Author: Zhu Yulong

A few days ago, two big stars in the industry, BYD and Tesla, collided with each other. Lian Yubo, Executive Vice President of BYD Group, said in an interview with the media, “We are now also good friends with Elon Musk. We will soon provide him with batteries, and we are all in a friendly relationship.” In response to this, Tesla said in an interview with the relevant media, “We have not heard this information.” Currently, CGTN host Kui Yingchun has deleted the previous BYD interview video.

From this incident, we can see several points:

-

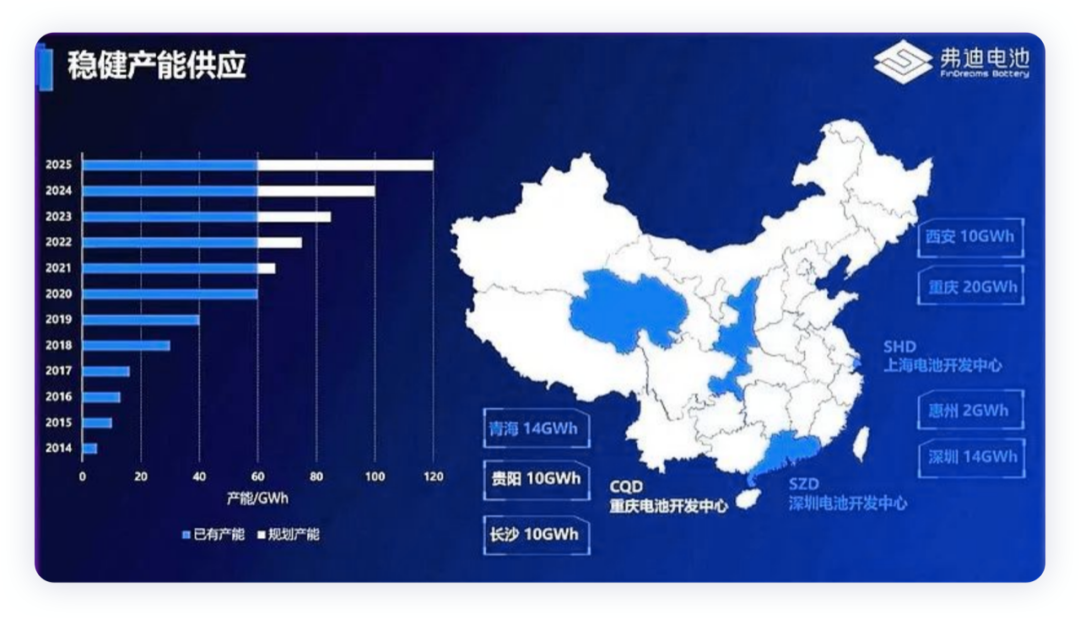

The subsidiary of BYD, Fudi Battery, is indeed in the process of project development and supply, including customized batteries such as the C112F model.

-

Both Tesla and Fudi Battery have confidentiality obligations. Tesla and all suppliers’ contracts contain clauses that prohibit the disclosure of their business relationships with Tesla on any occasion. Violating the contract may lead to huge fines from Tesla, which I understand is a form of protection for securities market investors.

-

Therefore, before the official announcement on the battery pack and the qualified certificate data in the battery alliance, everything is just a rumor. Even if everything is in progress, Tesla has the right to decide whether to do it or not.

Therefore, I wrote this article, which is more about the comprehensive information that exists, rather than information about the two companies.

Tesla’s Battery Procurement

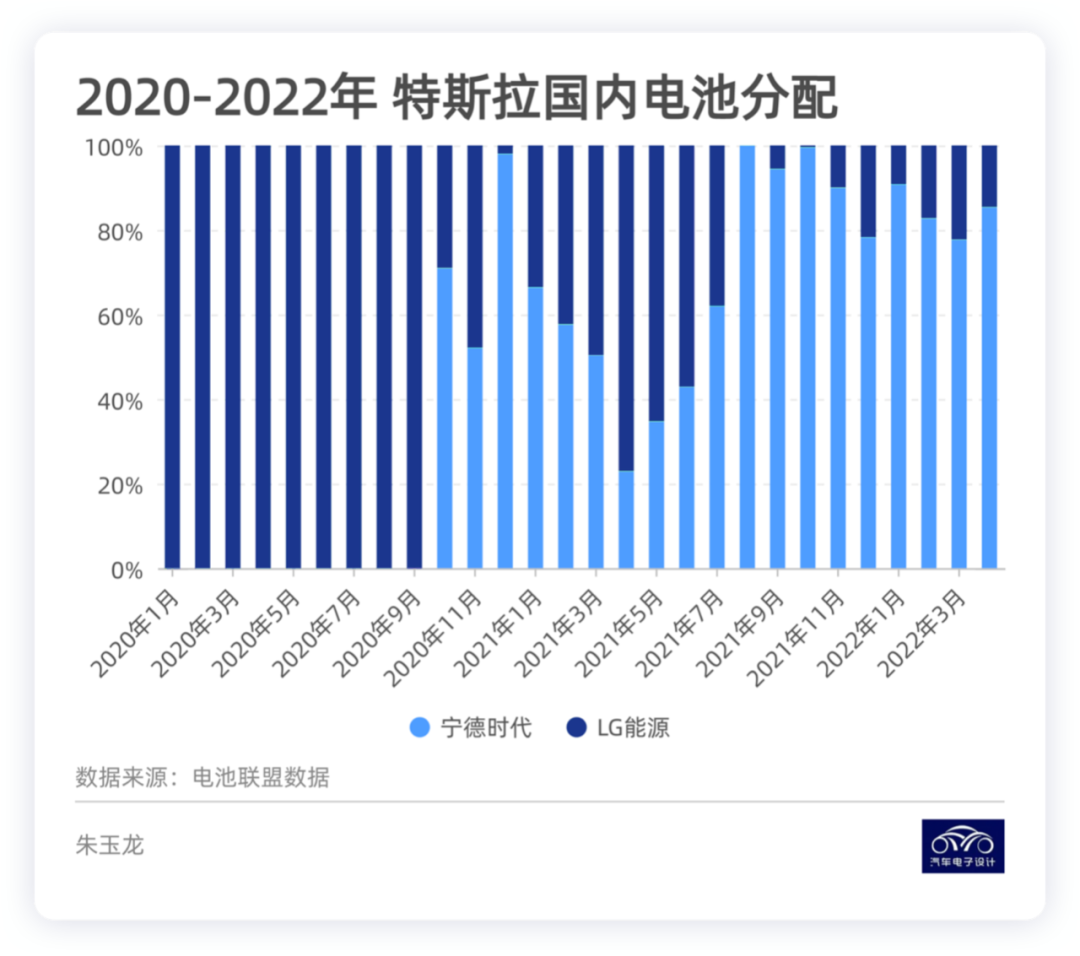

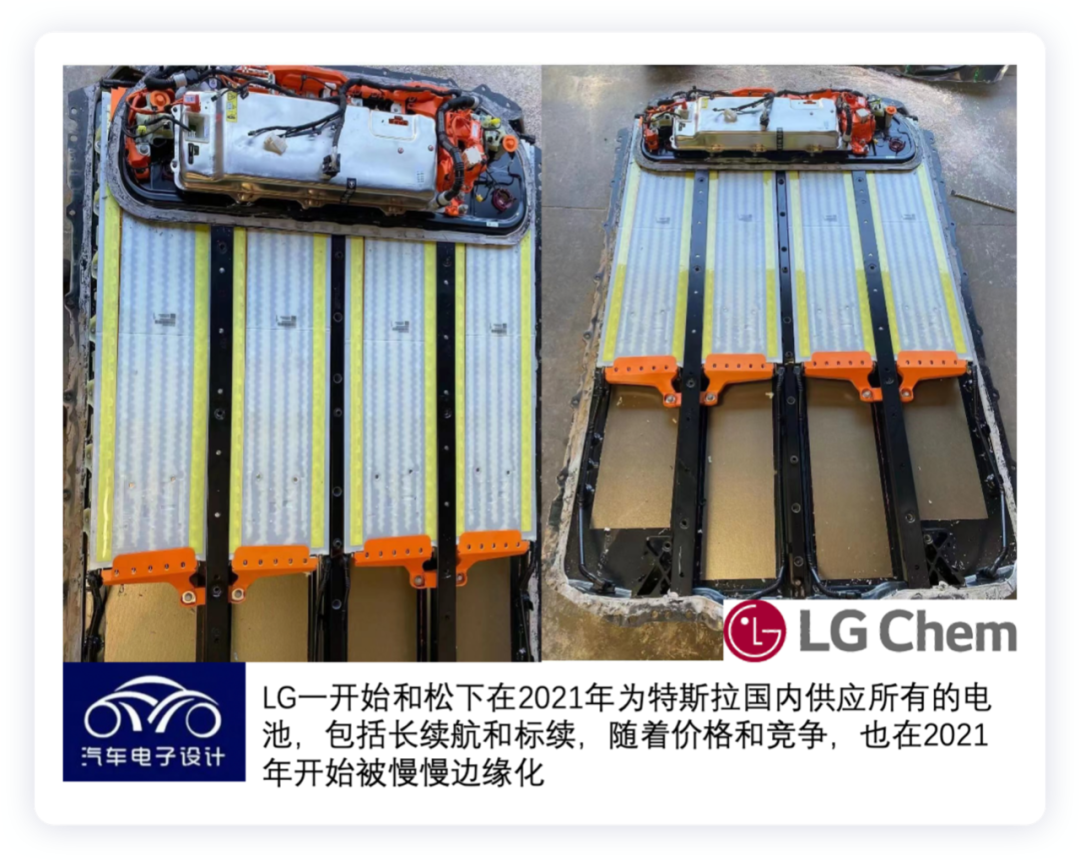

We are all aware of Tesla’s situation, from being tied to Panasonic at the beginning, to using LG’s batteries after localization in the Chinese market, and then using CATL’s lithium iron phosphate. The core logic is to find multiple battery suppliers. In fact, Tesla’s large-scale use of lithium iron phosphate, and BYD’s promotion of a large number of blade batteries later, are both based on low cost and considering safety.

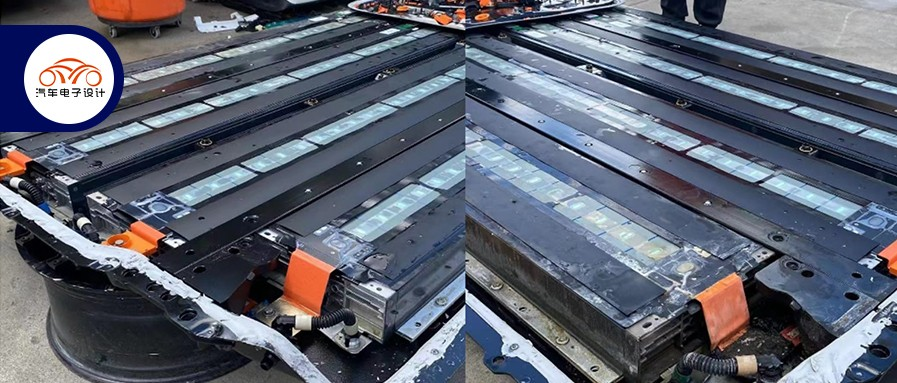

By 2022, with the problem of LG’s price and competitiveness, CATL’s proportion in Tesla China has reached a very high level, basically above 80%.

Translated English Markdown Text:

Translated English Markdown Text:

This is, of course, related to Tesla’s current pricing mechanism for different ranges, which is partly achieved by capping the standard and long-range versions at 300,000, and partly by the price and production capacity delivery situation.

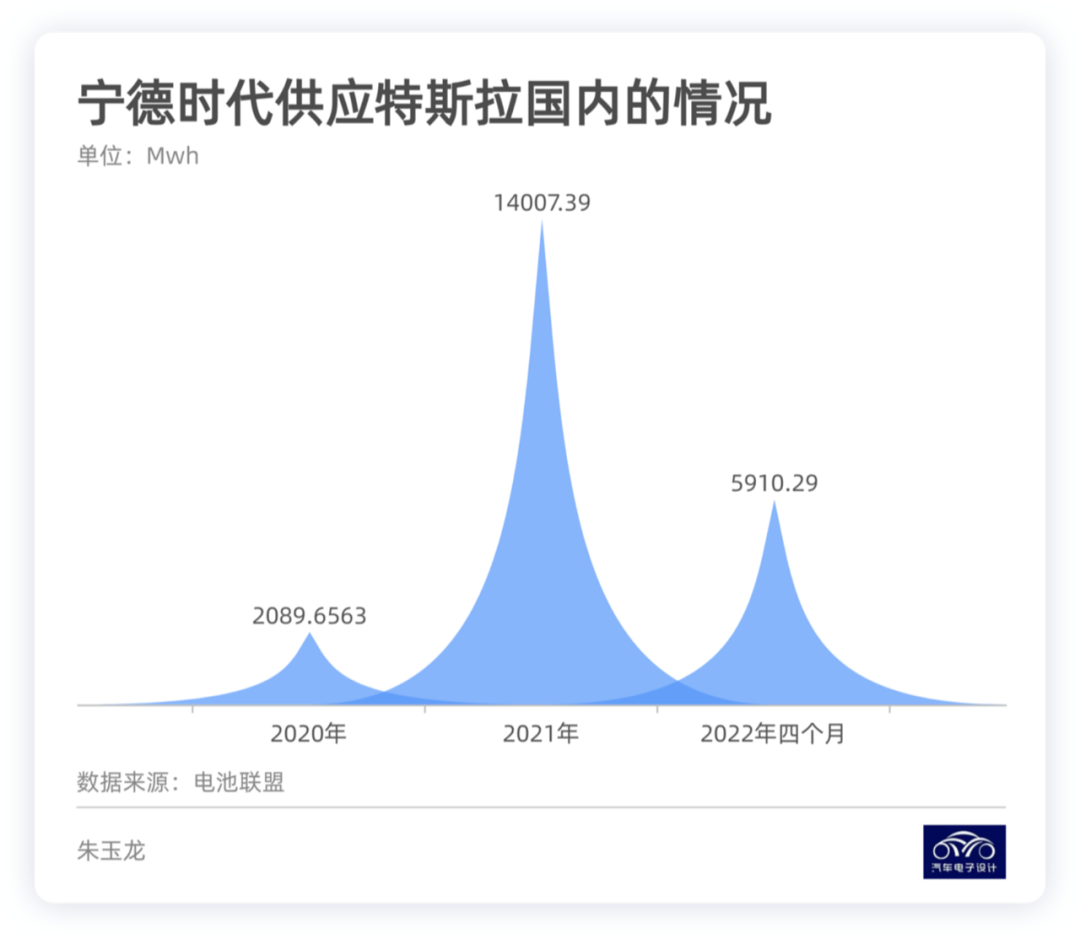

To be specific, Ningde began supplying Tesla with 2GWh in 2020, 14GWh in China in 2021, and 5.9GWh in 2022. Tesla delivered a total of 484,000 new cars in 2021, with 321,000 sold in China, and remaining 163,000 mainly exported to Japan and Europe. If we estimate, Tesla actually received about 21GWh in 2021.

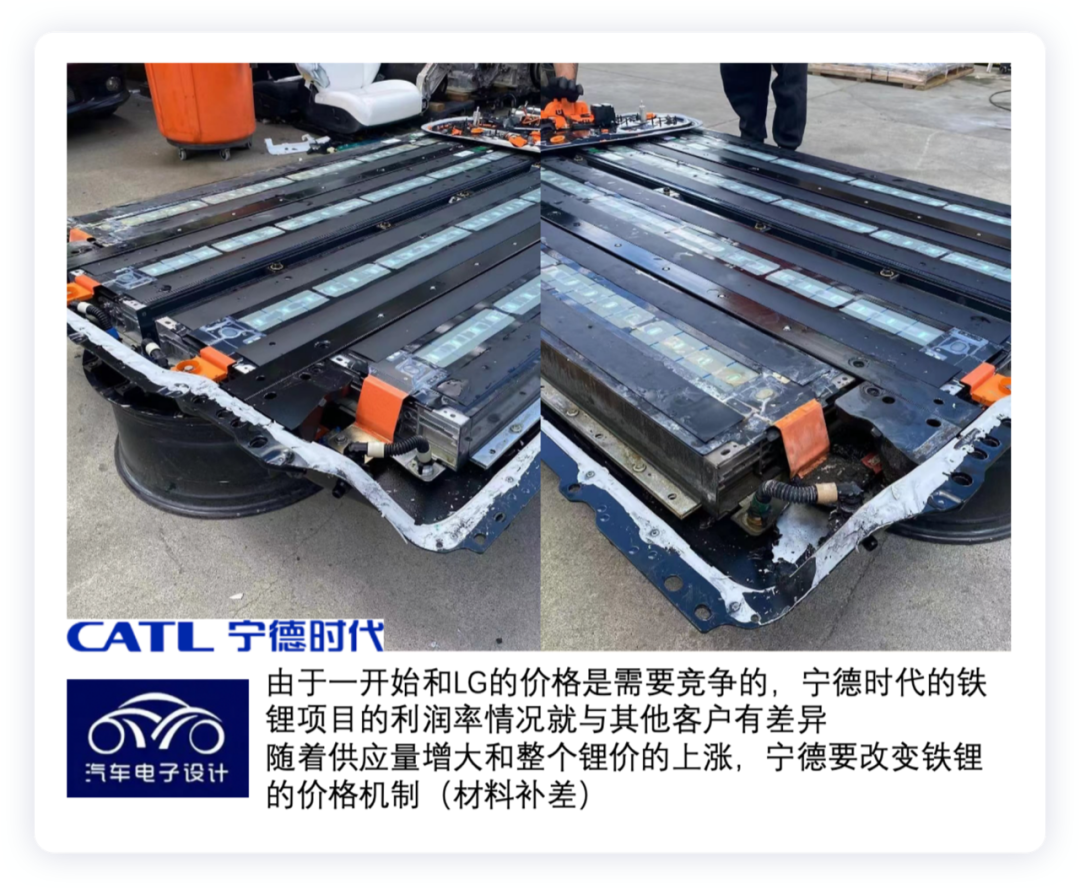

From a logical perspective, Tesla had the most bargaining power at Ningde, but it also consumed a large amount of batteries. If Ningde can’t transfer the raw material cost of the fabric battery, it will definitely affect the profit margin. This also led to the rationality of finding a lithium iron phosphate supplier from a purchasing logic.

What kind of product can BYD make for Tesla?

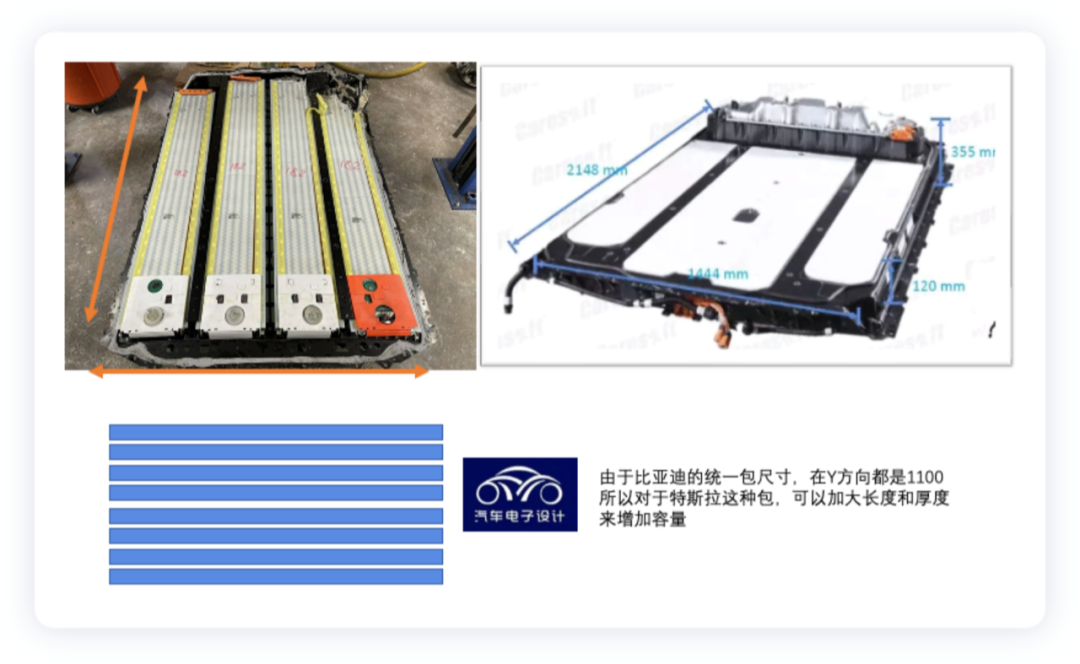

From the previous leak of information, there are issues such as importing factories (more complicated factory management), and issues with top management. However, we have seen the code C112F. What is this battery? From my point of view, the size of this battery is adjustable, depending on Tesla’s needs.

According to the current 96013.590mm specification, it can be inferred that the maximum capacity can be increased to 175-185Ah after adjusting the thickness and length, which means that if this battery pack is assumed to be 350V, the entire energy is between 61.2kWh-64.75kWh. According to Seal’s design, there is still some space when the height increases, which I think is valuable for Tesla.

According to the current 96013.590mm specification, it can be inferred that the maximum capacity can be increased to 175-185Ah after adjusting the thickness and length, which means that if this battery pack is assumed to be 350V, the entire energy is between 61.2kWh-64.75kWh. According to Seal’s design, there is still some space when the height increases, which I think is valuable for Tesla.

Summary: I think many things are not simply black or white. A lot of information has become a symbol of short-term market fluctuations in the secondary market. I prefer to think about Tesla’s considerations and balance in battery technology for longer periods of time.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.