Goals Set for the First Month: 10,000 Units Delivered

This is the goal set for the Geely Emgrand L Raytheon Hi·X Super Electric Hybrid, powered by the cutting-edge technology of combining electric power and traditional combustion engines.

How to Sell?

Perhaps some clues can be found from other competitors. Take BYD for example, they have revealed a backlog of over 500,000 orders, most of which are for Plug-in Hybrid Electric Vehicles (PHEV).

Bringing Customers Back through Emgrand L Plug-in Hybrid Electric Vehicle

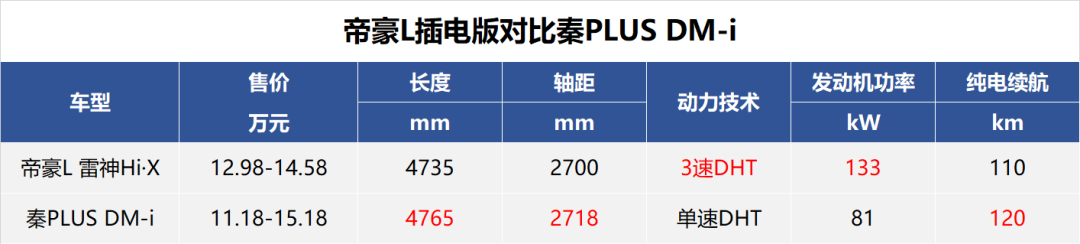

The Geely Emgrand L Raytheon Hi·X Super Electric Hybrid (hereafter referred to as the Emgrand L PHEV) is a household A-class PHEV that competes directly with the BYD Qin PLUS DM-i. Geely is hoping that the Emgrand L PHEV can win back the customers who lost their patience waiting in the long line of BYD orders.

As BYD Chairman Wang Chuanfu has said, “New energy vehicle market is dominated by fast fish eating slow fish. Speed is critical. If you cannot provide products quickly enough, demands will be dispersed amongst other brands.”

On various auto forums and social media, many potential customers of BYD Qin PLUS DM-i have turned to Geely’s Emgrand L PHEV due to the overly long wait time and unsatisfactory product details.

“Weak” Brand BYD in the Era of Gasoline Vehicle has Become a Sales and Popularity Key in New Energy Vehicle Era

Compared to BYD, Geely is like a thirsty traveller waiting to quench his thirst with BYD’s overflow. Geely has become the key to sales and popularity for other brands.

BYD Breaks Boundaries

BYD has already broken free from the shackles of the new energy auto industry and become a phenomenal auto brand.

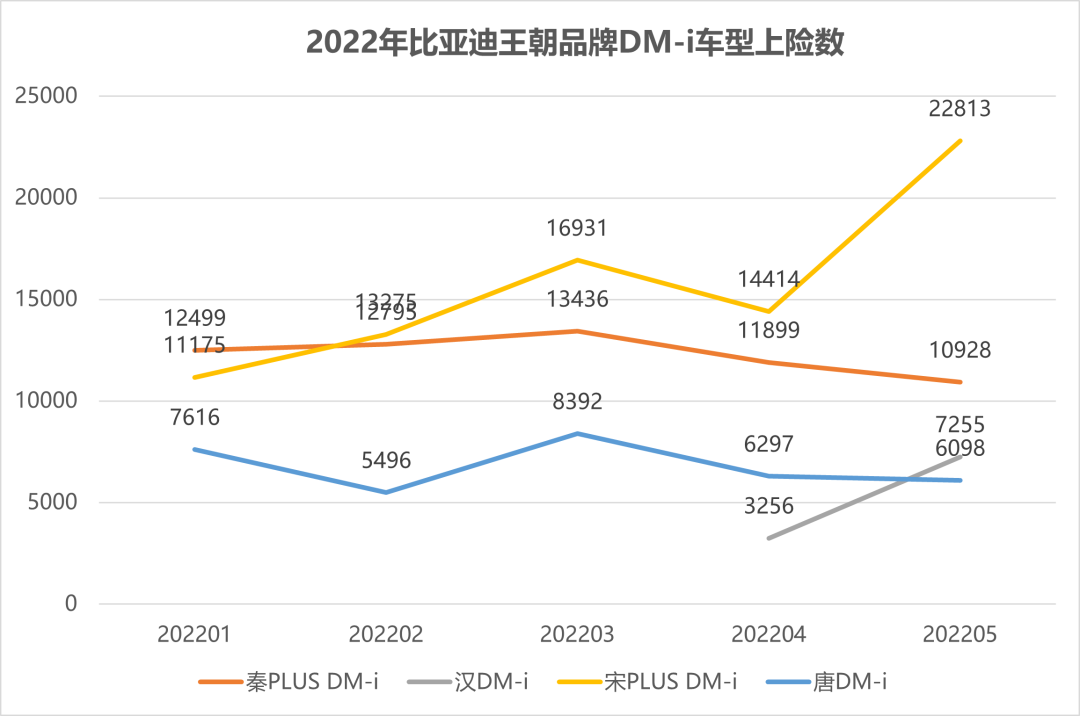

In the May passenger car sales ranking released by China Passenger Car Association, BYD Han and Qin ranked number 3 and 5, respectively. On the SUV sales ranking, BYD Song topped the charts by selling over 30,000 units, leading the runner-up by more than 10,000 units.

The data shows that the market share of the Dynasty series electric vehicles using DM-i plug-in hybrid technology exceeds 50% in the plug-in hybrid market. Relying on technological advantages, BYD has made breakthroughs in the market for family sedans priced at 100,000 to 150,000 yuan, family SUVs priced at 150,000 to 200,000 yuan, and mid-to-high-end cars priced above 200,000 yuan.

The data shows that the market share of the Dynasty series electric vehicles using DM-i plug-in hybrid technology exceeds 50% in the plug-in hybrid market. Relying on technological advantages, BYD has made breakthroughs in the market for family sedans priced at 100,000 to 150,000 yuan, family SUVs priced at 150,000 to 200,000 yuan, and mid-to-high-end cars priced above 200,000 yuan.

On the other hand, traditional fuel vehicles performed badly in the first half of this year, with models such as the Nissan Sylphy, Volkswagen Lavida, Volkswagen Bora, and Toyota Corolla experiencing a sales decline of more than 30% in the first five months, while the similarly positioned QIN PLUS DM-i achieved year-on-year growth of 366%.

In the compact SUV market where the Song PLUS DM-i is located, and similarly in the mid-to-large-sized sedan market where the Han is located, BYD’s sales continue to rise while sales of joint venture brands continue to decline.

Under the circumstances of the rise of one and the decline of the other, traditional car makers feel the pain caused by BYD.

Sales data from the China Association of Automobile Manufacturers shows that in the first five months of this year, BYD’s sales increased by 167.1% year-on-year, while sales of traditional automakers, especially joint venture brands, declined.

What makes traditional car makers even more upset is that BYD still has a large number of undelivered orders.

Data shows that BYD currently has more than 500,000 undelivered orders. The latest information shows that the cumulative order volume of BYD’s new Ocean series model, the sea lion, has exceeded 110,000 units, and the order volume of the Dynasty series Han model has exceeded 150,000 units. In order to meet the demand for new energy products, BYD has completely stopped the production of fuel vehicles.

The macroeconomic situation of the car market is also good news for BYD.

Local governments will deliver a large number of subsidies for the purchase of new energy vehicles, while national policies to support new energy, such as subsidies and tax exemptions, will expire at the end of the year, which will accelerate consumers’ replacement of fuel vehicles with new energy vehicles.

It is clear that BYD will be the biggest beneficiary in the accelerated transformation of the car market. After entering the entire automobile circle, BYD has become a star brand, with its own popularity and sales.

Benchmarking BYD

BYD has already become the sales champion of the new energy vehicle market, and it’s not a problem for its sales to exceed 1.5 million in 2022. BYD has a reserve capacity of 3 million vehicles in 2023.

In the next few years, BYD will be the car company with the largest production and sales volume in the new energy vehicle market, which means that BYD has transformed from a follower in the fuel vehicle market to a leader in the new energy vehicle market.Any new energy vehicle company must learn how to compete with BYD. Benchmarking BYD is a good way, which is bi-directional rather than simple imitation. Benchmarking can be both about making what BYD does or making what BYD lacks.

The key to benchmarking BYD is to see BYD clearly.

BYD’s advantage is technology leadership, but its disadvantage lies in the lack of ability to define car products.

BYD’s E-platform 3.0 technology and DM-i super hybrid technology are undoubtedly leading, but the cars launched based on these technologies are really mediocre.

The Geely Emgrand L Plug-in Hybrid is an example of benchmarking BYD.

Technologically, the Emgrand L Plug-in Hybrid uses the same Thunder God DHT hybrid technology as DM-i, but it excels in product definition.

Technologically, the Thunder God hybrid used by Emgrand L is a DHT dual-motor hybrid technology with the same concept as BYD DM-i technology. Thunder God hybrid adopts a 3-gear DHT gearbox, while DM-i is a single-gear gearbox.

In the case of the same mileage and fuel consumption, which is 3.8L, Emgrand L Plug-in Hybrid has a shorter acceleration time of 6.9 seconds.

In terms of product definition, although there is little difference in the exterior size of the two cars, Emgrand L Plug-in Hybrid knows better how to create a sense of luxury through the use of exterior lines, interior color matching, and material. This kind of sense of luxury is the most scarce product power for home-based sedans.

Taking advantages and making up for the shortcomings, the Emgrand L Plug-in Hybrid is undoubtedly a success, because after two months of pre-sales, it has received 30,000 orders, which has laid a foundation for the goal of delivering 10,000 vehicles in the first month.

Inheriting the overflow of BYD

The benefit of benchmarking BYD is the ability to inherit the overflow effect of BYD’s car-buying demand.

BYD is facing serious supply and demand imbalance. More than 500,000 outstanding orders means an average waiting time of more than 3 months for BYD’s consumers.

Under the imbalance of supply and demand, BYD brand has produced an obvious overflow effect, and consumers who are waiting for BYD’s cars are easily turned to other brands of new energy vehicles.

The overflow effect of BYD is essentially the potential car-buying demand attracted by the BYD star effect, which spills over to other brands.

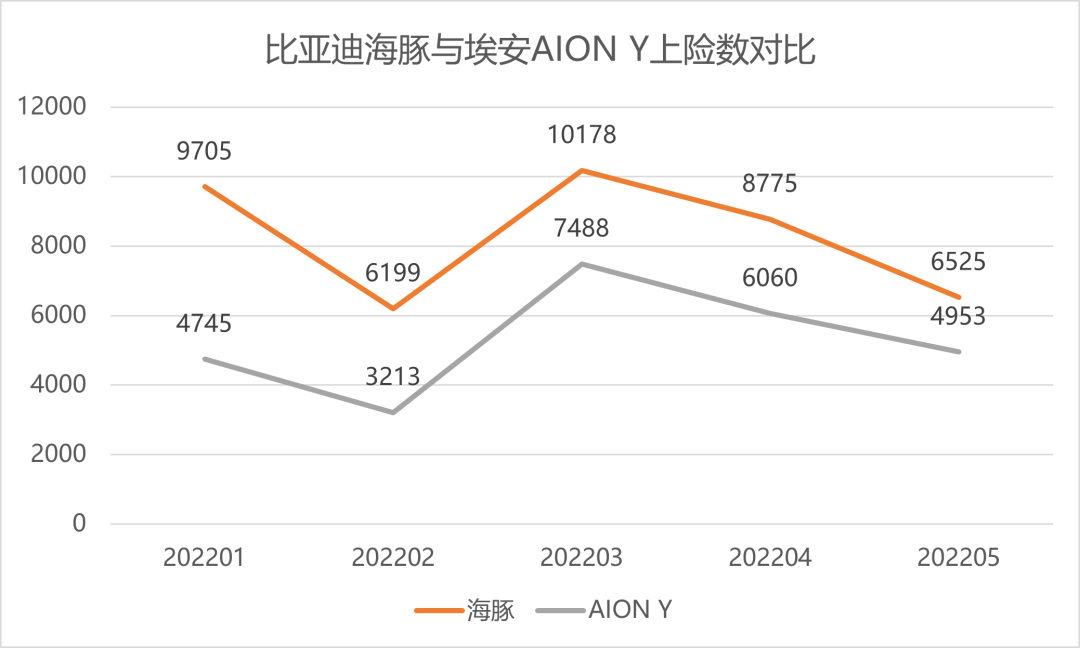

The star effect of BYD attracts consumers’ attention to new energy vehicles, and in the process of comparing and choosing cars, it deepens their understanding of more brands and models. BYD’s long waiting time leads to a diversion of car-buying demand to other brands.AION Y, a vehicle under the umbrella of GAC Aion, is a typical example.

As a competitor of BYD’s Dolphin compact car, GAC Aion Y is also positioned as a two-door car, but it is larger and more expensive than Dolphin.

According to Shangxianshu, the monthly insurance curve of GAC Aion Y is similar to that of BYD Dolphin, but the sales gap between the two is gradually narrowing, proving that AION Y is taking on some of the overflow demand from Dolphin.

What AION Y has taken over is the overflow demand for two-door cars from consumers who are dissatisfied with Dolphin’s space.

For any car company, it is not realistic to directly benchmark and hope to deliver cars to consumers faster if there is a shortage of chips and batteries for the popular models of BYD. BYD, as a company with the strongest industrial chain advantages, is difficult to satisfy the purchase demand that it cannot meet, and other car companies are equally difficult to meet.

Fast fish eat slow fish. To take on the overflow demand from BYD, it is necessary to act quickly.

For consumers, BYD launching a vehicle is the best choice to take on the overflow demand from BYD. And BYD does not leave a long window of time for competitors to take on their overflow demand.

In BYD’s plan, four brands will be launched in the future. In addition to the existing Dynasty and Ocean brand sequences, the DENZA brand jointly established by BYD and Daimler will be revived, positioned slightly higher than the Dynasty and Ocean brands.

The BYD luxury brand, positioned as a million-dollar high-end car, will debut in the third quarter of this year and be mass-produced in 2023.

In terms of product planning, the Ocean sequence will soon launch the Destroyer 07 plug-in hybrid SUV, the A00 electric car Seagull (tentative name), and others.

DENZA brand will continue to launch two SUV models this year, a 6-seat mid-size SUV and a 5-seat mid-size SUV.

The high-end brand is expected to launch off-road and supercar models.

At the same time, BYD is also developing new vehicle models such as pickups that can be used for both family and commercial purposes.In BYD’s plan, from the A00-level mini electric car with a price of several tens of thousands of yuan to the million-level luxury car, from private cars to public vehicles, BYD has completed the plan and is advancing quickly.

BYD Chairman Wang Chuanfu believes that the new energy vehicle market is a “fast fish eats slow fish” market, so BYD is not weak in pushing new products.

Taking mid-size pure electric sedans as an example of this subdivision, based on the success of the BYD Han EV, BYD’s new model, the Dolphin of the same size, received 110,000 orders in just one month of pre-sales, which is a considerable pressure for latecomers.

“Matching BYD and taking over the car purchase demand overflow from BYD can be transformed into our own sales.”

For BYD itself, it must also quickly fulfill production capacity and deliver vehicles, otherwise it will lose a lot of orders in hand.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.