Annual Summary of Top 10 Vehicle Companies in China

Author: Tao Yanyan

(1) NIO, pursuing long-termism;

(2) Xpeng, prioritizing technology;

(3) Ideal, championing market fragmentation;

(4) Leapmotor, developing end-to-end technology

(5) Leading EV newcomer in 2022, Hozon Auto;

(6) GAC, successfully split for EV strategic transition;

(7) BYD, catering to mainstream demands;

(8) Great Wall Motor, facing pressure and challenge;

(9) Geely, multi-brand strategy (with many newly listed);

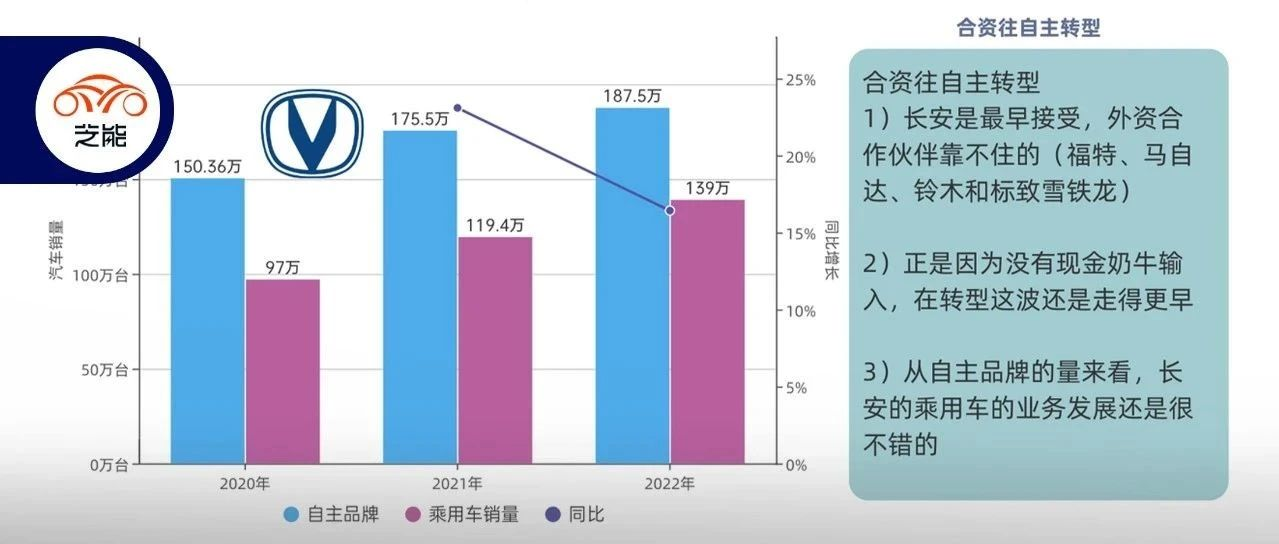

Finally, the last company to summarize among the top 10 is Changan Automobile. Based on the last three years, Changan Automobile has performed quite well in the current situation:

- The group’s total sales volume in 2022 was 2,346,000 units, an increase of 1.98% year-on-year.

- Sales volume of Changan’s self-owned brands was 1,874,569 units, a year-on-year increase of 6.83%.

- The sales volume of Changan’s own passenger cars was 1,390,387 units, an increase of 15.46% year-on-year.

- The overseas sales volume of its own brands was 169,773 units, a year-on-year increase of 48.83%.

Changan has the following characteristics in its transition from Joint Venture to self-owned companies:

- Changan was one of the earliest companies to accept the transition passively, mainly because its foreign partners (Ford, Mazda, Suzuki, and PSA Peugeot Citroën) were unreliable.

- It was precisely because there was no cash cow input that Changan began its electrification transformation earlier.## Overall Sales Situation of Changan Automobile 2020-2022

From the perspective of independent brand sales, the passenger car business of Changan Automobile has developed very well.

In 2022, Changan Automobile will still focus on the A00 small car and adopt a low-cost strategy. After testing the extended range capacity which can be promoted in the future, the play around the Deep Blue brand will be more obvious later on. The plug-in/extended-range path of traditional automotive companies is feasible!

Overview of Changan New Energy Vehicles

First and foremost, we look at the overall price and sales situation. In 2022, Changan’s small car promotion is relatively fast (over 150,000 units), with plug-ins and extended ranges being preliminary attempts. Lumin sold 61,500 units, while Benz E-Star sold 95,000 units, laying the foundation for the entire new energy vehicle market.

Then, Changan tried pure electric, extended range, and plug-in based on the Deep Blue and existing brand, and even produced a hydrogen fuel cell version.

In the early stage of the Deep Blue release, the positioning of extended range was 171,900 yuan, and the positioning of pure electric was 189,900 to 221,900 yuan to promote brand sales in a way that predicted the price war in 2023. Therefore, from the current price system, it still maintains a moat and is a bit far from other companies. Therefore, the speed of volume from the launch of the two Deep Blue cars is still very fast. Especially, the demand for the extended-range version is greater than that of pure electric vehicles.

And on the original brand, Changan borrowed both the tactics of the Wuling A00 model and attempted to promote plug-in hybrid on its original brand. With the hot sales of the Song DM-i, this plug-in hybrid’s dark horse objectively impacted Changan’s SUV matrix.

2022 is the first stage of Changan’s electrification process, and of course, Avita is the most difficult one. Under the cooperation of Changan, Ningwang, and Huawei, the new brand should have been more dynamic. We look forward to seeing how this brand born with a golden key in 2023 will perform.

The Next Battle for Extended Range and Hybrid

The core issue in 2023 is that, as BYD was the first to hand in the DM-i as homework, including Changan’s deep blue, which tried to transform from gasoline-powered cars to plug-in models, more than one automaker has attempted to do so in 2022, so automakers that can hand in their homework in 2023 are racing against time to release new cars. The fierce attack and defense of Chinese automakers in the SUV field in 2023 is very certain.

In the strategy of traditional automakers suppressing joint venture SUVs, the main things given to consumers are cost-effectiveness, high configuration, and space. With the addition of low fuel consumption and stronger power, we can see that consumers’ willingness to buy is very strong.

In conclusion: We will track and think about plug-in hybrids specifically, and after finishing the top 10 domestic and foreign companies, we will also look forward to the situations of Huawei and Xiaomi, two rising stars, and interpret the latest technology content in China. We hope you enjoyed it.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.