Author: Wang Xuan

After five years of brewing, the Tesla Semi has once again ignited the enthusiasm of Tesla fans by driving a 37-ton heavy-duty truck with pure electric power to travel continuously for 800 kilometers. The breakthrough in the three-electric technology of Tesla demonstrates the feasibility of putting the Semi into commercial operation.

But we cannot be too happy too early. At present, the Semi is still far from overturning the operating environment of traditional fuel heavy-duty trucks.

For the Semi, it needs to go through two stages of verifying feasibility and achieving necessity. The first stage allows users to get rid of energy supply anxiety and amplifies the cost advantages of pure electric heavy-duty trucks. The second stage requires a huge infrastructure system as the support for the Semi to travel farther, while realizing the automatic driving of commercial vehicles. Build the convenience, low cost, and automatic driving technology to create a high ground that fuel heavy-duty trucks cannot reach.

In fact, at this moment, the Semi is still struggling in the first stage.

Can you save $200,000 in three years?

In the stage of verifying feasibility, Tesla Semi needs to solve the problem of power consumption and energy replenishment efficiency of pure electric heavy-duty trucks. Heavy-duty trucks are completely tool-oriented products, and efficiency and economy are the core product power of commercial heavy-duty trucks.

As the foundation of implementation, Semi has considered two ways of fast charging in the past five years. In the early days, Tesla tried to achieve group charging through Supercharger. Now, Tesla Semi is equipped with three independent carbon fiber protective sleeve motors that are the same as Model S Plaid, adopts a 1000V high-voltage architecture, and implements Megacharger on the Semi, greatly improving the energy replenishment efficiency.

Through the optimization of the wind resistance coefficient, Semi has achieved an ultra-low energy consumption of less than 2 kWh/mile, and has a high-speed cruising range of 500 miles when fully loaded. At the same time, Semi can be charged for 30 minutes at the exclusive charging pile Megacharger to supplement the highest range energy of about 560 kilometers.

Tesla never disappoints the tech nerds, and it always finds the most hardcore way to solve technical challenges. At least in places where Megachargers are installed, Semi does not have range anxiety, but the cost advantage of Semi is not significant.

According to data disclosed by Tesla, in the ideal driving state, Semi consumes 1.25kWh per 100 kilometers, which means that the long-range version of Semi with a full range of 800 kilometers requires a battery capacity of 1000kWh. Based on the current prices of raw materials, the cost of a single battery cell is already over $100 per kWh, excluding the price of PACK. Therefore, the cost of the battery will account for a large proportion of the selling price.

The long-range version of Semi is priced at $180,000, and the short-range version with a range of 300 miles is priced at $150,000. The “Lower Inflation Act” passed by US President Biden in 2022 includes the “carbon reduction” part, providing a subsidy of $40,000 for each electric heavy-duty truck.

In terms of technology route, we can easily see Musk’s idealism, using larger-capacity batteries to solve the range problem, and using high-power ultra-fast charging to solve the energy supplement problem. This seemingly simplifies the problem but actually increases the user’s cost burden.

On the other hand, many domestic car companies choose to solve the mileage and energy supplement problems of pure electric heavy-duty trucks by swapping batteries. At the same time, battery companies come forward to implement vehicle-to-battery separation through battery leasing, reducing users’ cost burden of batteries. Both technology routes have their pros and cons, but what cannot be denied is that the key factor for the rise of battery swapping technology in the heavy-duty truck field is that heavy-duty trucks are a tool for users to make money, and they do not want to bear too much risk in areas where uncertainty is high, which is the case in both the US and China.

At the same time, Tesla claims that it can save $200,000 in operating costs over three years, which is equivalent to the price of a 500-mile range Semi. However, Tesla did not disclose the estimated mileage for this data. As we all know, those who talk about toxicity instead of dose are swindlers, so the same applies to those who talk about cost savings without mentioning running mileage.Let’s do the math again. Let’s take the long-range version of Semi as an example. It has a full charge of 1000kWh and a full charge mileage of 500 miles. In 2022, the average electricity price in the United States is 0.15 US dollars. Of course, this is only the average, and we will ignore the impact of peak and valley electricity prices for now. The cost of a 1000kWh full charge is $150, and the energy consumption cost per mile is $0.3.

Kenworth T-700, a heavy-duty truck with the same towing force of 80,000 pounds, will be used as an example. The test scenario is the same as that of Tesla Semi, with a constant speed of 60 MPH under full load conditions. The fuel consumption rate is 6.2 MPG. This data is consistent with the 6-7 MPG data provided by the American Transportation Research Institute (ATRI) for Class 8 heavy-duty trucks.

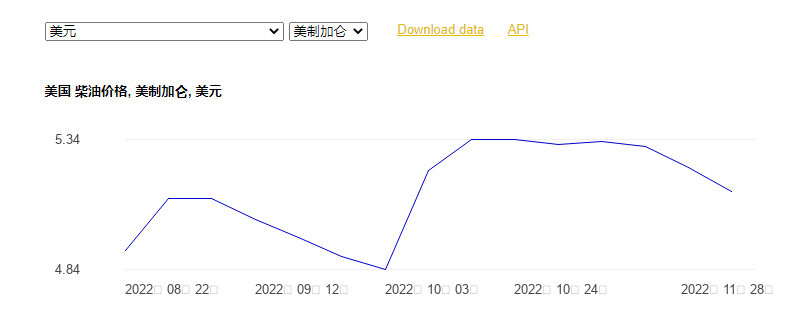

The fuel consumption for a 500-mile trip is 80.6 gallons. When calculated based on a diesel price of $5.5 per gallon in the United States, the cost of fuel consumption per mile is $0.88.

At the same time, we also obtained the latest data from the American Transportation Research Institute on various operating costs (in US dollars/mile) other than energy costs, including:

- Driver wage – 0.566

- Truck/trailer leasing or purchase payment – 0.271

- Driver benefits – 0.171

- Maintenance and repair – 0.148

- Truck insurance – 0.086

- Tires – 0.043

- Toll – 0.037

- License and permits – 0.016

With the latest energy expenditure data, the cost per mile of a diesel heavy-duty truck is $2.218, and that of a pure electric heavy-duty truck after excluding maintenance costs is $1.49/mile. The cost of pure electric is 33% lower than diesel. This is indeed a relatively significant data, but what we cannot ignore is that diesel prices in the United States this year have doubled compared to last year. Therefore, based on the data from the American Transportation Research Institute in 2020, the cost per mile of Semi is only reduced by less than 10% compared to diesel heavy-duty truck.“`markdown

The timing of Tesla Semi’s release is quite delicate, as it coincides with the time when diesel prices in the United States are at their highest.

Perhaps only large companies can afford Semi

At the presentation of the delivery of Semi, we learned that several companies, including Pepsi and Walmart, have signed orders to purchase Semi from Tesla. It’s not hard to see that only large companies are willing to try something new.

The freight logistics industry in the United States can be divided into two types, one is the point-to-point logistics system supported by large groups, while most scattered orders outside of large groups are held by individuals. Among individual operators, the OTR business model is very popular. Large truck rental companies purchase vehicles and offer them to individuals through leasing, thus reducing the threshold and cost for individuals.

For individual operators, Semi is a model that is beyond their reach. One important reason for this is that the Semi adopts the day cab body form, which reduces operational efficiency.

The heavy-duty truck market in the United States is extremely segmented. The Semi is a typical day cab heavy-duty truck with a simple cab layout and no bunk beds. The other type is the crew cab heavy-duty truck, which supports cooperative work by multiple people and is equipped with bunk beds. Day cab is mostly used for short-distance transportation within 400 miles, round trip within a day or every other day, and rest at the destination at night.

For day cab trucks, several states in the United States have regulations banning drivers from driving more than 200 miles per trip, and mandating rest times and monitoring driving logs to ensure drivers get rest. Crew cab vehicles, on the other hand, can achieve round-the-clock operation through shift changes.

For ower-operators working under the OTR model, they have to bear the responsibility of their own gains and losses. Therefore, ensuring freight volume and mileage is the only way to guarantee receivables. The crew cab is the most popular vehicle choice for individual operators, but running a day cab for operations also faces the issue of resting at motels, which increases operating costs accordingly.

“`同时,all independent freight drivers around the world will face situations of waiting for orders, and nobody knows where the next order will be dispatched to. Thus, the uncertainty of the destination further tests the establishment of Tesla Megacharge, and it is difficult for independent drivers to bear this kind of uncertainty.

For leasing companies, they can collect leasing fees from independent drivers, and trucks are also their fixed assets. However, the uncertainty of Semi lies in the significant drop in residual value caused by the battery decay of pure electric heavy-duty trucks. Unless the discounted cost is transferred to independent drivers, it is difficult for them to balance the value of assets.

Therefore, currently only large groups with considerable point-to-point demand have a specific demand for Semi, and subsidies for purchasing new energy heavy-duty trucks are also available in different states in the United States.

If Tesla wants to disrupt the heavy-duty truck market, it cannot do without autonomous driving

At present, Semi has only demonstrated its rationality as a pure electric heavy-duty truck, but it still cannot perfectly replace fuel-heavy-duty trucks. For Semi, one crucial factor for its success is the ability to land L4-level or higher autonomous driving, and electricity may not necessarily be necessary for heavy-duty trucks, but automation is definitely the future of the entire automotive industry.

However, we did not see Musk emphasize this point at the conference. Although Tesla officially endorsed Semi with their accumulated automatic driving technology on passenger cars, there is still a clear distinction between the two.

The biggest difference between the autonomous driving technologies of heavy-duty trucks and passenger cars lies in their generalization ability. During long-distance freight transport, the data of the truck’s various abilities is constantly changing, unlike passenger cars that withstand small loads, which can ensure relatively balanced vehicle conditions over a longer period. The autonomous driving technology on heavy-duty trucks also needs to constantly adapt to changes in vehicle conditions.

Taking the simplest example, many friends who have traveled a long journey know that there are emergency safety areas and cooling pools for heavy-duty trucks’ brakes on some highly undulating highways. During a single freight transport, heavy-duty trucks may experience significant brake attenuation due to large downhill roads, and for vehicles with poor conditions, brake failure may even occur, which is also the reason for preparing emergency safety areas.So the difficulty of heavy-duty truck autonomous driving technology lies in the fact that heavy-duty trucks are not as finely maintained as consumer cars and have to bear double the load. How to ensure that autonomous driving capabilities can fully cover different load situations of heavy-duty trucks? This is a problem that Tesla needs to continue to research in order to differentiate from consumer car autonomous driving.

Finally

The reason why Tesla has so many fans is because of its grand vision in the fields of consumer cars, motorcycles, pickups, and heavy-duty trucks. They are all trying to launch a product that can redefine industry standards. However, the problem that Tesla needs to face is that “a different trade has a different set of rules”. Although they are all cars, they have completely different attributes, different target users and opening methods, and many things they have to rethink.

Building a fully electrified transportation network is a long and difficult road.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.