Author: Xiao Ying

Editor: Qiu Kaijun

The outstanding performance of new energy vehicles in 2022 has passed, what will happen in 2023?

According to the data of the China Association of Automobile Manufacturers, the cumulative sales volume of new energy vehicles in China reached 6.887 million vehicles from January to December in 2022, and the sales penetration rate of new vehicles has reached 25.6%.

On January 12th, Zhang Yongwei, the Vice Chairman and Secretary-General of the China EV100, introduced China EV100’s judgment on the new energy vehicle market in 2023 at the 2023 media communication meeting of China EV100.

He mentioned that the production and sales growth rate of new energy vehicles in 2023 is expected to be around 40%, and the new car penetration rate will also be around 40%. The overall sales volume is expected to reach 10 million vehicles. The incremental space mainly comes from three aspects: third-tier and below markets, overseas markets, and the accelerated replacement of fuel vehicles.

Hedging Good News and Bad News, Slowing Growth

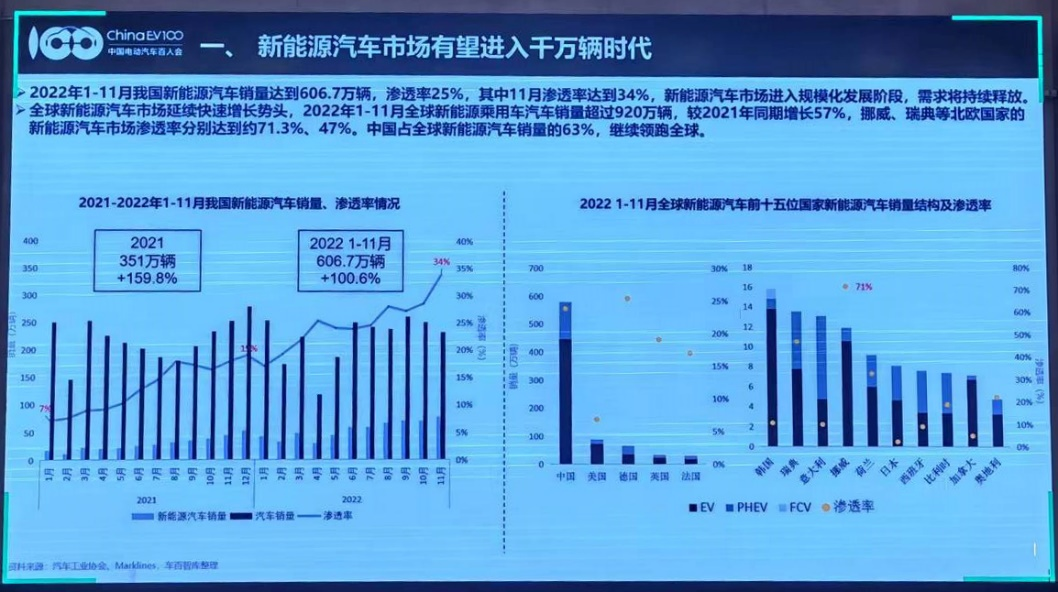

According to the data shared by Zhang Yongwei, the global new energy vehicle market continues to grow rapidly. From January to November in 2022, the sales volume of new energy passenger cars exceeded 9.2 million vehicles, an increase of 57% compared with the cyclical growth in 2021.

Among the top 15 countries in sales volume, Norway and Sweden have the highest market penetration rates of new energy vehicles, reaching 71.3% and 47%, respectively.

In 2022, the overall penetration rate of new energy vehicles’ new car sales in China showed an upward trend, and the penetration rate reached 34% in November, slightly falling in December but still exceeding 30%.

Zhang Yongwei judged that China’s new energy vehicle market has entered a stage of scale development and demand will continue to be released. However, compared with the doubled growth rate in the previous two years, the growth rate in 2023 is expected to slow down.

He analyzed that with the withdrawal of new energy vehicle sales subsidies in 2023 and the appearance of a certain sales volume downturn at the end of 2022, it will be difficult to achieve a doubling of sales volume growth in 2023 when the sales volume base of new energy vehicles is getting larger and larger. The reasonable expectation for sales growth rate is around 40%, and the new car penetration rate will also be around 40%. The overall sales volume of new energy vehicles is expected to reach 10 million vehicles.

Here is the judgment that based on many positive and negative factors offsetting.

In the positive factors, “Carbon Peak” goal will still incentivize all industries to develop toward low-carbonization, especially the automotive industry which is a big carbon emitter.

Meanwhile, although the era of new energy vehicle subsidies has ended, the preferential policy for new energy vehicle purchase tax is still continuing, and various regions are also introducing promotion policies such as car purchase subsidies and consumer vouchers, which will become an important method for boosting sales in a certain period of time.

In addition, according to the incomplete statistics of Hundred People Committee, it is expected that over 100 new energy vehicle models will be launched in 2023, the diversification of vehicle models and the improvement of product experience will provide impetus to the fundamental market demand.

In terms of negative factors, the discontinuation of new car purchase tax subsidies is the most significant factor. According to the calculation of the Hundred People Committee, after the subsidies are removed, the highest cost increase for consumers purchasing a car will be 12,600 yuan.

Secondly, the uncertainty factor on the supply chain side, the unstable international political and economic situation, and the structural shortage of upstream raw materials and chip issues remain prominent.

Finally, the competition in the global new energy vehicle market is becoming increasingly fierce. Developed countries such as Europe and the United States are constantly increasing their development efforts in the new energy vehicle field. They have introduced “Chip and Technology Act” and “Inflation Reduction Act” in the battery and chip fields, etc., which aims to restrict China’s enterprises and protect domestic supply chain construction.

Incremental space: sinking, going overseas

The incremental space of the new energy vehicle market in 2023 mainly depends on three aspects: the third-tier and below cities, overseas markets, and the mature and abundant new energy vehicle products that occupy the gasoline vehicle market.

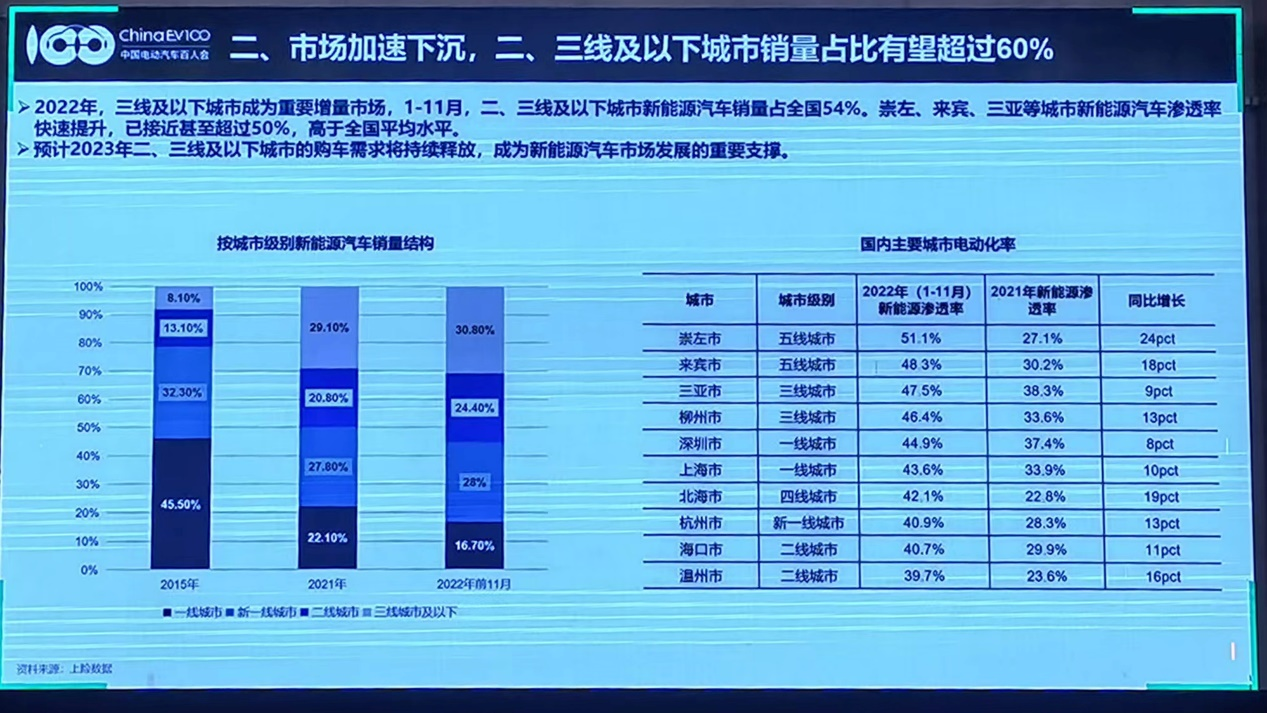

In 2022, third-tier and below cities are becoming important incremental markets. According to the Hundred People Committee statistics, from January to November, the new energy vehicle sales in second and third-tier cities and below accounted for 54% of the country. In specific markets, the penetration rate of third-tier and below cities, such as Chongzuo, Laibin, Sanya, and Liuzhou, has exceeded that of first-tier cities such as Shenzhen and Shanghai.

Zhang Yongwei mentioned that in the past, the main battleground for new energy vehicles was in first-tier cities. However, he expects that in 2023, the demand for purchasing cars in second- and third-tier cities will continue to be released and become an important support for the development of new energy vehicle markets.

At the same time, the export of new energy vehicles will become another growth driver for the automobile industry.

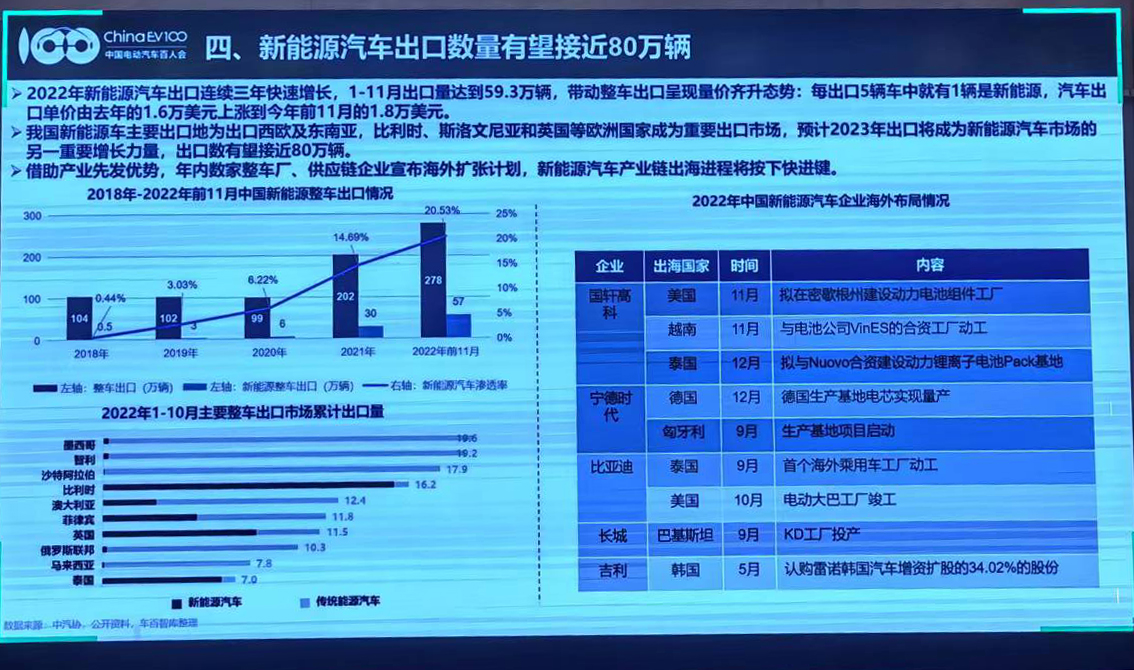

Zhang Yongwei introduced that China has become the second largest automobile exporting country after Japan, and the proportion of new energy vehicle models is increasing.

In 2022, the export of new energy vehicles has grown rapidly for three consecutive years, and the export volume from January to December reached 679,000 vehicles. Among them, one out of every five vehicles exported is a new energy vehicle.

China’s main markets for new energy vehicle exports are Western Europe, Southeast Asia, Belgium, Slovenia, and other markets. It is expected that the export volume will increase to 800,000 vehicles by 2023.

At the same time, in 2022, many vehicle manufacturers and supply chain companies have announced expansion plans, including Geely, Great Wall, BYD, CATL, and Guoxuan High-tech. It is expected that in 2023, the process of going global for the new energy vehicle industry chain will be accelerated.

On the product side, compared with 2019, in 2022, the prices of pure electric vehicle models have increased, prices of plug-in hybrid vehicle models have decreased, and mid-range vehicle models have made rapid progress in electrification. Zhang Yongwei predicts that, considering factors such as model supply and vehicle lifecycle costs, mid-range vehicles will accelerate penetration in 2023, and the sales structure of new energy vehicles will evolve from a dumbbell shape to a spindle shape.

He mentioned that the middle market will become the main battleground for electrification. In this market interval, it is not only the focus of hybrid vehicles, but also the focus of competition between domestic and joint venture brands.

Specifically, the proportion of cars priced between 150,000 to 300,000 yuan is expected to approach 50%, and plug-in hybrid vehicles will become an important support for the continuous growth of the new energy vehicle market.

Technological innovation drives the market

Technological breakthroughs are still the core means of innovation and cost reduction for new energy vehicles.

Taking power batteries as an example, Zhang Yongwei believes that there is still a lot of room for improvement in performance and cost, and he is very optimistic about battery technology innovation and believes that the probability of disruptive products appearing is very high.

He mentioned that in 2023, many new technologies, such as lithium manganese phosphate, PET composite copper foil, and sodium-ion batteries, are expected to achieve large-scale applications. At the same time, the landing of semi-solid and solid-state battery technologies will effectively improve indicators such as electric energy density, safety, and economy, thereby enhancing battery product effectiveness, and promoting the accelerated penetration rate of new energy vehicles.Another innovation stronghold will be in the direction of intelligent driving and intelligent cockpit.

According to Zhang Yongwei, in 2021, the penetration rate of new L2-level assisted driving passenger cars in China’s market has reached 23.5%, which will rise to 32.4% in 2022. It is expected that by 2025, the penetration rate of L2-level and above intelligent connected vehicles will reach 80%.

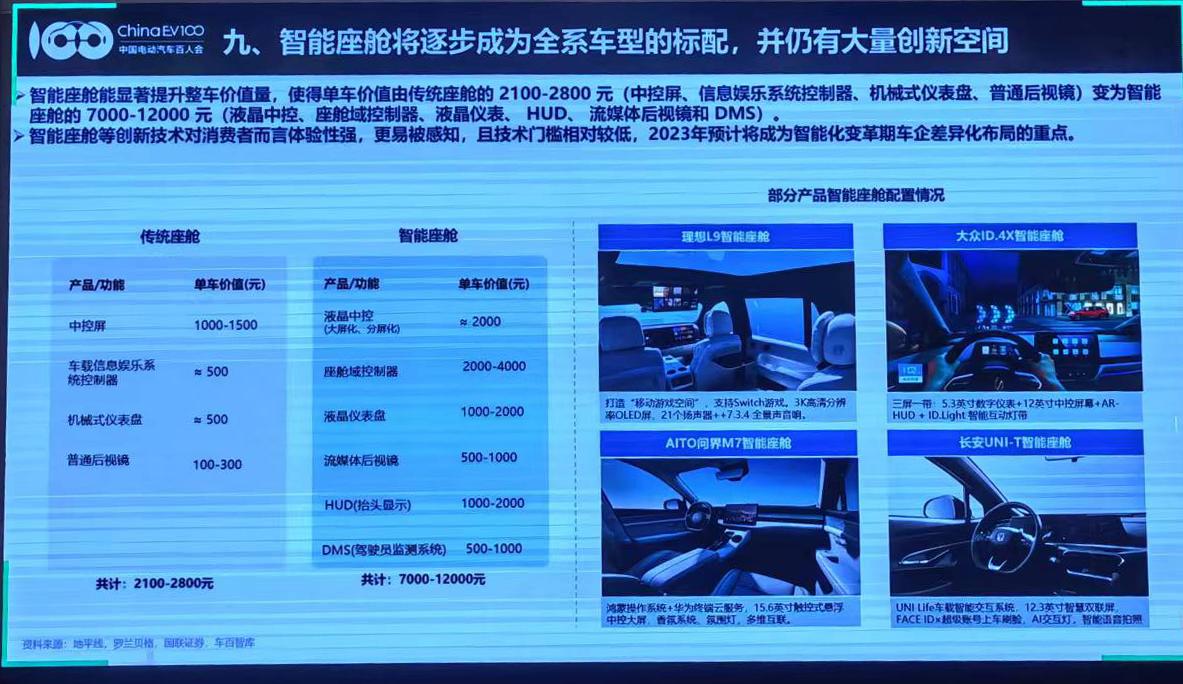

At the same time, intelligent cockpits will drive the increase in the value of the entire vehicle, making the value of a single vehicle change from the traditional cockpit of 2100-2800 yuan (central control screen, information entertainment system controller, mechanical instrument panel, ordinary rearview mirror) to the intelligent cockpit of 7000-12000 yuan (LCD central control, cockpit domain controller, LCD instrument, HUD, streaming media rearview mirror, and DMS).

Zhang Yongwei believes that innovative technologies such as intelligent cockpits have stronger experiential characteristics for consumers, are more easily perceived, and have relatively low technical thresholds. It is expected to become the focus of differentiation layout for automakers in 2023.

In addition, at the industrial level, there is a critical driving force, which is technology companies. Zhang Yongwei believes that technology companies and automobile companies can complement each other in terms of technical element resources, and will help accelerate the transformation and upgrading of automotive products and become the engine of the automotive industry’s transformation.

He also talked about the industrial evolution law, which is generally believed that the automobile market will become more and more concentrated, but currently, the market structure has not yet formed.

“In the process of industry transformation, disruptive and innovative forces will appear, and the concentration theory will no longer apply. Don’t forget the involvement of players outside the main track, they will affect the market structure.”

Zhang Yongwei also introduced that the 9th China Electric Vehicle 100-People Forum will be held in Beijing from March 31 to April 2 with the theme “Promoting the Modernization of China’s Automobile Industry”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.