Author: Zhu Yulong

In October, Hyundai Motor Company (Hyundai + Genesis brands) sold a total of 347,000 vehicles globally, with a total of 3.251 million vehicles sold in the first 10 months. In terms of new energy vehicles, the sales of this South Korean automaker were 24050 (an increase of 25%), accounting for 7%.

- BEV: 19952 (an increase of 35%)

- PHEV: 4098 (a decrease of 8%)

- FCV: 1157 (an increase of 15%)

Meanwhile, Kia’s global vehicle sales increased by 8.6% year-on-year to 238,600 vehicles in October. The cumulative sales from January to October were 2.41 million units, and the sales of pure electric vehicles (EV6, Niro EV, Soul EV) increased by nearly 9000 units in a single month.

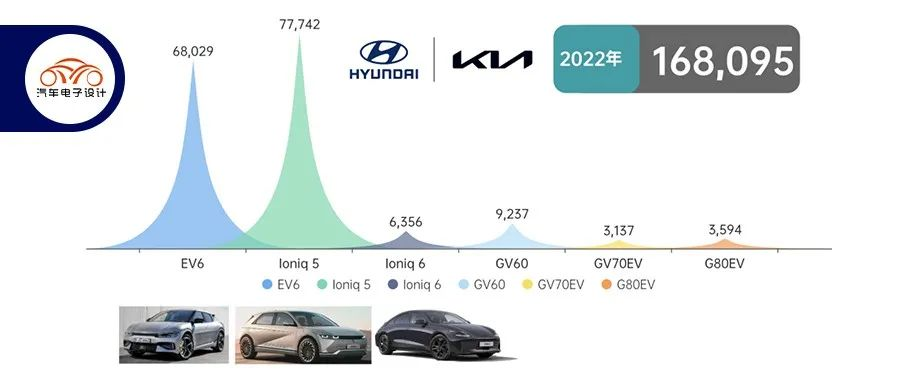

According to current sales data, the sales of 800V vehicles for the entire Hyundai-Kia group are as follows:

- EV6: 68,029 units

- Ioniq 5: 77,742 units

- Ioniq 6: 6,356 units

- GV60: 9,237 units

- GV70: 3,137 units

- G80 EV: 3,594 units

This article aims to explore this phenomenon and discuss why 800V fast charging in China has not been so popular.

Sales situation of Hyundai-Kia

Hyundai brand

In October, the wholesale volume of new energy vehicles increased by 18% year-on-year to 22,022 vehicles, including pure electric vehicles: 17,924 vehicles (an increase of 26%), PHEV: 4098 (a decrease of 8%), FCV: 1157 (an increase of 15%). From January to October 2022, Hyundai’s new energy vehicle sales exceeded 175,000 vehicles.

-

BEV: 135,595 (an increase of 43%)

-

PHEV: 39,494 (15% increase)

-

Total sales, including both types: 175,089 (35% increase)

-

FCV: 8,903 (7% increase)

Hyundai Ioniq 5 is the flagship model of Hyundai’s electric vehicle product line, with a monthly production of about 8,000 units, and the most important data this month is the rapid growth of the new Hyundai Ioniq 6. Last month, sales were 3,679 units (3,667 in Korea and 12 exported). The low export volume indicates that we are still a few months away from bulk sales in Europe and North America, but the Ioniq 6 will definitely be coming.

Genesis

Due to only promoting the production of electric vehicles (GV60, GV70EV, and G80 EV), the wholesale shipment volume was 2,028 units (of which GV60 was 1,220 units). From 2022 to now, Genesis has sold more than 15,900 electric vehicles: Genesis GV60 (9,237), Genesis Electrified G80 (3,594), and Genesis Electrified GV70 (3,137).

Kia

Kia EV6’s wholesale volume for October was 6,518 units (2,175 in Korea and 4,343 exported), and cumulative sales from January to October 2022 have exceeded 68,000 units.

## Discussion: Why is the 800V of modern Kia easier to promote?

## Discussion: Why is the 800V of modern Kia easier to promote?

My understanding is that, in promoting the 800V, there are Huawei (HiPhi and Avatar) and XPeng in China. Overall, this wave of logic around fast charging has not been paid for by consumers. Looking at modern Kia, its promotion is based on:

Less pre-existing charging infrastructure overseas

As previously seen, whether in South Korea, Europe, or the United States, the pre-existing DC charging network was limited, and from the system upgrades of CCS1 and CCS2, both the voltage range and current have quickly upgraded from 50kW level to 150kW and higher. This provides a basis for the promotion of modern Kia’s 800V. Since there are already less 400V, new facilities have quickly become compatible with the past, and consumers can directly feel the difference using 800V cars.

Regarding the evolution of charging interfaces and currents, both American and European standards are relatively complete. From cable cooling, interface currents to actual charging piles, except for cost differences, the planning of European and American charging facilities has a long-term layout.

Building and investing in charging networks

In South Korea, Hyundai-Kia Motors is accelerating the expansion of its own charging network and launching its ultra-fast charging brand “E-pit” to achieve a comprehensive electrification transformation. In Europe, Hyundai-Kia has joined IONITY, Europe’s leading high-power electric vehicle charging network, and has cooperated with EA and EVgo in the US.

The problem we face is that unless the automaker builds 800V high-power charging piles on a large scale, most highway charging piles and third-party piles will still be mainly used to meet the existing stock demand of over 10 million, and they will not be transformed for the power of new 800V vehicles. Moreover, the investment cost of a single 800V charging station is huge, which also limits the effort and output of XPeng and other automakers in this direction.Summary: Ignore the mistake in the summary editing here, and let’s make a judgement on the entire market in 2023, and then estimate the retail data based on different price segments. Where can it climb from the 5.04-5.18 million (or possibly higher) in 2022? What do you all think?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.