Author: Xuan Wang

Something unprecedented happened at the M5 press conference at the beginning of the year, which has never been seen before in the automotive industry. The host of the press conference was not the manager or founder of Kingsoft, but Huawei’s CEO, Yu Chengdong, who entered as a “partner”. The scene was reminiscent of the Dowager Empress Cixi herself sitting on the dragon throne, presiding over the overall situation.

Huawei told everyone that they were only helping car companies make good cars, but everyone understands that the prince of the Late Qing Dynasty was only a mascot, and the real power had already changed hands. Obviously, now AI companies have a strong influence in various industries, even allowing an unknown automaker to go directly to the center of the stage.

Rome wasn’t built in a day. To force traditional car companies to concede their souls, AI and traditional automotive industry have been involved in a 50-year game. The four parties involved in this game are: traditional semiconductor companies, traditional automakers, emerging AI companies, and new energy vehicle companies. To understand this game, one must understand the interests and ecological niches of each party.

This article is about telling you how AI slowly erodes the automotive industry and reaches its current status.

From Attachment to Footing: The Semiconductor Industry

The story began in the 1960s. The traditional automotive industry was a ecological system dominated by mechanical performance, and the participants in the closed loop were all manufacturing giants. At that time, the semiconductor industry was a latecomer, and the problem was converting innovative technology into products, such as microprocessors. This is an innovative product that is difficult to support single-handedly. In an era before personal computers, it had to rely on other industries to develop.

In the early days, microprocessors were closely related to the home appliance industry. For example, as a leader in the home appliance industry, Toshiba took the lead in developing semiconductor and microprocessor. In addition to home appliances, automotive products were also large-volume industrial products, and the semiconductor industry was trying all means to squeeze into the automotive ecosystem.

Of course, microprocessors belonged to the industry in the “growth” stage at that time. There were many pioneers in traditional industries who recognized its potential. In the 1960s, Ford signed an agreement with Toshiba to cooperate in the field of in-vehicle semiconductors, but they were never able to find a plate to embed microprocessors in the car.Until the 1970s, after the oil crisis broke out, Japanese car products entered the US market in large numbers. When Detroit was in distress, Japanese semiconductor companies knocked on the door of US car companies. The cooperation between Ford and Toshiba finally came to fruition on a microprocessor. The product named TLCS-12 from Toshiba was Japan’s first microprocessor product. Ford used it to control the working logic of the engine to achieve higher fuel efficiency, which we now call ECU.

If you think that the cooperation between Toshiba and Ford was a stumbling block for themselves, then you only see the first layer. The Japanese played a “first soldiers, then etiquette” move in this game, aiming not only at the automotive market. The Americans were the desperate ones. Besides the scheme offered by Toshiba, they could not find a better alternative in the market. There were the newly formulated US emission regulations ahead and the blockade of Japanese car products behind, so they had to choose to cooperate with the enemy’s younger brother.

This younger brother seemed to stand on the US side, but his purpose was impure. At that time, the United States was a powerhouse in the automotive industry. Even in the 1970s, its annual shipments could reach tens of millions. Obviously, the Japanese wanted to cultivate their own emerging industries with a broader market and use the automotive market, the largest consumer market, as a springboard. Japan’s semiconductor products quickly invaded various core industries in the United States. By 1988, Japan’s semiconductor industry had already controlled almost 80% of the global market.

After semiconductors entered the automotive ecosystem, there was a wave of “semiconductor dividend period”, and all the unresolved problems in purely mechanical angles could find solutions in the digital direction.

The most typical example is the cylinder deactivation engine launched by Cadillac in 1981, with the internal code L62 and the more vivid name “V8-6-4”. The engine can independently select the number of cylinders to deactivate according to different road conditions, in order to achieve higher fuel efficiency.

As early as 1905, there was a cylinder deactivation plan for internal combustion engines, which was completely based on the mechanical lever principle to achieve this function. In fact, there was no clear demand for this function at that time. It was not until the automotive industry entered the digital age that car companies brought this technology out for further development. In Cadillac’s product, the system was driven by a microprocessor, and Cadillac officially claimed that it could perform 300,000 calculations per second.# Translation

Actual performance falls short of expectations. Although the car equipped with V8-6-4 engine seems to be able to cope with the changing road conditions on the surface, a large number of owners feedback that the engine is a “fool”, and the processor cannot keep up with the rhythm at all. Especially when facing the situation of rapid acceleration, the system is prone to crash when downshift, engine speed is raised, and cylinders are opened at the same time.

Although Cadillac’s attempts ended in failure, the semiconductor industry took the lead in this game. If it only plays the role of a “firefighter”, it is highly likely to be abandoned. The oil crisis is temporary, and American consumers’ preference for Japanese cars will also decline sharply as oil prices fall. In the end, localized products in the US best cater to the tastes of their consumers.

Therefore, semiconductor companies have to rush to help automakers solve problems, and the more problems they solve, the more dependent automakers will be on semiconductors. If the closed-cylinder technology cannot make it, the technologies such as ABS and ESP on other components of cars may still make it. These technologies have gradually become mainstream configurations in the automotive industry only after the involvement of microprocessors.

When automakers start to develop new functions with on-board microprocessors, the ecological position of semiconductors in the automotive industry has undergone subtle changes. From the initial follower, it has gradually become an indispensable and important part. In the 1980s, well-known companies such as Toshiba, Motorola, IBM, Intel, and Apple have been involved in the semiconductor business in the automotive industry.

The rise of the new king and the revolution of lane changing

At the 2020 release conference of the all-new S-Class of Mercedes-Benz, NVIDIA CEO Huang Renxun appeared in Mercedes-Benz’s promotional video because he provided the intelligent cockpit computing platform for Mercedes-Benz. He drove the all-new S-Class sedan and talked confidently about the cockpit functions. Mercedes-Benz is so arrogant, just like the attitude conveyed in advertising slogan “Car Inventor, reinventing cars”. Mercedes-Benz has always centered on itself, and this was the first time for it to invite supplier partners to come on stage for endorsement.

This phenomenon also reflects the changes in the ecological position. In the second decade of the 21st century, the intelligent functions of cars have become as important as the cars themselves. The status of AI vendors in the industry chain is obviously higher than the little brothers in other industry chains.

Intelligence is understood from a macro perspective as the evolution of functionality from passive to active. Today’s autonomous driving and intelligent cockpit are the same. The chip is the most important part.Earlier, we talked about the competition between traditional car manufacturers and traditional semiconductor companies in the early stages of intelligent car development. To introduce a third player, AI companies such as NVIDIA and Mobileye are representative members. In any era, cars have always had an infinite appeal to the AI industry, and these two newcomers are no exception.

After the 1980s, the automotive industry chain formed a brand-new closed loop. For new AI companies, it is very difficult to replace predecessors in the same field and gain a share of the industry chain. As Zhou Hongyi said, “The premise of entering an industry is to overthrow the industry.” The way AI finds a way for itself is to help the most magnificent stories in the automotive industry come to fruition.

Although we tend to integrate autopilot into the automotive industry out of habit, it is actually a tool used by pioneers in various industries to compete.

In the early days, Americans hoped to achieve autopilot through wireless communication. In 1925, the American Houdina Radio Company demonstrated an “autopilot car” on the streets of New York. Based on radio remote control technology, there was no one in the car, but the person driving it was in another car with a remote control, just like the Robotaxi operator hiding in the technology center today.

In the 1960s, another American wireless technology company RCA collaborated with General Motors to build an “autonomous railcar” based on underground cables. Obviously, this approach is similar to putting V2X infrastructure in open roads today. The large amount of engineering, the many participating departments, and the wide range of industries involved make it difficult to promote this project.

Of course, Americans also understand this point. In their opinion, telling stories is more important than achieving results. At that time, American wireless communication companies occupied multiple seats in the top ten global market capitalization companies. This is like the current highest market value of Saudi Aramco establishing a special fund to “strew money” everywhere. Buying a football team in the English Premier League is to fulfill Salman’s dream of football? The social image and influence brought by this transaction make up the dominant factor.When it comes to autonomous driving technology in the 1970s, the Japanese took a different approach. In 1977, the Tsukuba Mechanical Engineering Laboratory developed a product called ALV, which relied on computer vision technology for autonomous driving. As mentioned earlier, however, the autonomous driving processors at the time could not meet the demands of actual operation, such as the Mercedes-Benz VAMORS in the 1980s, which used 60 microprocessors but still had slow image processing speed in seconds. The “computational bottleneck” limited the progress of engineers, resulting in the vehicles operating only on specific roads with a maximum speed of 60 mph.

Therefore, for autonomous driving before the 21st century, its dissemination was greater than its actual use. Traditional semiconductor industry has contributed little to autonomous driving, to the extent that their leading position is no longer secure. In the 2021 “Semiconductor and Digital Industry Strategy” released by the Japanese Ministry of Economy, Trade and Industry, it mentions the challenges faced by the Japanese semiconductor industry.

As shown in the following figure, the Japanese divide the chips into upper and lower bodies. The upper body consists of high-performance logic chips for autonomous driving and intelligent cabins, while the lower body uses low-power chips for basic ECU. The Japanese Ministry of Economy, Trade and Industry stated that the future growth of semiconductors lies in in-vehicle logic chips, but we can see Japan’s anxiety from the vertical chart on the left.

According to their projections, the logic chip market is expected to reach parity with traditional low-power chips by 2030, and the initiative for whether Japanese companies can obtain their expected market share is no longer in their own hands. In the top sector, Japanese companies Hitachi, Denso, and Sony face strong competition from NVIDIA, TSMC, Mobileye, Intel, and Qualcomm, and the market share of the latter five is currently much higher.

In fact, Japan is still at the forefront of the semiconductor raw material market. However, as we speculate about the trends of traditional OEMs, Japanese semiconductor companies are also taking the road of “selling their souls.” Japanese companies are a microcosm of the entire traditional semiconductor industry, and the reason why they find themselves in this situation is related to decisions made in the late 1990s.We have talked about the 30-year period of steady industrial development since semiconductor entering the automotive industry, and the basic vehicle chip technology is in a steady climbing stage. It is like a star player in a sports team who may perform poorly at any time, except in the “contract year” when good performance data can be used to ask for a big contract from the team. Therefore, when most industrial ecologies tend to stabilize, there is a possibility of relaxation for the participants.

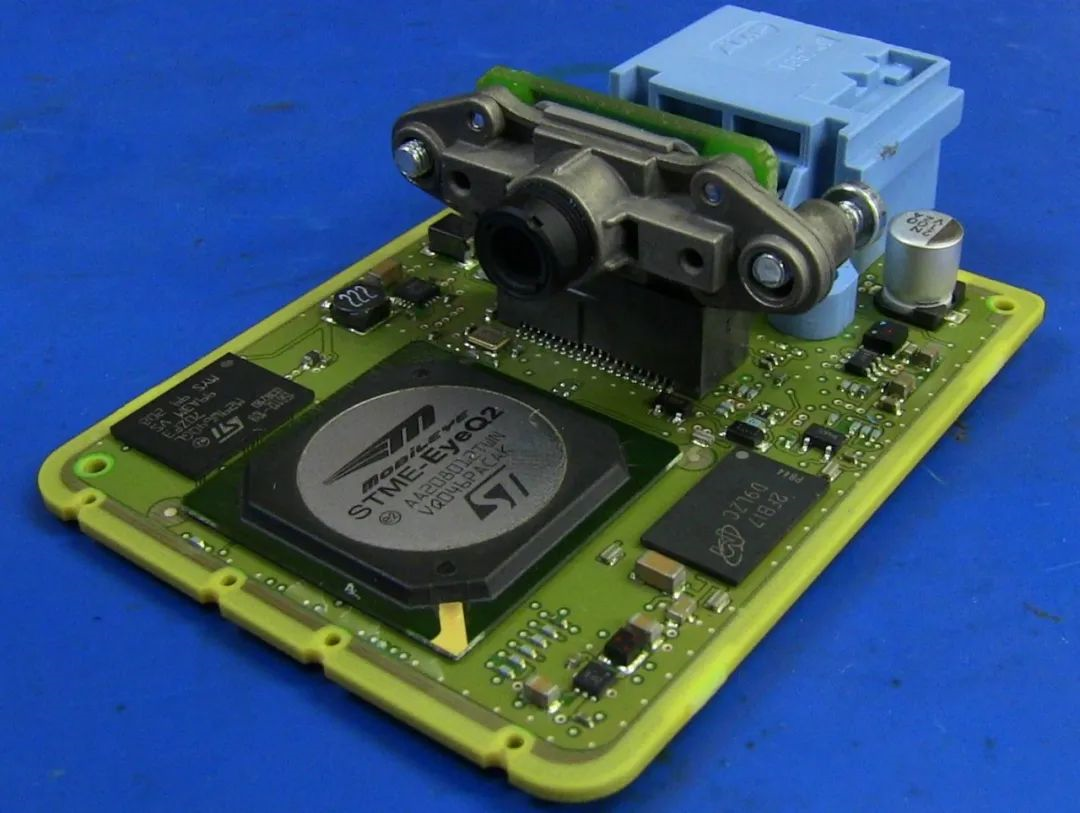

Mobileye, established in the late 1990s, was the first warrior to rise up when the tiger was dozing, and the road to the emergence of the new champion has some similarities. At that time, Mobileye encountered the same situation as Apple, where the “ceiling” of chip capabilities limited the imagination of the product.

The reason why the iPhone became a revolutionary intelligent mobile terminal product was also due to the support of the chip. When building the first-generation iPhone, Apple evaluated a group of chip suppliers, including big factories like Texas Instruments and STMicroelectronics, but the results were not satisfactory. Like the automotive industry, the sensitivity of traditional factories to change is often lower than that of newcomers. In the end, Apple chose Samsung as its partner and built the first-generation iPhone based on the Samsung S5L8900 processor.

Apple realized that it was difficult to find compatible suppliers with its own creativity. Therefore, in 2008, it acquired P.A. Semi, and in 2010, it acquired Intrinsity. Finally, we saw the self-developed A4 chip from Apple on the iPhone 4.

Relying on traditional semiconductor companies cannot realize their ideas. Therefore, in 2008, Mobileye introduced the first-generation eyeQ1 chip, which can support AEB active braking function, and completed installation on the BMW 7 series in 2010.

Through the examples of cylinder deactivation engines, early autonomous driving, and self-developed chips for start-up AI companies, it is not difficult to see that the chip is leading the development of the automotive industry, and the “ceiling” of the chip’s capabilities is the limit of product functions.

# AI and New Forces in the Auto Industry Writing the Next Chapter

# AI and New Forces in the Auto Industry Writing the Next Chapter

Today, we can see many car companies that have intercepted and developed their own autonomous driving software, deploying high-performance autonomous driving hardware platforms. Products like the Jidu Robo 01 are the first to incorporate Qualcomm Snapdragon 8295 cockpit platforms. What they have in common is the creation of more space for the imaginations of product managers and engineers.

In the past decade, the game between AI and the auto industry has come to a head – a time when autonomous driving and intelligent cockpit concepts have become popular. At this time, the last player joined the ecosystem – new forces in the auto industry. New forces in the auto industry and rising AI companies are allies with a common goal: to change traditional enterprise’s fate.

Here is an important prerequisite. Intelligence is the biggest difference between new and old forces, and it is the key to standing out in the market. The first generation of Tesla’s autonomous driving product, HW1.0, is based on Mobileye chips and uses sensors provided by Mobileye.

NVIDIA also boarded the new forces express, which began developing autonomous driving chips in 2015. The second product, Drive PX 2, was equipped on all newly produced Tesla cars in October 2016. Since then, NVIDIA has been able to flex its muscles in the autonomous driving chip market and has been the first choice for most automakers when developing next-generation autonomous driving technology.

It can be said that the ecological position of AI companies in the auto industry is positively related to that of new forces in the auto industry. If the intellectual story of new enterprises shaking traditional automakers, then the AI companies that work hand in hand with them can gain a larger market share. Huang Renxun’s appearance at Mercedes-Benz’s press conference is no accident.

Finally, many people compare traditional automakers to Nokia. If the former gives up their soul unconditionally, this assumption may come true. Apple and Google defeated Nokia, not just because of their strength but in the game of communication technology and computer technology. The leapfrogging of new forces in the auto industry and AI companies follows this logic – it is the competition between intelligence and traditional industry. Do not try to be subversive; there is no way to talk about standing.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.