The China Association of Automobile Manufacturers (CAAM) released its analysis of the national passenger vehicle market in October. Overall, 1.84 million passenger cars were retailed in October 2022, a year-over-year growth of 7.3\%, with steady growth. However, October’s retail sales decreased by 4.3\% from the previous month, marking the first monthly decline in “Golden September and Silver October” since 2013.

From January to October, a total of 16.716 million cars were retailed, a year-over-year growth of 3.0\%, with a net increase of 482,000. Among them, 1.56 million cars were added from June to October since the start of the car purchase tax incentive policy, which made huge contributions to the increase.

Due to continuous improvements in logistics and the supply chain, abundant channel inventories, and gradual elimination of the impact of chip shortages from last year, growth in the auto market has been stabilized. However, the pressure on the conventional fuel vehicle market in recent months is still significant. In October, the retail sales of conventional passenger cars (excluding new energy vehicles) in China were 1.28 million units, a year-over-year decrease of 8\%, reversing the positive growth trend of 6\% year-over-year in June-September this year. Retail sales of conventional fuel vehicles from January to October decreased by 13\% year-over-year, reaching 12.28 million units.

New Energy Vehicle Market

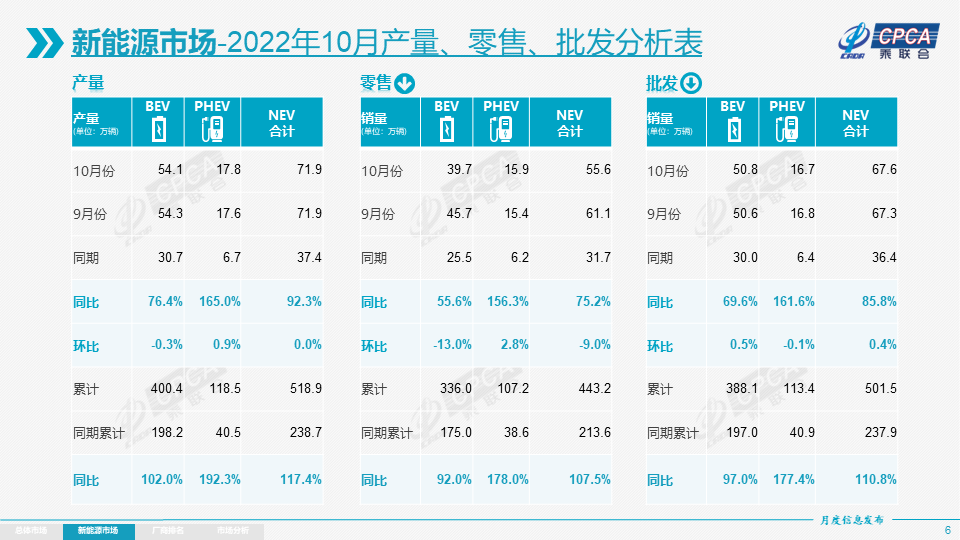

In the new energy vehicle market, the wholesale sales of new energy passenger cars in October were 676,000 units, a year-over-year increase of 85.8\%, with a 0.4\% increase from the previous month. Under the policy of halving car purchase taxes, new energy vehicles have not only been unaffected but also had a continuous and unexpected month-over-month improvement.

In October, the wholesale penetration rate of new energy vehicle manufacturers was 30.8%, an increase of 12 percentage points from the penetration rate of 18.4% in October 2021. Wholesale sales of pure electric vehicles were 508,000, a year-on-year increase of 69.6%; sales of plug-in hybrid electric vehicles were 167,000, a year-on-year increase of 161.6%.

In October, the penetration rate of new energy vehicles of domestic brands was 47.7%; the penetration rate of new energy vehicles in luxury cars was 31.4%; and the penetration rate of new energy vehicles in mainstream joint venture brands was only 4.7%.

In terms of rankings of automotive manufacturers, there were 15 companies (unchanged month-on-month, an increase of 8 companies year-on-year) with wholesale sales exceeding 10,000 units, accounting for 84.6% of the total sales of new energy passenger vehicles. Among them:

-

BYD Auto 217,518 units;

-

Tesla China 71,704 units;

-

SAIC-GM-Wuling 52,086 units;

-

Changan Automobile 35,058 units;

-

Geely Auto 31,070 units;

-

GAC Aion 30,063 units;

-

SAIC Motor 27,164 units;

-

Chery Automobile 18,301 units;

-

NIO 18,016 units;

-

Dongfeng Aeolus Special Vehicle 13,616 units;

-

Jinkang New Energy 12,040 units;

-

Great Wall Motors 10,954 units;

-

NIO Inc. 10,059 units;

-

Ideal Motors 10,052 units;

-

Dongfeng Passenger Vehicle 10,032 units.Overall, new energy vehicle retail sales of October decreased by 2.9\%, with a slight decline. It is worth praising Volkswagen (North and South China regions). Volkswagen new energy vehicle wholesale amounted to 16,771, accounting for 53.8\% of the mainstream joint venture pure electric vehicle market share, showing the initial effect of Volkswagen’s firm electrification transformation strategy.

New energy vehicle exports

In terms of exports, 103,000 new energy passenger vehicles were exported in October, with the top ten rankings as follows:

-

Tesla China exported 54,504 vehicles;

-

SAIC’s new energy vehicle exports reached 18,688 vehicles;

-

Dongfeng Yi Jie Te exports totaled 10,785 vehicles;

-

BYD exported 9,529 vehicles;

-

Geely Automobile exported 2,496 vehicles;

-

Great Wall Motors exported 1,552 vehicles;

-

Dongfeng’s DFSK exported 1,457 vehicles;

-

Skyworth Auto exported 1,098 vehicles;

-

SAIC-GM-Wuling exported 1,087 vehicles;

-

Dongfeng Passenger Car exported 445 vehicles.

Final remarks

As the countdown for the halving of car purchase tax policies approaches, the attention of potential car consumers has significantly increased. However, car prices are still low, and consumers’ urgency to buy cars is still not high.

In some areas, the temporary suspension of public transportation has led to the emergence of the first-time purchase of private cars. If the vehicles can be delivered this year, this part of the consumer group may continue to be a source of sales growth.

Due to the recent resurgence of COVID-19 in various regions, the proportion of closed dealerships is increasing, which has significantly affected market showroom traffic and order situations. There are significant risks and uncertainties in the release of automobile consumption demand at the end of the year.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.