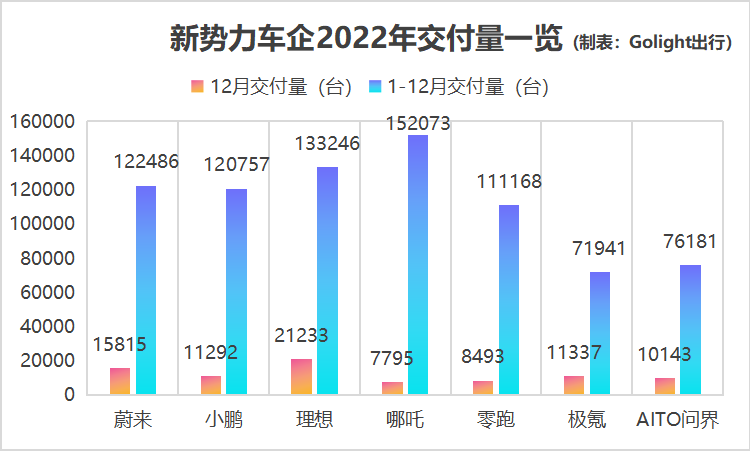

On January 1st, domestic automakers released the delivery data for December and the whole year of 2022. NIO’s monthly delivery surpassed 20,000, XPeng returned to the level of over 10,000 monthly deliveries, and Zhidou had a yearly sales volume of 150,000, concluding the volatile new energy vehicle market with satisfying achievements.

In the past year, the changes in China’s automotive market are visible to the naked eyes. In addition to the obvious trend of “electric vehicles replacing gasoline vehicles,” high-end new energy vehicle brands launched by traditional carmakers such as AITO and Ji-Ke are rising against the trend, making some new players nervous. Some even began to advocate that there are automakers falling behind in WeiXiaoLi. However, the ultimate result tells us that WeiXiaoLi still remains strong, AITO and Ji-Ke’s momentum is strong, and there will be a fierce battle in 2023.

01

Selling 120,000 units per year but blamed? The myth of “XPeng falling behind”

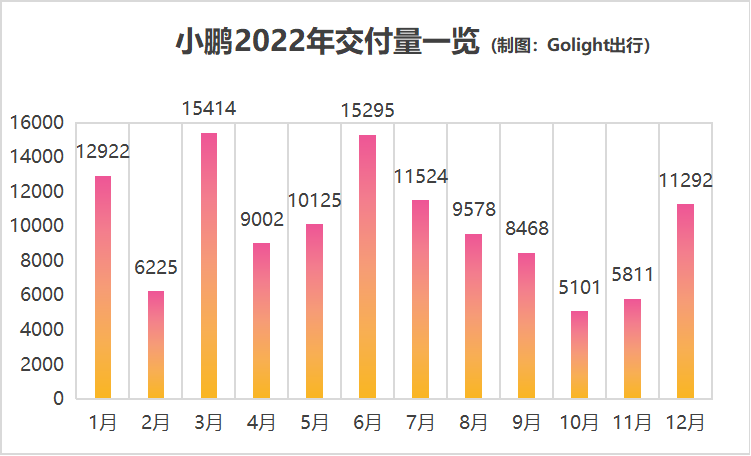

In October and November, XPeng Motors faced the problem of the G9 capacity climbing and the upcoming facelift of the P7, causing the delivery volume to drop to 5101 units. XPeng was taunted as the new “loser” after NIO and Li Auto. However, as He XPeng said, October was the lowest point of XPeng’s delivery volume, and things would get better later.

In November, XPeng’s delivery volume began to recover, and in December, it once again exceeded 10,000, delivering 11,292 new cars. Since then, XPeng’s delivery rhythm has returned back on track. In 2022, XPeng’s cumulative delivery volume exceeded 120,000 units, with a historical cumulative delivery volume of 259,000 units, maintaining the same level as NIO and Li Auto. XPeng is still XPeng.

Among them, the reputation fermentation and production capacity improvement of XPeng G9 injected fresh blood into XPeng’s delivery. In December, XPeng G9’s delivery volume reached 4,020 units, an increase of 160% from November. However, we seem to forget an important piece of information: due to the facelift, XPeng’s delivery pillar P7 is now also in a trough. The facelifted P7 will only be released in the first quarter of next year, and during this period, XPeng’s delivery volume will not be at its peak state. When P7 sold the best, more than 9,000 units could be delivered in a month. That is to say, with the double banners of P7 and G9, it is not difficult for XPeng’s full range to easily exceed 20,000 units.

In 2022, XPeng Motors exposed many problems, which prompted He XPeng to make organizational adjustments to XPeng Motors in a timely manner. From the revelations of the past two months, XPeng’s adjustment this time is unprecedented, involving various aspects such as strategy, technology, product planning, and market sales. He XPeng himself has also shifted his focus back to the specific affairs of XPeng Motors. In the period of replacement of old and new products, XPeng has also undergone a major switch, which is a positive signal for XPeng to make great strides in 2023.

Recently, XPeng also established a financial platform consisting of the Financial BP Department, Platform Finance Department, Comprehensive Financial Group, Tax Management Group, Fund Management Group, and Special Project Group, to improve the precision level of cost and expense management and reduce costs and increase efficiency. In fact, in the third quarter financial report, XPeng Motors achieved good results, with double growth in revenue and gross profit, and further narrowing of losses by 12%. XPeng’s stock price once rose sharply by 47%.

In the eyes of some people, XPeng’s short-term decline is a “falling behind”, but if you look carefully, XPeng’s adjustments are making this leading new force better.

02

After the cancellation of national subsidies, the new energy vehicle market surged in 2023

In terms of deliveries, new energy vehicle companies will continue to show a sustained upward trend. However, in 2023, the state subsidies for new energy vehicles have been cancelled. The first problem that Wei Xiaoli faces in the new year is the price increase caused by the cancellation of national subsidies.

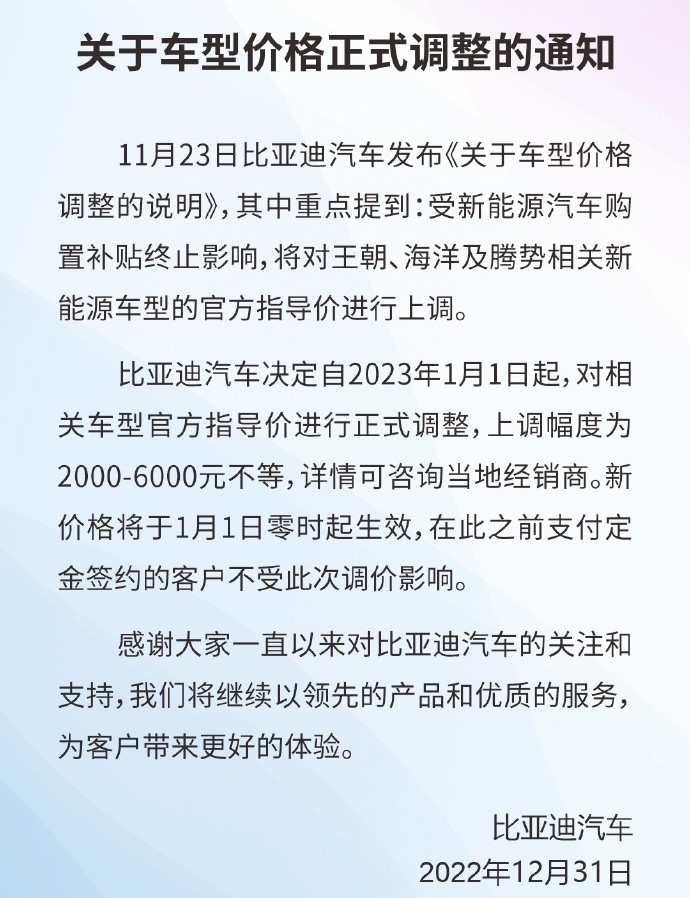

As early as December 31st, BYD announced that from January 1st, 2023, the official guide prices of relevant new energy vehicle models, such as Wangchao, Haiou and DENZA, will be raised by 2000-6000 yuan, sounding the first shot of the new year price increase.

However, while other automakers did not follow suit, Tesla announced a “New Year’s gift” on January 1st: until February 28th, Tesla will provide users with a limited-time delivery incentive of ¥6,000, a limited-time insurance subsidy of ¥4,000, and preferential finance packages. Despite being overtaken by BYD in terms of 2022 deliveries and declining order retention, Tesla’s discount policy will continue for a period of time.

However, while other automakers did not follow suit, Tesla announced a “New Year’s gift” on January 1st: until February 28th, Tesla will provide users with a limited-time delivery incentive of ¥6,000, a limited-time insurance subsidy of ¥4,000, and preferential finance packages. Despite being overtaken by BYD in terms of 2022 deliveries and declining order retention, Tesla’s discount policy will continue for a period of time.

XPeng, whose sales have rebounded, also announced that vehicles registered from January 1st would no longer receive national subsidies, but that the retail prices for all XPeng models in 2023 will remain the same as in 2022. That is to say, XPeng will bear the subsidy amount of ¥10,080 to ¥13,860 per vehicle. By offsetting the loss of subsidy cancellation through internal cost-cutting, XPeng is certainly generous in giving benefits to users, and 2023 sales are expected to see a boost.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.