Author: Liang Zhihao

Wait for the victory of the party!

Last week, the policy of tax reduction and exemption that we reported on has caused a heated discussion in the comment section. As domestic new car sales continue to decline, in order to save the market, on May 23rd, during the State Council Executive Meeting, the government proposed to “periodically reduce the purchase tax of some passenger cars by 60 billion yuan”.

When this news came out, whether they were auto manufacturers, car buyers, or car dealers, everyone was excited. Major automobile stocks responded by rising, and our comment section was filled with people constantly asking for more details and specific implementation time about the policy.

And today, I can finally say it out loud: it’s here!

Yesterday (May 31), the Taxation Department of the Ministry of Finance of China released a document called the “Announcement on the Reduction of Vehicle Purchase Tax on Some Passenger Cars.” It mentioned that “for passenger cars with a displacement of 2.0 liters and below and a unit price (excluding VAT) of no more than 300,000 yuan purchased between June 1, 2022, and December 31, 2022, the vehicle purchase tax will be reduced by half.”

In addition to the two major conditions of “below 300,000 yuan” and “2.0L displacement or below,” to enjoy the half-price tax reduction, the vehicle must also be a passenger car with less than nine seats.

More relaxed conditions, wider range of models

Compared with the previous implementation of the half-price purchase tax policy, the conditions of this policy are more relaxed. For example, the displacement limit has been relaxed from 1.6L (inclusive) to 2.0L (inclusive), which means that more slightly advanced models can meet the conditions of this half-price tax reduction, and more advanced models also mean that the reduction will be greater.

Of course, the maximum limit of the subsidy is still restricted to “bicycles only” with a pre-tax price not exceeding 300,000 yuan. After all, in the present-day engine displacement shrinkage, many luxury cars have a displacement of only 2.0L. The government would not provide subsidies for luxury cars priced at 500,000 to 600,000 yuan, so this is understandable.

Before the new policy was implemented, if you bought a new car which costs exactly 300,000 yuan, you would need to pay a purchase tax of about 26,500 yuan. After the new policy, you will save about 13,000 yuan, and if you buy a new car with a price of 200,000 yuan after the new policy, you will save about 8,850 yuan.

However, it should be noted that the “single-car price of 300,000” is based on the taxable vehicle’s transaction price. Therefore, the terminal discount does not affect the policy. For example, if you buy a mid-lower-end Mercedes C-class model, although its bare car price may fall below 300,000 yuan after the terminal discount, it is still considered a “luxury car” priced above 300,000 yuan in the state taxation system, and it may not be eligible for the purchase tax halving policy. (Specifically, it depends on the purchase invoice of the 4S dealership.)

As for another frequently asked question in the background: Can I still enjoy this policy if I just purchased a new car or if the new car has not yet been licensed?

The answer is no. The announcement stated that vehicles that meet this purchase tax halving policy must have a unified motor vehicle sales invoice or customs duty payment book (for imported cars) issued after June 1. Therefore, if you have taken delivery of the car, you can no longer enjoy the policy.

People who received their cars at the end of May are estimated to cry…

Vehicle enterprises urgently follow up on this policy.

The introduction of this purchase tax halving policy can be described as lightning-fast. The guidelines were immediately released the next day after announcement, which reflects the exceptionally poor new car sales. According to the China Passenger Car Association, new car sales in China plunged in April, and the government really had to intervene.

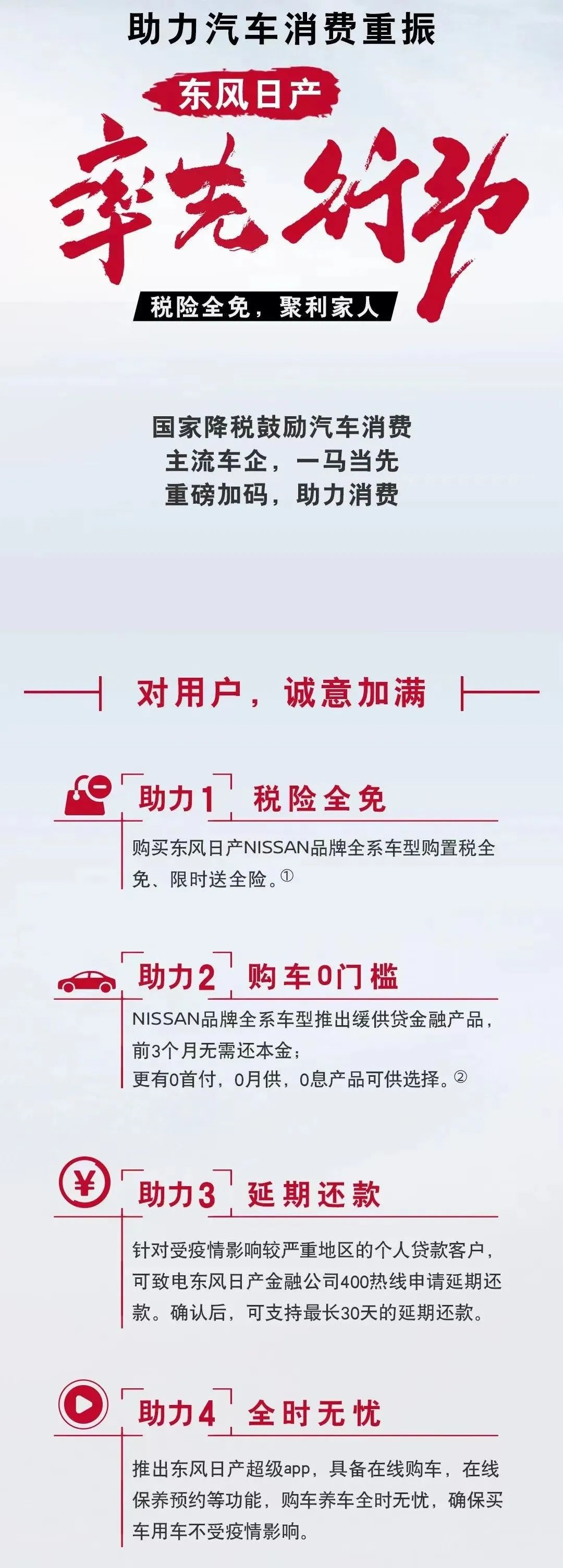

Encouraged by this “Visible Big Hand”, car companies have reacted quite quickly. Soon after the policy was announced, many car companies announced to follow the preferential policy. For example, Dongfeng Nissan announced that it will exempt all purchase taxes for all models except the new Qijun, and provide full insurance as a limited time gift.

And self-owned brands like Jetour and Changan have also announced various purchase tax reduction activities. Among them, Jetour provides an additional subsidy of up to 5000 yuan for the “Automobiles to Countryside” policy.

Speaking of “Automobiles to Countryside”, in order to further stimulate automobile consumption, MIIT issued a notice yesterday about launching the 2022 new energy automobiles to the countryside activity, which mentions that MIIT, MOA, MOFCOM, and NEA will jointly organize a new round of activities to guide rural residents to travel green.

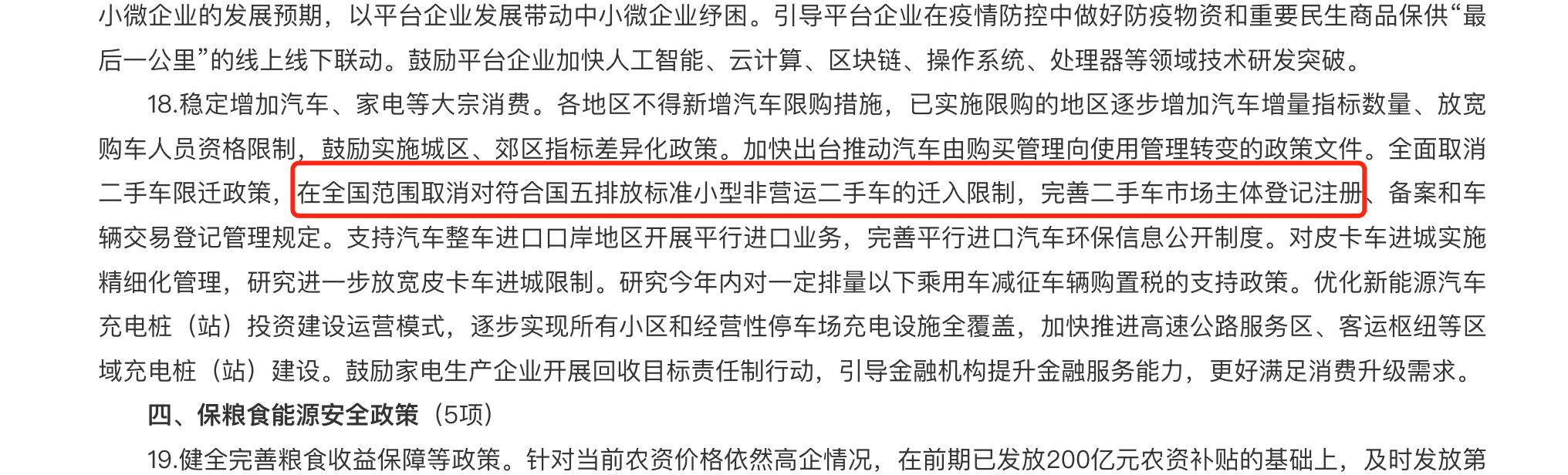

At the same time, in order to accelerate the circulation speed of existing cars and promote new car consumption, the policy of canceling the restriction on the migration of used cars with National Emission Standard V has been proposed again.

But don’t be too happy too early, because this policy is undoubtedly a big blow to the areas that have already implemented National Emission Standard VI. Therefore, the country also “left a hand” – the cancellation of the migration restriction for National Emission Standard V vehicles will be limited to non-“Areas with key air pollution prevention and control”, and as we all know, “Areas with key air pollution prevention and control” refers to the Beijing-Tianjin-Hebei, Yangtze River Delta, and Pearl River Delta regions, where plate and number restrictions and migration restrictions are most severe….

It is the best policy to do what you can.The feeling conveyed by the current halving of the purchase tax policy in China’s automobile industry is: “The more expensive the car you buy, the more you save”. However, let’s take this statement with a pinch of salt. Although this policy does have great appeal to many potential car buyers, no matter how much you save on purchase tax, it is still a negligible expense in the long-term of owning and using a car. As rational consumers, it is better to think carefully about our own needs and financial capability before buying a car.

After all, in a sluggish economic environment, “cash is king” is always true. If we buy a car just for the sake of buying it, and even have to take out a large amount of loan, then it is really not worth it.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.