Choosing between the LS7 and L7: Which SUV to Buy?

By Roomy

Edited by Zhou Changxian

Who to choose?

There is no shortage of arguments for both.

On February 10, the LS7 of IM Motors came roaring in, with a pledge to never back down. Co-CEO Liu Tao stated the need to “reconsider the demand for mid- to large-sized luxury SUVs.”

This is hardly a humble statement. Similarly audacious is the Ideal L7, which debuted two days before the LS7.

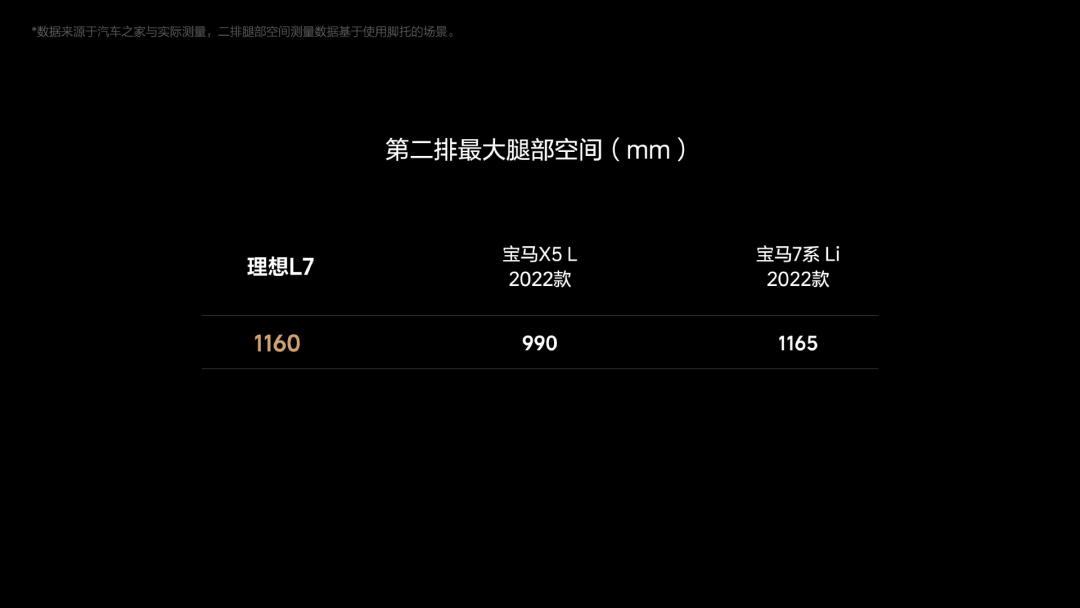

On February 8, founder Li Xiang, dressed in his usual blue shirt and jeans, presented Ideal Auto’s fifth product, called the “Little Ideal L8,” or the L7. Li claimed that it was “definitely the most comfortable second-row SUV under 500,000 RMB,” surpassing even the BMW X5L and 7 Series Li.

Both models aspire to disrupt the mid-range SUV market below 300,000 RMB. However, there is currently a disparity in feedback from the market. As of the launch date, the LS7 had received orders for 12,000 vehicles, while Ideal Auto boasted over 30,000 orders in the first 48 hours.

Undoubtedly, the LS7 does not accept this scorecard.

From conception to launch, a period of approximately 27 months, IM Motors has focused on prioritizing the driving experience, from hardware and software to the chassis and driving controls. This has been interpreted by some as a difficult feat for Ideal Auto’s L7 to replicate in terms of providing a “fresh driving experience.”

“Our product is superior, and there is no reason for us to lose,” claims Liu Tao, insisting that the LS7 and L7 are evenly matched in terms of product strength. Despite paying “tribute to Ideal Auto” in words, the confidence in the superior experience and cost advantages of the LS7 is only strengthened.

Regardless of the ongoing competition, and regardless of who currently has the upper hand, the Ideal L7 and IM LS7 will ultimately compete head-to-head in the mid-sized luxury SUV market.

You have your strategy, and I have mine. As for the question of which consumers will choose, it remains to be seen.

Where should intelligent cars go from here?

During an interview after the release of the LS7, Liu Tao’s words were not polite, and could easily strike a chord with certain individuals.He said, “Crazy price cuts, crazy internal competition, and various mixed products that are crazily grabbing the market are unhealthy competition. Because intelligent electric vehicles are a clear track, but the cognitive threshold is relatively high. A large number of brands and products are crowded into the market, and the market is mixed, which is not conducive to the development of the industry.”

This statement is somewhat self-contradictory, because smart cars are also involved in configuration. However, it also makes sense.

It is not because Smart has high self-esteem, but new brands that are from traditional groups show some differences in product and market logic compared to the internet car-making enterprises. I somewhat agree with Liu Tao’s opinion. Currently, Smart cars are indeed too obsessed with intelligence.

“Lulu” and Tesla have set the pace for new energy vehicles for many years.”

Liu Tao’s rhythm is not derogatory. Or it can be understood that Tesla and Lulul set the “appearance” of new energy vehicles. However, with the deepening development of the market and the influx of a large number of brands and products, some things have gone too far.

“Smart” is becoming an increasingly difficult selling point, so what is the breakthrough point?

Wang Chuanfu, the head of BYD, said, “Safety is the biggest luxury of electric vehicles.” Smart hopes to find an essential field that cannot be missing in the field of electric vehicles. “Driving” and “safety” are the most important underlying logic of automobiles.

“For the Smart brand, this extra-long board must be “driving control” and the driving control of the new world. ” Liu Tao has previously said that he hopes Smart will become the “BMW” of the electric car era. He believes that if an electric car cannot control the power of a supercar, it is better for the user to drive his/her petrol car back.

Therefore, ” Driving control” is the core label of Smart LS7, a mid-to-large size luxurious SUV. Smart believes that only driving control can create lasting differentiation and high technical thresholds that others cannot replicate. “The core is product strength. There must be persistent product strength. Only then, users will pay for your brand and products.”Translate the following Chinese Markdown text into English Markdown text in a professional manner, keeping the HTML tags inside the Markdown and outputting the result only:

Others, including new competitors that are about to enter the market, such as the Ideal L7.

In some test-drive reviews, it has been pointed out that “currently, Ideal lacks forward-looking core technology, which leads to a lack of power for key technological innovations such as the upgrade of intelligent driving systems.” In contrast, at the launch event, “It is definitely the best second-row comfort for SUVs under 500,000 yuan,” making it the most impressive selling point of the Ideal L7.

In other words, Ideal, which has been nicknamed as “Nesting Doll Design,” needs to provide more imagination to the market. Although, from the current order sales, the IM LS7 is not as good as the Ideal L7, it does not affect IM’s hope to become the one that “has more imagination.”

Of course, the first model, IM L7, did not perform well under the strong momentum of NIO and Tesla. There have been constant accusations such as “the next one out,” “shameful to the name of SAIC Group’s ‘Project No. 1.'”

Liu Tao also knows the reason, “As a new brand, its popularity is relatively low, and the challenge of accepting a 400,000 yuan pricing is high. Due to various reasons, the sales volume of the L7 did not meet expectations.” He also admitted that “the influence of Ideal in third-fourth tier cities is indeed relatively high. When users consider buying a car for 400,000 yuan, they may indeed first think of Ideal.”

Moreover, the ultimate driving control label, which Liu Tao regards as “going all out,” is difficult to build. BMW took 20 years to firmly maintain its handling label. IM does not have so much time.

Whether from the perspective of the size or price range of the model, IM LS7 and Ideal L7 have formed a direct competition relationship. The resulting problem is how can IM LS7, which has not yet stabilized the driving control label, respond to the Ideal L7 in the five-seater SUV market?

This test not only challenges Liu Tao but also Li Xiang.

Both Want to Win

The IM LS7 and the Ideal L7 have similarities and differences in their respective brand product lines.”L7 has helped IM Auto to solidify its position in the high-end brand lineup, while LS7 is striving for more market share by offering a higher value ratio. When Liu Tao spoke of this, part of it can be understood as confidence, and part of it can be understood as helpless. IM needs sales, so how can it achieve them? The method is only to exceed expectations in terms of value.

How to exceed expectations in terms of value?

Liu Tao gave several answers. The core is that “the product must be in place”. For products, there must be their unique understanding in order to have the ability to grasp the times with confidence. Secondly, they will never be soft-hearted, “never sacrificing the user experience, which is the bottom line of IM’s values”.

Of course, since the market is competitive, as a market-oriented brand, IM must deal with this competition. But how to compete? Liu Tao has his own opinion, “the configuration is a short-term solution, the essence of competition is experience”.

For example, electric doors have a very good user experience, but the control software is difficult to do. If only the configuration of the electric door is focused on, but the user experience is zero, or even negative, it is of no use.

The LS7 of IM is indeed competitive, and a series of configurations are listed, which are indeed impressive.

IMAX-level full dome vision, insulation using “three-layer silver plating technology” on the same panoramic windscreen as the C919; zero-gravity seats; air suspension provided by German Conti, Nvidia OrinX smart driving chip, Bosch’s top series of EPS electronic steering, etc. These star components form the driving control system… In addition to driving control, IM also needs to achieve electrification, intelligence and consumer upgrade.

Liu Tao said: “In the era of intelligence, automobiles cannot have only one ‘superpower'”.

Born from the iO pure electric architecture, IM’s LS7 has three major product points: “the best ‘sight’ of the whole view,” “the biggest five-seat scenario”, and “the best-driving control and safety in all conditions”. After the price came out, the market felt that IM’s LS7’s greatest advantage was its cost-effectiveness. However, in the eyes of some people, IM is just “piling up materials”.”When answering this question, Liu Tao said, “Rolls must have underlying thinking, knowing what to do and what not to do. Rolls centered on user experience are the real solution.”

For example, intelligence. When it comes to intelligence, Ji will roll to the extreme until others cannot keep up. But Ji also has things it does not want to roll, such as the trade-off between air suspension and four-wheel steering. Ji L7 is a sedan with the core tag of driving control, so Ji chose four-wheel steering without choosing air springs. Instead, the value of the air spring is enlarged in the LS7 SUV.

Ji has made many trade-offs for user experience. “Our ideas are very clear. First, underlying technological innovation must be differentiated; second, it must be what users need and bring them extreme experience. These are two particularly important anchor points that we adhere to.”

For example, in order to truly fold the seats that appear in the concept car, Ji LS7 cancelled the glove box at the copilot’s position, allowing the seats to be folded and stuffed in. The consideration of folding seats and canceling the glove box is mainly to balance the pros and cons.

However, the market is worried about how to ensure safety during driving with completely flat seats and a zero-gravity seat as a scenario experience. This is a huge challenge. Ji LS7 needs to provide more data to verify.

“This is a very difficult thing to push forward,” and Liu Tao also knows that it is very difficult to create a valuable product. However, it is even more difficult to demonstrate its value in the market. Ji LS7 needs to continue to solve this problem, which is relatively easier for the Ideal L7. Moreover, both models focus on the selling point of the second-row seats.

“Ideals are a typical example. Not only are the product managers very familiar with the users’ experience and feelings, but also the execution is very firm.” Liu Tao admits that Ideal has its own set of things in customer experience. In the process of transitioning from the “Big Single Product” strategy to the “Platform” strategy, Ideal hopes that each product can provide a user experience without any difference.Although the market segment is consistent, brand positioning and market roles are not completely the same. The goal of Li Xiang’s Ideal L7 is to shorten the increasingly distant profit distance and even reach profitability.

As seen from Ideal’s financial report, the success of L9 only helped Ideal achieve increased revenue, while losses continued to expand. How to quickly restore gross profit margin and reduce losses has become a problem that Li Xiang urgently needs to solve.

This time, Ideal directly launched the L7 with a starting price close to RMB 300,000, aiming to grab a share of the RMB 300,000-level SUV market, which is the market that Smart has been hoping to dominate with the LS7.

“Li Xiang is actually playing with a larger SUV model and selling it at a lower-level price market, and the price is even cheaper than competitors.” said a market analyst. So, how competitive is the “five-seater version of Ideal L8” called L7?

From the information announced at the launch event, in summary, Ideal is trying to supplement the intelligence gap of the L7 at the same time as its entry market price of RMB 300,000. Second, the “Queen’s Seat” located on the right side of the second row is considered one of the biggest selling points of L7, and its market demand covers both pure electric and fuel vehicles.

The weakness of Ideal L7 is also very obvious. From the appearance and interior of Ideal L9 and L8 from the same platform, they lack surprises. What the market criticizes is also the fact that many “good configuration” options were sacrificed for the “Queen’s Seat”. For example, the Ideal L7 does not have the refrigerator and some storage space that L9 and L8 possess. In addition, the price overlap between Ideal L7 and L8 will deepen the internal competition between Ideal’s products.

However, in terms of the product layout of L7, Li Xiang, who is “not simple”, made a careful move by removing the air suspension of L7 Air like the IM LS7 Quasi-Endurance Pure Rear Drive Version, which starts pre-sales at a price of RMB 300,000, two thousand lower than the Pro version. This shows Li Xiang’s determination to occupy the RMB 300,000 large five-seater SUV market.

In the end, everyone wants to win.

The Ability to Roll Directly Down

So, who will win?

Currently, based on orders, Ideal L7 targeted at family users is better than the tech-driven IM LS7. However, both still face their own challenges, as well as a common problem – in the next 3 to 5 years, 60% to 70% of brands may die, so how to seize the mainstream remains a challenge.This is a long-term issue that requires sticking to a “long-termism” strategy.

The ideal long-termism was already evident in May of last year. “We will introduce a best-selling product in every 100,000 yuan price range,” said Li Xiang, who indicated that he would follow Apple’s product strategy and create a best-selling product in every price range.

Smartisan’s long-termism is an intelligent brand that not only focuses on hardware configuration but also on user experience. However, before continuing this long-termism, Smartisan has a problem to solve, which is to address the brand’s visibility issue.

Li Xiang once said, “Without users, a brand is nothing.” Certainly, at the stage that Smartisan is currently experiencing, it is also the same initial stage that Wei Xiaoli once went through where “sales did not meet expectations” before establishing the brand, product layout and channel expansion.

The Smartisan L7 cannot support Smartisan’s sales figures, which are less than a thousand units a month, which naturally cannot support the promotion of brand awareness. Therefore, the sales of the Smartisan LS7 are crucial, even more pressing than the ideal L7, and also more stressful.

“We plan to achieve an 80% brand awareness target within three months,” said Liu Tao, setting a goal for himself. But indeed, a solid brand label cannot be achieved in the short-term but requires a continuous accumulation of models.

Lei Jun once said that the real brand market is like a round stone on a mountain top. As long as the wedge is removed, it will naturally fall down and roll faster and faster. Currently, Liu Tao also understands that Smartisan does not have the ability to roll down directly.

“We must change. What do users care about? It’s what we should provide.”

I express my support for Liu Tao’s ambitions, but it should be noted that the reason why the Nio ET7, which is priced similarly to the Smartisan L7, can achieve a monthly sales volume of 3,000 units and stay ahead of the Smartisan L7 is because of what?

Recently, market analysis agencies made different predictions for the Smartisan LS7 and the Ideal L7. The forecast for the Smartisan LS7 is that it will sell about 3,000 units per month, while the data for Ideal L7 predicted sales of around 6,000-7,000 units per month. What is behind this discrepancy?## Liu Tao needs to think.

However, the Ideal L7 has a solid foundation of brand and reputation that was established by the Ideal L9, L8 and other models, including the option to simply roll over. Of course, this does not mean that the Ideal L7 can rest on its laurels.

In terms of price, the IM LS7, the Ideal L7, and the XPeng G9 are in the same range, even though the XPeng G9 did not perform as expected. The Ideal L7 seems to have few competitors in this market, but there are even larger rivals that compete for this market. It is still the field of advantage for BBA.

Data shows that the 5-seater SUV models account for about 95% of the SUV market, and that large 5-seater SUV models are also the best-selling models in the 300,000 to 4 million RMB market. Moreover, various SUVs from BBA, such as the BMW X3, Audi Q5L, Mercedes-Benz GLE and BMW X5L, etc., occupy the core positions.

The competition pressure can be said to be great. However, the confidence of Ideal is clearly higher than that of IM.

Like with the Ideal L9, Ideal hopes that the L7 can create a separate niche market with the method of dislocated competition. With the arrival of the Ideal L7, Ideal’s products will basically cover the SUV market from 300,000 to 500,000 RMB. Although the competition pressure is high, Ideal is still confident and aims to sell over 30,000 units a month. In December of last year, Liu Jie, the Vice President of Sales at Ideal Motors, revealed that the stable monthly sales volume of the Ideal L7 would be around 10,000 to 15,000 units.

Can the IM LS7 compete with the XPeng G9, the NIO ES7, and the Ideal L7 in the market? Liu Tao believes that it can, but he sets the annual sales target for IM in 2023 as 45,000 units, which includes the sales of the IM L7 and LS7.

Clearly, the ambition of IM is not as big as a single model of the Ideal L7.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.