Author | Qiu Kaijun

Editor | Zhu Shiyun

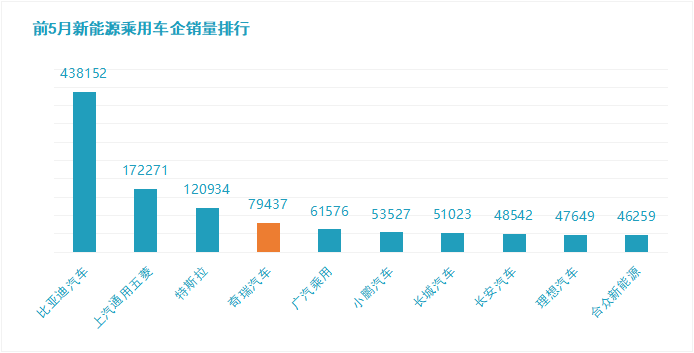

In the ranking of new energy vehicle companies, BYD, Wuling and Tesla are the “Big Three,” but who is the fourth?

The answer may surprise you. It is not a traditional large automaker, nor is it a new car force, but:

Chery New Energy.

Whether based on the number of terminal insurance or the sales data of the China Passenger Car Association (CPCA), Chery New Energy ranks fourth in the new energy passenger car market this year.

What accounts for Chery New Energy’s fourth-place position is mainly two A00 class cars: the Xiaomayi and the BingGeelyng.

Especially for the BingGeelyng, this high-replica model of the Hongguang MINI EV has achieved good sales performance despite the pressure from the Hongguang “miracle car”: delivery began in November of last year, and sales surpassed 10,000 units in March before the outbreak of the pandemic. Even in April and May, which were severely affected by the pandemic, there were still monthly sales of 5,878 and 7,702 units, which was no less than the leading players in the new forces.

As the “old car” of China’s electric vehicle era, the Xiaomayi has been on the market since 2017, and its sales have now approached 250,000 units. This year, the sales continue to be strong, with a total of 38,500 units sold in the first five months.

The performance of these two small cars from Chery New Energy is truly remarkable.

Equally remarkable is that the sales of the Hongguang MINI EV have not been affected by the pursuers, even including several high-replica models such as the BingGeelyng. In the first five months of this year, the terminal sales have reached around 155,000 units, with a cumulative sales volume of nearly 700,000 units. The annual target is 500,000 units!

The sales performance of Chery New Energy, particularly the BingGeelyng, is thought-provoking: is there really such strong demand for micro-electric vehicles? In the face of replicas such as the BingGeelyng, why has the Hongguang MINI EV not been affected? Why can’t the Hongguang MINI EV continue to expand its scale and beat those imitators?

Follower: BingGeelyng

After the popularity of the Hongguang MINI EV, there are many imitators. Among them, several are high-replica: Chery BingGeelyng, Baizhi Daxiong, Dongfeng Fengguang MINI EV.

However, the one that sells relatively well is Chery BingGeelyng.

On December 28, 2021, Chery New Energy launched a new car called the “QQ Ice Cream” in Wuhu, offering two ranges of 120km and 170km, with prices of 29,900 yuan, 37,900 yuan, and 43,900 yuan, respectively.

The appearance of this car is very similar to that of Hongguang MINI EV.Ice cream has made some changes. For example, the headlights feature a U-shape design, creating a cute smiley face effect; the grille has been changed to a vertical orientation; and the side of the car uses two wheel hubs and body lines to once again create a smiling shape, which is more design-conscious than the straight-flat surface of the Wuling Hongguang MNIEV.

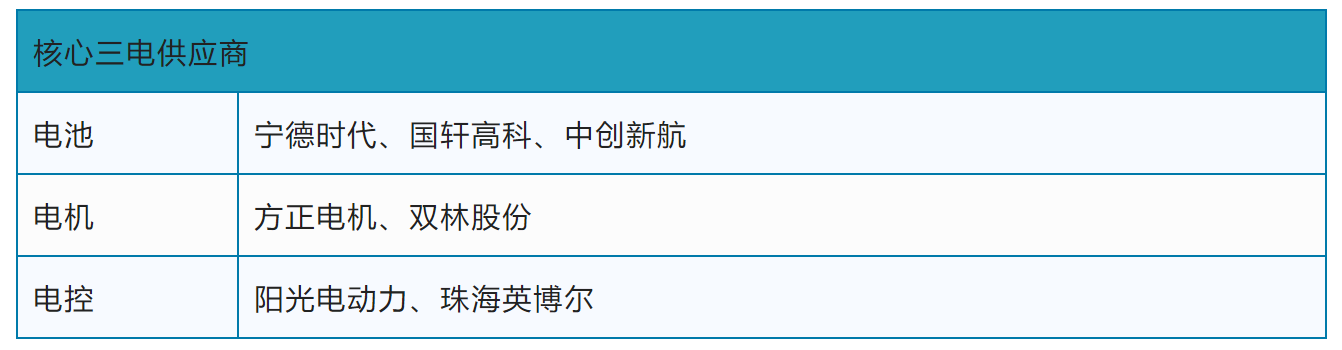

Regarding its core suppliers, they are basically the same as those for the Hongguang MINI EV.

In terms of space, the ice cream is slightly larger and offers slightly more comfortable seating space. The interior design of the ice cream is more fashionable and youthful, featuring a multifunctional steering wheel and using environmentally friendly materials for the seat fabric, among other things.

In terms of connected vehicles, the ice cream also offers differentiated features, including remote search for the car, remote lock/unlock, and remote control of air conditioning startup, as well as easily reviewing charging status and driving range.

Overall, because the ice cream is so similar to the Hongguang MINI EV, the external sales expectation is not high.

However, it’s doing very well in terms of sales.

Since November 2021, Chery’s ice cream has sold more than 40,000 units, ranking in the top 10 among pure electric vehicles, second only to the Hongguang MINI EV, Tesla’s Model Y and Model 3, several popular BYD models, and the ice cream’s big brother—the Little Ant.

One reason why the ice cream is selling well is that the Little Ant has given up some of the market.

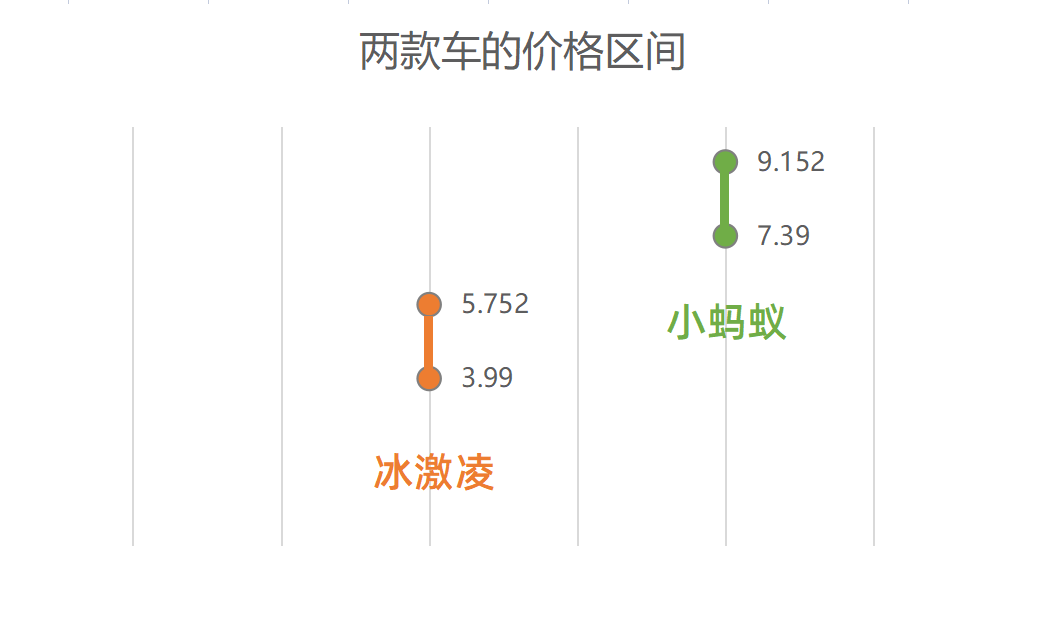

Currently, the Little Ant offers two ranges of driving mileage: 301 km and 408 km, with a starting price of 73,900 yuan. The ice cream’s price range used to be between 39,900 and 49,900 yuan.

On June 21, Chery’s new energy models, the ice cream and the Little Ant, were upgraded and launched the ice cream・Peach, and the Little Ant・Charm. The ice cream・Peach offers three models, with a price range of 47,520 to 57,520 yuan. The Little Ant・Charm offers two models, with a price range of 85,520 to 91,520 yuan.

Even with a richer variety of models, the two cars are still fighting separately and not competing with each other. Chery also had ice cream open an online store individually, but then later merged it. This indecision, however, reflects Chery’s positioning of the ice cream in the market.

Amid the rise of BYD, Tesla, Wuling and new players in the automotive industry, Chery quietly sells small ants and ice creams. Chery ranks fourth on the list of pure electric passenger vehicle enterprises in the first five months.

Amid the rise of BYD, Tesla, Wuling and new players in the automotive industry, Chery quietly sells small ants and ice creams. Chery ranks fourth on the list of pure electric passenger vehicle enterprises in the first five months.

Why Can’t Hongguang MINI EV Sell Well Everywhere?

Ice cream looks similar to Hongguang MINI EV, and the supply chain is basically the same. Why didn’t Hongguang MINI EV get this share of the market? Instead, ice cream cut in and took a piece of it.

In addition to ice cream, there are other high imitation models mentioned earlier, why they can all have certain market shares.

It should be noted that Hongguang MINI EV has both first-mover advantage and scale advantage, and undoubtedly has stronger competitiveness.

First, the product is the main reason.

Although many cars look similar to Hongguang MINI EV, they are all different in some way. For newcomers, they often focus on space, interior design, and intelligent connectivity to attack Hongguang MINI’s weaknesses. And automotive consumers have different demands and preferences.

Secondly, the channel is the main reason.

According to research by Anxin Securities, Hongguang MINI EV’s user portrait has the following four characteristics:

1. The majority of users are from cities, with rural users accounting for only 2%.

2. The majority are trade-in users, and have not yet replaced the market for low-speed electric vehicles on a large scale.

3. The majority are young users, not elderly mobility vehicles, with 75% of users being born in the 1990s.

4. The majority are stylish female customers, not low-end models.

From the first two characteristics, undoubtedly, passenger vehicle enterprises with a background in low-speed electric vehicles can grab some market share from Hongguang MINI EV’s target users. Because passenger vehicle enterprises with a background in low-speed electric vehicles have more confidence and channel advantages in upgrading the demand of urban and rural consumers for low-speed electric vehicles.

Similarly, in terms of channels, each car manufacturer is a key enterprise in various regions and will receive support from the local government.

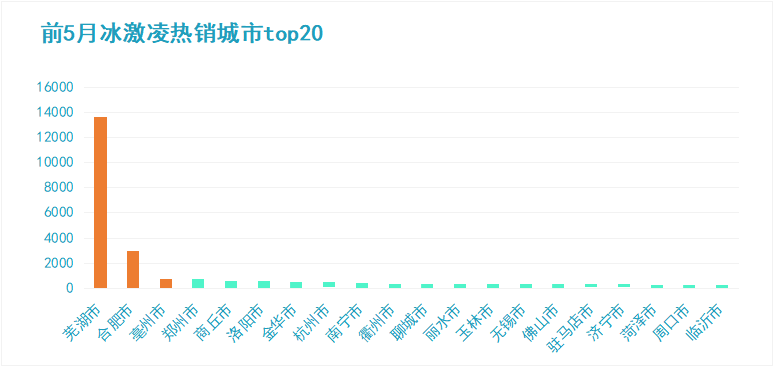

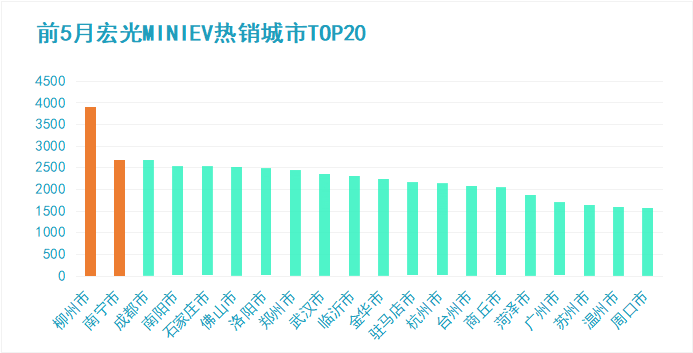

Looking at the city distribution of hot-selling Hongguang MINI EV and ice cream in the first five months of this year, the first few cities (shown in yellow in the figure below) are all local cities or nearby cities.

The situation is similar for other vehicle manufacturers, who can achieve certain sales in the regions or provinces where they are located.## The Cost Issue is the Third

The Hongguang MINI EV has the highest sales volume and is the first of its kind in its category. Many subsequent models have directly used the supply chain of the Hongguang MINI EV. The Hongguang MINI EV should have a huge cost advantage and should be able to knock down its competitors in terms of price.

However, this has not actually happened, although many competitors’ prices are relatively high. Also, the Wuling brand itself has difficulty controlling costs.

In the year the Hongguang MINI EV was first introduced, battery prices were still on a downward trend and credit prices were high. Wuling Hongguang MINI EV played a pricing and even loss-selling game and earned returns from credits. However, in 2021, battery costs are rising, and by 2022, credit trading prices in the previous year are expected to fall sharply.

Therefore, Wuling has been constantly raising prices and has launched Macaron and GAMEBOY versions, all in order to raise prices and increase profits. Although Wuling has been known as a cost killer, it cannot adopt a scale competition model.

Currently, Wuling’s space for further cost reduction is very limited, and its greater hope is batteries. Wuling now outsources batteries, but it is also adjusting.

On May 30, the SAIC-GM-Wuling’s “Sakura 20GWh Power Battery System Project” broke ground in Liuzhou. The project plans to build a 20GWh power battery and system industrial base with annual capacity. If this project succeeds, it may bring a significant cost reduction to the Hongguang MINI EV.

How Big is the Micro-Electric Space

Since last year, there have been endless reports of micro electric cars discontinuing their orders, first with Ola’s Black Cat and White Cat, and then with Changan’s E-Star.

The Changan E-STAR has also stopped several times. The latest was on June 30 when Changan New Energy announced that due to upstream raw material shortages and limitations on vehicle and parts production capacity, the delivery cycle of this model was long, so it is suspended again.

These almost “Versailles” moves show that the demand for A00 pure electric vehicle models in the market is very high, and supply fails to meet demand.

Moreover, some leave, while others arrive. In addition to the various “MINI” models, large automaker groups such as FAW and Geely are also entering the A00 pure electric market and their price ranges are similar to that of the Hongguang MINI EV. It is evident that the industry has such high expectations.

So, how big is this market exactly?

Wuling plans to sell a total of 650,000 micro-electric vehicles of various types this year. It is estimated that the Chinese micro-electric vehicle market will reach approximately 1.3 million vehicles per year with a 50% market share.

At the end of 2021, Li Jinyong, Executive Chairman of the Automotive Business Council of the China Council for the Promotion of International Trade, predicted that the production and sales of A00-grade electric vehicles in 2022 are expected to reach 1.5 million to 2 million.The effects of the pandemic and rising costs, which were fully reflected in the first half of this year, are expected to result in sales volumes of 1.3 to 1.8 million units after adjustments have been made to Li Jinyong’s prediction of 1.5 to 2 million units.

What about the longer term future?

According to a research report by Anxin Securities, the A00 market is expected to reach three million units in 2025, as electric A00 vehicles convert 5% of the 140 million “unlicensed” blue ocean group from 2021 to 2025, resulting in sales of approximately seven million vehicles within five years.

Although the data may vary, the sustained growth of the micro-electric market is almost certain.

It both creates demand and brings in those who were previously unable to afford or purchase cars into the automobile society, and also transforms some existing car consumers to choose lesser priced options.

“Consumer upgrades” and “consumer downgrades” coexist.

As a result, the micro-electric market will also break away from the pattern of the overall new energy vehicle market and have its own development rules and path. Among them, consumer demand is diverse, and channels for reaching, selling, and servicing are varied, and cannot be dominated by only one or two companies.

Chery New Energy, which has tapped into this market, has profited handsomely. This is the inspiration that Chery New Energy has given us: Don’t just focus on high-end new energy vehicles, or try to quickly replace the existing fuel vehicle pattern, but rather create new demand and form new markets based on the characteristics of electric vehicles. Even if there are pioneers, it doesn’t matter, just follow closely.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.