Author: Zhu Yulong

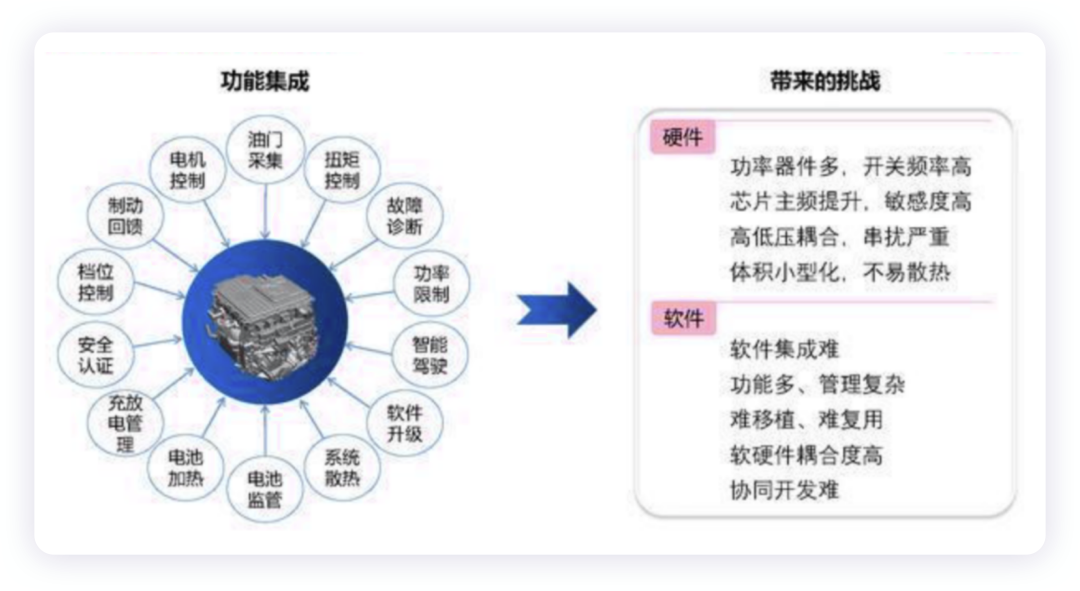

Recently, there has been a discussion on the development direction of electric drive systems for electric vehicles. With the entire integration process, from independent modules to the integration of motors and transmissions, the integration of power electronics into a “multi-in-one integration” stage, and the addition of more power electronics to form a multi-functional integration, bring changes to the automobile division of labor.

-

We can see that for mass-produced vehicle companies, in order to iterate their designs more effectively, they focus on power density and high performance aspects (power density, high efficiency, safety, and intelligent control of the three-electric domain).

-

From the perspective of evolving new technologies, the integration and thermal management, control integration, and NVH optimization of the electric drive system need to be carried out quickly. It is possible to integrate the electric compressor and thermal management unit, especially around the 800V voltage platform and the application of SiC/GaN power devices.

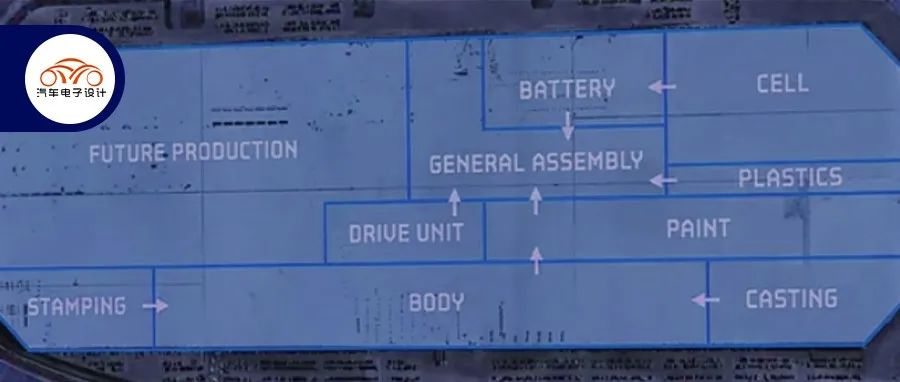

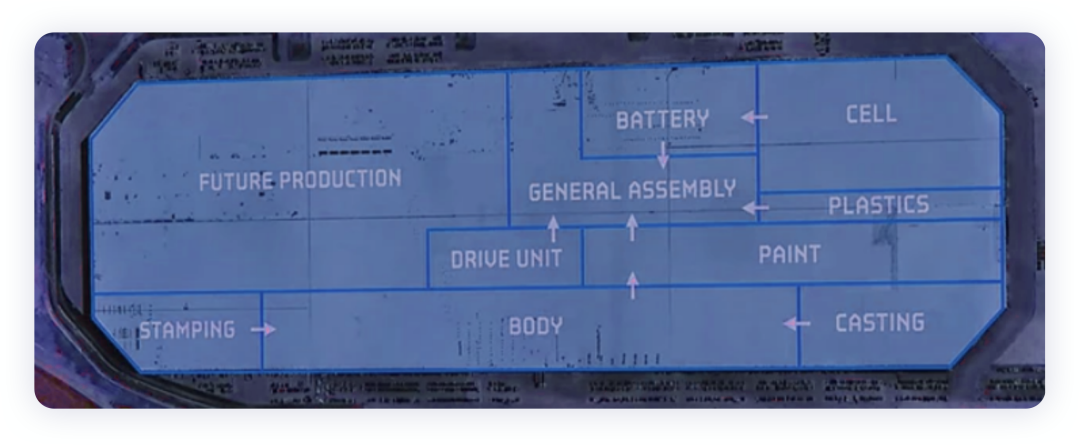

Due to differences in quantity, the demand from vehicle manufacturers for this area is also focused on cost reduction, making the overall logic differentiated. I speculate that the subsequent model is: from the production point of view of electric vehicles, all vehicle manufacturers will build an integrated production line, and then adopt a self-developed + modular procurement model, and ultimately demand the efficient production and prepared maintenance of Tesla.

“Eight-in-one” Electric Powertrain

Last year, BYD launched an eight-in-one electric powertrain on the e3.0 platform, which highly integrated the motor, transmission, motor controller, PDU, DC-DC, OBC, VCU, and BMS, further compressing the system’s occupying space and reducing weight. The overall performance of the system was improved by 20% in power density compared to the previous generation, and the overall weight and volume were reduced by 15% and 20% respectively, achieving a system comprehensive efficiency of 89%. Based on the overall positioning of the vehicle, BYD has created a boost charging topology that combines an independent boost device with a reused driving system power device on the same platform of 400V medium voltage and 800V high voltage, realizing a modular boost architecture.

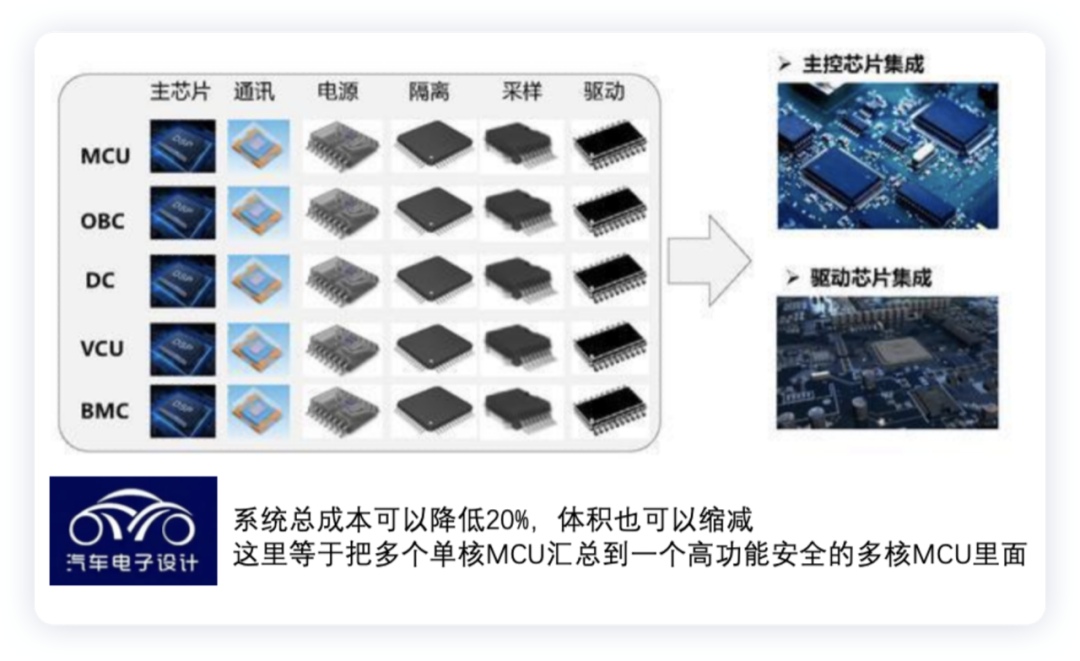

Introducing the domain controller of the electric drive system here is more appropriate. Through the high-end Infineon TC3 series microcontroller, a large number of functions can be integrated, providing significant help in isolation, power supply, communication, and drive.

During the boost stage, BYD also considered the logic of using motors and integrated them as a part of the fast charging boost topology to help the 750V system to be compatible with the quick charging voltage needs of existing vehicles.

We can see that all the software is integrated together, with more power devices and higher switching frequency on the hardware side, and with an increased frequency of the main control chip, the EMC requirements are higher. In the high and low voltage design, more consideration needs to be given to the overall shielding, and integrated heat dissipation will increase the difficulty of the entire power electronic design.

In terms of software, OBC, DCDC, VCU, and BMS are added to the existing inverter, which makes the development more complicated.

In my personal opinion, the challenge brought by such integration is enormous, and it will also change the supply pattern of the entire related product.

Current Pattern

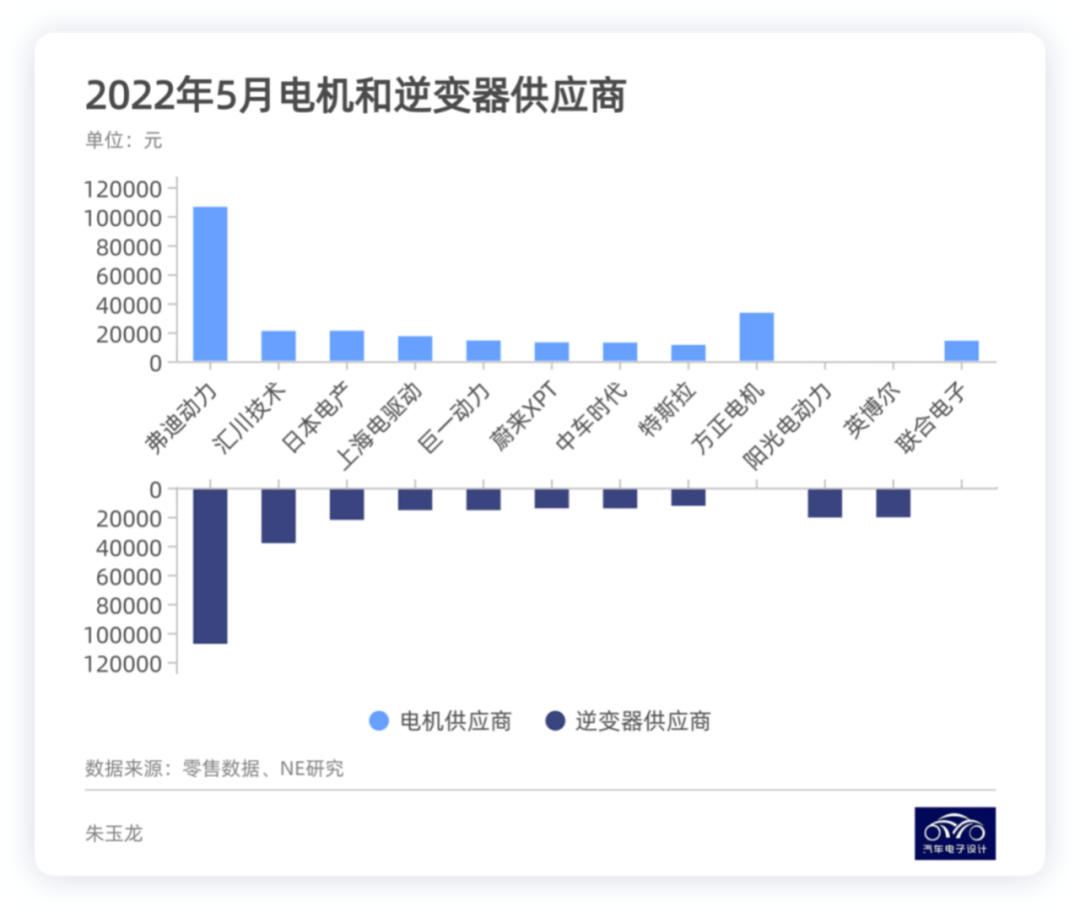

As of May, the cumulative number of motor controllers mounted in new energy passenger vehicles reached 358,000, a year-on-year increase of 71.2%. The installation of pure electric three-in-one and multi-in-one electric drive systems reached 196,000, a year-on-year increase of 77.8%, accounting for 54.7% of the total matching volume. In terms of drive motors, Fudi Power, Fangzheng Motor, and Japan Electric are the top three suppliers in terms of installation quantity. Currently, the supply mode of suppliers has transitioned from simply providing drive motors to providing crushed supply flat lines, fixed rotors, and motor control modules. Fudi Power, Huichuan Technology, and Japan Electric are the top three. From the data, Yangguang Electric appears to be doing well, and the demand for DHT assemblies around hybrid dual-motor controllers is increasing.

Therefore, my view is that different requirements will emerge around the production modes of pure electric and DHT, and external third parties may still strive to grow. If the patterns like Tesla and BYD become popular in the future, major customers will do it themselves, and only scattered modules will have a chance.

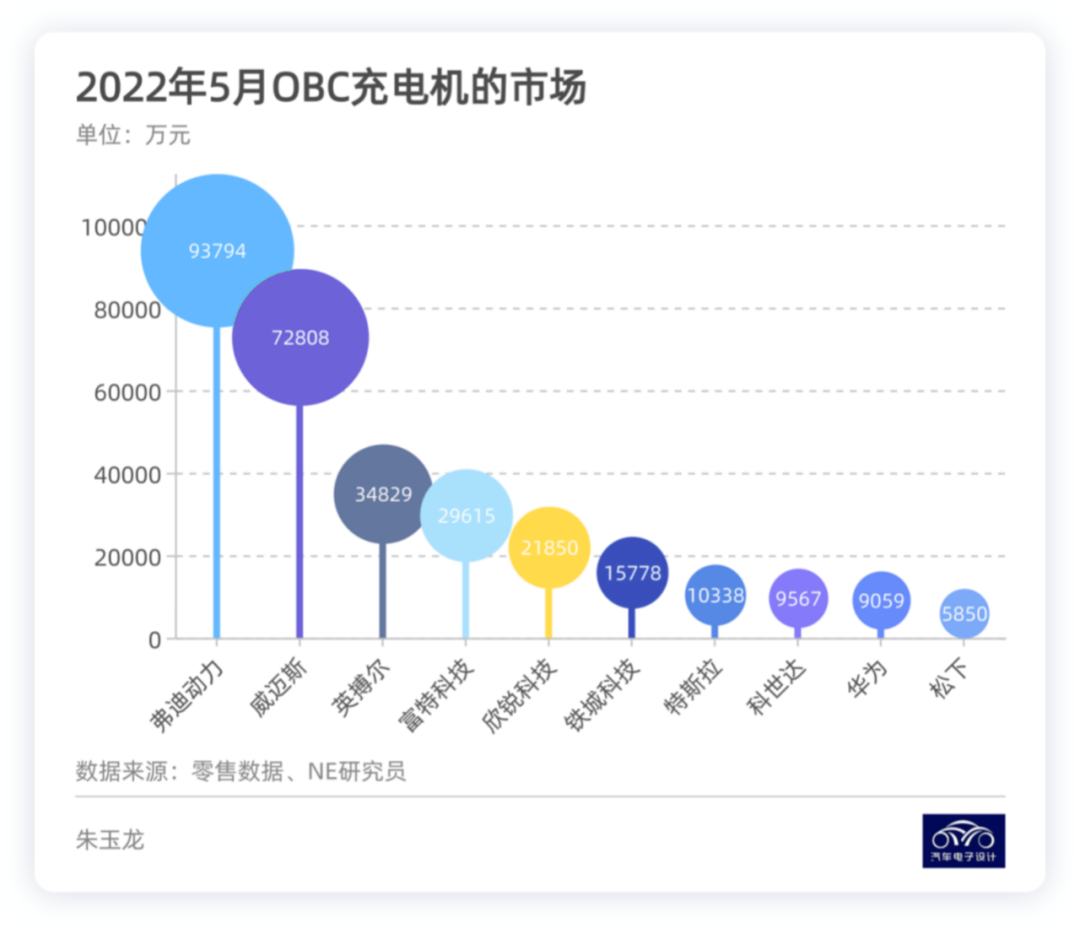

This has also affected the development of the related OBC market. In May, the installed capacity of OBC for new energy passenger cars reached a total of 322,632 sets, with a year-on-year growth rate of 81.77%. Currently, apart from companies like BYD and Tesla that do it themselves, the third-party supplier is the main player in the market due to the great price competition pressure on OBC. Domestic companies have started to introduce SiC devices from low-power modules. For example, Toyota has installed OBC and DC-DC converters on bZ4X based on Japan Electrics SiC technology. Domestic companies, such as Xinquan, Weimaisi, and Inbol, have also released OBC product solutions based on SiC devices.

This has also affected the development of the related OBC market. In May, the installed capacity of OBC for new energy passenger cars reached a total of 322,632 sets, with a year-on-year growth rate of 81.77%. Currently, apart from companies like BYD and Tesla that do it themselves, the third-party supplier is the main player in the market due to the great price competition pressure on OBC. Domestic companies have started to introduce SiC devices from low-power modules. For example, Toyota has installed OBC and DC-DC converters on bZ4X based on Japan Electrics SiC technology. Domestic companies, such as Xinquan, Weimaisi, and Inbol, have also released OBC product solutions based on SiC devices.

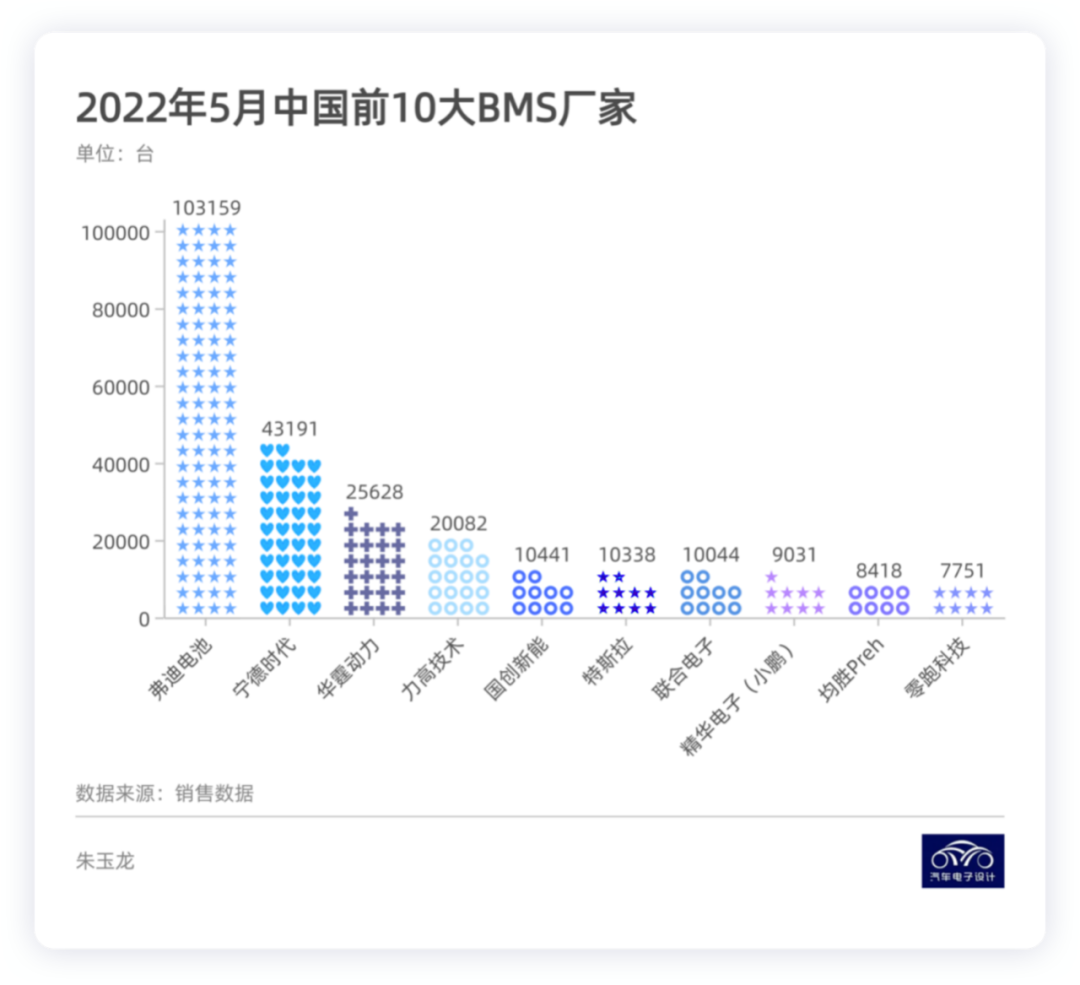

In May, the installed capacity of BMS for new energy passenger cars reached a total of 323,851 vehicles, with a market share of 31.9% for CATL and 13.3% for Contemporary Amperex Technology Co., Ltd. (CATL). The pattern of battery management systems is now relatively clear (car companies✨, battery companies💗, pack factories are +, third-party circle).

-

Car companies with large quantities will definitely choose to do it themselves.

-

New forces will outsource hardware (with their own name) and develop software on their own.

-

Battery factories and pack factories will also do it.

-

Due to the low price but high development cost of BMS, middle and low-end car companies have begun to choose third-party suppliers,

As the trend of doing multiple things in one continues to speed up, this trend will continue.

Conclusion: In my personal judgment, the model of car companies doing final assembly, developing their own core, and outsourcing some parts externally will become a major trend, and companies around their own advantages will do some scattered demand. This is probably the pattern.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.