Author: Zhu Yulong

Due to the hot market of new energy vehicles, the lithium industry, which used to be relatively low-key, has attracted everyone’s attention. The market value of the secondary market with lithium mine themes also reflects this trend.

For pure electric vehicles, the cost of power batteries is the largest part of the vehicle’s cost, accounting for about 40-50% of the total cost. There are 400 million cars in China. If all of them are replaced with electric vehicles and each car uses 60 kWh of electricity, China would need 24 TWh (=24,000,000,000,000Wh).

One GWh of battery requires 2200- 2500 tons of lithium iron phosphate cathode material. Each ton of lithium iron phosphate requires 0.25 tons of lithium carbonate. Therefore, the lithium carbonate consumption per kWh is 0.55-0.62 kg. In other words, to produce 24 TWh, 14.4 million tons of lithium carbonate would be required.

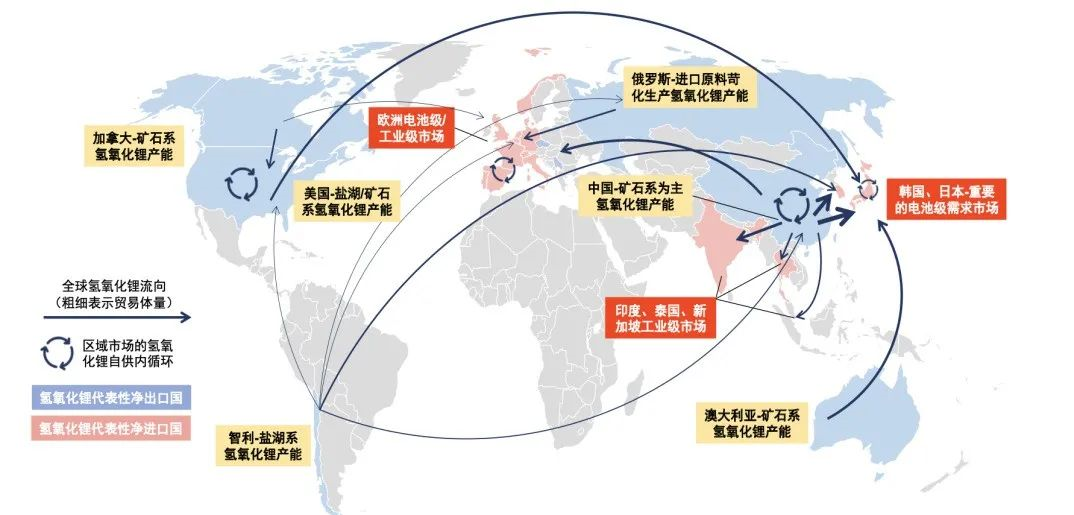

In 2021, China’s production of lithium carbonate was 298,200 tons (with a capacity of about 500,000 tons), an increase of about 59.47%; production of lithium hydroxide was 190,300 tons (with a capacity of about 260,000 tons), a year-on-year increase of about 105%. The lithium salt produced from domestic salt lake brine (60,000 tons), lithium mica concentrate (60,000 tons), spodumene (10,000 tons), and recovered lithium-containing waste (30,000 tons) is equivalent to about 160,000 tons of lithium carbonate. The external dependence of lithium raw materials is about 65%.

As a rough estimate, here’s a concept that might help: a 2022 Purple Whale with a standard range of 550km and a battery capacity of 61.4kWh costs around 210,000 CNY yuan. It requires about 36.8kg of lithium carbonate to make, which, according to current prices close to 600k CNY per ton, would cost about 22,000 CNY yuan.

This is why the price of lithium mines is being closely watched, as well as why the market value of lithium mine companies skyrocketed when the new energy vehicle market was booming last year.

How Do Lithium Resources Affect Battery Prices?

In the Past

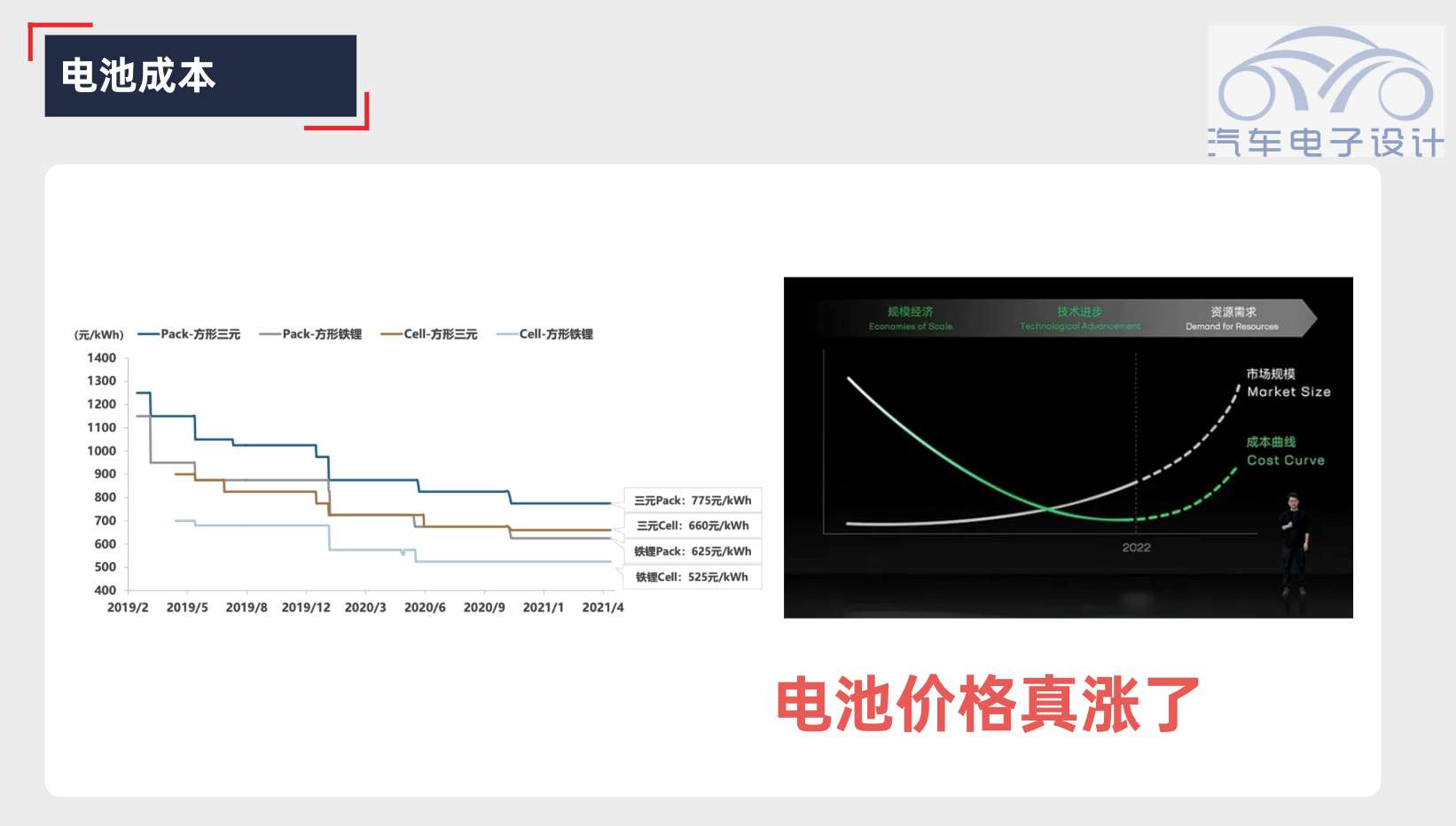

In the past, the key factor for increasing the penetration rate of electric vehicles in China and globally has been the reduction in the cost of power batteries. The main ways to reduce the cost of power batteries are:

◎ Technological development

◎ Scale expansion

◎ Material cost control

From 2021 to the first half of 2022, the rapid reduction in the cost of power batteries by domestic manufacturers has supported China’s new energy vehicles to transition from policy support to market development during the phase-out period of subsidies. Through the joint efforts of the supply chain, the power battery system in 2021 reached a low price.

Changes

Changes occurred in 2022. Prior to this, China’s power battery scale had been continuously breaking new highs, and such a large demand has pushed up the prices of upstream resources. In addition, there is also the external impetus:

◎ On the one hand, Europe and the United States have begun to move toward the path of electric vehicles.

◎ On the other hand, Europe and the United States also emphasize the safety of the local supply chain, constantly locking in resources and expanding local production capacity.

Globally, both domestic and international power battery companies are expanding production at the same time, and the demand for lithium resources required for lithium-ion batteries is increasing, causing prices to rise.

Future

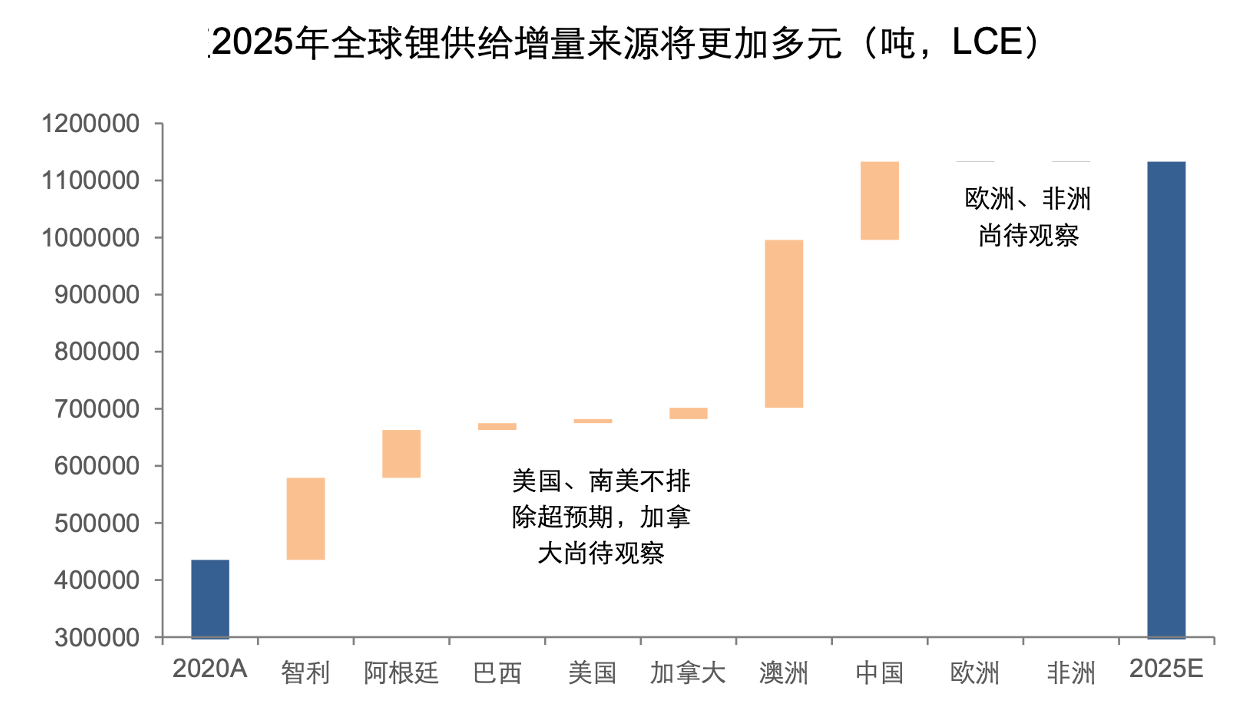

In 2021, the global lithium demand was about 600,000 tons of LCE (China consumed 29 tons of lithium carbonate and 19 tons of lithium hydroxide). In 2022, this is expected to reach 800,000-900,000 tons of LCE, and is projected to further increase to 1.5 million tons of LCE by 2025. At this rate, the supply of lithium resources will be inadequate in 2021, tightly balanced in 2022-2023, and may once again return to shortages in 2024-2025.

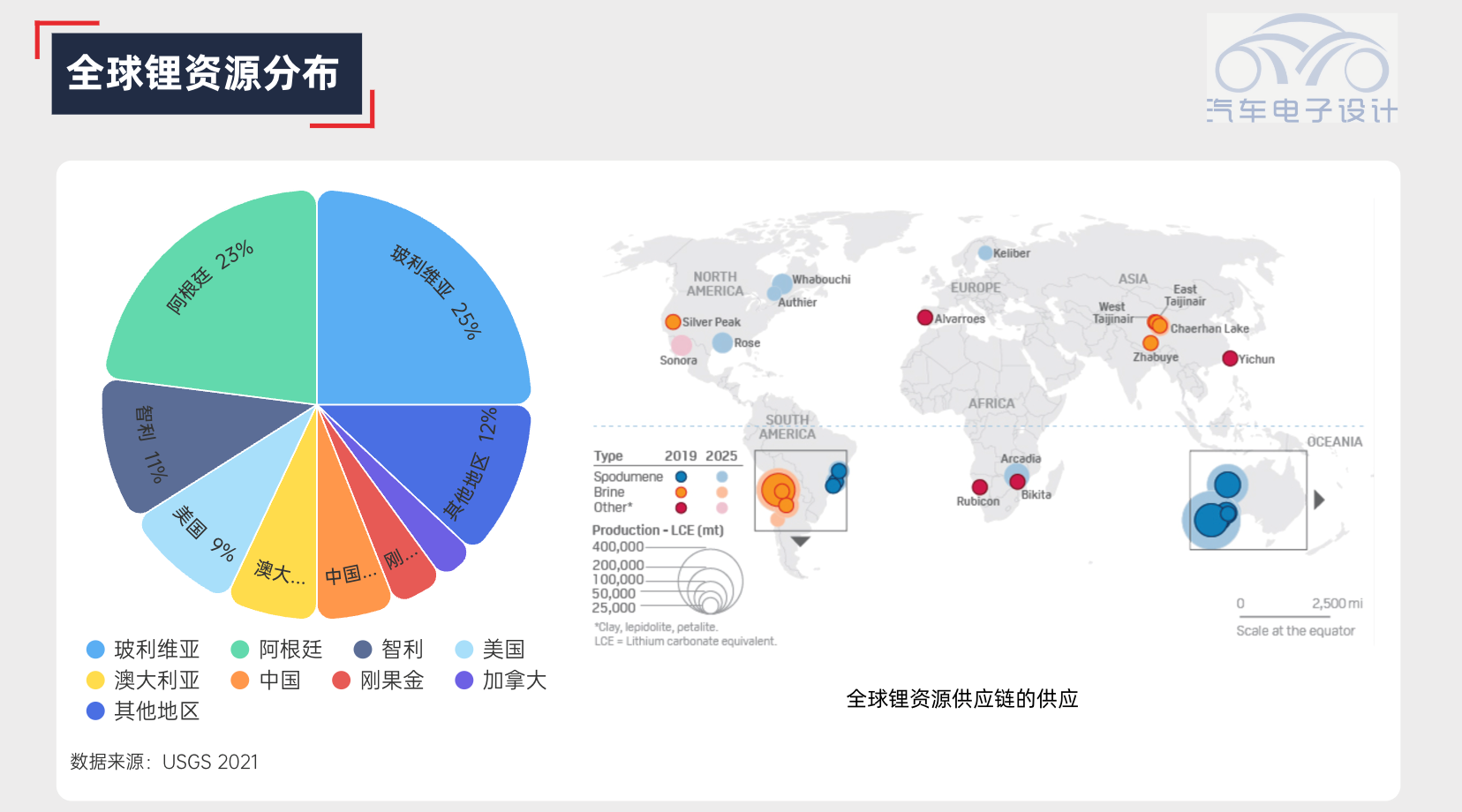

Where are Global Lithium Resources?Since lithium resources have such a significant impact on the prices of new energy vehicles, the next question is, where are the lithium resources worldwide?

As the lightest known metal in nature with the lowest standard electrode potential, lithium is inherently a “battery metal,” and has long been used in high energy density power batteries. The total amount of lithium resources is abundant and can support large-scale applications in power and energy storage. The global proven reserves of lithium resources (lithium carbonate) are approximately 374 million tons, of which 70% are stored in salt lakes. However, large-scale, high-quality, and easily exploitable lithium resource projects are scarce, and resources are unevenly distributed worldwide.

Lithium mines can be classified by mining methods as either lithium ore extraction or salt lake brine extraction.

Lithium Ore Extraction

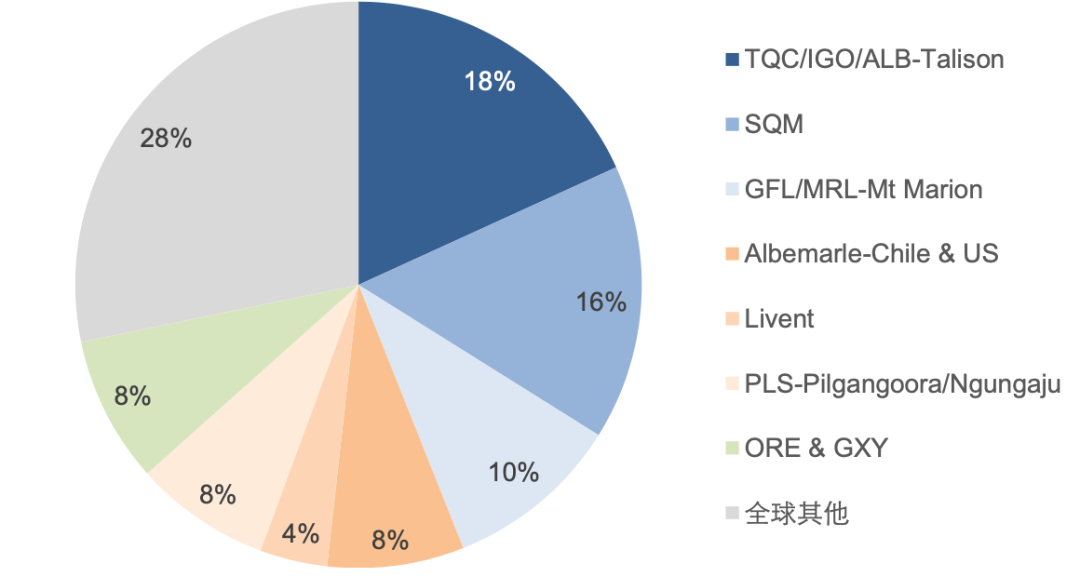

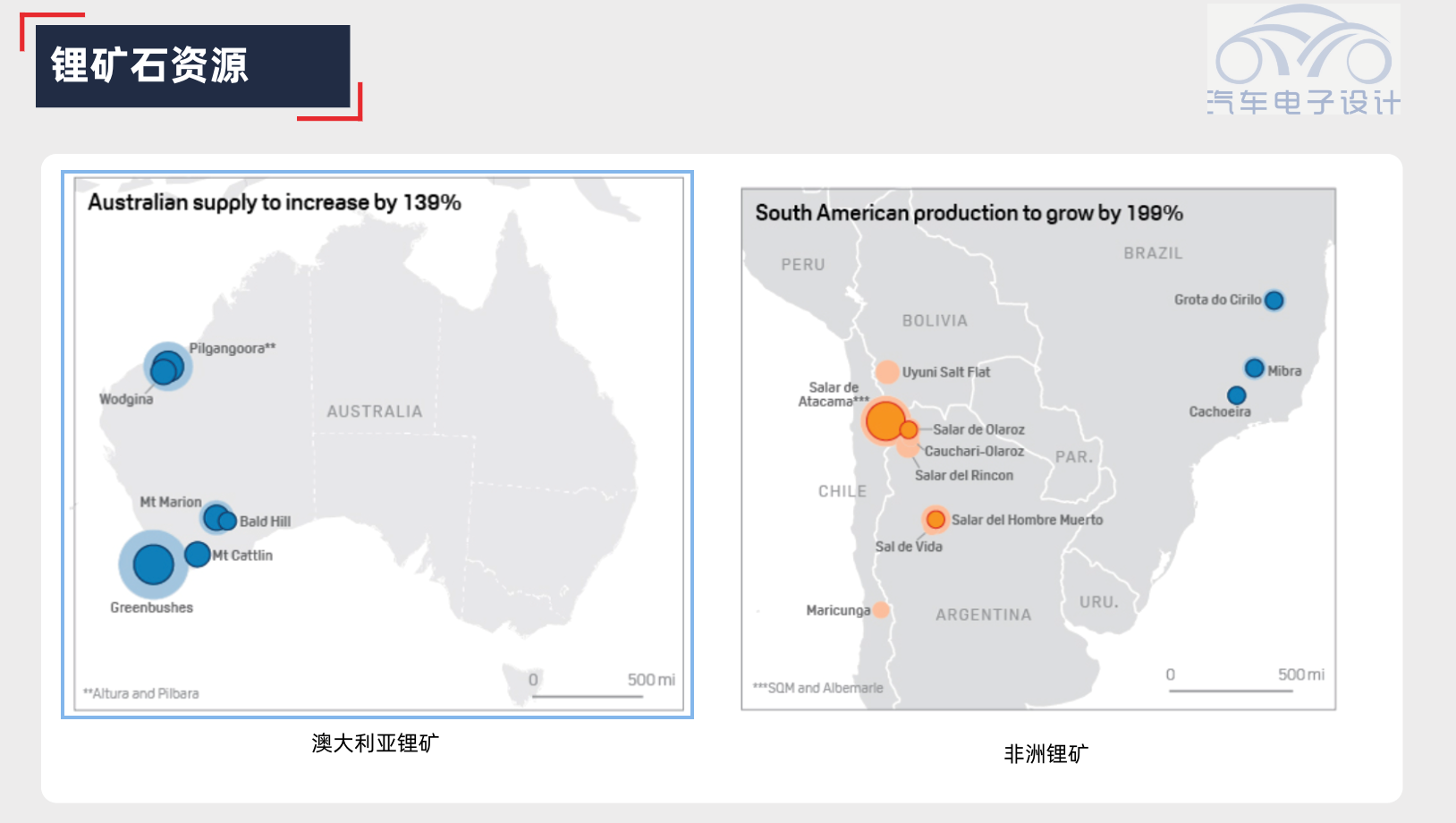

Lithium ore extraction has a long history, and the technology is relatively mature. The primary raw material is lithium pyroxene concentrate, which has a stable chemical composition, an easily controllable process, and is relatively easy to produce high-purity lithium products. Among the global lithium mines, projects with excellent resource endowments and large resource volumes are mostly concentrated in Australia, with Africa expected to be the next target.

After conducting a national security review, the Canadian government required three Chinese companies to sell their shares in critical mineral companies in Canada. Therefore, many foreign ore resources are not secure for us.

Brine Extraction from Salt Lakes

Salt lakes are comprehensive natural resources distributed globally, containing large amounts of inorganic salts, organic matter, and biology, which are the products of long-term sedimentation in the multi-level system (hydrosphere, atmosphere, biosphere, and lithosphere), rich in various minerals, and salt content exceeding 50g/L.

Valuable salt lakes have the characteristics of large reserves, wide area, and high grade, with a long construction cycle, and the process varies depending on the lake and location. The advantage is that the cost is low and the scale is large.

The constraint on lithium extraction from salt lakes is often not the resource itself, but rather the infrastructure construction (energy, logistics, environmental protection, team) and the impact of economic environment changes (such as the turbulent economic environment in South America).

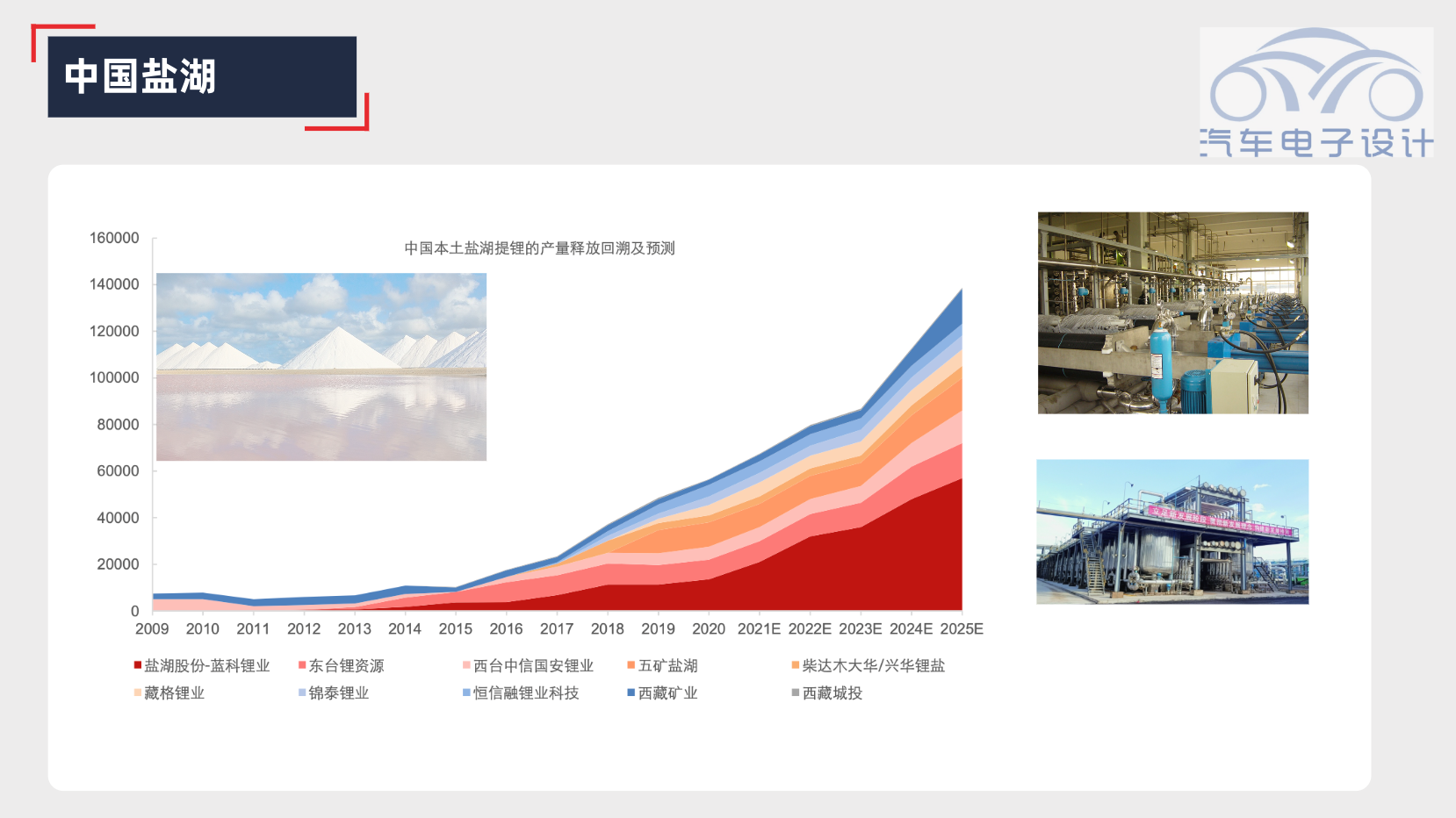

Currently, both the front-end and back-end lithium extraction technologies are advancing rapidly: the global total production capacity of salt lake lithium will increase from 260,000 tons in 2020 to 640,000 tons in 2025, with production increasing from 190,000 tons to 530,000 tons of LCE.

Development Potential of China’s Lithium Mines

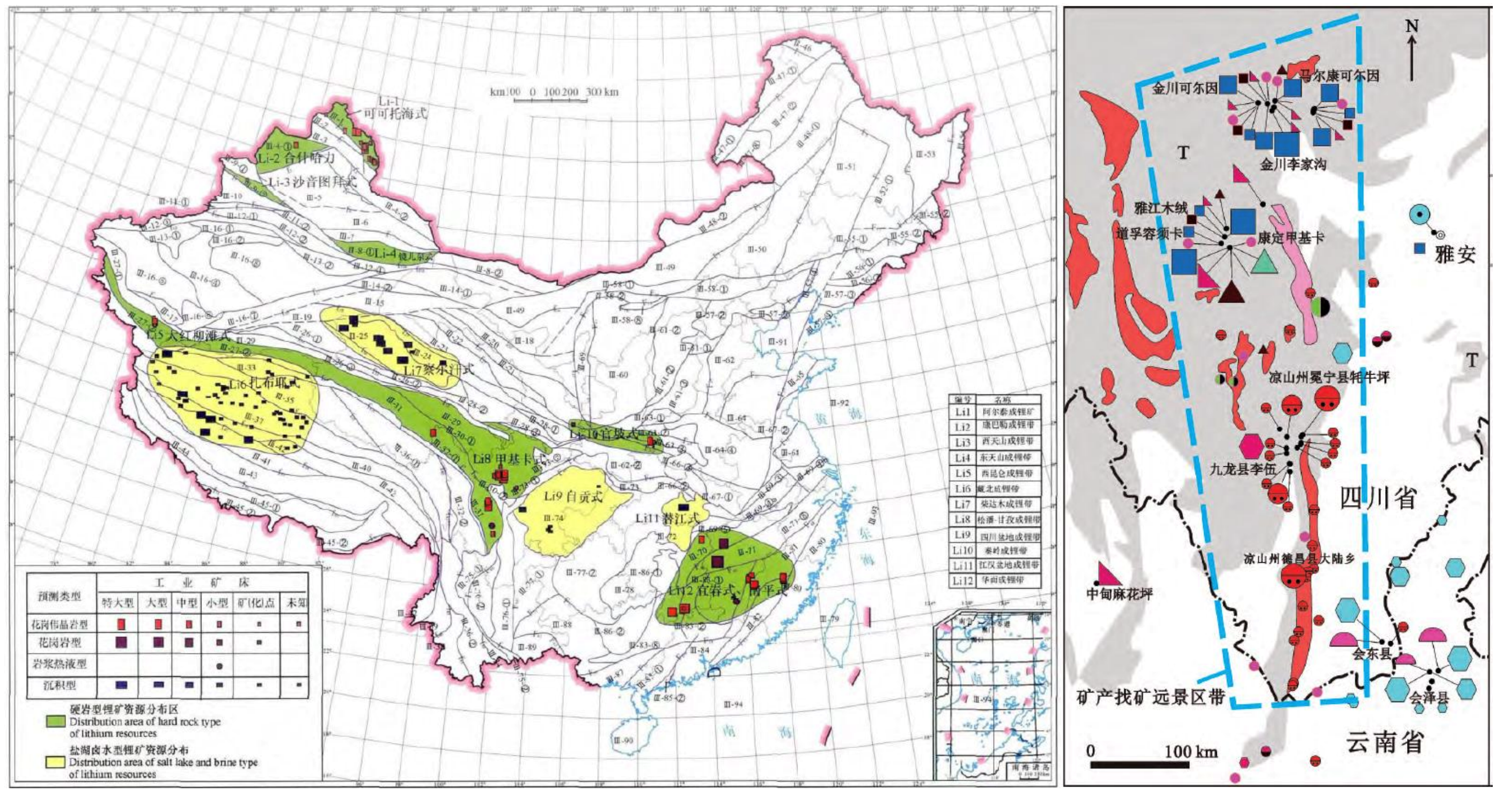

With China’s vigorous development of new energy vehicles and lithium batteries, its abundant lithium resources, which include both rock lithium and salt lake lithium, are being taken into consideration.

China’s Salt Lake Lithium Resources

China’s salt lakes are concentrated on the Qinghai-Tibet Plateau, with the Qinghai Salt Lake having the characteristics of high magnesium-lithium ratio, and large-scale potassium fertilizer production capacity has been built. However, its lithium extraction capacity is still in the growth phase. Tibet Salt Lake generally has a higher lithium concentration, but it has not been fully developed due to weak infrastructure, harsh high-altitude conditions, and stringent environmental protection requirements.

We look forward to China’s salt lakes becoming a treasure trove for our country.

Rock Lithium Resources

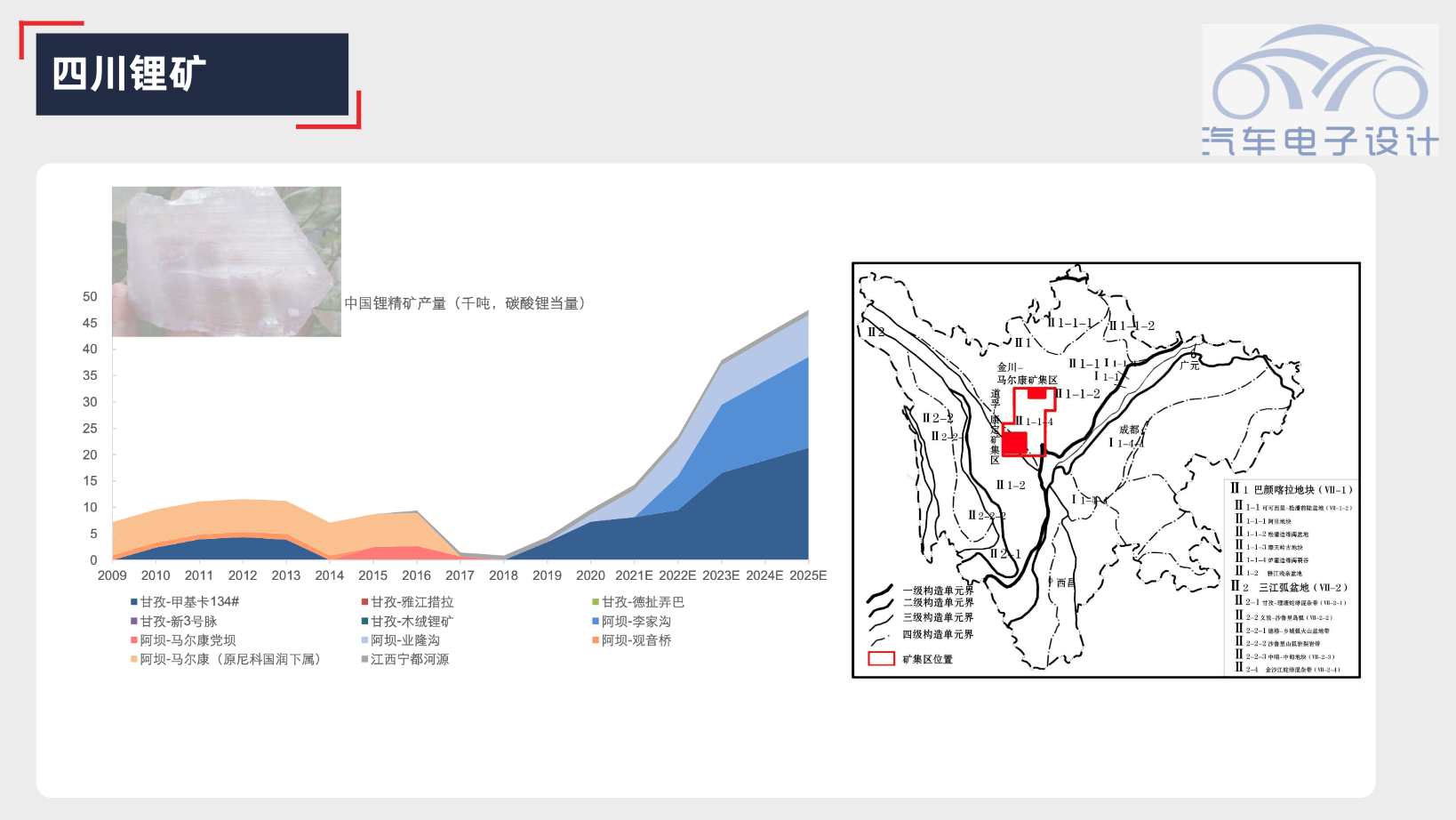

Among the domestically available hard rock lithium mines, those with higher mining value are mainly distributed in Sichuan and Jiangxi.

Sichuan’s Ganzi and Aba areas are rich in high-grade spodumene resources (with an average ore grade of about 1.30%-1.42%); however, due to being located in mining areas with relatively harsh natural conditions (the Jinchuan-Maerkang metallogenic zone and Kangding-Daocheng metallogenic zone), mining and utilization of these resources is more difficult.

Yichun area in Jiangxi Province is the main production base of lithium mica. The Yichun lithium mica mine resources are mainly concentrated in two areas: the Yifeng-Fengxin mining area and the Xinfang mining area. Yichun’s mines contain a large number of unexplored areas, and the confirmed reserves of lithium oxide converted to lithium carbonate equivalent exceed 6 million tons. In the future, there is still great potential for increased reserves.

Summary

After all the discussion, we can see that China has abundant resources and great potential in the field of electric vehicles. If fully utilized, these resources can meet our future needs. Moreover, we have a powerful weapon: battery recycling technology. Today, I will focus on discussing battery recycling, which can reduce China’s demand for lithium resources by at least one order of magnitude.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.