Laser Radar Industry in China and Abroad

By Nianhang Chen

A wave of bankruptcy, mergers, and plummeting stock prices has hit foreign laser radar companies, causing orders to fail and prospects to dim. Meanwhile, their Chinese counterparts have thrived alongside the smart car industry, developing into a promising new automotive parts supply chain.

These are the two distinct scenarios we see in the so-called “Year of Laser Radar Scale-Up” in 2022. In the battle between Chinese and foreign laser radars, Chinese companies have emerged as the winners.

If the buzz about laser radar in previous years was all talk and no action, this year has seen significant sales of cars with laser radars installed. We believe that the shipment volume of Chinese laser radar companies will soon surpass that of their senior competitor, Valeo’s Scala.

According to public data, the number of forward-mounted laser radars installed on vehicles in the Chinese market from January to September this year has reached 57,000, with an estimated 120,000 shipments for the full year, representing a ten-fold increase compared to 2021.

Furthermore, a research report from CITIC Securities pointed out that 2022 is the “Year of Laser Radar Scale-up,” with 26 new positions (car companies and models) designated for laser radars so far this year. This number exceeds the total from 2018 to 2021, indicating that the industry’s investment window has opened, and laser radars will continue to be a basic component of the global automobile industry.

Do We Need Blind Spot Laser Radars?

Against this backdrop, several mainstream Chinese laser radar companies have withdrawn from the competition for primary laser radars and opened up a new battlefield for blind spot laser radars.

This has led some to ask: Has the primary laser radar battle already been decided? Are we now shifting our focus to blind spot laser radars?

In this new battlefield, solid-state laser radars have become the main theme, which suggests that the scramble for solid-state blind spot laser radars will be increasingly heated in the next two years.

Before we delve into the second battlefield of blind spot laser radars, let us first examine the primary laser radars battleground.

- Has the primary laser radar battle been decided?The situation abroad:

In foreign countries, most of the lidar companies have not yet reached the stage of mass production for car-grade front-mounted equipment. Their current market is mainly in the field of L4-level Robotaxi, unmanned delivery vehicles, unmanned trucks and some industrial robot scenarios. Although they have received some mass production orders from car companies, they cannot quickly expand their business due to several factors, such as the difficulty in car-grade verification, slow development progress of car companies, and high cost.

According to some lidar industry insiders in China, take Germany as an example, the three German automakers, Volkswagen, Daimler, and BMW, have started early in the development of automated driving, use of lidar, and development of L3 functions. However, because they focus more on the safety and comfort of functions, more stringent certification standards, and careful mass production decisions, the development cycle of a car model is very long, ranging from four to seven years.

Moreover, the number of OEMs in Germany is limited, and car model development cycles are long. For foreign lidar companies, if they miss this generation of car models, they will have a long waiting window, and will need to continue to burn cash for some time.

OEMs in the US, Japan, South Korea, and other markets also face similar problems. They now have little incentive to push for mass production of lidar mounted on cars, and insufficient demand leads to weak supply.

Therefore, these foreign lidar companies either go bankrupt directly, are forced to merge, or have their stock prices plummet. For example, Ibeo, the pioneer of lidar in Germany, has filed for bankruptcy, Velodyne, the veteran lidar manufacturer in the US, has announced a merger with Ouster, and Quanergy has announced delisting. Many other listed lidar companies also see a significant decline in their stock price, and there are no substantial revenue expectations in the near term, let alone profit prospects.

Some foreign lidar companies also choose to come to China to try their luck, including Velodyne, Ouster, Luminar, etc., and were able to sell some goods smoothly in the early days. However, facing the strong competition of domestic lidar manufacturers, Velodyne and Ouster couldn’t take advantage of their expertise, and because they didn’t provide support and services locally, Chinese car companies were reluctant to purchase. In short, the situation is bleak. Luminar is one of the few companies that are treated well and has obtained a mass production order from SAIC, and now it remains to be seen how well the cars will sell in the future.“`

Domestic situation:

In China, the situation is quite different.

Domestic car companies have an increasing demand for LiDAR, and domestic LiDAR production has quickly reached the stage of delivering tens of thousands of units per month. More demand means greater capital inflow, which gives more confidence in tackling technological challenges. This is a healthy positive cycle.

Apart from Huawei, which is a “non-mainstream” LiDAR player, there are currently very active companies in the field of car-mounted LiDAR in China, such as Shenzhen Suteng Juchuang, Shanghai HeSi Technology and Suzhou Tudatong. Although Tudatong has fewer orders, it is taking the fast lane of mass production by relying on NIO, the smart electric newcomer.

Currently, Suteng Juchuang has accumulated orders for more than 50 designated vehicle models from enterprises such as BYD, GAC Aion, FAW Hongqi, Chery Automobile, Great Wall Motor, XPeng Automobile, JiKu, WM Motor, Lotus Technology, and Lucid, among others. Among the top 15 car sales rankings in China in 2021, 14 of the group automakers that provide designated orders to Suteng Juchuang are ranked. This is quite impressive, especially the order from BYD, the champion of new energy vehicle sales, which has received much attention, and follow-up sales should not be low.

HeSi Technology is also not to be outdone, as its AT128 LiDAR has received mass production designated orders for multiple vehicle models totaling millions of units under many OEMs, such as LiXiang, Changan, Jiedu, Gahe, and Lotus. Especially relying on the popular LiXiang Automobile line, HeSi has achieved twice the result with half the effort.

Tudatong’s “Falcon” LiDAR relies on the unique performance advantages brought by the 1550nm laser to form a binding effect with NIO’s capital and business levels, and fits like a fish in water on the NIO NT2 vehicle platform.

In addition to the above three leading players, companies such as Yijin Technology and Tanwei Technology also have their own main LiDAR products. Currently, Yijin Technology has not announced designated vehicle manufacturers for mass production, while Tanwei Technology announced on September 30th of this year that it has obtained designated car models from HEC Group, one of them being the mass production version of the Concept-M model, which HEC is committed to developing. The main LiDAR of other designated vehicle models will also adopt Tanwei’s automotive-grade solid-state LiDAR.

“`In the future, more and more LiDAR companies will receive orders for main LiDAR from automakers.

Many industry professionals might ask: What happened to Livox, who achieved the fastest LiDAR mass production on the XPeng P5? The reality is that since the failure on the XPeng P5 project, there has been no update on the progress of mass production. He XPeng previously mentioned in an interview that Livox had not delivered a mass-produced LiDAR for five or six months, implying that the LiDAR version of P5 was not unpopular, but rather the mass production of LiDAR was not yet available. Therefore, in G9, Shenzhen Juchuang became Livox’s replacement.

2. Are LiDAR enterprises opening up their second battlefield?

Looking at it this way, the main LiDAR field is indeed occupied by the leading players, with little left for the followers. However, the players who have taken a large market share will certainly not be satisfied with this, so Shenzhen Juchuang and Velarray have come to “sweep” the market of solid-state LiDAR.

On November 2nd, Velarray announced the pure solid-state LiDAR FT120 for filling the gaps, which is planned to be mass-produced and installed on the car in the second half of 2023, and has now received orders for more than one million units. On November 7th, Shenzhen Juchuang announced the full-solid-state LiDAR RS-LiDAR-E1 for filling the gaps, which is scheduled to be SOP in the second half of 2023 and has received orders from fixed-point testing and dozens of automakers.

Both products are chip designing with pure solid-state scanning, with a focus on small size and compliance with vehicle rules. In terms of parameters, the FOV of Velarray FT120 is 100° × 75°, the capability to measure distance is 30m@10% reflectivity, and the maximum range is 100 meters. The FOV of Shenzhen Juchuang RS-LiDAR-E1 is 120°×90°, the capability to measure distance is 30m@10% reflectivity, and the farthest measuring range is 120 meters. Although the Shenzhen Juchuang E1 seems to be more advantageous than the Velarray FT120, the pricing is still unknown.The competition in the main LIDAR field has taken shape, while the competition for solid-state LIDAR has just begun. Earlier this year in May, RoboSense announced its solid-state LIDAR product LDRS Satellite for blind spot detection, which is expected to start production verification in the first quarter of 2023. Recently, the core component of the LIDAR has passed the AEC-Q100 certification, which means it is another step closer to being used in cars. In terms of capital, RoboSense has also completed a B1 round of financing of over hundreds of millions of RMB in the near future.

Another player is i-Deal Technologies, which launched the ML-30s blind spot LIDAR product very early on, but this product is not pure solid-state, but the MEMS technology route. It still can be used for blind spot detection, such as it has been used in Mobileye’s Robotaxi. Recently, i-Deal Technologies also announced that Baidu Apollo’s sixth-generation unmanned vehicle RT6 will be equipped with its upgraded version of ML-30s, which covers a 120° field of view that is said to exceed the industry average, and only requires 3 to 6 LIDARs for 360° coverage. In contrast, other LIDAR solutions on the market require at least 5 to 8 LIDARs to achieve the same level of horizontal coverage.

This LIDAR is planned to be released at CES in January next year, and it is unknown whether it will adopt a fully solid-state solution or continue with the MEMS technology route.

In addition, i-Deal Technologies has also completed tens of millions of dollars of C round financing, which is said to have been obtained a long time ago. XPeng Motors, SAIC, Dongfeng, and Intel are i-Deal Technology’s shareholders.

In the field of blind spot detection LIDAR, RoboSense, Hesai, i-Deal Technologies, and Suteng are competing fiercely, and the show has just begun.

One may ask: do we really need blind spot detection LIDAR apart from the main LIDAR? How do we view this trend from a technical perspective?

Why do we need blind spot detection LIDAR? What are the scenarios that require it?

Some car companies use LIDAR for navigation assistance when driving at high speeds to increase safety, while others use LIDAR to achieve point-to-point driving assistance in more complex urban environments. Some car companies use LIDAR for more precise automatic parking or higher-level automatic valet parking (AVP) in underground parking lots without GPS signal.At present, the main purpose of the primary LiDAR in the market is to take care of the vehicle’s forward vision in driving scenes to achieve more stable autonomous driving. On the other hand, the fill-in LiDAR is designed to detect blind spots in narrow urban roads and parking lots, supporting advanced driver assistance systems. If the vehicle has blind spots, the ADAS system may fail to detect or make false judgments and operations during operation.

Technically, fill-in LiDAR is necessary.

Even if there are human drivers in a driving scene, traffic accidents caused by blind spots at close range are still very common. In some cities, more than 90% of traffic accidents may be minor collisions or rear-end accidents. Without a sensor that can perceive close range and blind spots, ADAS systems may fail.

Especially for the currently dominant primary LiDAR, it has strong detection capabilities for distant targets, but cannot detect targets at close range because of naturally uncovered horizontal and vertical view angles.

Nowadays, most car manufacturers aim to achieve high-speed navigation assistance, urban navigation assistance, and point-to-point autonomous driving across all scenarios. However, they do not want to install a primary LiDAR on the roof. Therefore, they choose to use a fill-in LiDAR to achieve sensing redundancy. In most cases, the system still relies on visual cameras and millimeter-wave radar for perception.

In simpler scenarios such as highways, visual cameras and millimeter-wave radar can still achieve the corresponding functions. However, the stability, reliability, and usability of the system cannot reach a very high level. Once entering urban areas, these two types of sensors will be under great pressure. Therefore, equipping some lateral fill-in LiDAR will greatly improve the experience.

Currently, it is still a stage of manned and machine driving. In the future, when the system really achieves full autonomy, the fill-in LiDAR will be indispensable. Therefore, we can see many different-sized LiDARs on Robotaxis, fully armed.

In parking scenes, many parking lots may have various vehicles, pedestrians, shopping carts, etc., and the parking spaces may be very narrow. There are various poles, pillars, pipes, and cabinets. In such scenarios, to make automated parking more user-friendly, it is necessary to be very careful in the perception of near-range and blind spots. Currently, the visual fusion parking can barely cope with the APA, and if higher-level functions such as AVP and memory parking are to be realized, the fill-in LiDAR is a must. For example, the P5 of XPeng Motors is more stable and reliable in its multi-story memory parking function thanks to the addition of fill-in LiDAR.To sum it up:

- In driving scenarios, if the usage of the function is not too complex, it can be handled with just “camera + millimeter-wave radar + auxiliary LiDAR”. Now, some car companies are using their main LiDAR as an auxiliary LiDAR. If the usage of the function is very complex, the perception solution required should be “camera + millimeter-wave radar + main LiDAR + auxiliary LiDAR”.

- In parking scenarios, the common APA function can be handled with visual + radar, but for more advanced functions in the future, the auxiliary LiDAR still needs to be introduced. After asking several companies, they unanimously agreed that the use of auxiliary LiDAR in automatic parking scenarios is more necessary.

- If we change our perspective and look at it from a consumer’s point of view, if they want to buy a car with such functions, installing more LiDAR will mean more money, and the subsequent maintenance costs may also increase accordingly. How can we take care of both the performance and functional development needs of car companies while making consumers less sensitive to the increased cost?

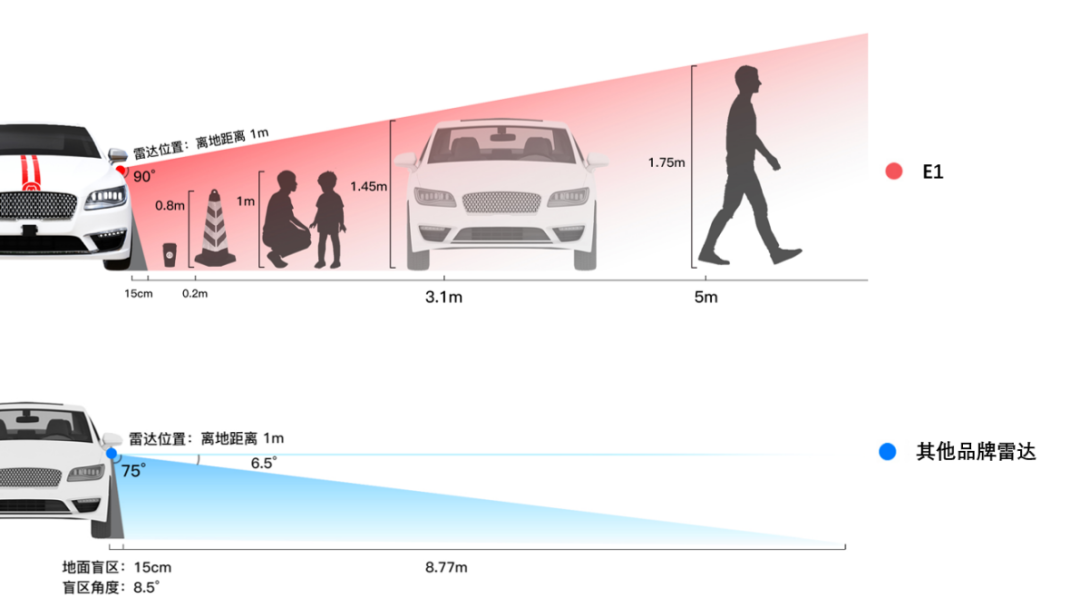

- To address this “want it all” problem, some auxiliary LiDAR companies have proposed several product development standards, including being designed for close range detection, having a super large field of view, a compact and flexible appearance, and high performance and low cost. There are even some specific parameter indicators: the horizontal field of view of the auxiliary LiDAR on the side should be greater than 120°, the vertical field of view should be greater than 75°, and it should be able to detect a tennis ball with a diameter of 6cm at a distance of 5m from the front of the car.

- Some LiDAR companies in China seem to have agreed. Their solution is a chip-based pure solid-state auxiliary LiDAR based on Flash technology. Given that companies such as Ouster and RoboSense do not have similar product development plans, today we will mainly look at how Sensible 4, Hesai Technology, and RoboSense “fight” with each other.

Surprisingly, Sensible 4, Hesai Technology, and RoboSense have all set the mass production time of their auxiliary LiDAR to the second half of 2023, indicating that there will be a wave of strong demand at that time.

- In terms of parameters:LDSatellite from LiangDao Intelligence: Horizontal field of view of 120°, vertical field of view of 75°, ranging capability of 30 meters at 10% resolution, external window of 48mm×88mm, and the farthest measurement distance is unknown.

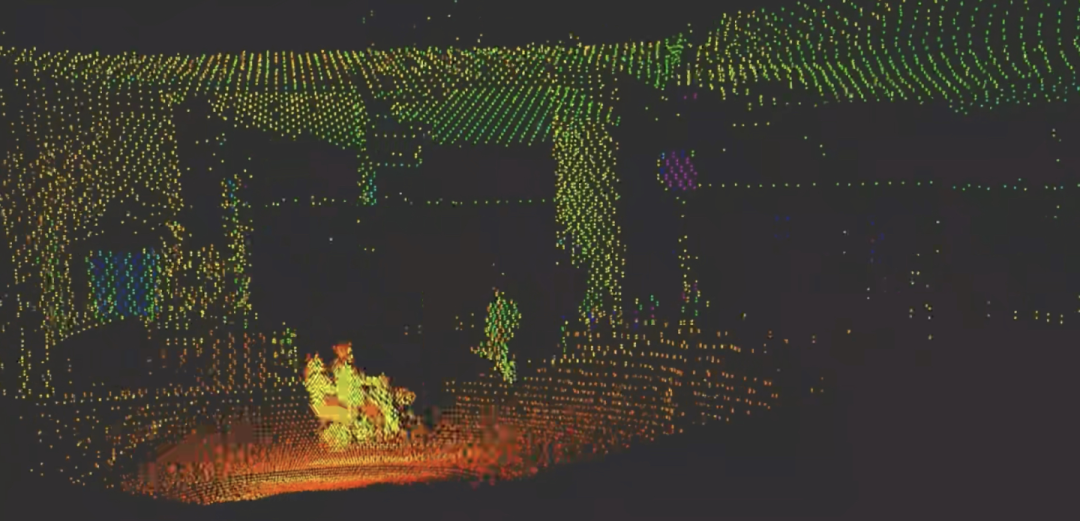

The point cloud effect of the laser radar is shown below:

FT120 from Hesai Technology: Horizontal field of view of 100°, vertical field of view of 75°, ranging capability of 30 meters at 10% resolution, external window of 75mm×50mm, and the farthest measurement distance is 100 meters.

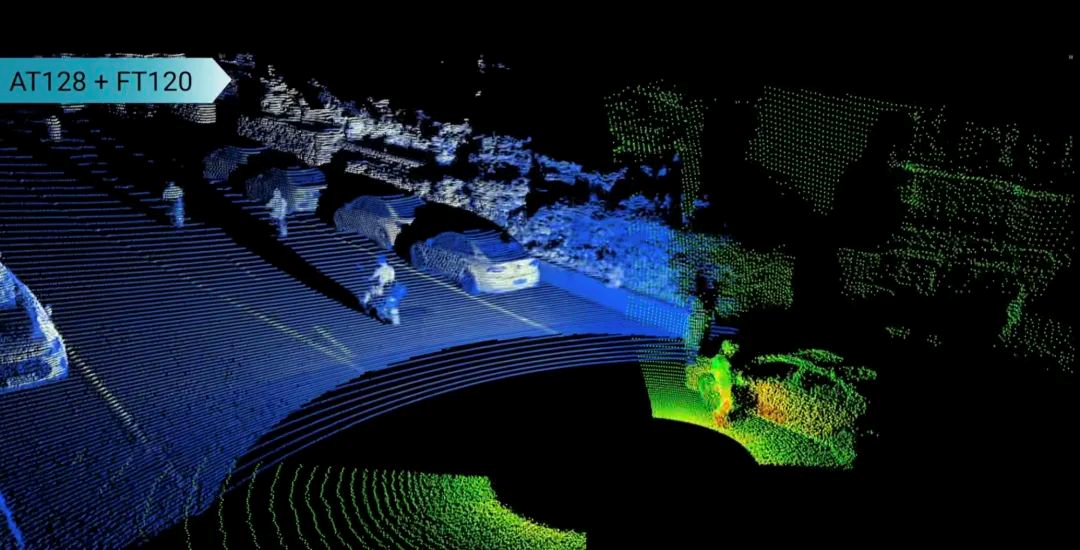

The point cloud effect of FT120 is shown on the right side of the figure below, and the point cloud effect of the main laser radar and the fill-in laser radar is shown in the whole figure:

E1 from StenSa: Horizontal field of view of 120°, vertical field of view of 90°, ranging capability of 30 meters at 10% resolution, the farthest measurement distance is 120 meters, and the external window size is roughly half the size of an iPhone 13.

From the parameters of the three laser radars, they have achieved the same ranging capability of 30 meters at 10% reflectivity. However, their understandings differ in terms of FOV field of view.In terms of horizontal field of view, Sagitar and Liangdao are consistent, while in terms of vertical field of view, Hesai and Liangdao are consistent, and in terms of comprehensive parameters, Sagitar has advantages. Of course, the actual performance cannot be judged solely by these parameters, and the overall practical performance must be taken into consideration.

As can be seen, although the ranging ability of the solid-state (flash) lidars is not very far, the field of view performance is excellent, thanks to the fact that these lidars are all based on flash technology, which naturally cannot “measure far,” but “measuring near” is a strong point.

In the promotion of the three companies, Sagitar and Hesai both suggest that automakers install blind spot lidar on the side of the car, as both have strong main lidar products and don’t want to compete for the limelight; while Liangdao says it can be installed on the side of the car, front bumper, or even on the headlights.

With such a large field of view, what kind of perception effect can be achieved?

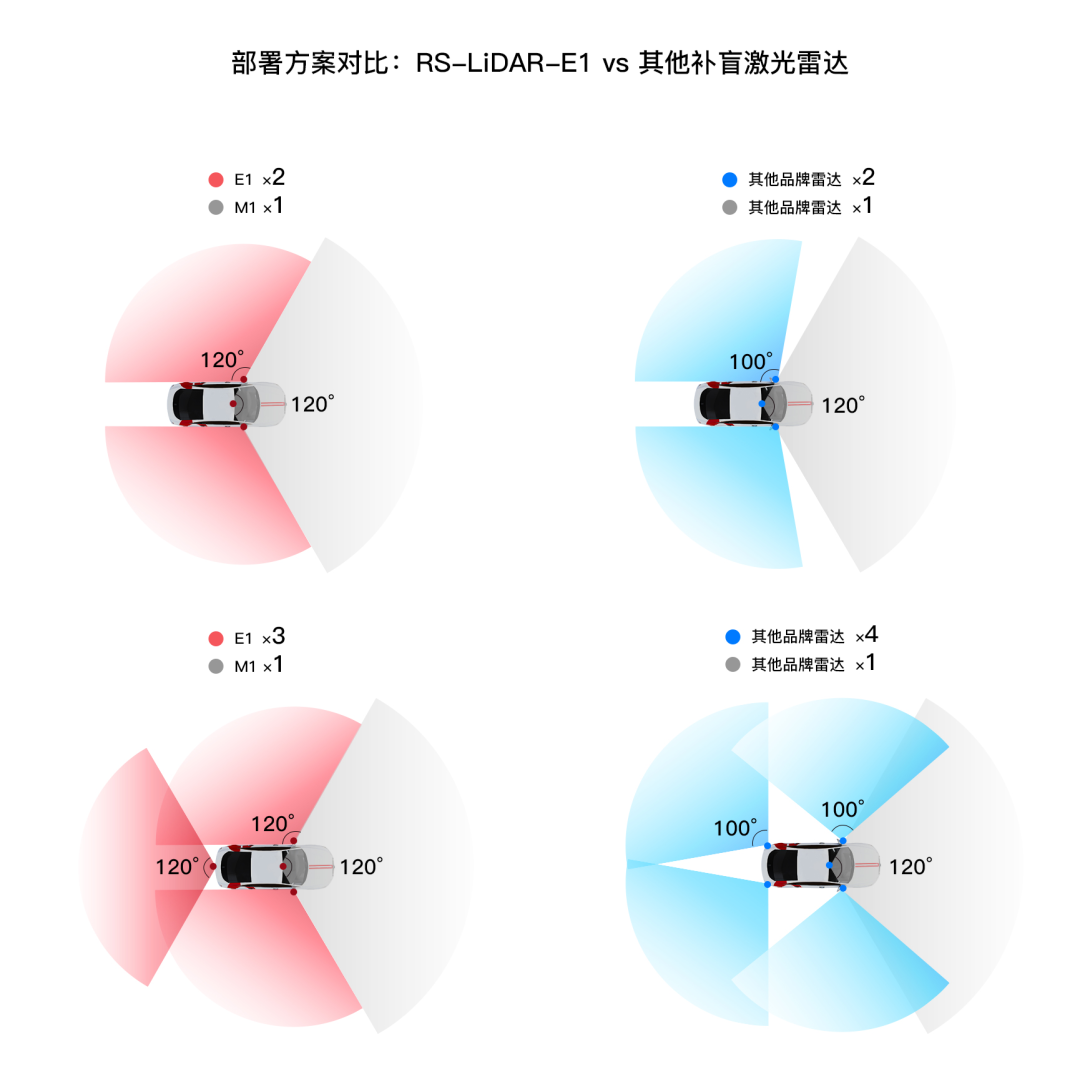

Sagitar Juchuang provides two reference samples: one is two E1s installed on the side of the car, in combination with a main lidar; the other is two E1s installed on the side of the car, plus one rear-facing E1, in combination with a main lidar.

The perceived effect of the two schemes in the horizontal direction is as follows:

It is worth noting that if the field of view of the blind spot lidar in the horizontal direction is not enough, then it can only be compensated by increasing the quantity (increasing costs), or finding a tricky installation angle (difficult to implement). Obviously, a large field of view has a natural advantage, just like a tall person can dunk by just reaching up, while a short person needs to jump hard to dunk.

Similarly, in the vertical direction, Sagitar believes that the FOV of blind spot lidar needs to reach 81.5° or more in order to take into account the perception of small objects on the ground and large obstacles. Otherwise, performance will be sacrificed. Therefore, the 90° of E1 is just right, while the 75° of FT120 and LDSatellite fall slightly short.

Is this little difference really important? Perhaps only automakers’ algorithm engineers who have used it will know for sure.

The frame rate is also a very important indicator for the blind-spot lidars in the automotive industry, as it directly affects the speed of perception. High frame rate is particularly necessary for short-range recognition, in order to quickly detect and respond. According to Suteng, the frame rate of their blind-spot lidar needs to be above 20Hz, while the other two companies either did not disclose this indicator or have different statistical methods, so we need to wait and see to make a fair comparison.

The frame rate is also a very important indicator for the blind-spot lidars in the automotive industry, as it directly affects the speed of perception. High frame rate is particularly necessary for short-range recognition, in order to quickly detect and respond. According to Suteng, the frame rate of their blind-spot lidar needs to be above 20Hz, while the other two companies either did not disclose this indicator or have different statistical methods, so we need to wait and see to make a fair comparison.

Finally, if we compare the speed and quantity of mass production, it is currently known that Liangdao LDSatellite will begin trial production in the first quarter of next year, while Hesai and Suteng will both begin mass production in the second half of 2023. However, Hesai is very confident that it can achieve the fastest mass production speed, as its previous model, AT128, was highly efficient.

In terms of the number of fixed point measurements, Hesai has already received orders for millions of units of its FT120 model, while Suteng’s E1 has already been used by dozens of car manufacturers for testing. However, Liangdao LDSatellite has not yet disclosed its fixed point measurements.

Moving on to the technical aspect, over the years the development of lidar has progressed from mechanical rotating to MEMS hybrid solid-state and finally to Flash pure solid-state, which is a result of continuous technological advancement and market demand.

Inside the lidar, there have also been various scanning methods, such as mechanical rotary scanning, single-axis mirror scanning, dual-axis mirror scanning, one-dimensional mirror scanning, mirror and vibration hybrid scanning, and finally pure solid-state electronic scanning.

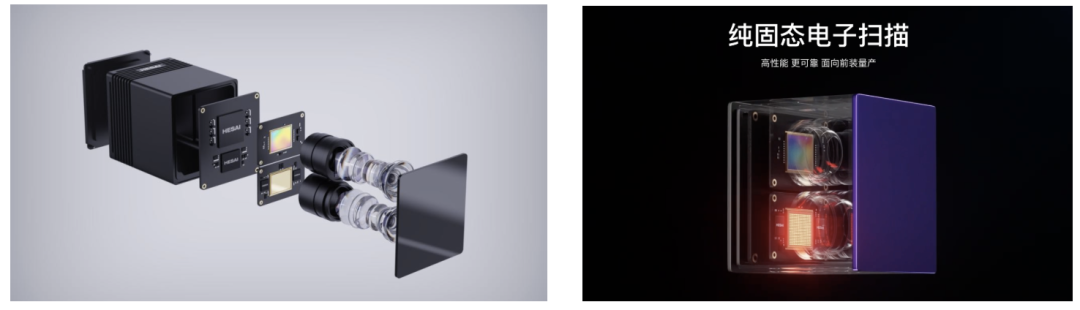

In the second battlefield of blind-spot lidars, the biggest revolution is full solid-state digitization, where the transmission and reception modules of the lidar are chip-integrated. This leads to smaller size, more stable performance, more suitable for automotive regulation, cost optimization, and easier manufacturing, making it more feasible for large-scale installation.

If these three lidars are taken apart, this is what we would see:

Suteng Juchuang E1: Dual emission and single reception.Hesai FT120: Single Transmit and Single Receive

RoboSense LDSense Satellite: Single Transmit and Single Receive

The development of lidar is being influenced by “Moore’s Law”.

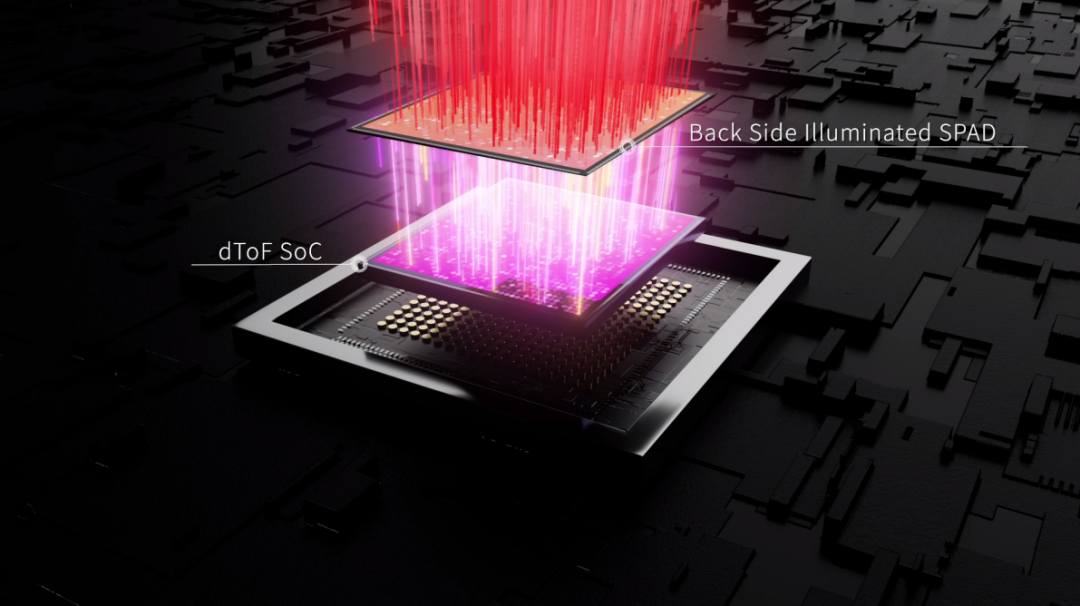

All three companies use a VCSEL (vertical-cavity surface-emitting laser) chip on the transmitting end, an SPAD (single-photon avalanche diode) chip on the receiving end, and a processing module chip for their photon-counting lidar. The specific techniques they use are likely different, but all three companies claim that they have developed their own systems.

Through chip integration, the number of internal components in photon-counting lidar is reduced and the moving parts are eliminated, resulting in a smaller, all-solid-state system.

Taking the mapping solution from Volkswagen Autonomy’s subsidiary AID as an example, the E1’s receiving chip uses advanced 3D stacking technology to integrate the SPAD array and high-performance SoC on one chip, greatly simplifying system connections and reducing costs, while also allowing the device to directly process and produce point clouds. However, the application cost of 3D stacking technology will also increase accordingly, which involves the cost of yield rate and the introduction of new technologies.

The SPAD array used in the E1 has more than 250,000 pixels, which is very advanced in the industry. The benefits of this are a very large field of view and a high angular resolution. In addition, the E1 receiver chip’s photon detection efficiency (PDE) is more than 20%, enabling further performance breakthroughs.

On the transmitting end, the E1 uses two-dimensional addressable VCSEL technology, which supports flexible scanning modes. Compared to one-dimensional scanning, the peak power of two-dimensional scanning is only one-tenth of the former, making it more power-efficient and less prone to overheating.

The one-dimensional scan here is to light up one column of VCSEL line array at a time, with the same emission power for the entire column, unable to flexibly configure the energy ratio of different areas, while the two-dimensional scan can dynamically adjust the local emission power according to different ranging scenarios, achieving the optimal energy allocation. Like concentrating efforts to accomplish great things, scientifically allocating existing resources dynamically.

The one-dimensional scan here is to light up one column of VCSEL line array at a time, with the same emission power for the entire column, unable to flexibly configure the energy ratio of different areas, while the two-dimensional scan can dynamically adjust the local emission power according to different ranging scenarios, achieving the optimal energy allocation. Like concentrating efforts to accomplish great things, scientifically allocating existing resources dynamically.

Hesai and RoboSense didn’t focus too much on the core technology of the transmitting and receiving chip, so it can only be compared and analyzed after the subsequent technology is announced.

In summary, solid-state LiDAR application chip design: strong performance, lower cost, smaller volume, fewer components, less power consumption, more friendly heat dissipation, easier for mass production and vehicle-level implementation, and other advantages.

So, how much cheaper can pure solid-state FMCW LiDAR be?

According to Hesai CEO Li Yifan, even though the cost of pure solid-state FMCW LiDAR is already much cheaper than AT128, it is still more expensive than cameras. The cost of MEMS LiDAR on the market is around 3000-9000 yuan, and the cost of FMCW LiDAR is about half of MEMS LiDAR.

Industry insiders predict that in the future, after large-scale production, solid-state FMCW LiDAR will have the opportunity to replace the current millimeter-wave radar on the car.

Where is the industry heading after solid-state FMCW LiDAR?

From mechanical rotating LiDAR to semi-solid-state LiDAR, and then to pure solid-state FMCW LiDAR, it took more than 10 years for this industry’s competition to reach this point. So where should we go next?

Two aspects:

-

On the industrial side, lower the cost of LiDAR through larger scale production, including production costs, use costs, and the material costs of the product itself;

-

On the product side, launch more advanced LiDAR products through the development of new technologies, including FMCW, OPA, and other cutting-edge technologies, making the primary LiDAR completely solid-state.

Perhaps one day, when LiDAR can impress Tesla’s Elon Musk, this industry will have achieved great success.

1. How to lower costs?

According to Hesai CEO Li Yifan, scaling can indeed lower costs, but it is also limited. The upgrade of the chip-making process through technology is the key to reducing costs. He believes that chip-making is the bottleneck for LiDAR, and the importance of chip-making for LiDAR is analogous to that of engine technology for cars.So, in order to reduce costs, we need to start from two aspects: automotive-grade mass production and the improvement of RF-module chip technology.

Only by meeting the requirements of automotive standards can we have the opportunity for large-scale mass production, which is necessary to serve the main manufacturers.

Therefore, based on this understanding, several LiDAR companies have invested heavily in building their own LiDAR laboratories.

Currently, the largest one is the in-vehicle laboratory of Velodyne Lidar, with an initial investment of 50 million yuan, covering an area of 2800 square meters and employing nearly 50 professional engineers. With the support of more than 200 sets of testing equipment, the laboratory can independently conduct more than 120 tests, covering HALT testing (Highly Accelerated Life Test), HAST testing (Highly Accelerated Stress Test), high and low temperature operation testing, EMC testing, as well as automotive-grade reliability testing items such as high altitude, salt spray, ice water impact, dust and water resistance, and extreme temperature.

Production is a part of research and development, which is particularly evident in the manufacturing of high-precision instruments such as LiDAR. As a result, most LiDAR companies prefer to have their own production lines.

The above-mentioned three LiDAR companies have different production layout strategies.

Hesai Technology invested nearly 200 million US dollars to build the “Maxwell” intelligent manufacturing center in Jiading, Shanghai, with an annual production capacity of over one million units. The new factory is expected to start production in 2023.

Velodyne Lidar chose to build its own production lines, collaborate with joint ventures and contract manufacturing, etc., and is expected to complete multiple intelligent production lines by the end of 2022, with an annual production capacity of more than one million units, including joint venture manufacturing lines with Lite-On Precision.

RoboSense has its own intelligent factory in Hangzhou. The fully automated intelligent production line is under construction, with a designed production capacity of 500,000 units per year for the first phase, and the first product is expected to be put into production for validation in Q1 2023.

Of course, in order to reduce the cost of manufacturing and the difficulty of assembling LiDAR, the industry is also proposing the concept of platform-based design and development. Just as making a car requires a platform structure, subsequent product variations can be realized on the same platform architecture with minor adjustments.

For example, although Velodyne’s M-Series LiDAR has upgraded in performance, the size, shape, connectors, and communication protocols remain the same, so automakers do not need to conduct large-scale second-time vehicle verification or re-open the mold, and the module pin-to-pin upgrade can be easily achieved. Moreover, the testing system and production line configuration are also platform-based.

Based on platform design, it can reduce costs, shorten R&D cycles, simplify production and design steps (just like iPhone upgrades), and at the same time improve product quality stability. Such a model also provides a development reference for other enterprises.

Based on platform design, it can reduce costs, shorten R&D cycles, simplify production and design steps (just like iPhone upgrades), and at the same time improve product quality stability. Such a model also provides a development reference for other enterprises.

2. All-solid-state technology?

There is a suitable technology for each phase and a suitable product for each phase, as is the case in the field of lidar.

In the matter of mass-producing cars, factors such as cost, performance, producibility, and stability determine whether this lidar will be used in automobiles, so car companies do not need the best product, but rather the most suitable and worry-free one.

The mechanical rotary lidar of the past has become the preferred choice for Robotaxis (no other option); the current MEMS solid-state lidar and mixed solid-state lidar have become the preferred choice for mass-produced intelligent vehicles (diversity); and the subsequent pure solid-state filling-in lidar may become the first choice for urban auxiliary driving and automatic parking functions (dominance), so how will the lidar evolve in the product end?

-

In terms of laser, will 905nm turn to 1550nm with stronger directionality?

-

In the route of scanning technology, will FMCW and OPA technology be developed based on MEMS, or will Flash technology achieve breakthroughs to promote solid-state main lidar?

-

In the receiving end, will APD, SPAD, or ASIC chips eventually dominate the market?

-

Will the chip technology of the lidar transmitter and receiver module make a breakthrough and continue to evolve following Moore’s Law?

These answers all exist in the secret R&D laboratories of various lidar enterprises, and I believe that the mysterious veil will be uncovered soon.

Industry insiders predict that large-scale industrialization of domestic lidar will be after 2024, and better functionality will appear in 2025.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.