Author: Zheng Senhong

Although the competition in the new energy car track has entered the elimination round, there are still new players who want to catch up with the last bus of “car making”.

On October 30, a musical called “The Light of Life” introduced a new luxury intelligent electric car brand – BeyonCa, positioning itself as a high-end car series comparable to international car brands such as Porsche and BBA.

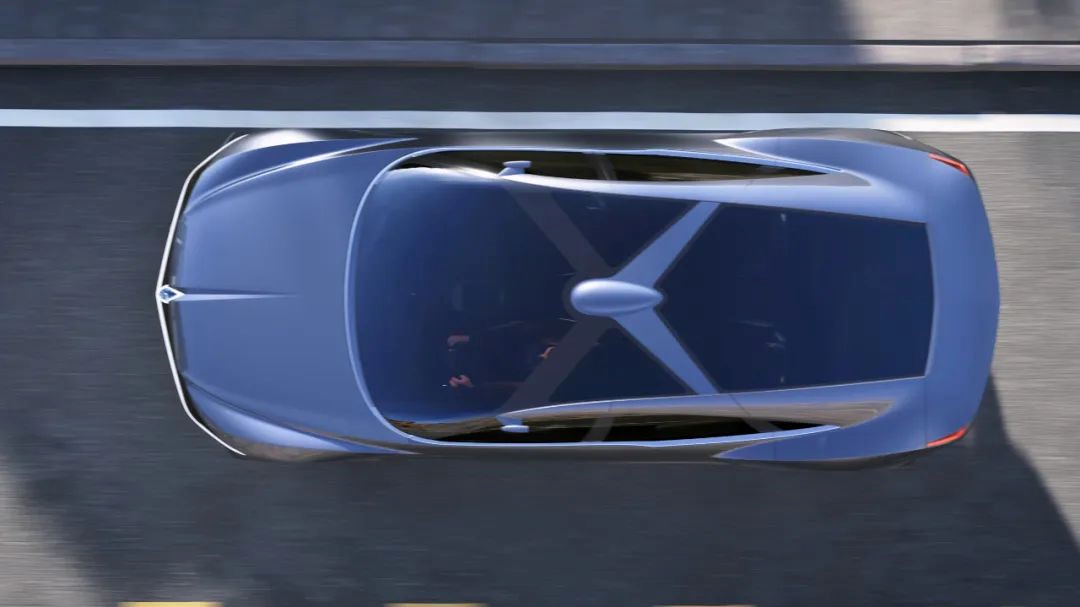

At the press conference, BeyonCa’s first model, the Gran Turismo Opus 1 (GT Opus 1) concept car, was unveiled synchronously, and it is planned to announce the first model and the Chinese brand name in the first quarter of 2023. The first mass-produced car is expected to be offline in 2024.

BeyonCa’s arrival has attracted attention from the outside world, but what people are more concerned about is: it’s already 2022, why are people still getting into the game of car making?

The logic here is not difficult to understand: it is difficult for the newly emerging car-making forces to have the opportunity and margin for error like We Xiaoli, because the best entry time has already passed.

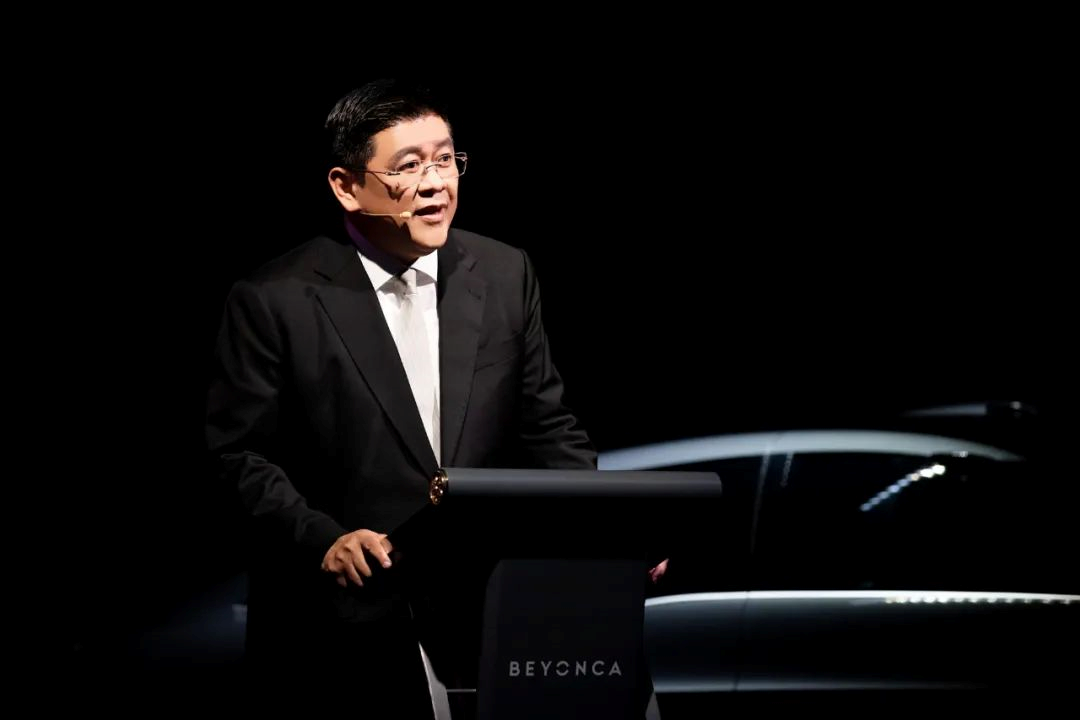

But Su Weiming, the former global executive vice president of Volkswagen Group and current CEO of Renault China and founder of BeyonCa, does not see it this way.

He believes that 2025-2030 will be the best market window for high-end and luxury electric cars.

Who is Su Weiming? He used to be the highest-ranking Chinese executive of Volkswagen, and he is proficient in car making and selling in all aspects.

In the automotive industry, Su Weiming is a “veteran” who has been through thick and thin.

“`

“`

In 1995, Su Weiming, 29, joined Daimler-Benz and served as Vice President of DaimlerChrysler (China) and General Manager of Beijing Jeep Sales and Marketing Department.

In March 2005, he left Daimler and joined Volkswagen Group as Executive Vice President of Volkswagen China. At the end of the same year, he was invited by the chairman of FAW Group at that time, Zhu Yanfeng, to join FAW-Volkswagen as Vice President of Business and General Manager of Sales Company.

In 2007, Su Weiming returned to Volkswagen China as Executive Vice President, mainly responsible for corporate strategy and sales and marketing, second only to Jochem Heizmann, President and CEO of Volkswagen Group (China). He is also the highest-ranking Chinese executive in the history of Volkswagen Group.

Su Weiming is not a “new player” in the new energy field.

During his tenure at Volkswagen China, he has been pushing for Volkswagen’s electrification and intelligent transformation. In 2017, he established Yijia Intelligent and integrated Volkswagen China’s original Mobility Asia business.

Anhui Volkswagen, the third joint venture of Volkswagen Group in China, was completed under his leadership, which further consolidated Volkswagen Group’s global electrification strategy.

The Süddeutsche Zeitung once described Su Weiming as “a pragmatist, not a conservative manager.”

Under Su Weiming’s bold reforms, the sales of Volkswagen Group in China have risen from 710,000 vehicles in 2006 to 3.85 million vehicles in 2020.

However, in January 2021, he chose to leave Volkswagen after working there for 16 years. On March 1, 2021, Su Weiming officially joined Renault and became CEO of Renault China.

According to informed sources, when former Volkswagen China CEO Heizmann retired in 2019, Su Weiming, who had hoped to succeed him as CEO, lost to Feng Sihan in the competition and chose to leave, and then had the idea of making his own car.

“`Su Weiming’s nearly 30 years of experience in the automotive industry laid the foundation for him to create BeyonCa.

Regarding the marketing strategy of “luxury brands”, Su Weiming has a unique approach.

In 2008, Su Weiming, who had been transferred back from FAW-Volkswagen to Volkswagen China, focused more on the sales of imported Volkswagen cars.

Take the Volkswagen Phideon as an example, which is a luxury flagship model that is truly developed from scratch without sharing parts with Audi.

However, due to the top-equipped price of the Phideon reaching up to 2.45 million yuan and its appearance being highly similar to Volkswagen’s mid-size sedan Passat, how to persuade consumers that the Phideon is a truly luxury car became a huge challenge for Volkswagen’s sales team around the world.

While the outside world was still questioning whether Su Weiming could break the dilemma of the Phideon, he had already opened the world’s first Phideon customization center in China and significantly increased Phideon’s sales in China in two years, accounting for half of the global sales.

After jumping out of the traditional automotive industry, Su Weiming deeply understands that only by continuously focusing on the direction of intelligence can he surpass Porsche, BMW, and Mercedes-Benz.

“Because the development of the E/E architecture and platform requires a lot of time and effort, and the enterprise culture that matches it also requires time to be polished. The current BBA, whether it is the awareness of the intelligent strategy or the inevitably cumbersome decision-making process of a super-large enterprise with seventy to eighty thousand employees.”

Su Weiming believes that the efficiency of BBA’s electric transformation will be constrained by its large system.

But compared with the design and manufacturing processes of traditional car companies, Su Weiming believes that this is a height that new car brands based on Internet thinking are difficult to achieve in the short term.

In terms of car manufacturing process, traditional luxury car companies tend to focus more on the design stage. The difference between luxury and non-luxury cars lies in the first six months, during which luxury car manufacturers spend a lot of time polishing the body proportions, configurations, tuning, etc. However, Su Weiming believes that new car makers will compromise on speed and efficiency.

Su Weiming said that it takes about 52 months for Volkswagen to introduce a new model from Germany to China and really put it on the market. In China, it takes about 36 months to make a new car with quality and design that can satisfy the market. At least two summer tests and two winter tests before the launch of the new car cannot be avoided.

“After all, nobody is a god and can’t make winter,” he said.

Therefore, Su Weiming believes that “intelligence” and “overall vehicle quality” are the opportunities for BeyonCa to break through between traditional car companies like BBA and new car makers.

Currently, BeyonCa has set up five R&D, design, and operation centers in Beijing, Shanghai, Wuhan, Singapore, and Munich.

BeyonCa, invested by Dongfeng and Renault, will begin mass production of its first vehicle in 2024, possibly manufactured by Dongfeng.

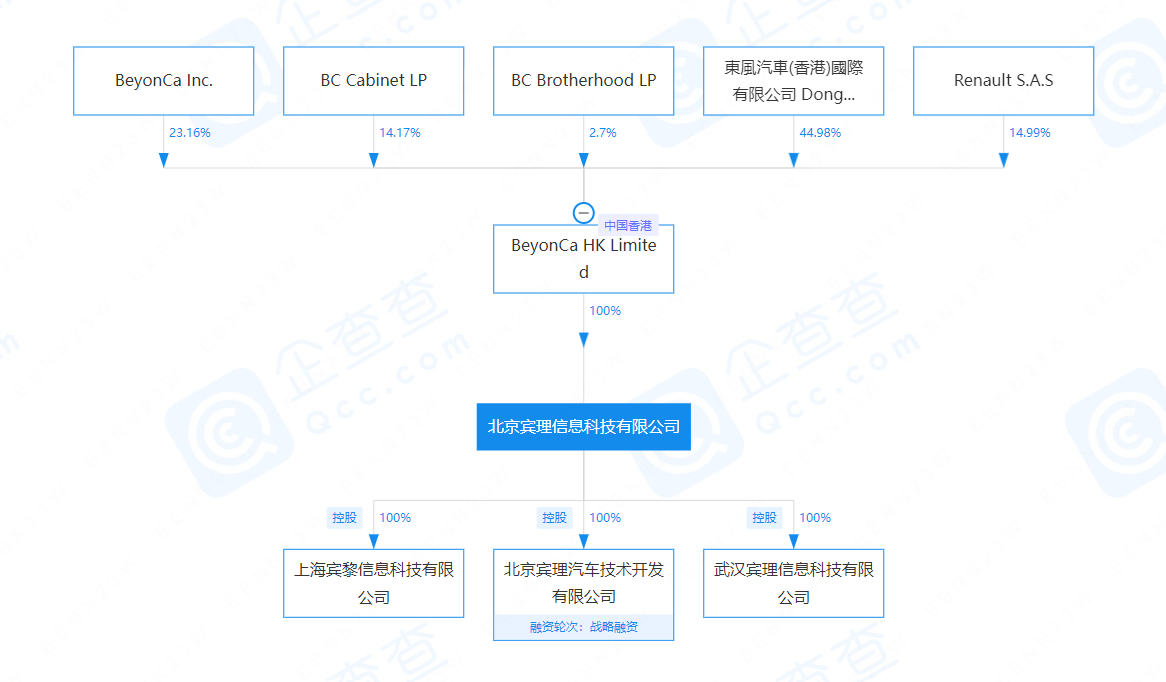

From publicly available information, BeyonCa began making cars as early as February 2021, when its parent company Biren Intelligent Technology was registered with a high registered capital of $200 million.It’s worth mentioning that Beijing BynoyCar Automotive Technology Development Co., Ltd. is jointly held by Beijing Changcheng Huaguan Automotive Technology Co., Ltd. and Beijing Binli Information Technology Co., Ltd. with a shareholding ratio of 80% (Beijing Binli) and 20% (Changcheng Huaguan). Changcheng Huaguan is actually the parent company of Future Mobility Corporation Ltd.

After Changcheng Huaguan was exposed to the news of being on the verge of bankruptcy and reorganization, some people once thought that Changcheng Huaguan’s stake might provide a technical qualification platform for Beijing Binli, or Beijing Binli might directly acquire Changcheng Huaguan, equivalent to having a car production qualification.

However, in July 2022, Beijing Changcheng Huaguan Automotive R&D Co., Ltd. withdrew from its shareholders.

For now, among the natural person shareholders of BynoyCar’s parent company BeyonCa HK Limited:

- Dongfeng Motors Hong Kong Company holds a shareholding ratio of 44.98%, the largest shareholder;

- The five natural person shareholders of Binli include You Zheng, Vice President of Dongfeng Motors, and Liao Xianzhi, Chairman of Wuhan Dongfeng Insurance Brokers Co., Ltd.

- Su Weiming currently serves as CEO of Renault China, and Renault owns a shareholding ratio of 14.99% in Binli, the second largest shareholder.

Renault’s appearance is indeed somewhat unexpected, but from the overall decline of Renault’s business in China and Su Weiming’s background, its intention may be to use a Chinese intelligent electric vehicle brand to reopen the domestic market.

As for Dongfeng Motors’ investment, it is highly likely to continue the mutual trust between ZHU Yanfeng, the current chairman of Dongfeng Motors, and Su Weiming when they were both at FAW Group.When the development speed of Voyah cannot meet the target expectations of Zhuyanfeng, BeyonCa may be another choice for the upward transformation of Dongfeng’s electrification.

In February 2022, Binyue Intelligent Technology and Changjiang Capital reached a cooperation agreement and planned to jointly establish the Hubei New Energy Automobile Industry Fund. The fund is expected to have a total investment of over 10 billion yuan and plans to build a passenger car industry base in Wuhan, which includes a complete vehicle production line.

As one of the six major automobile production bases in China, Wuhan has gathered more than 1,200 OEMs and auto parts enterprises, such as Dongfeng Passenger Car, Dongfeng Honda, and SAIC-GM, constructing a huge and complex automotive industry ecosystem.

During the BeyonCa press conference, Su Weiming extended gratitude to Dongfeng Group, Renault Group, Wuhan Municipal Government, and others. This indirectly illustrates that BeyonCa’s background is not to be underestimated.

Based on the current progress, in the initial stage, BeyonCa will most likely outsource production to Dongfeng.

On the one hand, BeyonCa currently does not have the qualifications for independent vehicle production and, combined with their plan to produce their first mass-produced model in 2024, building a factory in a short time is unlikely to guarantee the first model being put into production on time.

On the other hand, except for joint ventures with other OEMs and wholly-owned factories under Dongfeng passenger car, a joint venture factory with Renault that used to build 150,000 vehicles annually was eventually used as a new energy vehicle manufacturer by Dongfeng after Renault withdrew due to sustained business declines. This is the same production line for Voyah Automotive today.## How does BeyonCa achieve luxury and what are its highlights?

After solving the funding and production issues, BeyonCa chose to enter the fiercely competitive new energy vehicle market with the “luxury intelligent” route.

Su Weiming believes that there are obvious differences and pain points between luxury intelligent electric vehicles and intelligent electric vehicles currently on the market. If they were to create a new brand, they would have to solve these pain points. This is the original intention behind the establishment of BeyonCa.

“In the era of electric vehicles, BeyonCa has a new understanding and definition of luxury. Luxury intelligent vehicles represent high-quality products, represent the advancement of intelligent technology, and represent deep scenarios and user psychology.”

Su Weiming further explains how BeyonCa achieves luxury.

For example, regarding the positioning of high-quality products, BeyonCa’s Chief Designer Dirk van Braeckel stated that BeyonCa benchmarks top European luxury car manufacturers, and strict quality and quality control systems are the foundation of the product.

For the vehicle appearance, all the external parts of the car body will be controlled within a tolerance of +/-0.3 mm, and the matching quality of the entire car body will be controlled within +/-0.5 mm in terms of planarity and step difference.

In addition, BeyonCa’s product logo will become the world’s first dynamic car badge, which will first appear on the V-shaped front face of the GT Opus 1, forming a new way of exterior interaction.

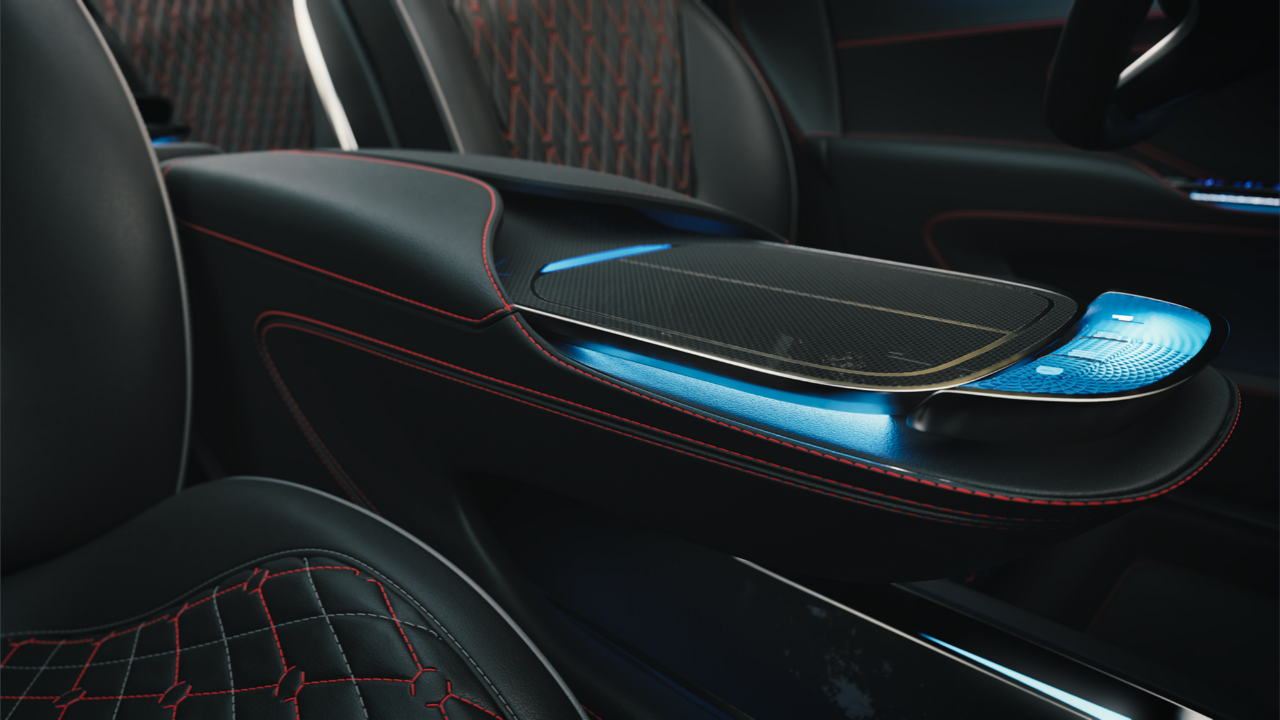

For example, regarding the definition of “deep scenarios,” Su Weiming believes that the success of a car depends 50% on the vehicle itself and 50% on the scenario. Software is only a tool, and what truly defines a car is the scenario.

Taking intelligent cabin scenario as an example, compared with other car manufacturers who make intelligent cabins first and then stack different functions to create scenarios, BeyonCa solves users’ actual pain points from a psychological perspective, which is “define cars by scenes”.

Therefore, BeyonCa proposes the concept of “healthy cabin”. Different from the light scenario functions such as blood pressure and heart rate that can be implemented with only technology, Su Weiming believes that deep scenarios should be more comprehensive in detecting users’ health.

Su Weiming introduced, “If you buy a BeyonCa car and drive 18,000 kilometers in a year and a half, spending two hours in the car every day, we will collect data with the user’s consent. This enables us to provide users with deeper health services.”

So far, BeyonCa has developed an intelligent cabin with a real-time health monitoring system, which can already achieve multi-dimensional perception, response, and reach of health solutions.

In Su Weiming’s envisioned service ecosystem, there are three levels of ecology:

- Energy (inside the car)

- Insurance (around the car)

- Medical (beyond the car)

Su Weiming calls this a competitive differentiation and a moat:

“Scene is not just a simple superimposition of functions and configurations, but should be the perfect combination of art and technology. The development of technology should serve the most core needs of people.”

BeyonCa focuses on deep scenarios and health. This is an innovative model supported by digital technology that cannot be realized by purely developing functions. It requires redesigning the ecosystem service system from the product definition stage.”

Overall, based on the initial shape of the concept car GT Opus 1, BeyonCa has interpreted the understanding of luxury from four perspectives: quality, intelligence, scenario, and user experience.

For example, taking the scenario with satisfying the core demand of health as an example, this is indeed a bold attempt. However, BeyonCa needs to highlight more scenario advantages to ensure consumers do not consider it a false demand.

Is it too late to enter the car manufacturing industry? Su Weiming: The window period of the luxury electric car market will last from 2025 to 2030.

In 2021, “We Xiaoli” successively passed the 0-1 verification period.

Li Xiang once said that the iconic characteristic of the verification period is from scratch to achieving a market share of over 3% in your segmented field. You have a significant expertise and can become an industry ceiling. In my opinion, our three car-making fools completed the 0-1 verification period in 2021, and everyone achieved a market share of about 3% in their segmented market.

Based on such market judgment, Li Xiang divided entrepreneurship into three stages: “the 0-1 verification period”, “the growth period of 1-10”, and “the maturity period of 10-100”.

Clearly, this group of new car-making forces has already entered the growth period of 1-10, while BeyonCa has just entered the starting stage of the market and has not yet fully shown to consumers.

This is also why consumers have questioned the “timing of car manufacturing.”

In fact, not only BeyonCa but also Jidu, which recently completed the limited edition car model’s debut, and Xiaomi’s cars all face such problems.But Su Weiming believes that the window for making cars has not yet entered a tightening phase, and the window for luxury intelligent electric vehicles will continue from 2025 to 2030.

He believes that the development of China’s new energy vehicle market can be divided into three stages:

- The first stage: 2015-2020, which is a stage driven by policy and subsidies.

- The second stage: 2021-2025, marked by the decline of subsidy policies at the end of 2020 and the implementation of the “double credit policy” in January 2021.

- The third stage: 2025-2030 will be the best market window period for high-end and luxury electric vehicles. It is expected that by 2030, the penetration rate of new energy vehicles will reach 68%, and the penetration rate of high-end passenger cars will reach 35.4%.

The subdivision market of the intersection between new energy and luxury cars can be said to be a blue ocean.

Currently, new-generation technologies and infrastructure such as CTP/CTC batteries, 800V voltage platform, 130 kWh battery, and 300 kW fast charging are gradually being applied, and user mileage anxiety will be basically solved.

The electric vehicle market has entered the consumer-driven stage and entered the rising stage of the S-curve.

“China’s electric vehicle penetration rate is 25%-30%, which is already the world’s largest electric vehicle market. When this market enters the rising stage of the S-curve, the luxury electric vehicle market will also quickly explode, bringing a market with annual output of millions.” Su Weiming said.

According to the number of vehicle insurance policies for MPVs, SUVs, and sedans, the number of high-end vehicles above 500,000 yuan in China in 2021 was 9.563 million.According to McKinsey’s 2021 Automotive Consumer Insights report, 88% of luxury car owners prefer to stay in the same price range when purchasing a new car. Roughly estimated using a 3-8 year car exchange cycle, the demand for replacing high-end cars of over 500,000 RMB represents a market of between 1.2 million to 3 million cars per year.

It can be said that the structural transformation from traditional fuel cars to new energy vehicles has just begun, and the upgrading consumption needs of new energy vehicle owners will gradually be released.

Su Weiming stated that the penetration rate of new energy vehicles is currently about 5% of passenger cars costing over 500,000 RMB, and it is expected to reach 45% in 2025 and 75% in 2030.

Currently, new energy pure electric vehicles that cost more than 500,000 RMB include Red Flag E-HS9, GAC HiPhi Z/X, NIO ET7/ES7/ES8, Mercedes-Benz EQS/EQE, Tesla Model X/S, Porsche Taycan, and BMW i4.

Using 500,000 RMB as a benchmark, luxury brands and new forces in high-end new energy pure electric vehicle sales reached 465,000 units in 2021. However, compared with the passenger car market of over 20 million units in 2021, the former only accounted for 2.2% of the domestic passenger car market.

This situation highlights two trends:

- The market for new energy vehicles priced at 500,000 RMB and above or even higher is still scarce due to a high entry threshold, resulting in very limited model selection from high-end pure electric vehicle brands.

- In the market priced at or above 500,000 RMB, judging from the hundreds or even dozens of sales of various electric brands each month, the market has not yet started to expand.

From the present market environment, BeyonCa is targeting a lavish market of intelligent electric vehicles with the window of opportunity wide open.

By choosing this path of offbeat competition, BeyonCa is creating a “Porsche” for the Chinese people, and perhaps it can be anticipated.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.