Introduction

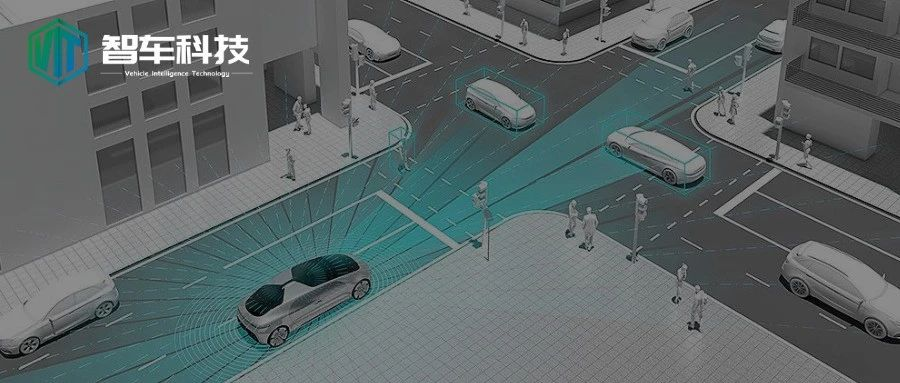

In the thriving development of intelligent automobiles, self-driving technology is undoubtedly at the forefront. Many industry leaders have already taken the lead in laying the groundwork for the digital transportation revolution. Tesla has already proven the possibility of pure vision-based autonomous driving through practical actions, providing valuable references and guidance for followers. Domestically, Momenta is the first autonomous driving business to enter the autonomous driving 3.0 era, based on mass production data accumulation. Although Huawei does not directly manufacture cars, its technical strength in autonomous driving has been deeply cultivated for many years, giving it the confidence to master the core soul of the future automobile intelligent revolution. The outstanding performance of these companies indicates that the competition in the autonomous driving industry has entered a white-hot stage, and a new generation of automotive industry revolution has begun to take shape.

In order to seize the opportunity of this industrial revolution, autonomous driving companies have been preparing their new landing plans since the beginning of 2023. Along with policy encouragement, chip computing power dramatically improving, technology strategies becoming more certain, and algorithm capabilities upgrading, everyone is ready to show their skills in the new year and get the first-mover advantage in the rise of intelligent automobiles. In just two months, industry news has been emerging frequently: multiple self-driving companies announced their plans for further landing of urban scene-assisted driving systems and continuous iteration of L2 level-assisted driving in the year; frequent movements have been seen in technology development and hardware upgrades, and technology companies hope to gain first-mover advantage in the fierce competition… From this series of actions in the industry, we seem to have seen the inevitable trend of self-driving development in 2023.

Charging Forward, Focusing on the Competition of City NOA

In the second half of 2022, “city NOA” emerged as a key area of competition among automobile manufacturers in the autonomous driving field. Functionally, city NOA can implement point-to-point “navigation-assisted driving” in complex city roads. Users can set the destination in the navigation system, and the vehicle can drive to the destination with full assisted driving without the need for human intervention. The difficulty of city NOA is far greater than that of high-speed NOA, approaching the level of L3 assisted driving. According to a survey, as a high-frequency and rigid demand scenario for user travel, city driving mileage accounts for about 70% of the total driving mileage, and in terms of time, city driving time is as high as 90%. This means that conquering the city is a hurdle that must be overcome on the road to popularizing self-driving technology. The promotion of city NOA can greatly free the hands of drivers and will also become one of the most widely used highlights, so many autonomous driving companies are competing to lay out in this area.

Tesla, as the top player in the field of autonomous driving, is about to launch FSD beta in Europe and has been recruiting safety personnel for testing. Meanwhile, the Huahua Alpha S HI version, backed by Huawei, has already released the NCA (Navigation Cruise Assist, smart driving navigation assistant) feature in the urban area of Shenzhen. The Huahua urban NCA is the most important feature introduced by the Huawei ADS team. Li Xiang mentioned in the all-staff letter that the Ideal City NOA navigation-assisted driving will be launched at the end of 2023. So many companies are focusing on the city NOA scene this year, which shows the vast prospects of this market. HiAuto has been laying out the urban scene since 2021, and its iteration of HPilot3.0 is China’s first mass-produced urban driving assistance product. Unlike most NOA products on the market that are only available in a few cities, HiAuto’s product based on heavy perception will quickly expand to hundreds of cities and cover all scenarios including highways, urban roads, and parking lots, and is expected to become the most practical and efficient driving assistance product in China.

Compared with highway NOA, city NOA needs to face more complex working conditions, with more types of traffic participants and a more chaotic traffic environment. Therefore, the challenge posed by intelligent driving technology for auto companies is the greatest. However, at the same time, risks and benefits coexist. Faced with such strong market demand, the focus of auto companies at the beginning of the year also verifies the vast prospects of this field. If the driving scene in the city can be solved, the level of intelligent driving technology will reach a new level.

The trend is towards heavy perception route instead of light map route

There have been many technical routes to autonomous driving. After 2019, two main schools of thought were formed. One is the “map school” that uses high-precision maps and LiDAR. High-precision maps and LiDAR are like the “two crutches” of autonomous vehicles, relying on LiDAR to enhance perception capabilities, improving planning capabilities with high-precision maps, and then using algorithms to achieve automatic driving. The other is the “perception school” that gets rid of the limitations of high-precision maps. To put it simply, it abandons the crutch of high-precision maps and relies on the perception capabilities of LiDAR + millimeter wave + cameras. The “perception system” is like the “eyes” and “ears” of autonomous driving, and then makes real-time judgments on road conditions.As the autonomous driving technology advances, companies are gradually realizing that excessive dependence on high-precision maps brings many constraints and limitations. Currently, the main reason why autonomous driving is difficult to fully implement is the high cost of building and maintaining high-precision maps. Updating city maps daily is an even more difficult goal for autonomous driving companies. With the tightening of high-precision map qualifications, only a few map vendors in China have the qualifications to draw maps. For automakers, no OEM is willing to hand over such an important chip to others, and cooperation with map vendors cannot completely eliminate such concerns. In such a background, abandoning high-precision maps and enhancing perception capabilities is a good choice.

Tesla is undoubtedly the earliest player to implement this idea in foreign countries. Its use of the BEV perception model was welcomed by domestic and foreign autonomous driving companies, and it also proved the possibility of future pure-vision autonomous driving through market feedback. In China, many companies are also gradually undergoing strategic transformation: XPeng reiterated that it will no longer rely on high-precision maps from highways to urban NOA from 2023; LI will use BEV perception and Transformer model to achieve city NOA that does not rely on high-precision maps. In fact, the heavy-perception route is not a fresh concept, and the domestic autonomous driving company Momenta was the first to choose this route, and for a long time it was almost the only vendor in the industry to adopt the “heavy-perception” route. The five MANA models it released helped improve perception effects and reduce the dependence of autonomous driving on high-precision maps. The switch of corporate routes in an industry is often well-considered and has far-reaching impact, and establishing the correct route as early as possible will bring a strong first-mover advantage to the enterprise, which Momenta has taken the lead in the Chinese autonomous driving industry.

In the future, the advantage of the “heavy-perception, light-map” route will gradually become apparent. Automakers will accumulate a large amount of real road condition data through on-ground testing, allowing the autonomous driving system to learn more valuable experience and become a true “veteran driver”. We humans don’t need to know as much global high-precision map information when driving, and it is theoretically feasible for machines to rely entirely on powerful perception capabilities to deal with various scenarios. More and more companies are proving this point. Only in this way can we truly lay a solid foundation for the mass production and implementation of autonomous driving.## Full Bloom, High Computing Power Hardware Deployment

For autonomous driving systems, both software and hardware play a critical role and are indispensable. As for hardware, autonomous driving chips, as the carrier of the computation, have become the core of smart vehicles. In the past, autonomous driving chips mainly focused on accomplishing a single function (supporting low-level assisted driving), such as controlling the chassis, engine, brake lights, etc. However, Tesla’s electronic and electrical architecture, as a representative of automobile electronics, overturned the conventional mode and adopted a central centralized architecture, which used a “brain” to control the whole vehicle. The domain controller gradually integrated sensor, data fusion, path planning, decision-making and other calculation and processing functions. Additionally, as the level of autonomous driving gradually increases and the range of application becomes richer, the requirements for chip computation power are becoming increasingly higher.

In this context, high computing power hardware deployment has become pressing in the industry. On January 11, the National Information Center and relevant departments jointly released the “Guidelines for Innovation and Development of Intelligent Computing Centers”, which showed that more than 30 cities nationwide are either building or proposing to build smart computing centers. Many technology companies are also cooperating with local governments and deeply involved in this process, such as Inspur Information’s Huaihai Smart Computing Center, SenseTime’s Shanghai Smart Computing Center, Alibaba’s Zhangbei Super Smart Computing Center, etc., which are providing efficient computing power services for the local AI industry. “Momenta” has also joined forces with the “Volcano Engine” to carry the largest smart computing center for Chinese autonomous driving, “Mana Oasis”. The construction of Mana Oasis will allow Momenta to have the ability to conduct large-scale AI training, abundant data and computation power, and Momenta’s technological and product capabilities will be even stronger. “Geely Xingrui Zhi” computing center was also launched recently, as the world’s first integrated super-cloud computing platform of cloud, data and intelligence in the global automotive industry, which increased the R&D efficiency by 20%.

We know that data-driven is the direction and trend of future development of autonomous driving. Massive product data, large-scale data training, and the application of big models all demand more computing power. In the future, getting rid of high-precision maps will be a trend, and heavy sensing and high computing power will be inevitable. It can be said that the future of autonomous driving is a competition between data and computing power. Whoever has the most comprehensive and abundant scenario data, and has sufficient hardware deployment with powerful computing power can gain the upper hand in the future competition of autonomous driving. In 2023, autonomous driving will fully enter the era of 3.0, which is mainly driven by data. Advanced intelligent driving will become a standard configuration of mid-range models, and heavy hardware deployment with high computing power will be crucial among them. Only with chip hardware with powerful computing power can enterprises have the confidence to achieve true autonomous driving functions.## Breaking the Deadlock, Financing and Listing Process Accelerated

When it comes to the most critical term in the current autonomous driving industry, mass production and commercialization is undoubtedly the top priority for all companies. According to industry insiders, autonomous driving is an exciting track that requires a lot of AI technology. Autonomous driving cars are also automated robots on four wheels, making autonomous driving the intersection of two future trends: AI and robotics, underscoring its strategic value. Therefore, more and more investors and companies are pouring into this track, hoping to be the first to achieve commercialization of autonomous driving.

Since its development, autonomous driving has not disappointed, giving birth to batches of star companies, with multi-million-dollar financing being a common occurrence, and the listing process of top players is gradually accelerating after the start of 2023, rumours began to circulate that many autonomous driving companies were preparing for initial public offerings.

Firstly, China’s leading LiDAR company, Hesai Technology, announced in January that it would be listed in the United States and has already submitted the F-1 document to the US Securities and Exchange Commission (SEC), becoming the first LiDAR stock. Soon after, Black Sesame Technologies was planning to go public on the Hong Kong Stock Exchange, with plans to raise about $200 million. As the leading Chinese representative enterprise, the listing will undoubtedly greatly enhance the morale of China’s smart car industry, and will also make more investors optimistic about the industry and willing to support the rise and development of Chinese autonomous driving.

In fact, autonomous driving has many subdivided tracks, and there are no relatively clear leaders at present. As long as the market is buying, there is no bubble in this field. Three to five years ago, people were talking about investment and financing in autonomous driving, but the development direction and path were not yet clear. Investors wanted a relatively certain and high expected return on investment action. At this stage, the development path of scenario-based autonomous driving is already very clear. In the capital market, there is no better investment direction than autonomous driving this year. However, the time window left for startups is not long, and the choices made by capital are also very picky, increasingly concentrating on leading companies and mature enterprises within the industry, and the financing and listing process of top players will become faster and faster.## Summary

After going through the storm in 2022, the beginning of 2023 undoubtedly gave the autonomous driving industry a good start, and it also greatly restored the confidence of investors and practitioners. The consensus within the industry is that smart cars will welcome a second round of rapid development and large-scale competition in the next five years, with the core being autonomous driving.

In the future, whoever can deliver mature autonomous driving products first will be able to break through with mainstream manufacturers. As 2023 is expected to be the year for city scene-assisted driving, the fierce competition within the industry is self-evident, and only by better integrating technology into the product end can companies stand out in this era where mass production is the king of autonomous driving. The road to the competition for autonomous driving is a journey of sprinting from the starting line to the finish line.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.