buyback: Mercedes-Benz plans to buy back up to €4 billion worth of shares in the next two years.

- 2023 outlook: Group revenue is expected to remain at the same level as the previous year, pretax profit is expected to be slightly lower than in 2022, and the industrial business’s free cash flow is expected to remain the same as the previous year. Mercedes-Benz Passenger Cars’ adjusted sales profit margin is expected to be between 12% and 14%, Mercedes-Benz Vans’ adjusted sales profit margin is expected to be between 9% and 11%, and Mercedes-Benz Mobility’s adjusted net asset return is expected to be between 12% and 14%.

According to Ola Källenius, CEO of Mercedes-Benz Group, “In addition to achieving strong financial performance, our team has also accelerated Mercedes-Benz’s pace as a technology leader in the areas of electric power and autonomous driving. The next new chapter in Mercedes-Benz’s transformation will be unveiled at the strategic upgrade conference to be held in California, USA, on February 22. We will focus on the all-new Mercedes-Benz operating system MB.OS.”

Mercedes-Benz continues to expand its lineup of pure electric vehicles, currently covering 9 passenger cars and 4 light commercial vehicles, including the all-new EQS pure electric SUV, the all-new EQE pure electric SUV, and the newly launched all-new eSprinter pure electric light commercial vehicle.

To expand the production scale of zero-emission vehicle models, Mercedes-Benz Cars and Light Commercial Vehicle Production Network have both undergone re-planning and reached new procurement agreements with related suppliers.

Mercedes-Benz will purchase power batteries from Ningde Times, a new factory in Debrecen, Hungary. It has also signed a supply agreement with the Canadian-German joint venture start-up, Rock Tech Lithium, to ensure an average annual supply of 10,000 tons of lithium hydroxide. In addition, Mercedes-Benz announced plans to launch a high-power charging network in North America, Europe, China, and other major markets.

Free cash flow from industrial operations has increased to €8.1 billion (2021: €7.9 billion), while industrial business net liquidity has increased to €26.6 billion (€21.0 billion at the end of 2021). The Group’s total investment in real estate, factories, and equipment for the year was €3.5 billion (2021: €4.6 billion), while R&D spending was €8.5 billion (2021: €9.1 billion). (*The 2021 figures include amounts before the separation of the Daimler commercial vehicle business.)

Mercedes-Benz Cars achieved total sales of 2,040,719 vehicles in 2022, a year-on-year increase of 5%. With the continuous promotion of electrification strategy, the sales of Mercedes-Benz pure electric vehicles have achieved strong growth, reaching 149,227 vehicles (including smart), a year-on-year increase of 67%. Driven by the sales of Mercedes-Benz S-Class sedans (up 6% year-on-year) and the pure electric EQS, the sales of high-end luxury vehicles exceeded 23,400, an increase of 8% year-on-year. In the fourth quarter of 2022, the flagship pure electric model EQS achieved its best quarterly sales. In addition, thanks to the outstanding market performance of star products such as the Mercedes-Benz C-Class, GLC SUV, and pure electric EQE, the sales of core luxury vehicles increased by 9% year-on-year. Mercedes-Benz Cars’ adjusted sales profit margin increased from 13.1% in the same period last year to 14.6%.In the fourth quarter of 2022, after careful consideration, the payment to certain suppliers as well as the “inflation bonus” given to eligible employees in Germany have a slight impact on performance, but the adjusted sales profit margin still reaches 13.4\%.

Despite the continuing global challenges in parts supply and logistics, with a comprehensive product portfolio for commercial and private customers, the total sales of Mercedes-Benz Vans reached 415,344 vehicles in 2022, an increase of 8% compared to the previous year. In 2022, Mercedes-Benz sold a total of 15,000 electric vans, a YoY growth of 15%, with about two-thirds of them being commercial electric vans. The adjusted sales profit margin of Mercedes-Benz Vans increased to 11.2\% (2021: 8.3\%). Since the recent introduction of small pure electric commercial vans eCitan and EQT, the commercial van business of Mercedes-Benz has achieved the full electrification of its product portfolio. Recently, the all-new eSprinter pure electric van had its global premiere.

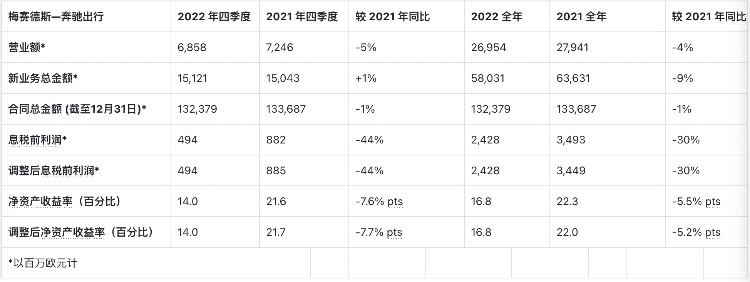

The total new business amount of Mercedes-Benz Mobility (including financial services) reduced to 58 billion euros (2021: 63.6 billion euros). However, last year’s data includes the amount of this business segment before the spin-off of Daimler Trucks. As of the end of 2022, the total contract amount remains basically unchanged from the previous year, at 132.4 billion euros (2021: 133.7 billion euros). The total amount of financial and leasing services for pure electric and plug-in hybrid models has significantly increased compared to the previous year. Overall, due to increased borrowing risks caused by uncertainty in the economic situation, as well as increased refinancing costs and decreased new orders due to the spin-off of Daimler Trucks, the adjusted EBIT for 2022 decreased to 2.4 billion euros (2021: 3.4 billion euros). Therefore, the adjusted return on equity is lower than the previous year, at 16.8\% (2021: 22.0\%).

In terms of overall demand, the growth of new orders in the European market tends to slow down, but existing order stocks will help boost sales in the first half of the year. The demand in the American market is currently at a good level. In China, the new coronavirus epidemic in the fourth quarter of 2022 will have some delayed impact on the market atmosphere in the first quarter of 2023. The current signs indicate a steady recovery of the Chinese auto market after the 2023 Chinese New Year.In terms of sales forecast, the Group remains cautious and expects that the total sales of Mercedes-Benz passenger cars will maintain the same level as last year in 2023. Thanks to the successive launch of new products such as the all-new EQS pure electric SUV and the all-new Mercedes-Maybach EQS pure electric SUV, the overall sales of high-end luxury models are expected to be slightly higher than last year. Sales of pure electric models are expected to roughly double. The adjusted sales profit margin is expected to reach 12% to 14%. The net pricing is expected to slightly increase. Based on current judgment, the target is to achieve positive results in hedging the cost increase caused by inflation, supply chain impact, and one-time expenses. Compared with 2022, the used car business is expected to slightly decline. Research and development expenses are expected to be slightly higher than last year. The investment in real estate, factories, and equipment will increase significantly and will mainly be used for the MMA pure electric platform.

The total sales of Mercedes-Benz light commercial vehicles in 2023 are expected to remain flat compared to last year, and the adjusted sales profit margin is expected to reach 9% to 11%. Net pricing will tend to be stable. Based on current judgment, the target is to achieve positive results in hedging the cost increase caused by inflation, supply chain impact, and one-time expenses. Significant investments in real estate, factories, and equipment, as well as research and development expenses, will be higher than last year, mainly for the VAN.EA pure electric platform.

The total amount of contracts for Mercedes-Benz’s mobility business (including financial services) in 2023 is expected to slightly decrease. The adjusted return on net assets is expected to reach 12% to 14%, which includes the increase in operating expenses brought by the recently announced charging network.

Mercedes-Benz Group expects that its turnover in 2023 will remain the same as the previous year. In a still challenging market environment, based on the development situation of various sub-markets, the Group’s pre-tax profit is expected to be slightly lower than last year. The industrial business free cash flow in 2023 is expected to remain the same as last year. The amount of tax to be paid is expected to increase compared to last year. The Mercedes-Benz Group expects that the average carbon emissions of new passenger cars in the European (including the European Union, Norway, and Iceland) market in 2023 will decrease significantly compared to last year. With the further expansion of the electric vehicle lineup, the Group is also expected to meet the European carbon emission standards in 2023.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.