Author|Zhang Jingtai

It has fallen again and again! Tesla’s stock price fell by 4.72\% in a single day on December 16th Eastern Time, and its market value shrank to US$474.4 billion. Since the beginning of this year, it has fallen by more than 62\%.

Returning to the beginning of this year, Tesla’s market value reached 1.2 trillion U.S. dollars, making it one of the companies with the highest market value in the world. Musk also successfully became the world’s richest person. Unexpectedly, the situation changed so quickly. When Tesla fell from the stock market altar and its sales growth did not meet expectations, the “Tesla killers” seemed to have the best opportunity to catch up, but the cruel reality is that their own situation is worse than Tesla’s.

Sales are getting worse and worse

Tesla’s growth rate has indeed slowed down. At the beginning of the year, Tesla CEO Musk stated in a conference call that Tesla should be able to produce 1.5 million cars in 2022. “Our problem is not limited demand, but limited production capacity”, meaning that Tesla is not worried about sales, but about insufficient production capacity.

However, the market supply-demand relationship has changed extremely quickly. From January to September, Tesla’s global sales were 908,000 vehicles, which means that 600,000 vehicles must be sold in the last quarter. In order to achieve the expected target, Tesla has adopted promotion methods such as insurance subsidies and price cuts, but the effect is limited.

According to foreign media reports, informed sources revealed that in the case of production line upgrades and slowing consumer demand, Tesla’s Shanghai super factory will be phased out from the end of this month to early January next year. Although Tesla has told the media that the above content is untrue, it is an indisputable fact that Tesla’s current sales growth is weak.

Compared with Tesla, the situation of Tesla’s several killers is even more dismal, and their sales growth is lower than expected.

In China, XPeng Motors is considered to be the company most similar to Tesla, both of which are mainly based on intelligent technologies. XPeng P7 and Tesla Model 3 are even direct competitors.

After achieving sales of 98,000 vehicles in 2021, XPeng Motors confidently locked in its sales target for 2022: to ensure sales of 250,000 vehicles throughout the year and aim for 300,000. However, in the first 11 months of this year, XPeng Motors delivered a total of 109,465 vehicles, a year-on-year increase of 33\%, and the achievement rate of the annual target was 43.78\%, which was 140,535 vehicles away from the target of 250,000. It is basically difficult to achieve.

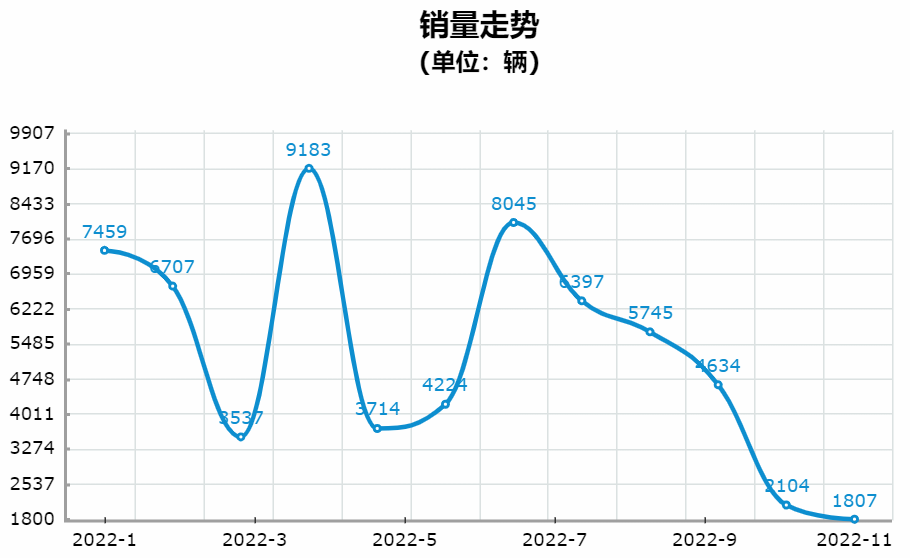

P7, Hozon’s hope, only sold 56,097 units from January to November this year, far from the expected 10,000 units per month, and has been declining month-on-month for five consecutive months since June of this year, indicating an alarming situation.

In the USA, Rivian and Lucid, two new carmakers, are known as “Tesla killers.” The capital market broadly favors Rivian for its core technology, such as the skateboard-style chassis platform. Wall Street investors believe that Rivian, the rising star and brand that specializes in electric pickup trucks, will be Tesla’s biggest competitor, even surpassing the Cybertruck.

However, the delivery and quality control of Rivian’s products have been terrible. Since the third quarter of last year, Rivian has delivered a total of 14,317 vehicles, with production volumes of 2,553, 4,401, and 7,363 in each quarter, while delivering only 12,278 vehicles. Despite such a low delivery volume, the quality is also a cause for concern. Rivian is currently recalling vehicles due to the loosening of the steering knuckle fastener, which could lead to loss of vehicle control and increased collision risk. The recall number is expected to be 12,212 vehicles, which equates to nearly all of the cars being unfit for use.

Lucid, another “Tesla killer,” is not doing well either. After two years of its IPO, Lucid still struggles to ramp up production capacity, with sales of only 2,437 vehicles in the first three quarters of this year, making it almost impossible to achieve the initial target of delivering 20,000 vehicles per year. Lucid’s CEO and CTO, Peter Rawlinson, admits, “We are still struggling with supply chain issues.”

Market Values Keep Declining

Lower-than-expected production and sales volumes directly reflect on the stock market value, which keeps falling.

As of the US Eastern Time on December 16th, XPeng’s latest market value is $8.878 billion, a drop of 79.5% from the beginning of the year. Rivian’s latest market value is $20.703 billion, a decrease of 78.1% from the beginning of the year. Lucid’s latest market value is $12.385 billion, a decrease of 83.7% from the beginning of the year.

The sharp drop in market value is obviously related to the capital bubble formed earlier. New energy vehicle companies represented by Tesla have been favored by capital all along and were repeatedly manipulated in the market. Stock prices and market value have overdrawn a lot of future expectations. Once bearish trends worsen, the speed of capital market withdrawal will also accelerate, resulting in continuous stock price declines. This year, the US Federal Reserve has continuously raised interest rates and tightened liquidity, which is also an important reason for the crash in the stock market value of new energy vehicles.

From the current overall situation in the capital market, it is also in a downturn, and currently Wall Street is in deep despair.

According to the latest report from Bank of America, investor sentiment has reached an all-time low, with a rush to cash and avoidance of most other asset classes. BofA’s chief stock strategist, Harnett, says that the impact of inflation, interest rates, and recession has not yet ended, and investor confidence has hit a new low since the 2008 financial crisis. Driven by pessimism, Bank of America’s BullBear Indicator has dropped to 0.

If the drastic shrinking of the stock market’s market value is an external threat, then the lingering and severe losses it faces are internal concerns. Financial reports show that in the third quarter of 2022, XPeng Motors achieved a total revenue of RMB 6.82 billion, a 19.3% increase from RMB 5.72 billion in the same period of 2021, and a decrease of 8.2% from RMB 7.44 billion in the second quarter. In terms of profits, in the third quarter of 2022, XPeng Motors suffered a net loss of RMB 2.38 billion, which was larger than the net loss of RMB 1.59 billion in the same period of 2021 but smaller than the net loss of RMB 2.70 billion in the second quarter. Therefore, on average, XPeng Motors loses RMB 70,000 to 80,000 for every car sold.

According to Rivian’s financial report, the company’s net loss in the third quarter of this year was US$1.72 billion, compared to US$1.23 billion in the same period of last year. At the end of the third quarter, the company held $13.8 billion in cash, down from $15.9 billion at the end of the second quarter.

Lucid’s financial report shows that the company’s revenue in the third quarter was US$536 million, lower than the market expectation of US$551.6 million, with a net loss of US$1.724 billion, compared to US$1.23 billion in the same period last year, and a loss per share of US$1.88, compared to a loss of US$12.21 per share in the same period last year.

For the car manufacturing industry, which has a “large initial investment, long construction cycle, and unstable returns”, whether it can withstand long-term losses is a huge challenge. The current situation of the “Tesla killers” has already been mercilessly ridiculed by Musk, who said “They are not long for this world,” implying that new players in car manufacturing like Lucid are not far from collapsing.## Stuck between “10,000-100,000 Vehicles”

Even though both Tesla and the “killers of Tesla” have seen a significant drop in market value, Tesla is in a much better position.

Currently, Tesla has already overcome supply chain shortages, production capacity ramp-up issues, and product quality defects that its competitors are still struggling with. Tesla has also established a deep moat.

Take the “chip shortage” that has long plagued the entire automotive industry as an example. Tesla is almost unaffected by it. A Morgan Stanley research report points out four reasons why Tesla is immune to chip shortages. First, Tesla has powerful vertical integration capabilities, so it can understand the status of the supply chain earlier and use multiple suppliers to ensure supply; second, Tesla has strong chip self-research capability, which is the foundation of its self-developed chips; third, Tesla has strong negotiation ability, which ensures that it is adept at dealing with various suppliers; fourth, suppliers are more optimistic about Tesla’s development and are more willing to prioritize chip supplies for Tesla in the context of insufficient supply.

Tesla’s large-scale production capacity of one million vehicles per year has brought almost all returns to Tesla. When production costs are minimized and production scale is maximized, it means considerable profits. Data shows that Tesla’s profit per car is $8570 or approximately ¥69,000, while Toyota’s profit per car is $1200 or approximately ¥8,700. Thus, Tesla’s profit per car is about six times that of Toyota.

On the other hand, the “killers of Tesla” are still stuck in the sales range of 10,000 to 100,000 vehicles per year, which means weaker bargaining power with suppliers, production and R&D costs are unable to be amortized, and a vicious cycle of “losing money for each car produced” ensues. They must quickly achieve annual sales of hundreds of thousands or even millions of vehicles to get out of the dangerous “lose money to gain popularity” stage.

Looking at the current automotive market, the intelligent electric vehicle market is still growing rapidly, but with the awakening of traditional automotive companies, the days of new car manufacturers are no longer as good as before. Even strong Tesla faces considerable challenges.

Data shows that in the third quarter of 2022, Tesla’s market share of new registered electric vehicles in the United States was 65%, still the best-selling electric vehicle brand. However, compared with the same period last year, it declined by 6 percentage points, and its market share has been declining year by year. The companies snatching Tesla’s market share are not other new car manufacturers, but traditional automotive companies, such as the Ford Mustang Mach-E, Chevrolet Bolt, Hyundai Ioniq 5, Kia EV6, Volkswagen ID.4, and Nissan Leaf, which are starting to counterattack Tesla from behind.In the Chinese market, in addition to the new forces in car making, automobile brands such as Geely’s Ji Ke and Sailess’s AITO have also begun to take the fast lane in sales, with annual sales of nearly 100,000 vehicles, or close to it, relying on their accumulated experience in car making in recent years. They have their own advantages in supply chain, cost control, channel construction, etc. This means that there is also enough room for future growth.

The current situation is obviously very unfavorable for the “killers of Tesla”. There is a distant Tesla in front and a group of traditional car companies in fierce pursuit behind. This winter is bound to be long and cold.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.