Author: Zhu Yulong

Compared with the grand scale of Volkswagen Group, Stellantis, led by Carlos Tavares, has always been on a gradual track in this issue. The Stellantis Group achieved a net revenue of 88 billion euros, a net profit of 8 billion euros, and an adjusted operating profit margin of 14.1%. In terms of sales, Stellantis’s global sales volume was 3.019 million units, which has overall decreased. Currently, the main focus is on the United States (31%) and Europe (45.61%), which together account for more than three-quarters of the total market. In China, the sales volume is only 47,000 units, which is a completely overseas market.

Stellantis’ Electrification Transition

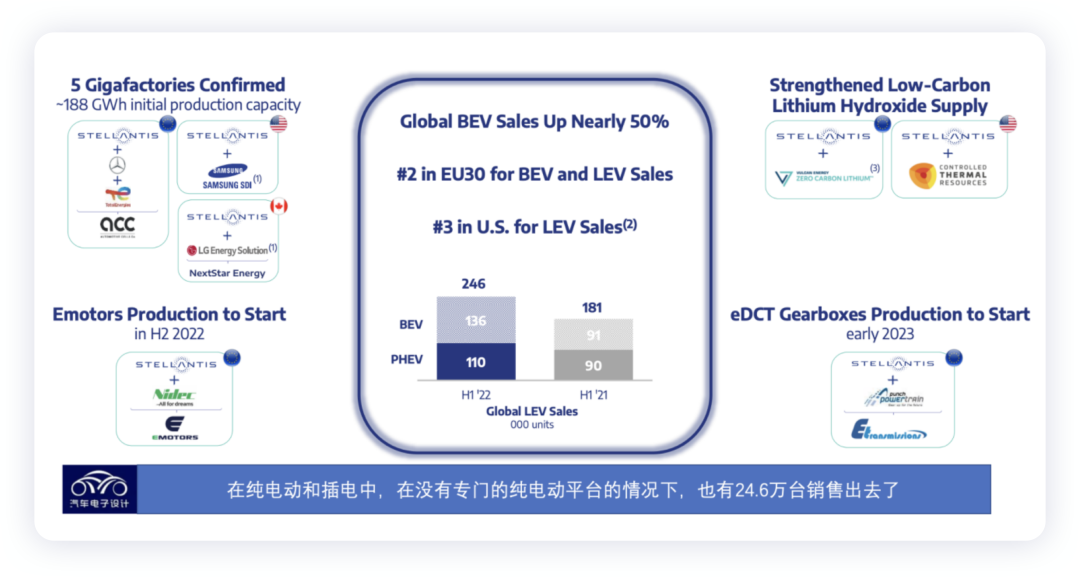

In the first half of 2022, Stellantis’ new energy vehicle sales totaled 246,000 units, of which pure electric vehicle sales increased nearly 50% year-on-year, a total of 136,000 vehicles sold.

Overall, the main focus is still on Europe and the United States.

-

United States: 28,000 new energy vehicles, of which Wrangler 4xe PHEV ranked first in U.S. sales, with a year-on-year increase of 55%, totaling 19,000 units; Pacifica PHEV ranked second in U.S. plug-in hybrid sales, with 8,000 units sold. In 2023, the first pure electric vehicle will be launched on the Jeep platform.

-

Europe: 69,000 new energy vehicles, with a relatively high market share in the European market, in which Opel accounts for 32,000 units, a year-on-year increase of 52%.

Overall, Stellantis is relatively efficient in its investment in new energy vehicles and does not blindly emphasize pure electric platforms and software-the main difference, in my understanding, lies in the lower input-output ratio of software investment in the European and American markets for the time being. There is not much feedback in the Chinese market, which allows Stellantis to invest relatively calmly in technology.

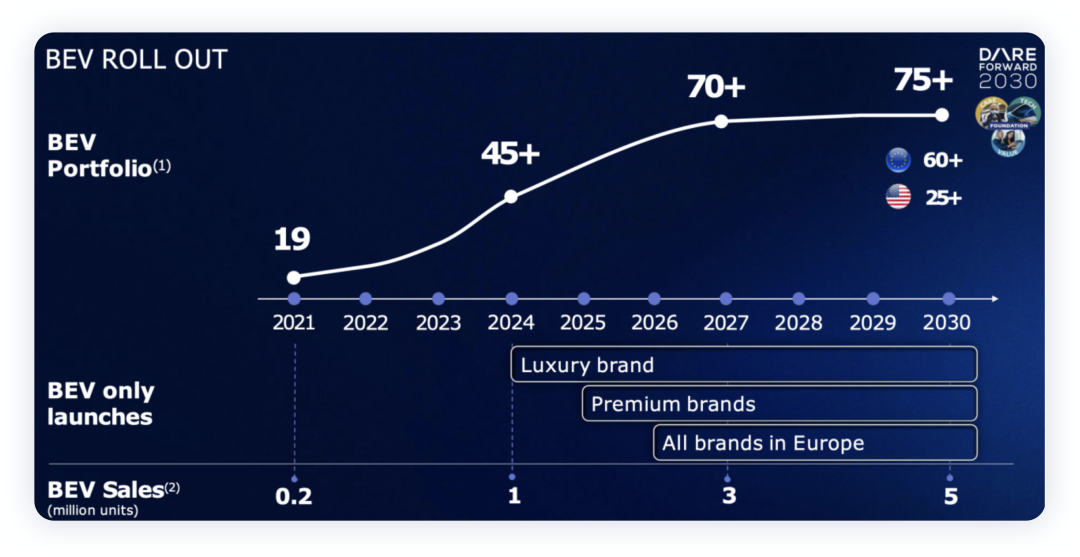

We compare the differences between Stellantis and VW, and the main difference is that Volkswagen invested in MEB several years earlier. Due to its direct competition in the Chinese market, the situation for VW in terms of technology investment and competition feedback is actually more severe. For Stellantis, things are much simpler. It aims to achieve 1 million cars in the European and American markets in 2024, and 3 million cars in 2027. This is interesting because it can help Stellantis further improve the penetration rate of electric cars in Europe and America.

We compare the differences between Stellantis and VW, and the main difference is that Volkswagen invested in MEB several years earlier. Due to its direct competition in the Chinese market, the situation for VW in terms of technology investment and competition feedback is actually more severe. For Stellantis, things are much simpler. It aims to achieve 1 million cars in the European and American markets in 2024, and 3 million cars in 2027. This is interesting because it can help Stellantis further improve the penetration rate of electric cars in Europe and America.

Whether or not the pure electric version of the Jeep can sell well when it is imported to China in 2023-2024 is not important. What is important is that there is a big separation between the European and American markets and the Chinese market. With less investment in the Chinese market, Stellantis can have a better investment-output ratio due to less intense competition and stricter market supervision for Chinese automakers.

Stellantis’ Investment in Electrification

It is precisely because of this background that Stellantis has time to invest in battery factories and establish the entire electrification chain. These layouts may not seem sufficient in China, but Stellantis cannot be beaten in Europe and the United States at the moment.

The battery ecosystem is actually built on the growth in demand, and the locations for the group’s five super factories have been confirmed (three in Europe and two in North America). Related partners include Automotive Cells Company, Samsung SDI, and LG New Energy. By respectively signing agreements with Vulcan Energy and Controlled Thermal Resources, the group can enhance the supply of low-carbon lithium hydroxide in the European and North American markets. Related agreements with Samsung SDI and LG New Energy are still underway.

In terms of electric drive systems, the group has formed a joint venture with Japan Electric Corp to establish EMOTORS, which focuses on inverters, and it has independently developed gearboxes and motors. It has also established a joint venture with Free2charge to form esolutions, a charging service company. In terms of hybrid and plug-in hybrid systems, the group continues to use the E-DCT system, which is still acceptable in Europe and the United States.

Currently, due to fierce competition in fuel economy and ride comfort in China, HEV and PHEV achieve a shared 93% of their drive system components, while this remains feasible in Europe and America.

Summary: In my opinion, VW’s challenges in China have disrupted the pace of developing pure electric platforms, batteries, and software. In comparison with the calmness of Stephan Wöllenstein, Diess is a bit chaotic. This is precisely why Volkswagen is changing its CEO. It is difficult to accomplish anything in China if you go against German management rhythms, no matter how hard you try. I believe that Volkswagen will learn from Stellantis in the future, make efforts to expand in the US market, and keep pace in Europe. The utilization of production capacity for fossil fuel vehicles and the launch of pure electric vehicles in China will both experience changes in pace.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.