Author: Zhu Yulong

Recently, EasyDyn A-round financing was completed smoothly, and at the same time, its Power Domain Core Controller product began to break through.

Tianjin EasyDyn Power Technology is an old-fashioned enterprise that grew up in the last wave of electric vehicle development. A-round financing was jointly invested by Zhongsheng Huipu, Huitongda Network, and the original shareholder EVE Energy.

Here are my personal judgments:

-

After long-term suppression, Chinese ECU does not have an obvious cost disadvantage in the development of new energy vehicle power ECU, and it has the potential to serve global automakers after covering various requirements of domestic automakers in terms of functional development.

-

With the arrival of the chip crisis in China, a large number of domestically produced alternative chips in the A00 and logistics vehicle fields are entrusted to domestic automotive electronics Tier1 to complete; it is difficult for foreign Tier1 to use domestically produced chips.

-

In the long run, Chinese automotive electronics Tier 1 actually needs to cover relatively strong software development capabilities and hardware manufacturing capabilities and lower its own posture. In the era of Tier 1 software and hardware structure, it is possible to survive in the low-profit era.

EasyDyn

EasyDyn may be unfamiliar to everyone. It was founded by several founders from China Automotive Technology and Research Center in the wave of electrification. Its main product is the core controller of new energy vehicles. The core team is composed of core members of the “Pure Electric Passenger Car Power and Control” direction project team of the National Electric Vehicle Major Project for three consecutive five-year plans, focusing on the core technology research and development of VCU, BMS, DCU in the field of new energy vehicle power control.

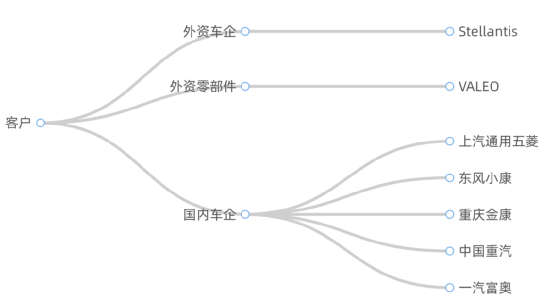

Its main products have entered into the supporting system of the core enterprises in the domestic and international automobile industry chain, including Stellantis (formerly French PSA), VALEO, SAIC-GM Wuling, Dongfeng Xiaokang, Chongqing Jinkang, China National Heavy Duty Truck, FAW-Futian and so on. In particular, we can see the growth path of Chinese enterprises in this round of self-owned brand growth, then entering into the joint venture system and expanding into the global system, while the development cost of Global Tier1 in new fields is very high.

Looking at the development of vehicle controllers, it requires a functional safety development process based on ISO 26262, and has the technical development capabilities of vehicle control technology including requirements analysis, system design, hardware design, software design, testing and calibration throughout the whole process based on AUTOSAR architecture. In terms of production capacity, it already has a production capacity of 400,000 control units.## Domestic Substitute ECU

In the design of Yidingfeng, there is a very interesting point. The controller product has already joined forces with multiple domestic automobile companies to achieve mass production and supply of domestically produced VCU chips. In the context of the tight supply of chips, it has achieved supply guarantees for entire vehicle factories.

The substitution of domestic chips for new energy vehicles, especially the Chinese self-developed MCU chips entering the industry of vehicle power control, has strategic significance.

Conclusion: In 2021, Yidingfeng achieved a year-on-year growth of 45% in the context of tight chip supply. It is expected that the supply of controller products such as VCU will double in 2022. We wish Yidingfeng to become better and the founders to continue to accelerate forward on the road to becoming the leader of core controller products in China’s new energy vehicle power domain.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.