Author: Bai Xue

Recently, due to Evergrande shorting Li Auto, Li Xaoli in HK stock market dropped approximately 7-8%, with some happy and some sad. On the other hand, Xpeng Motors landed on the US stock market and welcomed heavyweight capital support.

On June 24th, Xpeng officially listed on NASDAQ through SPAC with stock code “PSNY.”

As of June 26th, Xpeng’s stock price was $11.23 per share, with a total market value of $27.499 billion. The listing of a car company is a signal to expand brand recognition and seek funds, which is a major event for everyone.

Xpeng CEO Thomas Ingenlath also said publicly: “Xpeng’s new chapter can be summarized in one word – ‘growth.’ The listing not only brings Xpeng financial support, but also provides an important platform for us to achieve our brand goals and sustainable development goals.”

Founded only five years ago, Xpeng has grown rapidly.

According to statistics, Xpeng expanded from 10 markets to 19 in 2021. Although its footprint is large, its sales cover South Korea, Australia, New Zealand, and other regions. In 2021, Xpeng sold a total of 29,000 vehicles worldwide.

Xpeng’s CEO led the Xpeng team to ring the bell at NASDAQ. Company employees appeared on the Times Square big screen, attracting the attention of many people. Among them, actor Leonardo DiCaprio, as an investor, congratulated Xpeng on its listing on Twitter and emphasized that he was proud to support this new energy car company dedicated to climate change.

Xpeng stands out among new energy car companies for its globalization positioning and outstanding environmental attributes. Xpeng’s growth is also closely related to its “China background.”

In fact, Xpeng Automotive, headquartered in Gothenburg, Sweden, is a “domestic product” through and through.

Behind Xpeng is Chinese enterprise Geely and Nordic car company Volvo. Xpeng’s vehicle manufacturing is also produced in China’s Taizhou factory and exported to the global market.

Will the quietly listed “family member” Xpeng become the most dazzling star among new energy car companies?

Why Is Xpeng’s Listing Worth Watching?

When a car company goes public, there are complex considerations behind it, summarized in fundraising and development planning.

On the issue of money, the most direct advantage of going public is the ability to quickly raise capital, increase enterprise strategic funds for research and development, and open up new business opportunities. At the same time, it can realize equity cash out and improve the company’s financial situation, attracting talent in the startup phase.In terms of development planning, going public is a true starting point to test the company’s management issues, and any problems may be “publicly executed” before the capital market. At the same time, going public can further expand the reputation of the automaker and become a “wealth machine.”

Polestar, based on global market positioning, is not surprising to be listed on the US stock market. On the one hand, Polestar needs a large amount of capital investment, and on the other hand, Polestar needs to expand brand awareness.

After five years of establishment, Polestar is still a new energy start-up company and needs financial support for research and development work at this stage.

Polestar 1 was released in 2017, Polestar 2 was released in 2019, and Polestar 3 will be unveiled this autumn.

Currently, Polestar has planned the release of three new cars before 2024: the electric SUV Polestar 3, the high-end mid-size SUV Polestar 4, and the two-door sports car Polestar 5, which will further improve the product layout.

Accelerating the release of new cars also means that a large amount of capital is needed.

Therefore, as early as last September, Polestar announced its intention to go public through a shell merger. This listing on the US stock market is a big step forward for Polestar’s product plans.

At the same time, Polestar is also expanding its brand influence and moving towards the center stage. Before the opening bell rings, Polestar seized the Super Bowl advertising space, known as the American Spring Festival Gala, and tailored a commercial called “Uncompromised” for the Super Bowl.

The advertisement is simple but piercing, with a Polestar 2 saying “NO” to the scandalous emissions scandal “Dieselgate” and Tesla founder Elon Musk’s promise to “conquer Mars,” showcasing the brand’s challenge spirit to more consumers.

Although Faraday, which belongs to the same SPAC shell merger with Polestar, is in a mess, Polestar seems to understand the meaning of avoiding bubbles more clearly at this time.

It should be emphasized that Polestar’s listing is worth attention not only because of its affiliation with Geely and Volvo but also because of the product strength it extends from the two.

In terms of the electric vehicle power system, Polestar’s core highlights lie in the SPA2 system, P10 transmission group, and 800V battery architecture.

Regarding the SPA2 platform, although SPA2 is still an upgraded platform of the oil-to-electric platform SPA platform within the Geely-Volvo system, SPA2 has made great progress- the traditional domain control unit has been upgraded to a central computing unit, and the structure is more suitable for the layout of lidar and high computing power chips.

In addition, the 800V power architecture is also very competitive.Recently, Polestar showed off its muscle at the Goodwood Festival of Speed, releasing four flagship models of the Polestar 5 prototype and successfully completing the challenging iconic hill climb race.

The Polestar 5 is equipped with Polestar’s self-developed all-electric power system based on an 800V electrical architecture. It is reported that the Polestar 5 has a dual-motor drive system with a maximum power of 650kw.

In terms of intelligent systems, Polestar has a strong lineup of partners, including Waymo, Zenseact, NVIDIA, and Luminar, although there is a difference between direct and indirect collaboration.

For example, Polestar’s collaboration with Waymo began with Volvo, and the partnership accelerated the landing of L4 level autonomous driving capabilities in Volvo’s brands.

Polestar’s collaborations with Luminar and NVIDIA are more direct, with the former providing the Polestar 3 with LiDAR and the latter providing it with Orin chips with a computing power of 254TOPS.

This shows that the intelligence level of the Polestar 3, which was released in late October this year, can also compete with the new forces in the domestic car industry for consumers on the same battlefield.

Polestar and Tesla, becoming a “binary star”?

Polestar’s Flag is “dancing with Tesla, becoming a binary star”.

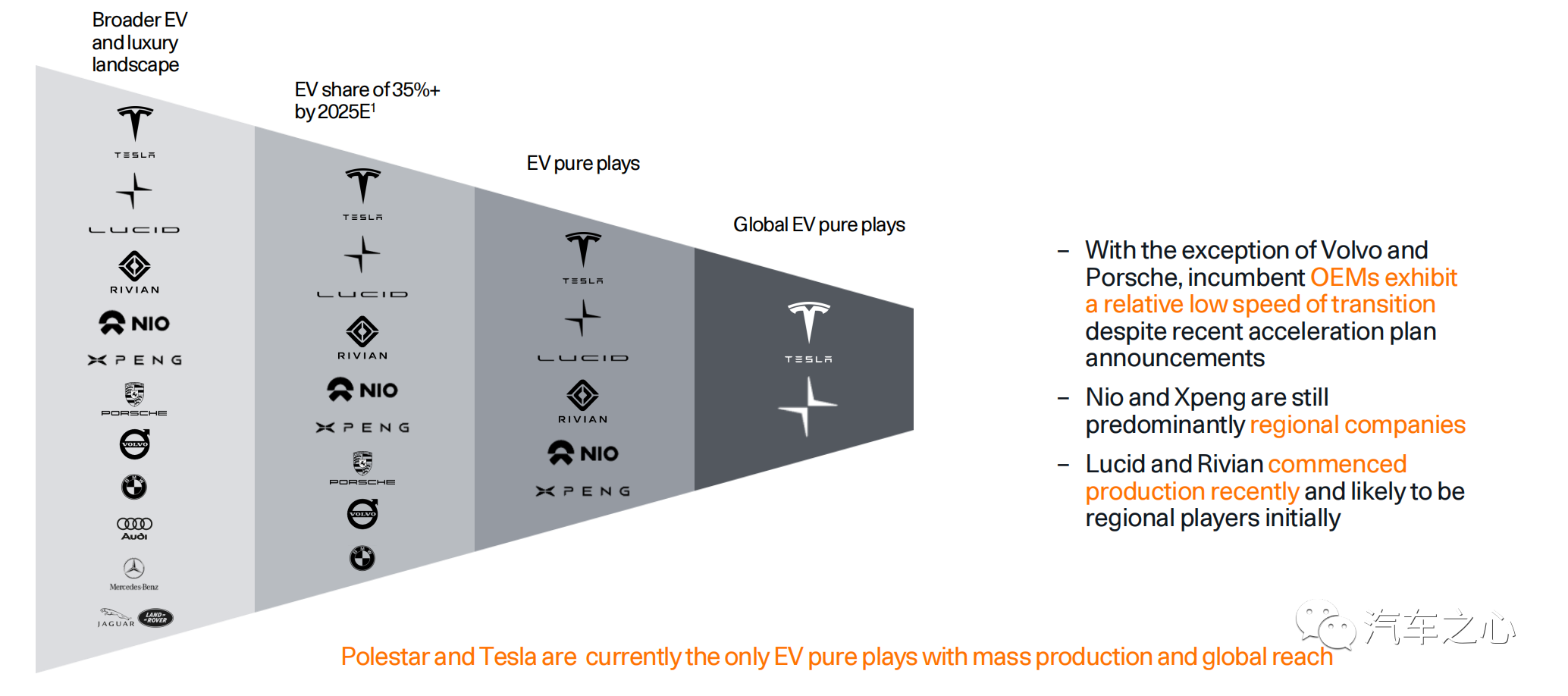

Open Polestar’s investor relations report, and you will find that Polestar divides global new energy vehicle companies into four levels. Tesla, Polestar, Lucid, Rivian, Nio, and XPeng are classified as pure electric players. However, the only two global pure electric players left standing at the top are Polestar and Tesla.

Polestar’s pace inevitably reveals Tesla’s shadow, as both are positioned in the global high-end pure electric market. Polestar, like Tesla, regards the European market as a key battleground.

In 2021, Polestar 2 sold a total of 14,720 units in Europe, the best-selling among Chinese brands.

However, if we look at the positioning of global brands, Polestar still has a long way to go to catch up to Tesla. In 2021, Tesla’s sales in Europe were only second to Volkswagen, selling about 115,000 units, 12 times the sales of Polestar.

Secondly, Polestar’s products and product planning are very similar to Tesla’s, both of which are high-end from the outset. Tesla’s first car, the hybrid convertible sports car Roadster, was born in 2008. The sale price of this car is equivalent to RMB 745,000.Tesla has no intention to achieve large scale sales with its Roadster, as the cumulative sales volume of the first generation Roadster was less than 3,000 when it was discontinued in 2012. However, this car set the tone for Tesla’s high-end positioning, laying the foundation for the Model S, which helped Tesla gradually establish its foothold.

Polestar is similar to Tesla in that it sold its first model, the hybrid power GT coupe Polestar 1, in 2017, and it did not focus on performance, but rather on “Nordic design” and panoramic sunroof. Only 1,500 units were produced worldwide, and the company claims it is a mobile work of art.

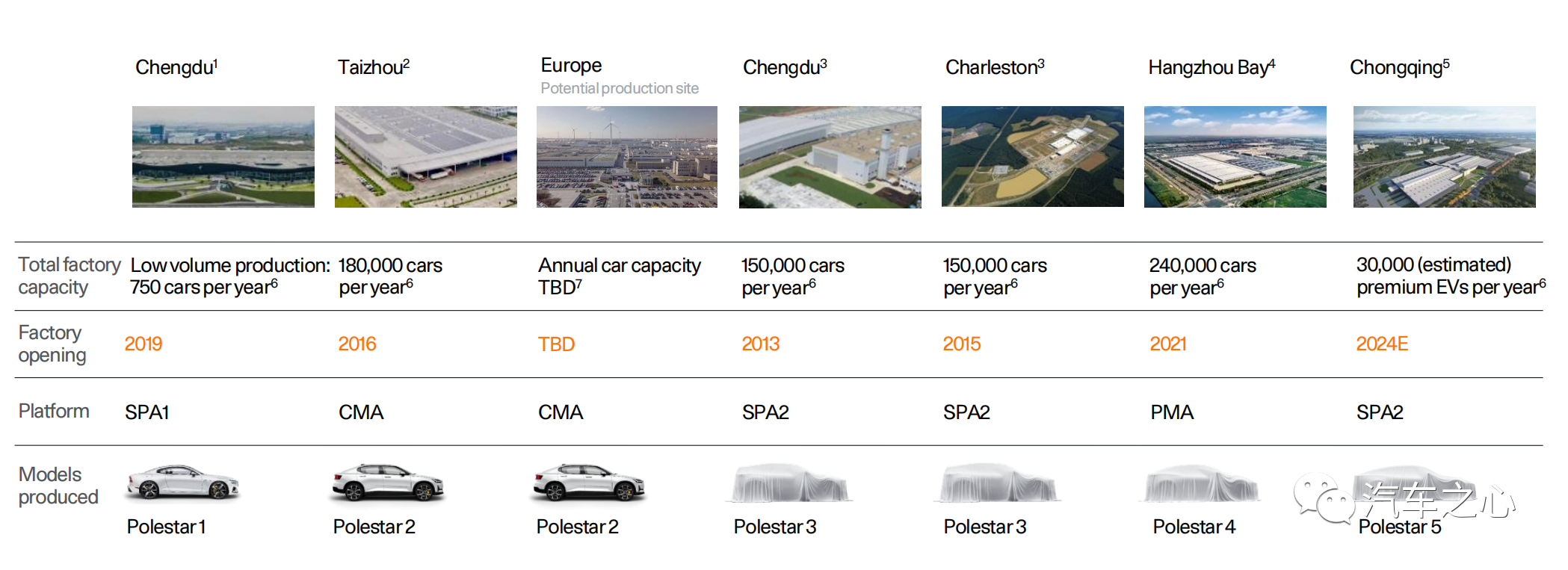

At first, Polestar 1 was only available through a “custom lease”, priced as high as 1.45 million yuan. This year is the last year of Polestar 1’s production, and its rarity is attributed to strict assembly and precision processing, with no more than two Polestar 1 cars being produced per day at the Chengdu factory.

Polestar’s second car, the Polestar 2, is targeting the consumer market, inheriting Volvo’s matrix grille and the LED “Thor Hammer” headlights. Performance-wise, Polestar 2 offers dual-motor and single-motor versions for consumers to choose from, with a maximum range of 565 km, 0-100 km/h in 4.7 seconds, and a starting price of 250,000 yuan.

Polestar 2, which has yet to become a hit, must find another way out. In April of this year, Polestar signed a contract with global car rental giant Hertz to deliver 65,000 Polestar 2 cars to customers in Europe, North America, and other regions over the next five years. This single deal is the largest amount in the history of electric vehicle transactions, providing short-term security for Polestar’s operation.

At present, “curveball” is a viable option, but in the long run, Polestar has chosen to bet on the future, continuously laying out based on its global positioning.

It is reported that by 2023, Polestar will expand its 40 exhibition halls globally to 150 and expand its Volvo-based automotive service points from 400 to 1,100, covering more than 40 countries in the global market.

In addition, Polestar also intends to aim at Tesla and dance under the same spotlight. The P10 450kW rear-wheel drive motor that Polestar is currently developing claims to be one of the most powerful motors in the world, while the Model S Plaid motor power is only 375 kW.

In the long run, Polestar may also become a “twin star” with Tesla and become a global pure electric vehicle player.

Volvo Heritage, Rooted in China

Is it possible to establish a premium brand under a relatively non-premium brand like Geely?

Despite its dual Geely-Volvo heritage, Polestar 1 and 2 have received mediocre performance reviews, leading some to see Polestar as a “neglected child” of Geely and Volvo, who respectively have the electric SUV C40 and the hi-end Lotus and Lynk&Co brands. However, this is not the case.

Firstly, Polestar’s differentiated positioning. Originally, Li Shufu set Polestar the goal of being “even better than Volvo,” although Polestar has not yet achieved this, it has at least achieved differentiation from Volvo.

Specifically, though Volvo has the premium electric SUV C40, Geely has pure electric high-end brand Lotus and intelligent pure electric high-end brand Lynk&Co, Polestar has distinguished itself with a global market focus, striving to build a green and minimalist electric car brand oriented towards younger consumers.

For example, Polestar is likely the most environmentally-focused of the three brands. As Polestar’s website notes, the company aims to produce its first climate-neutral car by 2030—meaning a Polestar leaves no carbon footprint, nor emits any greenhouse gases, from production to delivery.

Even Polestar employee assessments include section on reducing carbon emissions, and sustainable development will be a major highlight of Polestar’s future.

If Lotus and Lynk&Co are too associated with Geely, both using Geely’s new SEA platform, then Polestar has inherited a unique personality from Volvo. For example, the 800V power structure is based on technology developed by Polestar and Lotus, and on a vehicle level platform, Polestar uses the double platform from Volvo, with the CMA for Polestar 2, and SPA2 for Polestar 3 and future products.

Secondly, both Geely and Volvo remain the foundation of Polestar. Over 20,000 full-time employees specializing in research and design within Geely and Volvo provide key marketing support for Polestar, though such human support is only a microcosm of Polestar’s dual foundation, which has over 100 years of combined experience in the car-making industry.

For Polestar, however, Geely and Volvo are not puppet masters, but rather the foundation of the pyramid. Geely provides architecture development, manufacturing, and supply-chain management capabilities for Polestar, while Volvo provides engineering design, manufacturing, vehicle testing and verification capabilities.

With the support of two industry giants, Polestar, which has deep roots in China, is determined to root itself in the Chinese market.

According to official sources, Polestar expects to sell 290,000 vehicles in 2024, with a focus on the Chinese market. Polestar predicts that from 2020 to 2025, its annual compound growth rate in China will reach 39%, the highest among the US, EMEA (Europe, Middle East, and Africa), and global markets.

In addition, from Polestar 1 to Polestar 5, all will be produced in China, with Chinese factories being the main base for Polestar to radiate globally.

The electric SUV Polestar 3 will be produced at the Chengdu factory, while the mid-size SUV Polestar 4 and the two-door sports car Polestar 5 will be produced at the Hangzhou Bay and Chongqing factories, respectively.

If everything goes well, Polestar 3 will make its debut in the third quarter of this year, marking the start of a “product outbreak period” for Polestar.

Perhaps, as Polestar CEO Thomas Ingenlath said, “Tesla also spent many years trying to find a breakthrough in the Chinese market. A new brand entering a new market requires necessary accumulation.” The second-generation Polestar has not been lazy in expanding stores, upgrading software, and improving owner services. For example, Polestar plans to expand its Chinese stores to 50 by the end of the year.

In the face of a highly competitive Chinese market with many new forces and internal competition, Polestar still faces a tough battle.

For ordinary domestic consumers, Polestar is still a car company outside their scope of awareness, so it needs to accelerate its pace and quickly enter the core competition circle of pure electric vehicles.

However, from a strategic advantage perspective, Polestar’s differentiated positioning and pyramid-style strategic structure may bring bold and avant-garde possibilities to China’s new energy market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.