Lei Gang Posted from the Co-pilot Temple

AI4Auto – Reference for Smart Cars

L4 is very cold, while L2 is very hot.

Recently, there have been many negative news about autonomous driving, causing public opinion to enter a cold winter. However, new cars with-assist driving are being mass-produced one after another, ushering in a new climax.

There used to be two paths for autonomous driving competition. Many people said that the players who aimed at robotaxis and L4 and above autonomous driving couldn’t continue after burning so much money on financing. In the end, it’s still the mass production of assist-driving cars that wins with the Tesla path blazed by Musk, achieving an “upgraded victory”.

But don’t be blinded by the apparent prosperity brought by new hardware. Except for Tesla, new models from domestic car manufacturers cannot achieve intelligence without installation of laser radar and high-power NVIDIA Orin.

Technically speaking, without L4, one cannot handle the delicate work of assisted driving, especially driving on open roads in cities.

According to the four technical stacks of autonomous driving: perception, localization, decision-making, and control, the most critical decision-making and control has yet to be touched by most current and upcoming mass-produced vehicles. This is a pressing issue, one that cannot be easily resolved without being an L4 player.

Perception and Decision-Making Determine the Winning and Losing of PNC

In fact, the four technical stacks of autonomous driving are also being integrated and unified. Perception and localization can be combined to solve “what kind of environment the system is facing” problem. Similarly, decision-making and control, also known as planning and control (PNC), are being combined to solve the challenge of “how the AI system should drive.” In layman’s terms, the nature of autonomous driving is to figure out the environment it faces and how to move efficiently.In recent years, due to the popularity of lidars on cars and the rise of large-scale models, the topic of perception has become increasingly hot, and various new effects based on Bird’s Eye View (BEV) continue to emerge.

However, no matter how the perception domain changes, the increase or decrease in the number of basic elements is still the core issue.

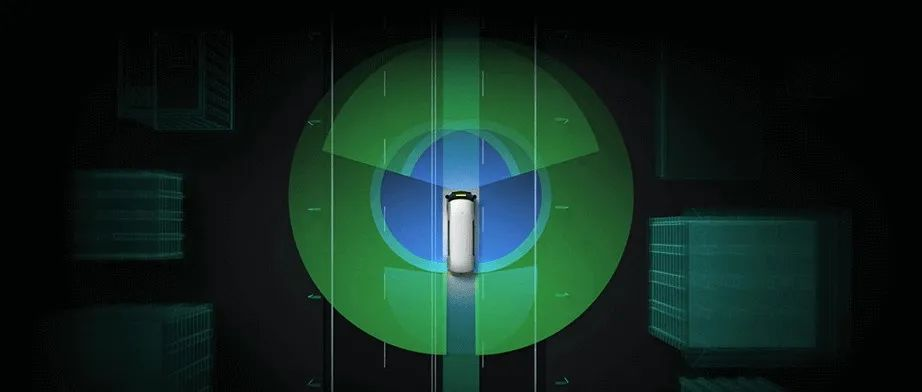

In theory, the more targets that drivers can track and the wider the range, the more conducive it is to making better driving decisions.

However, in reality, the effective area and efficient tracking are the true embodiment of technological capabilities. The perceptual radius of human driving is far inferior to that of intelligent vehicle perception systems equipped with lidars and ultra-clear cameras, yet humans can still drive well.

Therefore, no matter how grandiose the perception may sound, in the game between players, it only affects the speed.

The real determinant of success or failure is PNC.

PNC, which stands for Planning and Control, covers core modules such as navigation, prediction, decision-making, planning, and control on the vehicle side.

Usually, the industry uses spatiotemporal separation planning to do PNC, splitting trajectory planning into two sub-problems: path planning and speed planning.The path planning corresponds to lateral control, i.e., steering wheel; speed planning corresponds to longitudinal control, i.e., brake or accelerator, and this decision-making mechanism is known as the so-called separation of lateral and longitudinal control.

Analogy-wise, this approach is to lay a track for the vehicle first, and then calculate the speed of the vehicle on the track.

The characteristics of this approach are also very prominent: it heavily relies on manually adjusting the vehicle behavior with rules and relies heavily on a large number of road tests to verify the algorithm.

In fact, the car companies that have already launched navigation-assisted driving on high-speed and expressways are using this approach, which works well in high-speed and expressway scenarios.

However, once in the urban area, the drawbacks of this approach begin to emerge in terms of user experience, since it lacks high-precision maps and relies on manual rules adjustments.

Even with lidar support, the experience of this car company’s L2 product is far from satisfying, in contrast to the excellent experiences on highways and expressways. The most obvious problem is a long following distance, making it easy to be cut in by other cars, which leads to poor user experience.

What’s even worse is that facing “small and differently-shaped objects” such as motorcycles with high-speed, it often triggers an emergency brake, and if the driver does not pay attention or responds improperly, it can easily cause rear-end collisions. This is the preset scenario processing logic under the “manual rules.”

And this is still the case for well-known car companies leading in the intelligent driving field domestically.

The incapability of this PNC system in facing urban road conditions is due to the inertia in the research and development and product positioning of the car companies’ L2 products, which rely heavily on “manual rules” as a shortcut and give drivers the possibility of emergency intervention.

This also determines that in the long run, it will be difficult for the experience to change significantly unless the model can be rewritten and reconstructed based on large-scale road test data.

Tesla owners may have experienced the sudden “Qualitative Change” of the AutoPilot system after a major upgrade.

And prior to that version, Tesla used the same sensor technology, accumulating a considerable amount of data on the order of millions of production cars in shadow mode.

And prior to that version, Tesla used the same sensor technology, accumulating a considerable amount of data on the order of millions of production cars in shadow mode.

L4 players are different, as they have been clear from day one about their Robotaxi direction, and their on-road products must be free from human dependency to cope with complex urban road conditions.

Therefore, the “handwritten rules” have not been effective since day one. What L4 players need to design is like AlphaGo playing chess, using deep learning to help AI systems provide the optimal solution based on real-time data such as traffic and vehicle speed.

The pursuit of a good process experience and efficient traffic leads to state-of-the-art Robotaxi species being integrated with spatial-temporal joint planning and long-term intention trajectory prediction.

Therefore, when intelligent vehicles have entered urban scenarios implementing parking lots, high-speed expressways, and open city road point-to-point navigation, the ceiling pursued by L2 players is actually the starting point for L4 landing players.

This is also why many L4 star players have opened up the premise of assisted driving to provide the most desirable but naturally unattainable ability for OEMs’ intelligent transformation.

And among these, PNC is the most critical aspect.

Otherwise, based on the simple idea of “data accumulation,” Japanese and German automakers with large production volumes and early L2 functional configurations would have long been leading in intelligent driving.

L4 Player’s PNC Tech Details Disclosed.It is interesting that, with more L4 players turning to production-oriented tracks, they have had to disclose more core technical details with convincing evidence to persuade more potential automotive customers.

One of the L4 star players who have made a huge splash this year by launching an advanced driving assistance engine is Qingzhou Zhihang.

Those familiar with the industry will not be unfamiliar with Qingzhou. Qingzhou was founded by a young talent from Waymo in 2020, with a focus on building L4-level autonomous driving from the beginning. However, after experiencing Waymo’s baptism, it realized the difficulty of landing Robotaxi and the importance of closed-loop data, so it chose to land first in the small bus and bus scenarios.

The small bus scene was later repeatedly praised for two reasons. First, its ODD area and data were comparable to Robotaxi, and the technical verification it underwent was basically the same. Second, it was always able to maintain a high level of technical sophistication to build its technical engine. Third, it was on the trend of carbon neutrality, and the way of shared and collective transportation received greater policy encouragement.

For Qingzhou, there is even more specific significance. As a newcomer in the field of autonomous driving startups, it can be quickly recognized in the most iconic way and has quickly become the representative of autonomous driving minibuses. And, due to its demonstration of technology and products, it has received investment from venture capital firms such as ByteDance and Meituan.

After setting up the banner on the L4 track, Qingzhou Zhixing officially launched another engine this year, the advanced driver assistance solution called “Chasing the Wind” for mass-produced vehicles, hoping to provide rapid urban NOA to transforming automobile enterprises, especially the intelligent driving ability under Chinese city road conditions.

According to Qingzhou’s latest disclosure, PNC technology methods have been shared.

First of all, there is spatio-temporal joint planning algorithm.

Considering both space and time to plan trajectories, instead of first solving the path separately, and then solving the speed based on the path to form the trajectory. Upgrading from “horizontal and vertical separation” to “horizontal and vertical integration” can solve the optimal trajectory directly in the space of three dimensions of x-y-t (i.e., plane and time).

Based on this strategy, not only can the AI driver drive as steadily as an experienced driver, but also when facing dynamic obstacles, it can seize the best opportunity in advance, select the best driving path, complete the vehicle game more smoothly, and avoid repeated and sudden braking.

In addition, in the scene of driving on multiple lanes, the vehicle can also flexibly change lanes and choose a faster route by judging the traffic flow and speed of the front vehicles, instead of rigidly following the front vehicles in slow speed. Smarter, more flexible, and more efficient driving.

Secondly, there is intent and trajectory prediction.

Lightboat uses an L4-level prediction model that can achieve long-term predictions of up to 10 seconds. To put it simply, it provides 10 seconds to make a decision.

Behind this, Lightboat’s main prediction model has at least three probabilistic trajectories which, when compared to the maximum probability trajectory and the average error of the true value, have an average error of 3.73 meters. This is an industry-leading level for an overall trajectory error of 10 seconds.

Lightboat also revealed that its main model can concurrently support the prediction of 256 targets, with an inference overall time of less than 20 milliseconds, which can meet real-time computing requirements.

Therefore, what Lightboat demonstrated for smart air navigation was actually the reason why L4 players can provide faster and more efficient solutions for car manufacturers, such as L2+ thist-quenching solution.

However, PNC is only one of the most noteworthy projects in this solution, and not the entirety.

Lightboat also disclosed details of its perception and data loop iteration. Interested readers can check out the official website for more information.

It should be emphasized that the trend of L4 solutions for quenching car manufacturers’ L2 needs is no longer just a trend, as there have been numerous examples.

For example, Momenta with SAIC’s Ji Smart L7, Humin Smart Travel with Great Wall Mocha New Energy, DJI with Wuling’s Hongguang Kiwi, and Huawei with Beiqi’s PolarFox and Avida.

Although the roles of each company in the automotive supply chain are different, when it comes to product development and technology solutions, they are all based on L4.And they are all technology companies, with no internal burden of traditional automotive enterprise. Even if they are like Momenta, they are essentially different from the internal intelligent driving department of Great Wall, and they are completely activated by entrepreneurial organizational vitality at the mechanism level.

However, although there are not a few companies that can supply L4 level technical capabilities, the market opportunity is still huge.

On the one hand, the mass production car market is large enough, on the other hand, the technical solutions are not yet standard products and require deep cooperation between automakers and suppliers.

This is also why, when SAIC did not want to lose its soul, Huawei’s response was that the automatic driving brain is still scarce and not something that anyone can get.

Moreover, due to the competition between car manufacturers, they often do not choose the same supplier, or let one supplier supply all models. Therefore, after Tesla, WeRide, and other companies began to show their intelligent competitiveness, traditional car companies panicked and there were more cases of downward mergers of L4 companies.

It is expected that star L4 players, including Pony.ai, DeepRoute.ai, and the aforementioned Plus.ai, will make rapid progress in “transformation” faster and more fiercely than expected.

After all, the ceiling of L2 is just the entry-level threshold of L4.

Upgrading? Technically impossible

Isn’t Tesla proving that upgrading is possible?

This is the most common misunderstanding of many traditional car companies or host factories’ supporters.

Because, if you pay attention to Musk’s sharing, he has said more than once that Tesla is not for making cars, but for making automatic driving cars faster. Tesla is essentially an AI and automated driving company.

Musk figured out the path method of unifying sensor solutions, unifying data input, and closed-loop iteration very early.

In order to promote AutoPilot with deep neural networks, he did not hesitate to offend the OpenAI board of directors, and used Andrej Karpathy, the AI genius, to help Tesla–later leading the OpenAI board to expel founder and major contributor Musk from OpenAI.

However, the journey of Musk and Tesla has proved that elevation is effective in data modeling and iteration, with significant results.

Therefore, after solving Tesla’s production capacity at the Shanghai factory, Model 3, the large-scale autonomous driving sensor, helped Tesla’s autonomous driving performance from quantitative changes to qualitative changes.

Internally, Tesla has been using technology solutions that can be used in L4 or even L5, and there are even Tesla test vehicles with lidars. This is also why the self-developed chip was renamed from AutoPilot to FSD-Full self-Driving when it was launched. Musk even publicly stated that FSD is L5.

Therefore, for the iteration and development of autonomous driving, there is technical support for dimensionality reduction, while elevation only exists in imagination.

This is like rocket building technology, which can build spacecraft or satellite orbiting tools.

But airplane players who attach many engines to themselves and can fly higher and faster believe that they can be as good as rockets, just like attaching propellers to cars and leaving the ground.

In summary, the changes and trends in the field of intelligent driving are already apparent.Also, there is no need to be pessimistic about autonomous driving technology just because some Level 4 players have gone bankrupt. The fundamental reason for Argo’s downfall has little to do with their chosen technology. If one has had the opportunity to interact with Argo after their acquisition by a major company, one would know why they have stagnated.

This is also a problem faced by traditional car companies and even large corporations – the organization is too large, there are too many burdens, the inertia is too strong, and ancestral methods cannot change… and eventually, they end up with self-developed Level 3 technologies like Mercedes, opening up questions about the meaning of autonomous driving.

While many common-sense observations sound like nonsense, the most important thing when it comes to escaping is to prioritize survival over dignity and face.

Of course, survival and dignity need not be mutually exclusive.

Volkswagen invested 2.4 billion euros to establish a joint venture company with Horizon Robotics, seeking a life-saving ticket while also maintaining face, and even making a splash in the Chinese GR market. This type of joint venture company, where the automaker has controlling stake in the autonomous driving technology solution, may become a more common organizational structure in the development of advanced driver assistance.

Finally, returning to the two paths in the autonomous driving race: the Waymo route and the Tesla route.

If we were to trace back the time when Musk gained the recognition that “the car is the hardware platform for autonomous driving”…

Perhaps it could be traced back to 2009.

At that time, Google completed a milestone with its autonomous driving prototype car, causing a sensation worldwide upon its release. Among those who saw the news was Elon Musk. With his excellent relationship with Google co-founder Larry Page, he quickly arrived at Google to eagerly seek advice on how to implement autonomous driving technology from scratch.

The two autonomous driving routes that are often talked about today began as one source early on, diverged at some point, and have now started converging again.

- End –

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.