Author: Tuantuanyuan

Recently, WM Motor has submitted an application for listing on the Hong Kong Stock Exchange and will be listed on the main board market. This is another new force in the car-making industry that is expected to be listed in Hong Kong, following NIO.

The prospectus of WM Motor shows that as of December 2021, WM has delivered a total of 83,400 vehicles, with 44,200 delivered in 2021 alone, a year-on-year increase of over 100%. With the increase in sales volume, WM’s revenue has also increased. In 2020, the total revenue was 3.446 billion yuan, a year-on-year increase of 63.30%, and in 2021, the total revenue reached 6.364 billion yuan, a year-on-year increase of 84.70%.

From the data, WM has already shown good performance in sales and performance. However, in the eyes of the outside world, with NIO’s successive listings and the more stringent scrutiny of the capital market on new energy automobile targets, WM still needs to give the market more confidence to successfully go public. Obviously, after seven years of honing, WM is ready. In this prospectus, WM has also fully demonstrated its technological achievements to the outside world, and it is not difficult to see its outstanding performance under the background of technological attributes, which has become the biggest certainty of WM’s listing.

Impacting Hong Kong Stocks, Dual-forwarding of Technology and Capital

Since XPeng Motors returned to the Hong Kong stock market in June 2021, the interaction between domestic new forces in the car-making industry and the Hong Kong stock market has become very active. After XPeng, Nio and XPeng Motors have also completed their secondary listings on the Hong Kong stock market. Now, WM Motor has announced that it will join in, making the Hong Kong stock market a new battlefield for domestic smart electric vehicles.

The reason for this is that the first generation of new forces in the car-making industry, represented by “NIO, XPeng and Li Auto”, has gradually entered the transition stage from the growth period to the stable period after many years of development. In this stage, although the enterprises have already had a certain market share, with the continuous improvement of users’ demand for intelligence, the investment required for technological research and development by enterprises has also increased. New forces need more stable and diversified financing sources.

Under this background, going public undoubtedly becomes the best choice for the new car-making forces to finance. In the context of the legal issues in the US market leading to a general coldness towards Chinese concept stocks, the Hong Kong stock market has become the best channel for new forces to communicate with the secondary market investors.

At the same time, in recent years, the Hong Kong Stock Exchange has also made great efforts to increase the proportion of technology stocks and is also open to high-tech investment targets. New energy automobile stocks are the perfect intersection of various intelligent technologies, which means that automobile stocks that truly “include technology” will be more easily recognized by the investment market.

Therefore, this application for listing on the Hong Kong Stock Exchange is actually a dual-forwarding choice between WM and the Hong Kong Stock Exchange.According to WM Motor’s prospectus, its R&D investment in 2019, 2020, and 2021 was RMB 893 million, RMB 992 million, and RMB 981 million, respectively, accounting for 50.7%, 37.1%, and 20.7% of the total revenue of the same period. The continuous high R&D investment may earn WM Motor recognition from many investors for its technological attributes, and under the continued R&D investment, the capital market also sees the clear trajectory of WM Motor’s technological moat being established.

“Teching to the bone”, building a technological moat by intelligentization

In fact, in the current new energy vehicle market, intelligent technology has gradually become the key indicator for valuation of new energy vehicle companies in the capital market, and this is precisely the biggest trump card for WM Motor. Since its establishment, WM Motor has been insisting on independent R&D and positive development, and has already achieved commercial landing of numerous forward-looking technologies in intelligent manufacturing, intelligent three-electricity, intelligent driving, and intelligent cockpit.

For example, in terms of intelligent driving, WM Motor has chosen to take two parallel paths, promoting the popularization of L2 level intelligent driving while launching L4 level autonomous driving products.

As early as 2019, WM Motor launched the L2 level driving assistance system Living Pilot. Through customized development of domestic road and driving habit environments, the system features the most L2 level intelligent driving assistance configurations in the same level in the EX5 model, achieving intelligent driving within the full-speed range of 0 to 130 km/h.

Regarding L4 level autonomous driving, WM Motor has chosen the “single-point breakthrough” model, starting with the pain point of parking, a high-frequency use but complex operation, and upgrading the system to the Living Pilot 4.0. As the first mass-produced vehicle with unmanned driving function in China in 2021, the WM Motor W6 is equipped with the Living Pilot 4.0 system and can achieve two kinds of unmanned autonomous parking functions, HAVP (unmanned memory valet parking) and PAVP (unmanned no-learning valet parking) at the L4 level. At present, WM Motor is the only new energy vehicle company to have landed L4 technology.

WM Motor’s attempts in intelligent driving go beyond this. In the flagship sedan WM Motor M7, which will be launched for mass production and delivery in the second half of this year, it will be equipped with four Orin-X intelligent driving chips with a computational power of 1,016 TOPS, the highest in the industry. It also has the most complete three fixed-state solid laser radar intelligent driving solution in the same level, achieving intelligent driving in the full-scene for the first time.

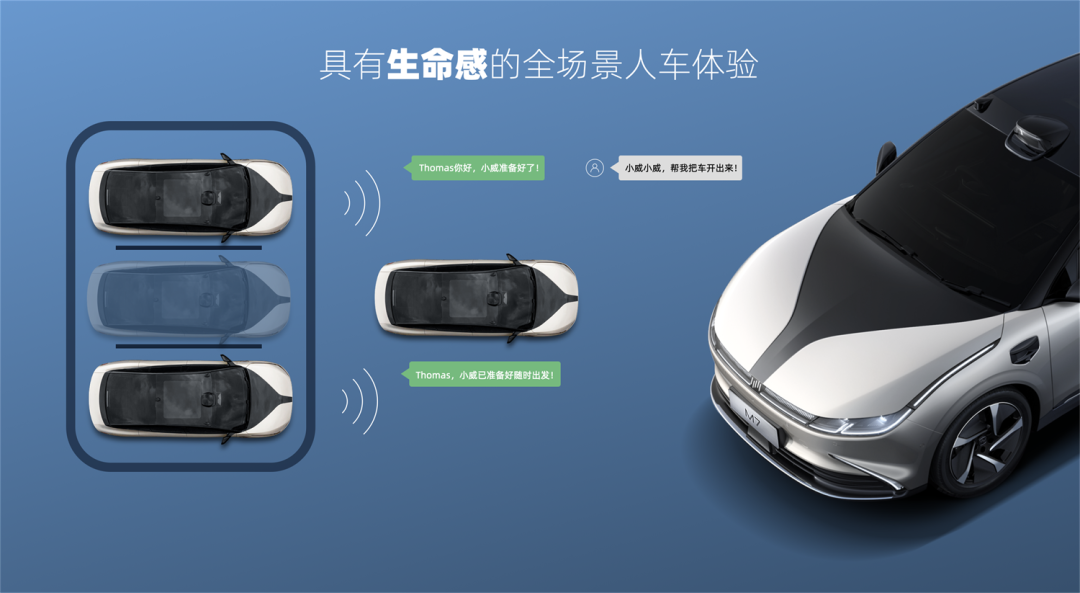

In addition to intelligent driving, intelligent cockpit is also a focus of development. Unlike the previous cockpit systems that simply incorporate a variety of intelligent technologies, Living Engine, the intelligent cockpit system developed by WM Motor, takes the actual application scenarios and demands as the starting point for cockpit functionality.

For instance, through the architecture of cross-domain integration, the SOA platform connects different domain controllers in the cockpit, allowing for modular and atomized function calling to give users the power to define their own custom cockpit layout.

At the 2021 Guangzhou Auto Show, the WM M7 showcased the Living Engine intelligent cockpit system based on the SOA architecture. This system adopts a “zero-button” cockpit design, with the exception of touch buttons on the steering wheel. Interaction is achieved through the central control screen, the i-Rota super instrument panel, and a customizable fabric display screen with SOA, along with AI-based visual perception technology, providing AI gesture recognition and FACE ID functions for an immersive experience.

Additionally, to support higher-level intelligent driving and intelligent cockpit functions, WM’s self-developed EEA4.0 architecture for “full car domain control + intelligent driving domain control + cockpit domain control + regional gateway” combines traditional, decentralized vehicle processing modules into a centralized computing platform with a high integration hardware architecture of control and regional control. This highly integrated EEA architecture can support higher-level intelligent driving and intelligent cockpit functions, allowing vehicles to complete high-level assisted driving functions even in extreme conditions.

Today, WM has clearly built its own intelligent fortress. It is worth mentioning that WM has also continuously increased investment in positive and independent research and development. According to the prospectus, the funds raised by WM’s Hong Kong stock offering this time will mainly be used for the research and development of new platforms and next-generation models, which will be continually invested in the accumulation of intelligent technology.

However, for the development of the industry, technology is only a major tool for improving automotive travel, and “technology for all” is its ultimate goal. Intelligent cars are not niche products. The company with a market value of more than one trillion dollars is not the one with the earlier and more advanced technology, such as Model S/Y, but the later, more universal Model 3/Y. Similarly, for independent brands, mass production capabilities guarantee subsequent deliveries, investment in intelligent technology ensures product strength, but capturing mainstream consumer markets and meeting their needs is the key to achieving the transformation from quality to quantity.The most fiercely competitive segment in the smart EV market nowadays is the 250,000 to 350,000 RMB price range, especially above 300,000 RMB, which attracts the strongest firepower and the best intelligent experience from self-owned brands, new forces, and traditional auto companies. However, for consumers, the largest demand group falls within the 150,000 to 250,000 RMB price range, accounting for nearly 20% of the passenger car sales. The vast potential consumers in this range also need smart EV products with strong product power and excellent intelligent experience. And the price range of 150,000 to 250,000 RMB happens to be the price range of WM’s current mass-produced models. So improving the intelligent experience in this price range and reducing the threshold of intelligence has naturally become WM’s trump card.

WM, which has played the “Technology for All” trump card, is also constantly enriching its product matrix. According to the prospectus, in 2023, WM will launch a brand new SUV, sedan, and MPV based on the C platform, achieving full coverage of all product categories and from A-level to B-level products, further solidifying its intelligent competitiveness in the new car-making field.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.