Author: Zhang Yi

Amid the ever-increasing information cocoon, we often fall into extreme speculation about things unintentionally. The God’s view is accidental, and the blind touching elephant is the norm.

Just like the CEO and Chairman of XPeng Motors, He XPeng, said in a recent interview, “We are not as good as you might imagine when we are good, and we are not as bad as you might imagine when we are bad.”

Undoubtedly, in the eyes of the outside world, XPeng Motors is almost at the brink of collapse due to the rapid evaporation of market value, the consecutive suspension of sales, and the G9 upgrade crisis in the third quarter.

But in He XPeng’s view, temporary setbacks are inevitable, and the future of XPeng Motors is far from over.

Just two days after the launch of G9, the XPeng crisis exploded. Faced with internal and external troubles, He XPeng chose to inject cash into XPeng Motors from his own pocket, with a cost of about CNY 210 million, and increased the number of XPeng Motors’ ADS by 2.2 million.

This increase in holdings revealed He XPeng’s determination and courage to continue ALL IN XPeng Motors. Internally, He XPeng injected a shot of strength into the entire XPeng Motors; externally, He XPeng made a strong statement to the market as the founder.

However, just like watering a tree that has already rotted roots, the chronic problems of XPeng Motors cannot be easily solved by just throwing money at it. He XPeng’s follow-up actions were exactly aimed at the root.

In October, He XPeng vigorously reorganized XPeng Motors’ organizational structure, established five virtual committees and three product matrix organizations, broke up the company’s scattered departments, smoothed out the major business lines, and began to improve the efficiency of the organization. At the same time, with the help of this reform, He XPeng also took advantage of the momentum to consolidate power in his own hands.

In addition, XPeng Motors recently announced that its co-founder and president, Xia Hang, will resign from the board of directors but continue to serve as the company’s president, focusing on product development in the future. Therefore, He XPeng will be the only executive director of XPeng Motors. He XPeng completely consolidated power.

While adding power to himself, He XPeng also subtracted power from himself.

XPeng Motors stated that after the new restructuring of the organizational structure, He XPeng’s personal direct participation in ecological enterprises will be significantly reduced, and he will focus more on XPeng Motors’ strategy, product planning, and research and development.In short, the revamped XPeng Motors is like a rebirth after Nirvana. Yet, as the saying goes, “Good things never last, but bad things spread like wildfire.” The tag of “the new force in car sales” that used to be associated with XPeng Motors is gradually being faded away, and the former trend-setter is losing its novelty appeal among users.

Now that XPeng Motors is facing a series of uncertain factors, such as customers, policies, markets, and supply chains, is the current change enough to catch up with the competition?

From the perspective of journalist “The Electric Force,” XPeng Motors may need to reassess four issues:

What is the fighting power that the organization can exert?

Although the restructured organizational structure of XPeng Motors is much clearer than before, and efficiency and decision-making have improved significantly, it is still primarily dependent on how much XPeng himself can do to explore its fighting power.

We previously mentioned in the article <

The fact that XPeng Motors had to make such a drastic change shows that XPeng’s previous management failed. Now that XPeng Motors has centralized power in the hands of a leader with no automotive industry experience, who does not like or do well at management, the question remains as to what percentage of effectiveness this new organizational structure can exert. The pressure is all on XPeng.

Although XPeng is an experienced entrepreneur, he needs to step out of his role as a product manager as early as possible and become a qualified manager.

Can confidence in the terminal market still be revived?

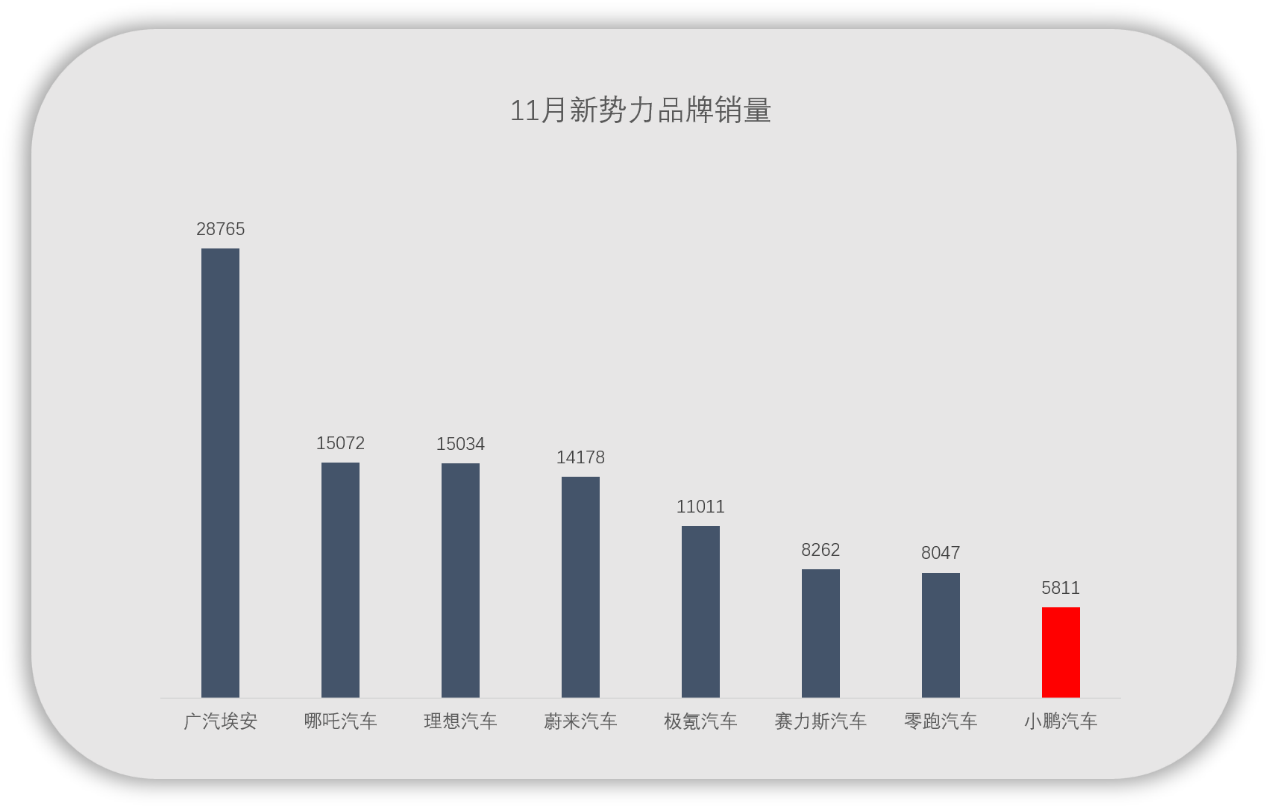

Since August, when XPeng Motors began to drop below ten thousand vehicles sold per month, it has been on a decline, reaching a low point of only 5,101 vehicles sold in October. The G9, which was once hailed as the “car that will determine XPeng Motors’ fate” sold only 623 vehicles.The sales volume of XPeng Motors in November was 5811 units, showing a slight rebound but not enough to draw any conclusions. This indicates that the effectiveness of XPeng Motors’ new organizational structure has not been fully demonstrated.

It takes certain time to determine the strength of this structure and how much of it can be tapped, which will require substantial verification through sales growth. However, during this process, it is crucial not to overlook how to rebuild customer confidence in terminal sales, which might not be avoidable in case of continuous low sales figures.

Internally, XPeng Motors’ new organizational structure will take some time to show its effectiveness, which requires patience from terminal sales staff.

Externally, on one hand, a string of negative news will inevitably reduce users’ confidence and enthusiasm for XPeng Motors, leading them to buy other brands. On the other hand, compared with NIO and Ideal, XPeng Motors’ more complex SKU will also create certain pressure on customers’ purchasing decisions.

With the pressure of waiting for time, user skepticism and hesitancy, as well as NIO and Ideal’s sales performance in November reaching 14,178 units and 15,000 units respectively, three huge challenges are looming over terminal sales of XPeng Motors, which needs to regain its customers’ trust as soon as possible, otherwise, the intention of jumping ship among employees is inevitable.

Is Gross Margin that important?

When sales haven’t reached a certain scale, gross margin becomes increasingly important to achieve profitability. Since new energy vehicles hit the market, “gross margin” has become a keyword that more and more people mention frequently. But is gross profit really that important?

One example some people have cited is a small retail shop, where they sell Kang Shifu instant noodles they bought for 1 yuan and then sold for 2 yuan, which means a gross profit margin of 50%. However, in the year the shop was open, they only sold one bottle. After deducting rent, labor and other costs, their net profit ended up in severe negative territory.

The example is extreme, but it shows that high gross margin does not necessarily indicate a sustainable profit for businesses.

Recently, XPeng Motors announced its third-quarter financial report, gross margin was 13.5%, which is a 0.9% year-on-year decrease but a 4.4% month-on-month growth. However, the loss reached RMB 2.38 billion, with RMB 6.8 million loss per vehicle sold, adding up to RMB 6.778 billion in total losses for the first three quarters.

Why does Xpeng Motors emphasize gross profit so much when gross profit cannot truly reflect the whole profitability of the company?

There are two reasons as seen by the reporter from “EV Momentum”.

Firstly, it is due to conventional thinking. We can find that the brands that emphasize gross profit repeatedly are mostly the brands founded by internet giants, such as NIO and Li Auto, whereas the traditional brands are rarely mentioned.

In fact, the gross profit margin of the manufacturing industry itself is difficult to reach a high number. In 2021, the gross profit of Great Wall Motors was 16.16%, and that of SAIC was only 4.91%; NIO and Li Auto were slightly higher, at 20.1% and 20.6%, respectively.

On the other hand, the gross profit margin of internet service-related industries is significantly higher than that of the automotive manufacturing industry. In 2021, Autohome’s gross profit margin was 35.7%, Alibaba’s was 41.28%, and Xiaomi’s internet service segment reached as high as 74.1%.

It is easy to become accustomed to the luxury of high gross profit rates and difficult to adapt to gross profit rates of only ten percentages. But as Xpeng said, China’s auto market is mainly between A and B level cars. Since the market that focuses on sex-price ratio has been identified, it is naturally difficult to achieve high gross profit rates. In this market segment, it is still essential to get rid of conventional thinking and aim for quantity over quality.

The second reason is to tell a good story to the capital market. In addition to frequently mentioning gross profit margins, new forces of brands have another significant difference from traditional brands: they get listed earlier.

Xpeng took only six years to go public, Li Auto took five years, and NIO took four years, all in the US stock market, which is faster than Tesla’s seven years. On the other hand, recognizing the made-in-China concept, traditional self-owned brands, such as Geely and Great Wall Motors, took 19 and 27 years to be listed on the A-share market, respectively, while Chery has not yet gone public.

It is well known that manufacturing cars are an extremely costly project, and going public to raise funds is a significant channel. Moreover, Tesla set an excellent precedent in the US stock market, and investors are optimistic about the future trend of electrification and the potential of the Chinese market. New forces of brands such as Xpeng Motors need quick money to cope with heavy spending, and the two sides complement each other.

Since the decision has been made to go public, there is a need to provide evidence that proves the ability to generate profit in the market. Due to the current situation of having a large tree but shallow roots, it is impossible to demonstrate sales in a short period of time. Therefore, pursuing a high gross profit margin is the only way to justify to the market.

The excessive emphasis on gross profit margin has led to some abnormal policies for XPeng Motors.

For instance, Guangzhou Pengbo Automotive Technology Co., Ltd, with a registered capital of CNY 5 billion, was recently established. Its business scope includes battery manufacturing, automobile parts, and accessories manufacturing. The establishment of this company may indicate that XPeng Motors will start to promote battery self-supply.

Currently, batteries costs account for 40% to 50% of the new energy vehicle production costs, and due to Covid-19 and other reasons, have an enormous amount of uncertainty, which seriously threatens the production capacity of new energy vehicles. Battery self-supply means that XPeng Motors will have further control over the supply chain to promote further gross profit margin improvement.

However, based on relevant statistics, the current battery production capacity is ten times higher than the number of vehicles produced. Although the short-term demand is still increasing, the price will not decrease. In the long run, as the Covid-19 pandemic eases further and the market gradually grows in a benign way from a barbaric development, the battery price will inevitably return to normal.

For dynamic batteries, which are high-risk, high-investment, and high-tech industrial products, long-term investment in research and development is necessary for success. XPeng Motors should focus on improving the current situation of poor sales instead of competing with battery suppliers such as CATL for the time being, as surviving first and then pursuing other goals is a more realistic plan.

Even if key components are produced in-house, it does not mean that the gross profit margin will increase significantly. In addition, investment risks and hidden dangers such as offending suppliers also need to be taken seriously. Professional matters should be left to professional people to deal with.

Is it the capital market or the user who matters more?

Gross profit margin serves the capital market, and the value of travel serves the user. XPeng Motors has clearly been persistently struggling for the former, while the latter has been criticized until now.Since its establishment, Xpeng Motors has been labeled “intelligent”, which is comparatively more elusive than the labels like “space” and “comfort” that are straightforwardly presented by household SUVs.

“Space” and “comfort” can reinforce users’ impression by straightforward presentation, while “intelligence” often requires a pile of technology. At the current stage, technology often leads to frequent accidents, making users want to use it but dare not. Meanwhile, Xpeng’s intelligent technology has no corresponding system of values or corporate culture to support it. Ultimately, the so-called intelligence is just empty accumulation, becoming an unpleasant and regrettable chicken rib.

However, if we spoil the users by smashing services and technology, the profit margin will be compressed, and the capital market will have to be accounted for.

Therefore, whether to focus on the capital market or users is often a question of to be or not to be. However, most examples have proved that choosing the former is to choose early bloom and early decline, and choosing the latter may die halfway. But once you get through the darkest moments, you will see a smooth path ahead.

Talk from Electric Power

Xpeng Motors, which has resolved the organizational structure problem, has certainly been renewed, but He XPeng’s management ability is still limiting the effectiveness of the organizational structure. At the same time, Xpeng Motors cannot blur the basic but important principled issues such as gross profit or sales, the capital market or users, and must have a clear position.

Only after these principled issues are resolved can Xpeng Motors become targeted, spend money on the cutting edge, create real travel value for users. Only these values can allow Xpeng to go further and more stably in the background of gradually subsiding policy subsidies and increasingly fierce market competition.

There are rumors that Xpeng Motors will launch two new models next year, and P7 will also receive facelifts. The intelligent driving assistance system will also become standard equipment for more customers to use. By 2025, Xpeng Motors will embark on autonomous driving and unmanned driving.

At that time, the current new forces will have matured, and future new forces such as Xiaomi Motors will surely launch full attacks. A blunt battle will break out and Xpeng Motors’ future remains a question mark at present. We hope it will be an exclamation mark in the future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.