Author: Rezz

In recent months, the pattern of the new forces in the automotive industry seems to have “changed”. From the original “big three” to the “fabulous five” – in addition to the original WEY-XPeng Motors and Li Auto, zero run and NIO have been added.

Since its inception, zero run seems to have chosen a road that is not so easy to stand out: while focusing on high-performance-price ratio models and targeting second- and third-tier cities, it has also invested heavily in autonomous driving technology and claims to have surpassed Tesla’s NOA in three years. It can be said that zero run has put a lot of effort into the technological investment and steady development of its car models.

Perhaps it is this choice, that while zero run’s car models have good technology and performance in the same price range, it still lacks a certain degree of presence among consumers.

Now, zero run is also seeking a new path, with its upcoming IPO, enabling it to expand its production capacity, continue to increase research and development efforts, and of course, its most critical pain point, expand its channels of operation and brand awareness.

On March 17, zero run officially submitted its application for listing to the Hong Kong Stock Exchange, hoping to compete with WmAuto Automobiles as the fourth new force to be listed on the Hong Kong Stock Exchange after WEY-XPeng Motors, Li Auto and NIO. The IPO listing price is one yuan per share, with approximately 40% of the net proceeds used for research and development, 25% for increasing production capacity, 25% for expanding business and increasing brand awareness, and about 10% for operating capital and general corporate purposes.

Can zero run’s IPO mark the beginning of a new story for the company when it comes to light in its seventh year with its 100,000th car having already been produced?

Zhu Jiangming and his Zero Run

Looking at the resume of the brand’s founder, Zhu Jiangming, we can see that zero run’s entrepreneurial mission and tone flow through his veins:

In 1993, Zhu Jiangming, together with Fu Liqun, the current chairman of Dahua Technology, started the company with just 5,000 yuan, serving as the CTO of Dahua Technology and building the company’s supply chain system from scratch.

For more than 20 years, Mr. Zhu Jiangming has experienced two successful entrepreneurial journeys from 0 to 1, starting with enterprise scheduling machines and transitioning to security equipment in 2001. Today, Dahua Technology has developed into the world’s second-largest company in the security industry with a market capitalization of nearly RMB 96 billion.

In 2015, based on Dahua’s research on intelligent transportation and predictions of the trends towards vehicle electrification and intelligentization, Zhu Jiangming entered the intelligent automotive industry and founded Zero Run Automotive.

Perhaps his experience in building Dahua Technology’s supply chain system gave Zhu Jiangming the confidence to pioneer the automotive industry again. Zero run automotive insists on independent research and development of three electric technologies, intelligent networked technologies, and autonomous driving technologies, committed to building an automotive brand with core technology capabilities.

Backing on a big tree for shade, Link Tour Motors has the financial and technical support of Dahua Co., as well as years of experience in visualization, image and video processing technology, and factory production lines. This path naturally fits Link Tour’s technical background and is a hidden but great technological route.

If we look at the progress of early R&D, the results are still remarkable. Under the leadership of Zhu Jiangming, in less than 3 years, Link Tour became the world’s second manufacturer with complete independent research and development capabilities for intelligent electric vehicles after Tesla, including self-developed electric drive, battery, electric control three-electric technology, intelligent network connection technology, and autonomous driving technology.

However, making cars seems to become more difficult as time goes on.

Burning money on technology research and development, and even more on operating costs

It is well known that making cars burns money. How much money does it really burn?

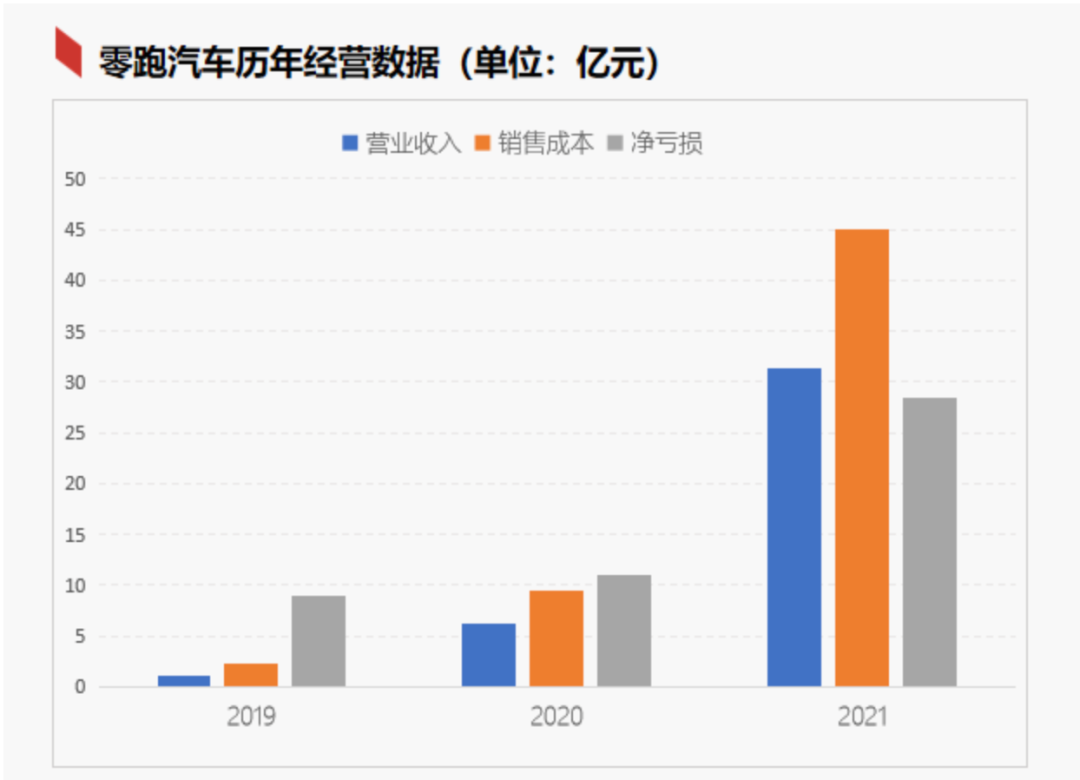

From 2019 to 2021, Link Tour’s R&D expenses were RMB 358 million, RMB 289 million, and RMB 740 million, respectively, with operating losses of approximately RMB 730 million, RMB 869 million, and RMB 2.868 billion, respectively.

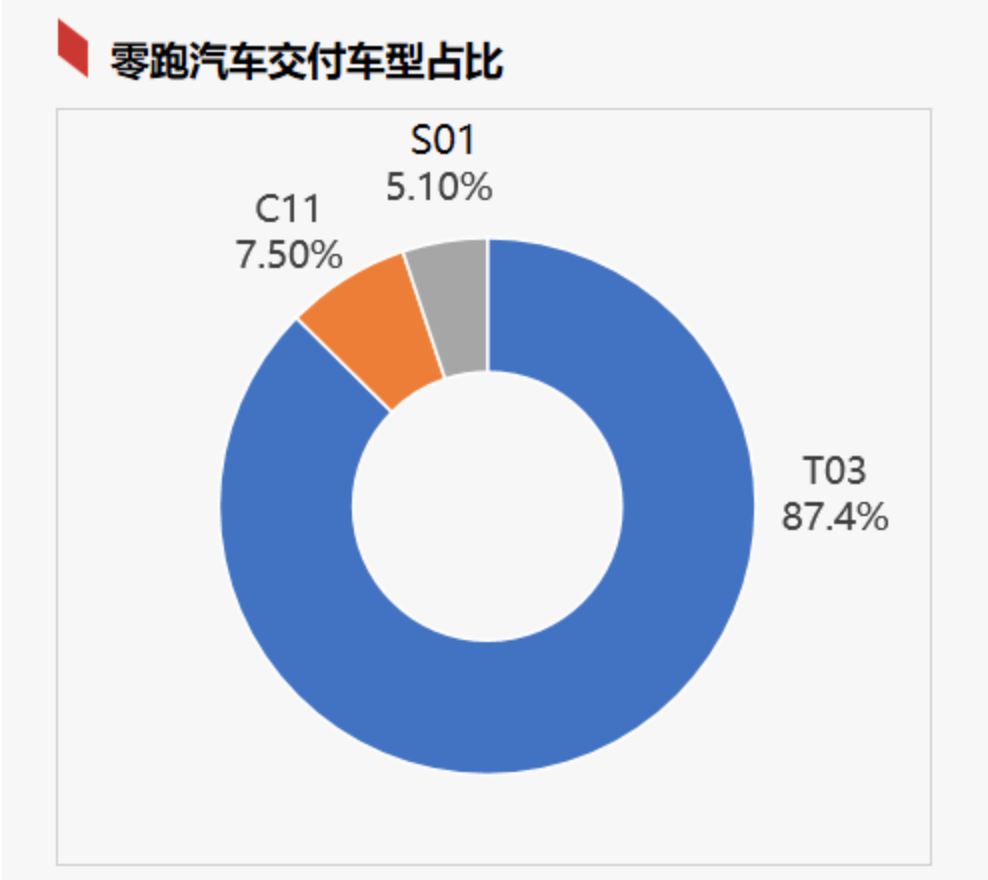

Link Tour’s recent performance has been impressive. It delivered a total of 43,848 vehicles last year. Currently, it has achieved mass production and delivery of three models, including the T03 microcar, the S01 two-door coupe, and the C11 mid-size SUV. From the data and consumer analytics perspectives, the T03 is unquestionably an affordable mass-market vehicle, accounting for 87.4%.

This also means that the T03, which is rooted in the sinking market, shoulders more revenue responsibilities and R&D investment burdens.

A simple calculation of R&D investment indicates that the average R&D and production cost of a single Link Tour T03 might be around RMB 135,000. This means that for each T03 sold at a price of RMB 70,000, the company still needs to lose RMB 65,000.

It is no wonder that, despite the T03’s strong sales, Link Tour chose to launch the flagship S01 coupe to enter the mid-to-high-end market priced at RMB 150,000 to RMB 300,000. By highlighting its self-developed strength with high-end models, the company can also increase the revenue of each individual vehicle.

Even though this price is a few thousand more expensive than C11, which also increased in price to 180,000-230,000 RMB, consumers have a discerning eye. Given its price, body size, configuration as well as endurance, it is not unreasonable to say that Zeekr is more a friend than a profit-maker. The price-performance ratio remains a Zeekr highlight.

Even though this price is a few thousand more expensive than C11, which also increased in price to 180,000-230,000 RMB, consumers have a discerning eye. Given its price, body size, configuration as well as endurance, it is not unreasonable to say that Zeekr is more a friend than a profit-maker. The price-performance ratio remains a Zeekr highlight.

This result is inextricably linked to Zeekr’s comprehensive and independent R&D selection.

Unlike some automakers that focus on three-electric systems, user experience or forming their own self-driving R&D teams after forming a scale with sales, Zeekr intends to independently research, develop, design and manufacture all core systems and electronic components from the outset.

In addition to self-research and outsourcing of the battery, chassis, automotive electronics, and interior and exterior decorations, Zeekr produces and researches all other parts from top to bottom including car lights. This makes Zeekr more like a traditional manufacturer that focuses on R&D and industrial production.

As of March 31, 2022, the company has more than 3,200 employees, of which more than one-third are R&D personnel, accounting for 34% of the total number of employees. It is clear that Zeekr’s investment in and emphasis on technological research and development stems from founder Zhu Jiangming’s technology-oriented gene, which has been present since the beginning of his entrepreneurship at Dahua.

When evaluating a product, the barrel effect is often used to describe the hope that it has no shortcomings and that each feature is particularly outstanding. However, in the increasingly fierce field of mid-to-high-end electric vehicles, it is important to have a clear long-board tag while considering the barrel effect.

Almost every high-profile electric vehicle company has its own distinctive tag. For example, BYD, which also insists on independent research and development and has technological hardware capabilities, began developing its own batteries and three-electric systems before 2003 and officially entered the automotive market. This year is also the year of BYD’s multiple product explosions. Qinhan Tangyuan’s DM-i and EV earned full bowls at a rate of 100,000 units per month in the first half of the year, and capacity is expanding. It is said that the new Zhengzhou plant will be able to produce 600,000 vehicles per year. The three-electric system has become BYD’s distinguishing tag.

As consumers, we spend most of our time learning not about the technical foundation of a new energy vehicle, but about the convenience it can bring to our lives. Although Zeekr’s price-performance ratio is important, whether it can take a share in the process of consumer upgrade and domestic brand awakening in the new energy vehicle trend, and create its own tag, is the area that Zeekr truly needs to focus on.

Going Against the Tide in IPO

In terms of sales, Zeekr’s cars have seen robust growth over the past year. However, the C11, which embodies the high-end technology that Zeekr prides itself on, is not selling well, while its low-end product, the T03, is selling well.

The market for new energy vehicles in the middle to high-end segment of around 200,000 has become a fiercely competitive field. Apart from traditional manufacturers with abundant accumulation standing in front of it, there are also Tesla and WmAuto Xaoli who started from the same starting point, destined to face a difficult road upwards for their brands. Leading in the mid-to-low-end market and adhering to the cost-effective route, Zero-run has been dubbed the “Xiaomi of the automobile industry”. However, in the near future, it will encounter the real Xiaomi – Xiaomi cars will begin volume production in 2024.

Looking at the Zero-run company, the company plans to launch eight new models at a rate of one to three models per year before the end of 2025, covering various sizes of cars, SUVs and MPVs. To achieve this plan, sufficient funding is required.

Tianyancha shows that since its establishment, Zero-run has completed at least 7 rounds of financing, with a total financing amount of over RMB 12 billion. The latest round was the Pre-IPO financing round in July last year, with a financing amount of up to 4.5 billion yuan.

However, Zero-run has not yet achieved profitability, and over RMB 12 billion in financing has already been used up by about two-thirds. According to the prospectus, as of December 31, 2021, Zero-run held cash and cash equivalents of RMB 4.34 billion. As a comparison, the three companies under WmAuto Xaoli all have cash reserves of over RMB 20 billion. It can be said that Zero-run has reached a point where it has to go public.

According to the prospectus: from 2019 to 2021, Zero-run’s gross margin was -95.7%, -50.6%, and -44.3%, respectively. Although with the increase in the delivery volume of intelligent electric vehicles with higher profit margins, and the decrease of unit costs due to economies of scale, Zero-run’s gross profit margin has improved somewhat, it still cannot be optimistic.

How to turn the tide and turn losses into profits is not a problem that can only be solved by going public financing. Whether it is Tesla or WmAuto Xaoli, they have all been through the process of “losing money to buy cars”. When Tesla released the Model 3, WmAuto launched the ES6, and Ideal just delivered the Ideal ONE, all three companies had an average loss of one to two thousand yuan per vehicle, not to mention XPeng Motors’ net loss of an average of 100,000 yuan per vehicle.

Financing and going public have given these new forces a breathing space, but the key to “turning danger into safety” is that these few cars all have the potential to become explosive products, with sales steadily increasing. In the first half of this year, the average monthly sales of Ideal ONE and XPeng P7 remained above 10,000, while Tesla Model 3 sold more than 508,000 vehicles in the domestic market in 2021, which has also led to a positive increase in their gross profit margin and a turnaround to profitability.

Financing and going public have given these new forces a breathing space, but the key to “turning danger into safety” is that these few cars all have the potential to become explosive products, with sales steadily increasing. In the first half of this year, the average monthly sales of Ideal ONE and XPeng P7 remained above 10,000, while Tesla Model 3 sold more than 508,000 vehicles in the domestic market in 2021, which has also led to a positive increase in their gross profit margin and a turnaround to profitability.

Looking at it this way, the C11 and C01 launched this year are the heavyweights, the real brand force points and quantity products of Zeros. By highlighting the self-developed strength of the mid- to high-end models, revenue per vehicle is also increased. When the latest flagship sedan has maxed out on product strength and cost performance, what really tests Zeros is its branding and promotional ability.

Good Storytelling is Needed to Go Public

From 2019 to 2021, Zeros Auto adopted a model of combining direct sales stores with channel partner stores to quickly expand the number of stores. As of December 31, 2021, Zeros Technologies has 23 direct sales stores and 268 channel partner stores covering 101 cities in China.

However, Zeros seemed to be more focused on second- and third-tier cities before, which also fits the positioning of their mainstream product T03. In Beijing, where I live, there are less than 10 Zeros Auto experience centers, mostly located outside the Fourth Ring Road, far from the mainstream business district. This has indirectly led to a low frequency of seeing Zeros Auto on the streets of Beijing.

With the launch of the C01, when Zeros sounded the horn for their upward brand push, new stories and demands for sales networks were generated. Nowadays, people don’t just compare the cost performance of cars when buying, they also value the social attributes of cars, which is why so many new forces in car manufacturing are opening experience centers in shopping malls and places where internet celebrities gather.

Perhaps as Zeros’ new story gradually unfolds, we will also see the presence of Zeros in these gathering places of new forces.

Final WordsMany people consider that 2022 is the second year of China’s new energy vehicle development, in which a domestic brand of pure electric vehicles will begin to make efforts to occupy the market and sales of joint venture and import manufacturers. Each company has launched its flagship upgraded products.

As of the middle of 2022, LingPao and NIO, as the last two of the new forces in the automobile industry, have relatively little attention and discussion, more like “achieving success through quiet efforts.”

However, I still have great confidence and hope for LingPao because successful entrepreneurs never only try once and stop or stagnate. Founder Zhu Jiangming is such a pragmatic and low-key entrepreneur, who has not only achieved results in the field he is good at, but also ventured into an unfamiliar field, namely whole vehicle manufacturing, and survived tenaciously.

While LingPao announced its IPO, WM Motor also submitted its prospectus for listing on the Hong Kong Stock Exchange. Who will be the winner among the fourth new forces to enter the market? Will the story of the counterattack of the new energy vehicle brand convince the investors in the financial center of Asia to pay the bill? Everything will be revealed in the third quarter.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.