According to Reuters, Musk announced that he would terminate the acquisition of Twitter because Twitter violated some of the terms in the acquisition agreement, such as failing to provide assessment information on the proliferation of robot accounts in social media business, firing important senior executives, and other significant personnel changes.

Twitter stated that the party who proposes to terminate the agreement under certain conditions in both parties’ acquisition plan must compensate the other party with a termination fee of $1 billion. The matter will be resolved through legal channels.

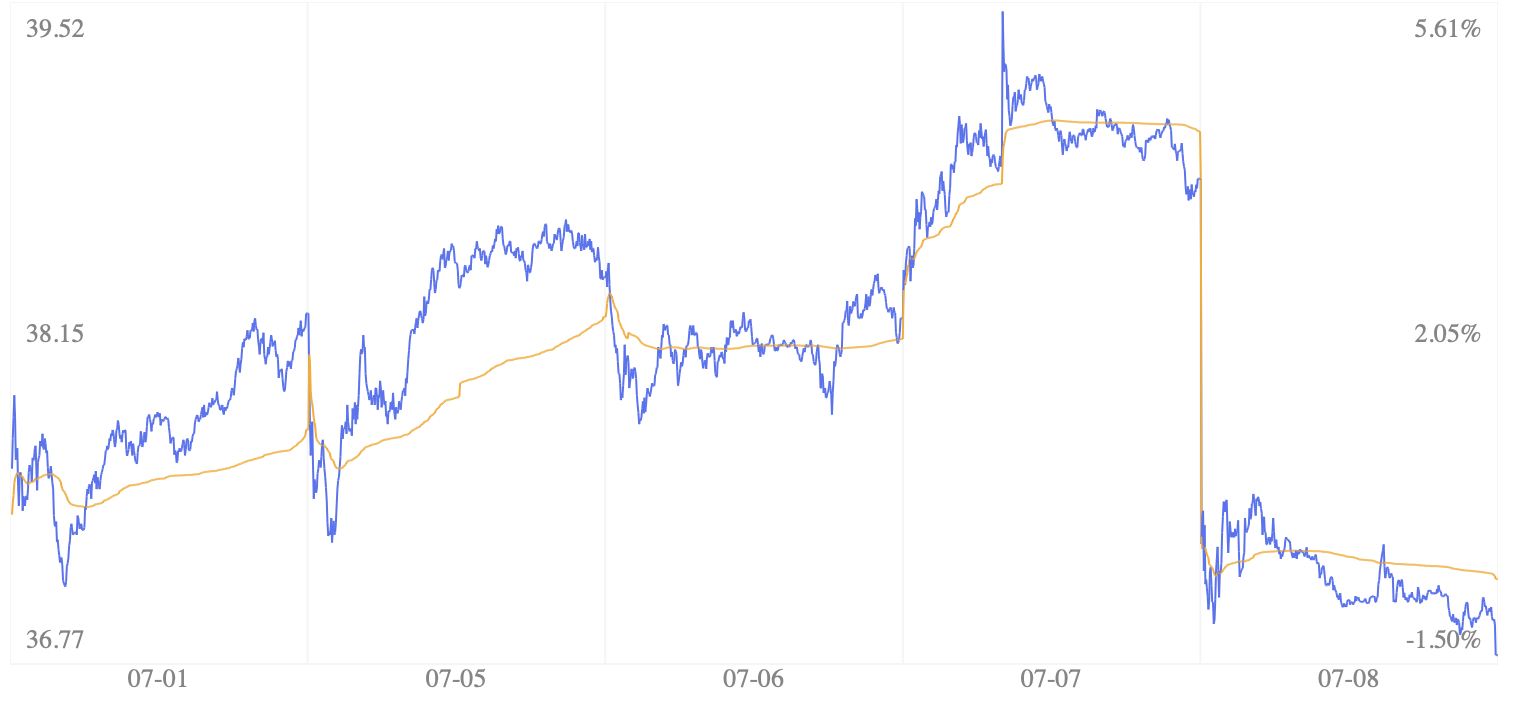

After the “poison pill plan” was implemented, Twitter actually tended to facilitate the acquisition. Currently, after Musk proposed to terminate the acquisition, Twitter’s stock price has responded with a sharp drop. The subsequent termination and compensation lawsuit is more harmful than beneficial for Twitter. If Twitter wants to complete the acquisition, it may need to give Musk a lower offer (the agreed acquisition price is $54.20 per share, and Twitter’s current price is $36.81 per share).

In its SEC documents, Twitter stated that only 5% of Twitter users are fake robot accounts, but Musk requested more data from Twitter. Musk stated that he thought Twitter’s estimate was very inaccurate. Twitter insisted on this estimate but also stated that the proportion of these accounts may be higher.

Musk’s lawyer stated that Twitter refused to provide detailed information, and Musk also stated in a letter to Twitter on Friday that Twitter’s distortion of the number of spam accounts may be a “material adverse effect (MAE),” which would allow him to withdraw from the acquisition.

Twitter, on the other hand, insists that it is impossible for them to calculate fake robot accounts from public information alone.

In response to Musk’s application, Twitter board chairman Bret Taylor stated:

“The Twitter board is committed to completing the transaction based on the price and terms agreed with Musk, and Musk plans to take legal action to enforce the merger agreement. We believe that we will win in the Delaware Chancery Court.

Taylor also pointed out that Twitter hopes to complete the acquisition of Musk at the agreed price of 44 billion US dollars.”

Affected by this news, Twitter’s stock price fell more than 5% on Friday, closing at $36.81; the after-hours trading also once expanded by 8%.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.