Author: Tao Yanyan

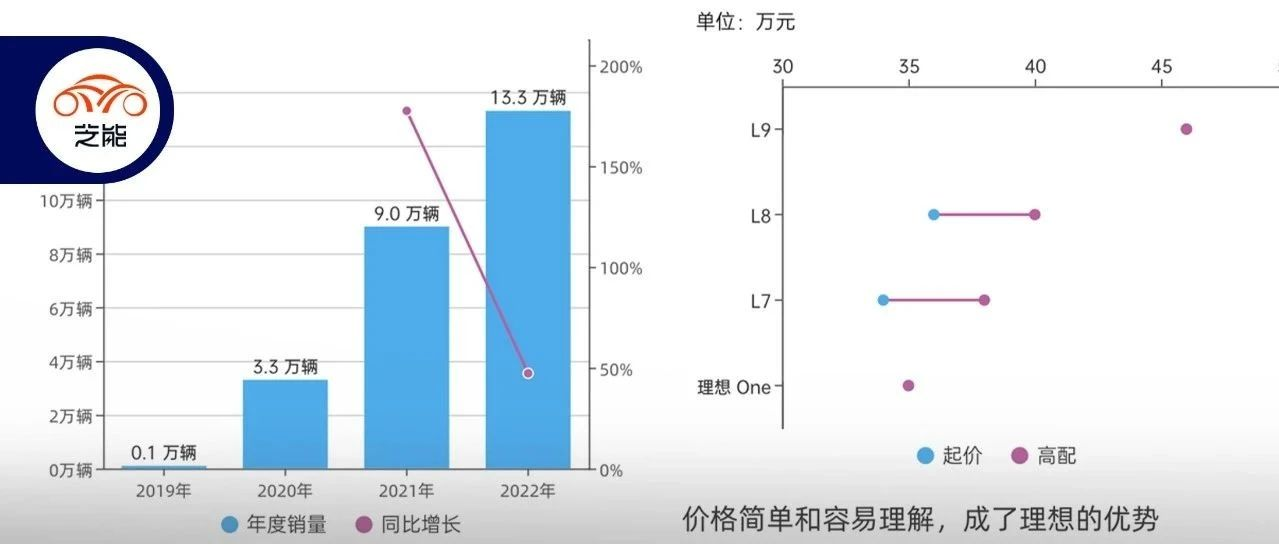

Ideal Auto delivered 133,000 vehicles in 2022, a good achievement after 33,000 in 2020 and 90,000 in 2021. It should be noted that this was achieved with only three models. The small number of models and pinpointed positioning and product strengths contribute to Ideal Auto’s reputation. I think the advantages can be simply understood as follows:

◎Ideal Auto’s current pricing is simple and easy to understand, making it a worry-free choice for consumers with high decision-making and conversion rates.

◎In terms of cost, unexpected and significant price hikes in 2022 for batteries have become the biggest advantage for extended-range models, with manageable costs.

◎In terms of configuration, many configurations that are close to consumers’ needs have been developed through a study of their demands, such as the interesting refrigerator.

! ▲ Figure 1. Ideal Auto 2022 performance report

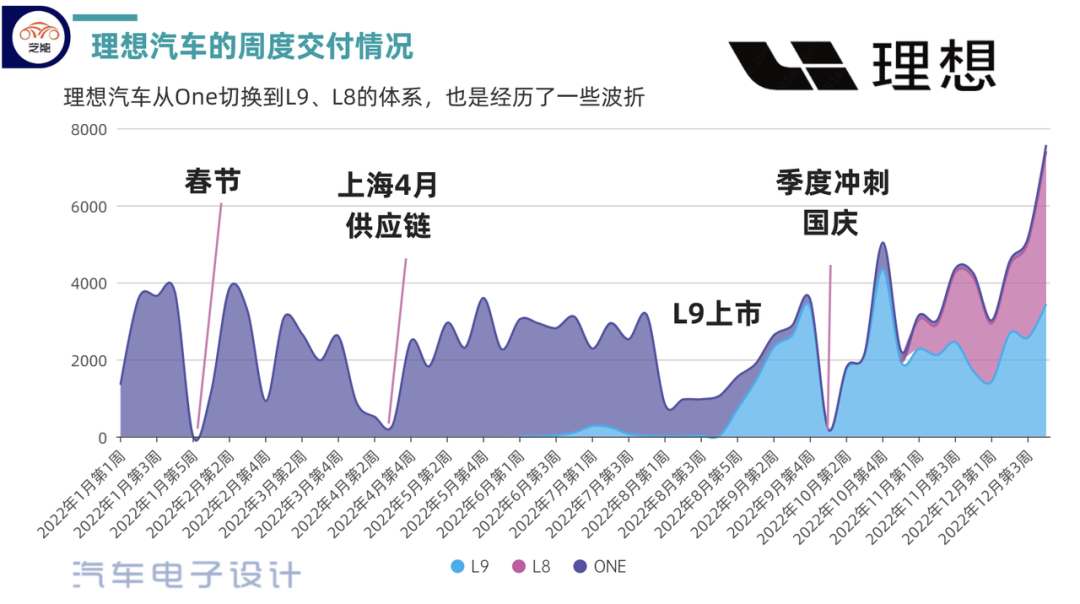

When dealing with weekly data, it was unexpectedly discovered that the number of consumers switching from Ideal One to L8 is currently less than those who purchase L given 9 – although L9 is indeed a good product that stimulates the consumption desires of many existing consumers. This vehicle, priced at 459,800 yuan, replaces the inventory demand of many big cars. So far, with the absence of good large SUV gasoline cars under the national sixth standard, it can be said that it has precisely segmented consumer groups and become the most popular product among NIO, Ideal and XPeng in the fourth quarter of 2022.

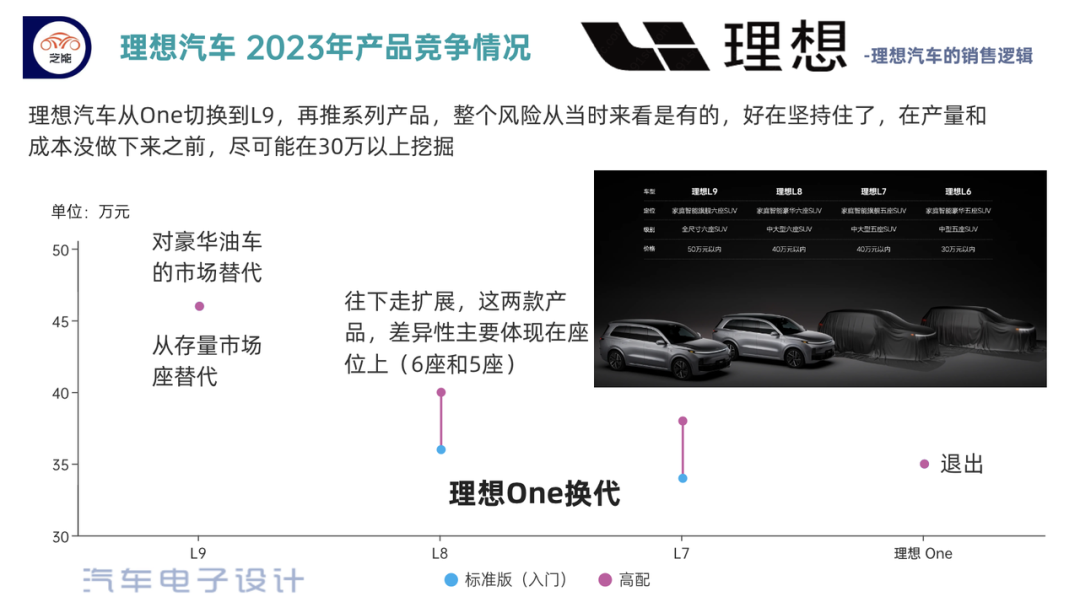

! ▲ Figure 2. Sales proportion of Ideal Auto 2022

Where does Ideal Auto Win?

Ideal Auto has overcome the risk from transitioning to L9 and launching a series of products. Fortunately, before production and cost issues were resolved, they were invested as much as possible concerning 300,000 yuan. Therefore, before L7’s release, L8 and L7 were more like the same car divided into 6- and 5-seat configurations, with some differentiation in design and size.From a strategic point of view, Ideal Automotive is trying to explore as much as the 350,000+ market share as possible.

Reviewing the weekly data of 2022, Ideal Automotive encountered some obstacles in the transition from ONE to the L9 and L8 systems. The sales of L9 increased from the second week of September, when the sales data of ONE began to decline – this was the most stressful time for Ideal Automotive. After surviving this period, the inventory market of L9 was replaced, L8 took over the positioning of ONE, and product strength was further improved, ensuring Ideal Automotive’s good delivery data in Q4, which was not easy.

From a positioning perspective, Ideal Automotive has achieved some success in 2022 by relying on different technology paths and targeting consumers with high-end configurations.

Where is the bottleneck of development?

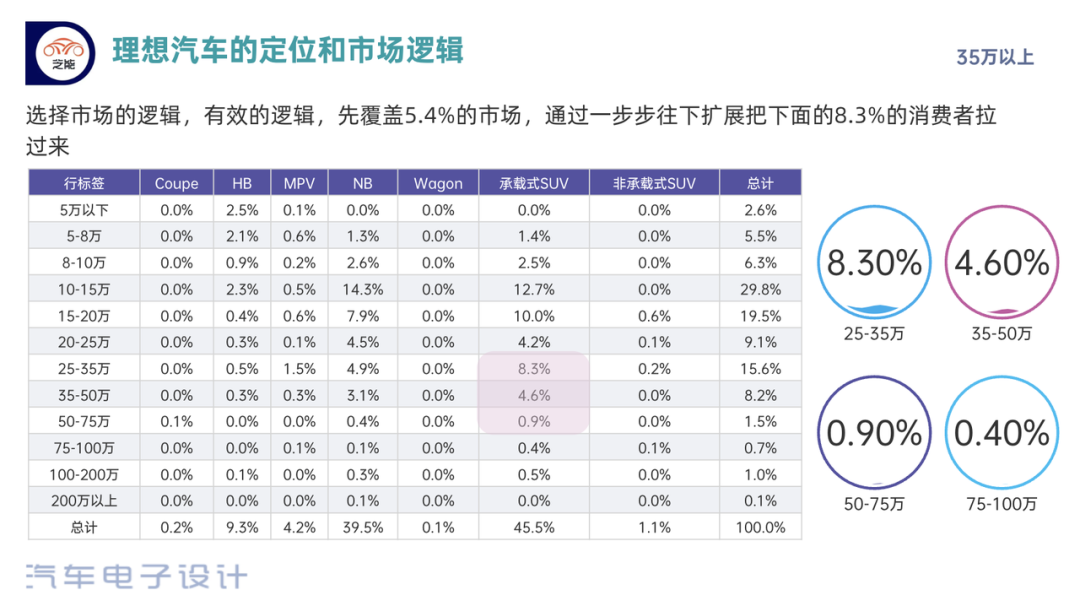

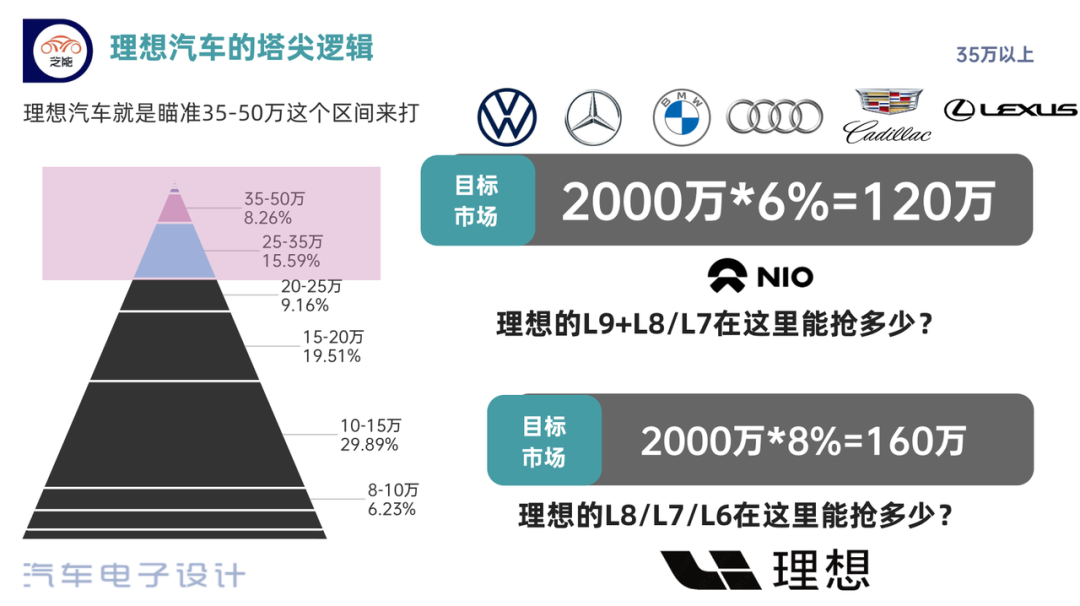

As a new force, Ideal Automotive must solve the problem of profitability, which is the most cautious issue. In the early stage of entrepreneurship, the pursuit is cost-effectiveness and the strategy of capturing best-selling products under the limited resources. From the logic of choosing the market and targeting the effective market (making money and selling), they initially covered 5.4% of the market above 350,000, and further captured 8.3% of consumers in the price range of 250,000-350,000 by expanding downwards.

We have calculated that before the L6 was launched and entered the price range of within 300,000, Ideal Automotive could only effectively reach around 1.2 million people, considering the proportion of the Chinese market with 35-50 million and SUV conditions. The unique advantage is that the core logic of user choice is to replace the fuel vehicles in second- to fourth-line cities with extended range. Therefore, Ideal Automotive’s geographical distribution is very scattered and does not rely on regional charging facilities, nor invest a lot of money in energy supplement facilities.The next step is to reach consumers in the 1.6 million price segment with the lowering of L6 prices. This is a difficult task because there is competition from the lower-priced Tesla Model Y and gasoline-powered cars are also competitive in this area.

Conclusion: We believe that Ideal Auto has done an excellent job in evaluating their position and choices as a car company, allocating resources wisely and taking careful consideration in their strategy. As they expand their product line with pure electric vehicles, Ideal Auto will face new challenges that will require further strategic planning. We will revisit this topic in the future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.