Top Ten Domestic Automotive Companies Annual Performance Review

(1) NIO, pursuing long-termism;

(2) Xpeng, emphasizing technology;

(3) Ideal, winning the segmented market;

(4) Leapmotor, self-developed in various fields.

We come to the fifth article of the review, and also the last article of new forces: Hozon Auto (Neta). We will continue to review domestic automobile companies and their transformation towards electrification.

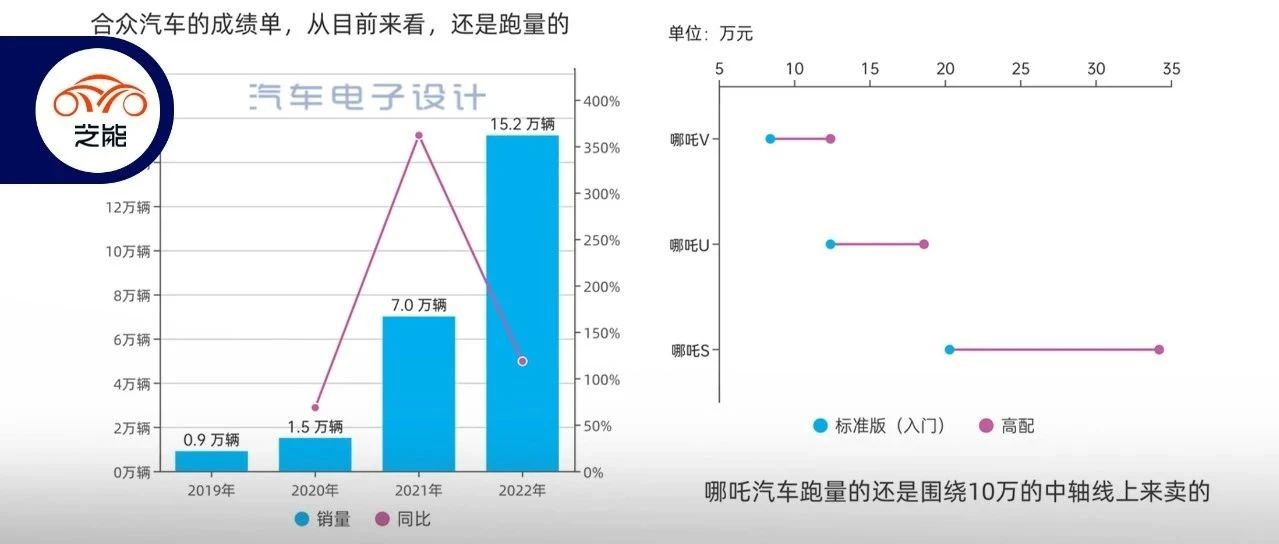

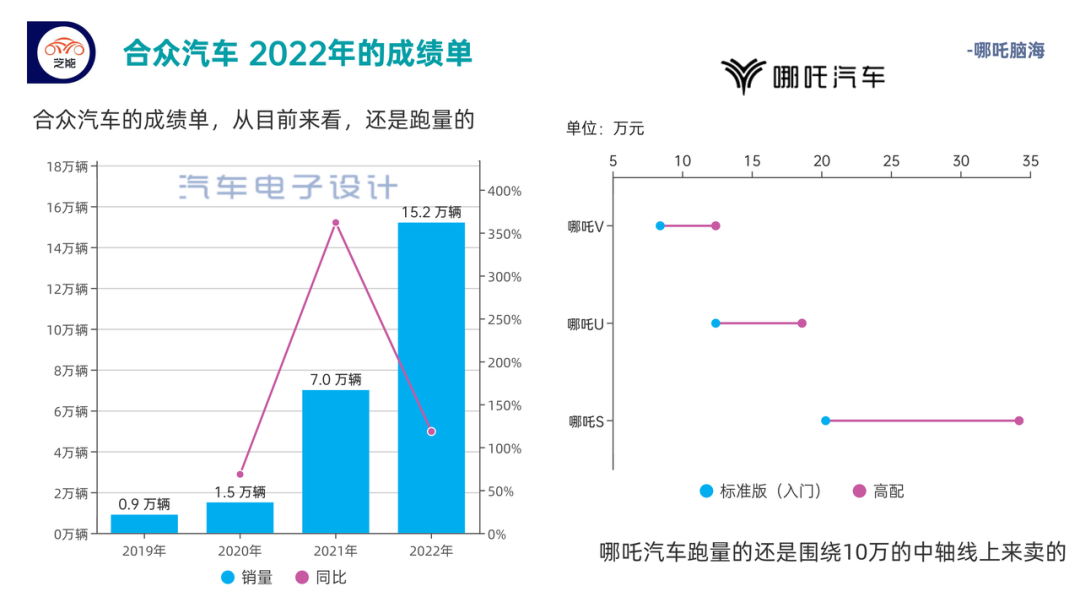

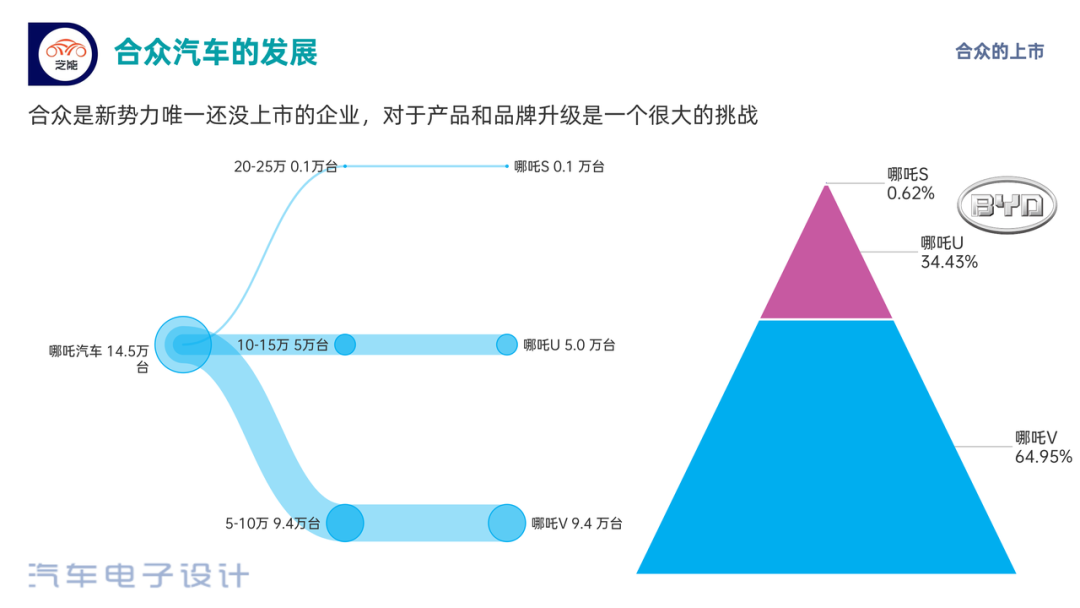

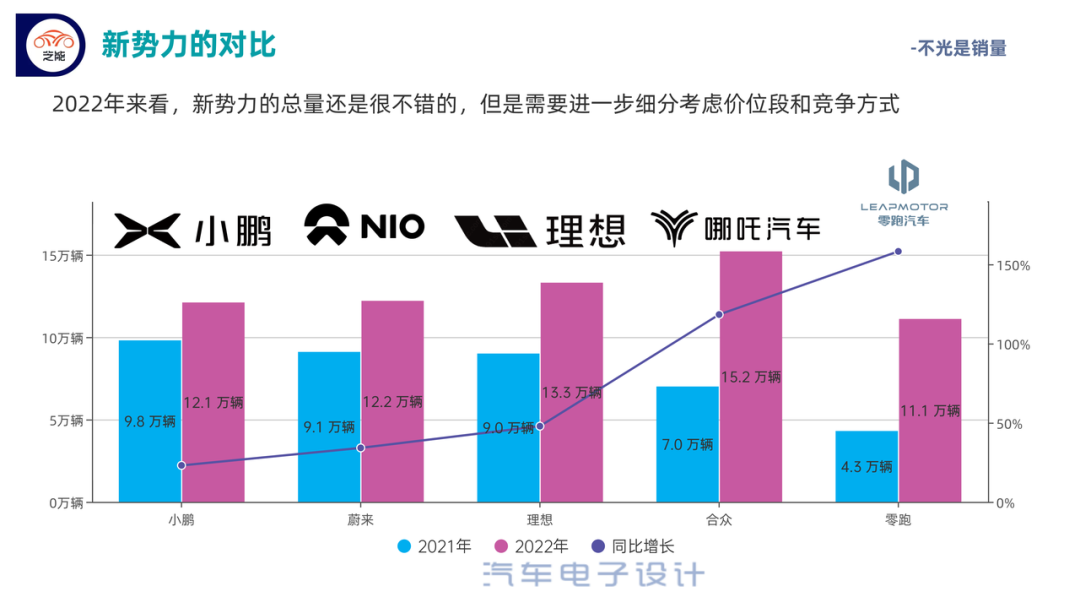

Hozon Auto is the simplest company among these new forces, with a relatively traditional overall strategy. In 2022, Neta sold 152,073 new cars in total, a year-on-year increase of 118%. In order to win the 2022 new energy vehicle sales championship, they exhausted the market demand in January 2023. Looking at the product structure, the layout of the Neta V, U, and S models is gradually ascending; In terms of price segments, Hozon Auto hopes to improve its brand image through the S segment sedan.

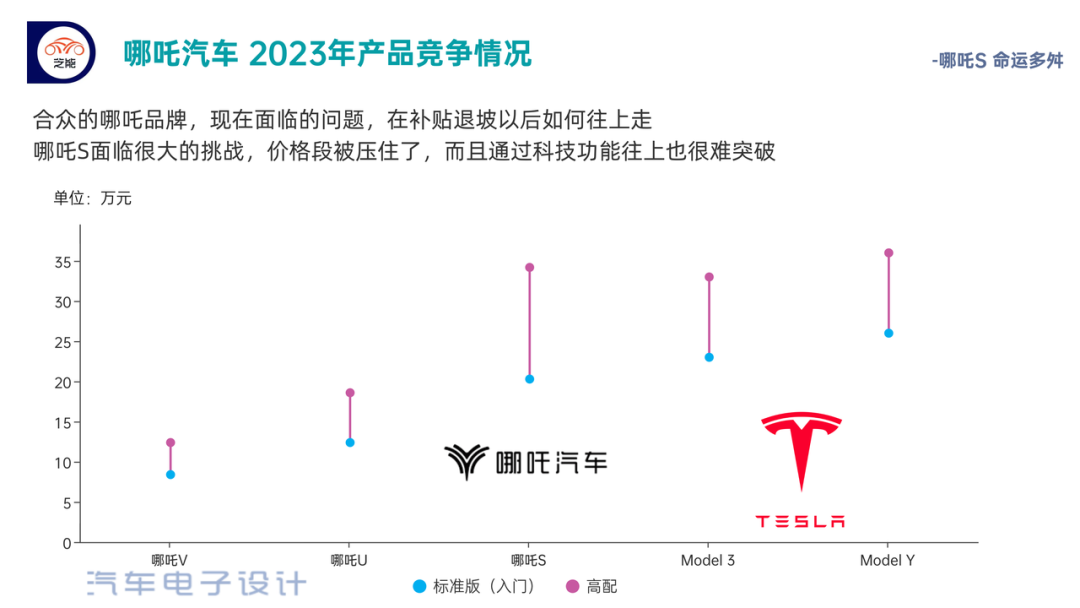

However, the problem is that the foundation of the V and U models is too large, and switching to the Neta S requires improvement in technology and other aspects, especially in the context of Tesla’s price reduction. In fact, the sales of the first two models are mainly driven by their cost-effectiveness, while the strategy of Neta S puts themselves into a market that not only demands cost-effectiveness but also requires recognition by individual consumers. As a result, we believe Neta’s product positioning is relatively divided.

## NETA Auto in 2022

## NETA Auto in 2022

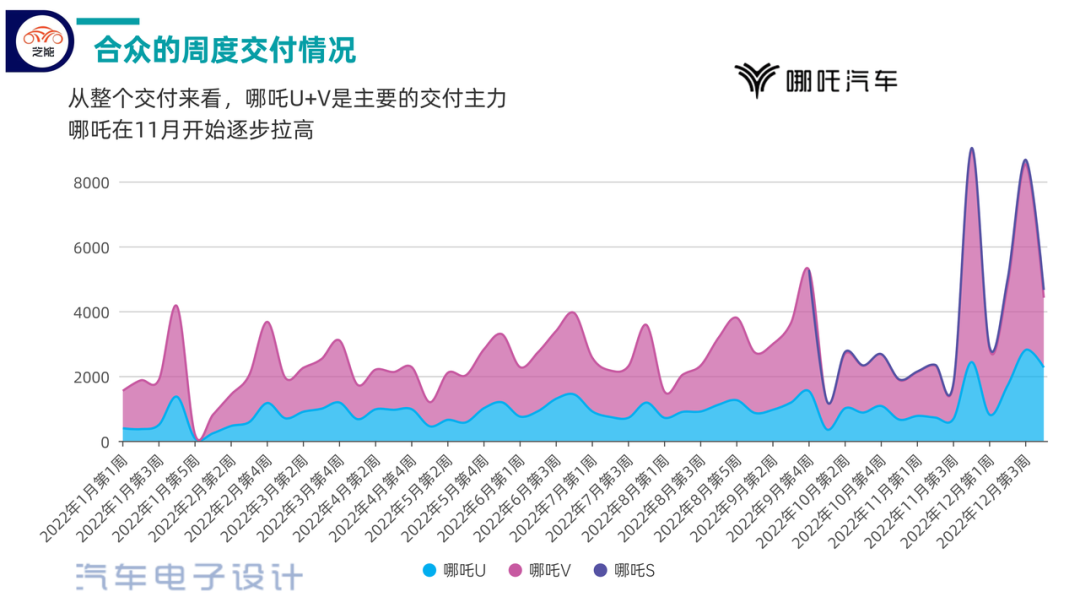

In terms of actual terminal insureds, NETA Auto had a very significant boost in demand after November last year, which concentrated on selling these cars before the end of the year. This is actually opposite to the actual demand state from November to December. At that time, individual consumers did not have the energy or conditions to digest and absorb such a high volume. Therefore, this part of the data was heavily affected by artificial operation factors.

The normal weekly demand for U+V two models is about 2,500, which is a monthly sales volume of 10,000.

Currently, the 50-100k NETA V accounts for 65%, and the 100-150k NETA U accounts for 35%. NETA S is still in the trial stage, and the road ahead is not easy. Currently, Hozon is also one of the top five new forces, the only one that has not been listed, and the pressure is high.

The problem with Hozon is very clear. From all products, the actual use on the B side (B side can also operate in the name of individuals) relies heavily. The NETA brand is not well-known among individual consumers, and most consumers still see it as an operating brand.

Comparison of NETA Auto with other new forces

In terms of sales volume and growth rate, NETA Auto and Leapmotor are among the largest and fastest-growing. However, the essential situation of these new forces’ development is different.

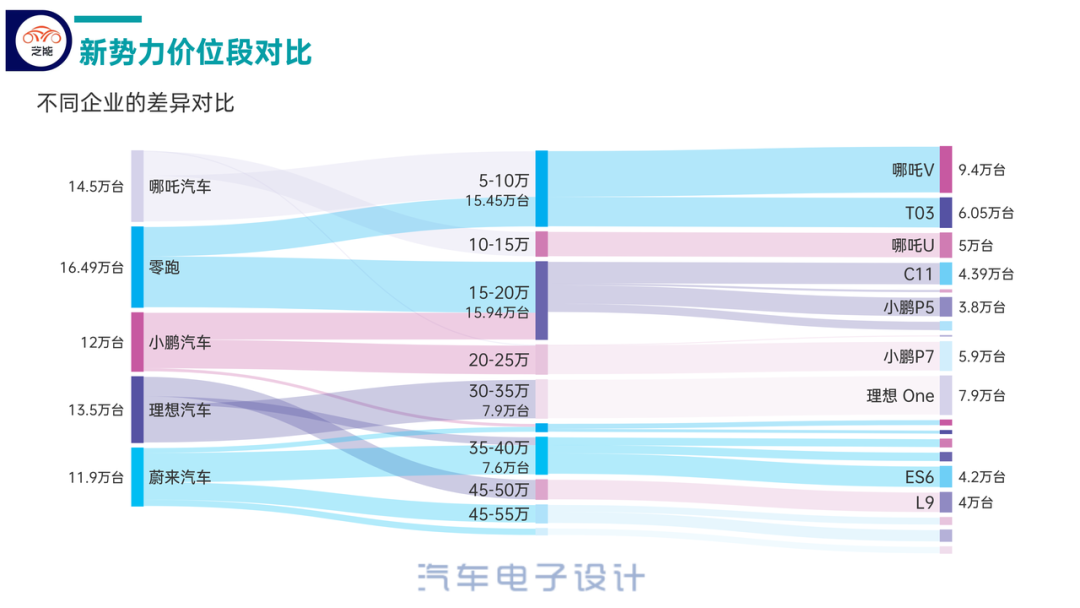

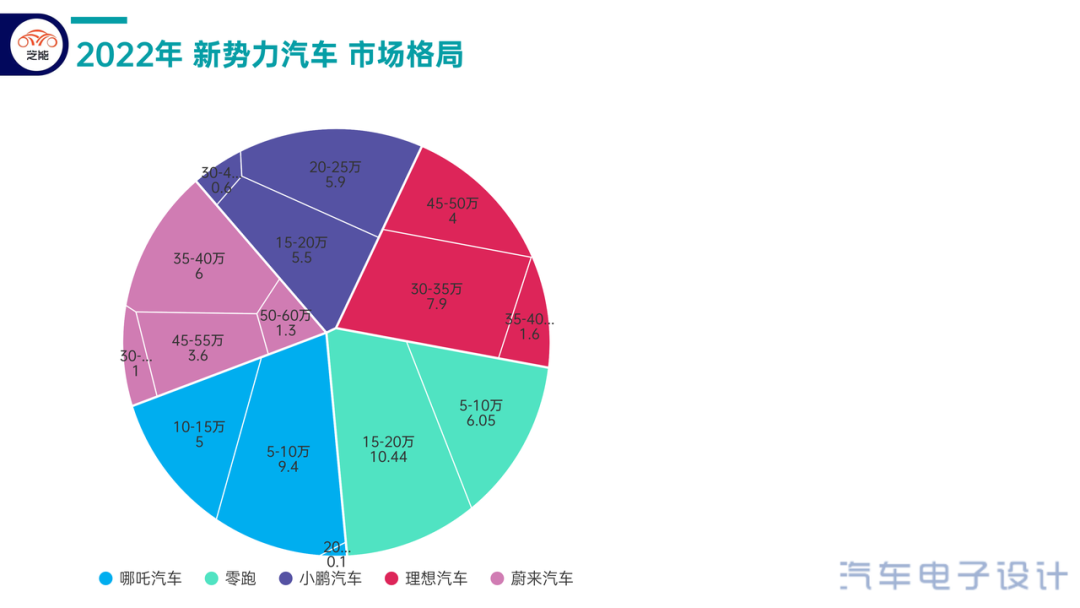

If we look at different price ranges, we can see that these companies are divided into two categories:

◎ Hezhong, Zeropao and XPeng mainly distribute in price ranges of 50,000-100,000 RMB, 100,000-150,000 RMB, 150,000-200,000 RMB, and 200,000-250,000 RMB. It is relatively difficult for Hezhong to upgrade their models. Zeropao has already jumped half of their sales to the 150,000-200,000 RMB range, while XPeng is attempting to position themselves in the 300,000-400,000 RMB range.

◎ The main market for Ideality and NIO cars are priced above 350,000 RMB. Both companies have a luxurious positioning, with NIO emphasizing brand operation and Ideality focusing on product strength.

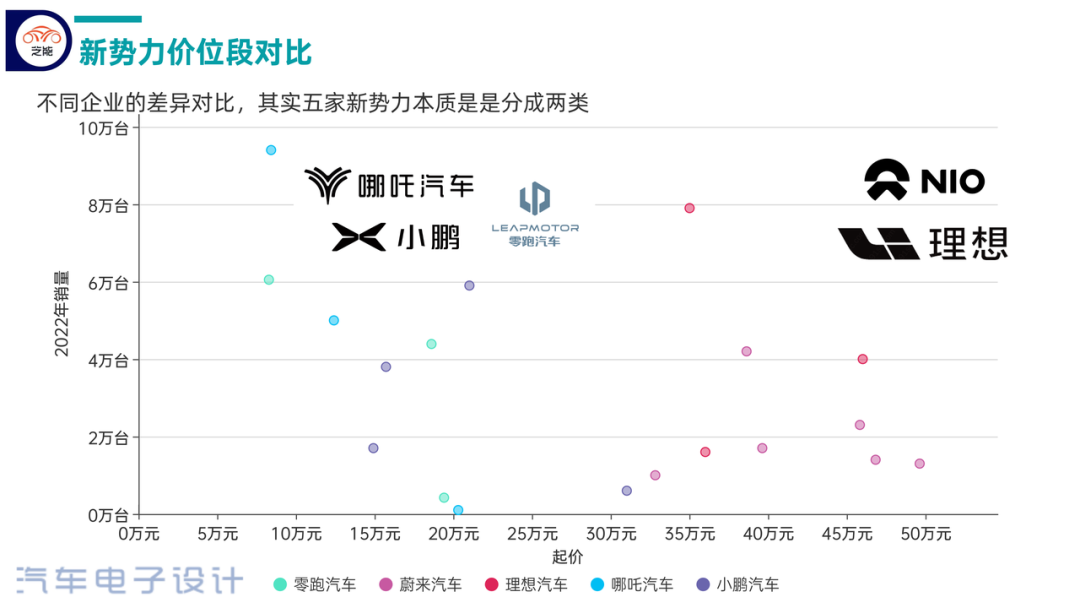

Using a scatter plot to view the price and sales positioning can provide a clearer picture (Figure 7). We can see the differences between the five companies.

Currently, the biggest crisis in the new energy market is that after Tesla lowered their prices, products priced between 150,000-200,000 RMB, 200,000-250,000 RMB, and 250,000-300,000 RMB have been affected. Products priced far from this range are not affected to such a great extent – either their prices are already relatively low without room for price reductions, or they are products with higher price positioning where price reductions are not the focus.

In conclusion: Our analysis of new energy vehicles ends here today. Studying new energy vehicles relative to traditional vehicles is relatively simple, as these new-generation companies have no historical burdens and clear goals. We will continue to focus on technological and market updates in the future. Our annual review is part of a series that mainly shares the overall competitive situation and main status of the companies. These five new energy vehicle companies have performed relatively well in the market, but by 2023, the situation may change, and it will likely be a 5-to-3 pattern.# 这是一个标题

这是一段普通的文本,中间没有任何格式。

这是一段代码块。

下面是一个链接:Markdown语法说明

下面是一个图片:

这是一个无序列表:

- 无序列表项 1

- 无序列表项 2

这是一个有序列表:

- 有序列表项 1

- 有序列表项 2

下面是一个表格:

| 项目 | 价格 | 数量 |

|---|---|---|

| 计算机 | \$1600 | 5 |

| 手机 | \$12 | 12 |

| 管线 | \$1 | 234 |

我推荐你阅读的书目:

- <<活着>>

- <<从你的全世界路过>>

- <<贫穷的本质>>

- <<黑客与画家>>

短代码:print("Hello world!")

这是一个代码块,在其中可以放入任何代码。

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.