Author: Zhu Yulong

The biggest news in the automotive market yesterday was a wave of price reductions by Tesla (the starting price of Model 3 is 229,900 RMB, and Model Y is 259,900 RMB). The magnitude and urgency of this action were unexpected. My understanding is that after the original 12,600 RMB pure electric vehicle subsidy was phased out, Tesla continued to lower its prices. This not only reflects the issue of their order pool, but also indicates an attitude. Companies like Tesla are able to transfer the decline in national subsidies by making concessions to consumers, and then continue to grab market share from fuel vehicles.

At present, it is difficult to continue to subsidize local car companies, and distributing consumer vouchers without a clear plan is not effective. As we can see, Tesla has started to make moves in the market without national subsidies by operating in a market-oriented manner.

As a result, the rear-wheel-drive version of the Model was released for 48,600 RMB less (1.4万 was released in October, a total of 62,600 was reduced). This brings the price down to 229,900 RMB. If Tesla can make a profit of $10,000 on each car (69,000 RMB), then they will soon reach their limit. I personally estimate that 220,000 RMB is the limit of their cost reduction.

The Model Y also absorbed a reduction of 40,600 RMB (28,000 RMB price reduction and 12,600 RMB subsidy). Combined with the 28,000 units reduced in October last year, this is a total reduction of 68,600 RMB. If Tesla only earns $10,000 in Q3, it has been explained completely.

Returning to the baseline

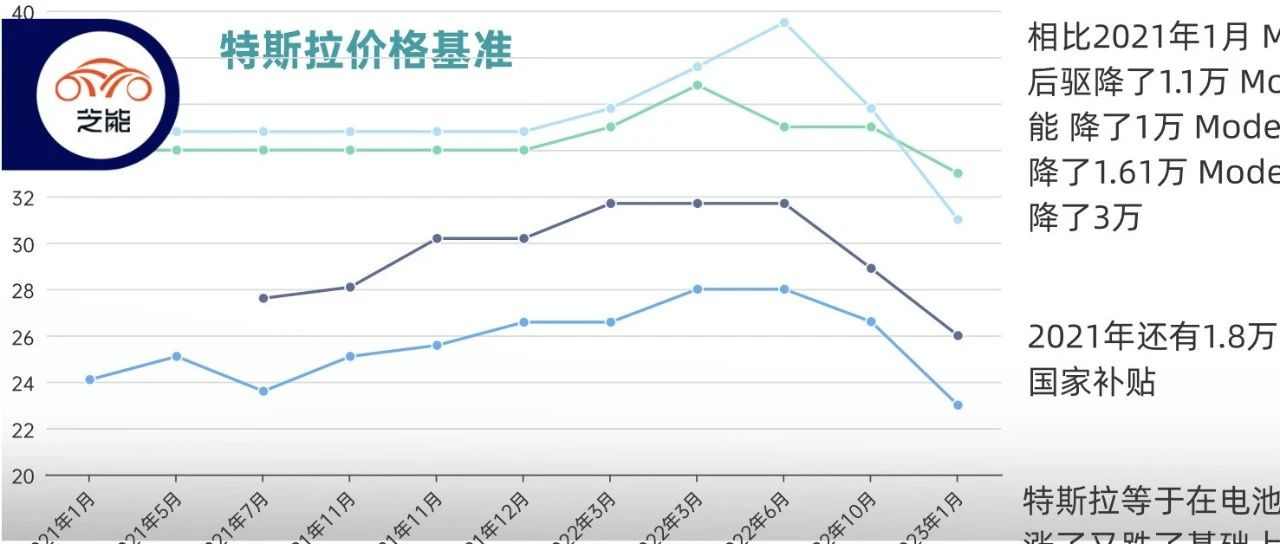

Without considering the ups and downs of this process, and in the context of the abundance of chip supply and low battery costs in 2021, compared with the price in January 2021, Tesla’s consumer-oriented price changes are as follows:● Model 3 RWD version decreased by 11,000 yuan (battery increased by 5 kWh).

● Model 3 Performance version decreased by 10,000 yuan (without subsidy).

● Model Y RWD version decreased by 16,100 yuan (battery increased by 5 kWh).

● Model Y Long Range version decreased by 30,000 yuan (without subsidy).

Taking into account the national subsidy of 18,000 yuan in 2021, Tesla has reduced the cost by 30,000 yuan and increased 5 kWh of electricity within two years by expanding production scale and reducing costs. It costs about 5,000 yuan.

Now let’s go back to the cost issue: In January 2023, will the price of Tesla’s battery return to its original cost and approach 0.75 yuan per Wh for lithium iron phosphate? Assuming that this cost cannot be calculated based on the cell cost of 0.9 yuan/Wh, and the pack is still 1 yuan/Wh, the entire cost structure will be changed to this figure. Essentially, for a car for household use with the same size battery as Tesla, the three major components and other costs will cost more than 73,200 yuan, adding to the original baseline cost, manufacturing, and so on, and this car has a minimum price.

From the current stage, if Tesla can save nearly 70,000 yuan for the same battery and configuration, other car companies cannot just sit idly by, and consumers are not stupid. Therefore, for Chinese car companies, if they cannot compete on the cost of extending mileage, they will have no way to compete, as battery prices are not that extreme.

## Do New Energy Vehicle Companies Want Market Share or Profit?

## Do New Energy Vehicle Companies Want Market Share or Profit?

Looking at the market situation in 2023, there will be a wave of price increases, a wave of flat prices, and a wave of price reductions. Comrades who are raising prices haven’t realized that their order pool is based on high cost-performance ratio. Now, electric vehicles have evolved into a market without strong brand concepts. Users are looking for the cheapest and most cost-effective cars.

The path to brand premiums cannot be discussed before the pattern of electric vehicles is determined and there is no technological gap. Who has the best cost-performance ratio is the answer given by the Chinese new energy vehicle market. The key is how to achieve this. In 2023, after national subsidies and local consumption coupons fade away, Tesla’s pull will certainly have its own considerations, which will also accelerate China’s development.

In October and November, pure electric and plug-in models priced from $10,000 to $20,000 for home use accounted for 42% of the market. The change in this market is significant. In 2021 and before, the products of new energy vehicles that consumers can choose from are not rich enough, which has led to the “dumbbell-shaped” structure of the pure electric passenger car market, with the main force concentrated at both ends of the high and low-end markets. The corresponding sales situation is that the consumption of new energy vehicles has obvious regional characteristics: the new energy vehicle market in the eastern region, where first-tier and second-tier cities are concentrated, is obviously better than that in the central region where there are more third-tier and fourth-tier cities, which in turn is better than that in the western underdeveloped regions with fewer large and medium-sized cities. The factors of market adjustment have not been fully played out.

In 2022, with the mainstream price range of $10,000 to $20,000, many products will be concentrated and launched, greatly opening up third-tier cities. The market structure of the new energy vehicle market began to change towards market orientation, taking away a considerable share of the traditional fuel vehicle market. Tesla’s constant price increases are actually off track and a bit chaotic, while this wave of price reductions from the perspective of the larger trend still has its own characteristics.

In summary, in 2023, automakers must choose between market share and gross profit. And based on the fact that the electric vehicle industry was in a loss-making state in 2022, Tesla’s recent moves are a bit reckless.# 好的例子

以下示例展示了一个使用表格和代码块的好的例子:

| 姓名 | 年龄 |

|---|---|

| 张三 | 25 |

| 李四 | 30 |

<p>这是一个段落。</p>

<blockquote>

<p>这是一个引用。</p>

</blockquote>

坏的例子

以下示例展示了一个没有使用表格和代码块,以及排版混乱的坏的例子。

姓名:张三 年龄:25

这是一个段落。

这是一个引用。

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.