Huawei Speaking Out Again

At the 2022 Guangdong-Hong Kong-Macau Auto Show, Yu Chengdong, CEO of Huawei Consumer Business Group, stated that the era of gasoline-powered cars will come to an end soon. Yu emphasized that if one still buys a gas car, it is like buying a feature phone in the era of smartphones. The last time we heard such clear and radical language was from a leading pure-electric new energy automaker.

According to previous information released by Huawei, the company’s positioning is a supplier of smart car components, aiming to create competitive products in key sub-fields such as car networking, car cloud, smart cockpit, battery management, and intelligent driving.

However, looking across the industry, few similar automotive parts suppliers have spoken so clearly in support of new energy vehicles. So, what is Huawei’s intention?

Huawei’s Car-Making Model

Let’s briefly review the journey of Huawei’s entry into the auto industry. Since 2019, although the time is not long, they have successively participated in the development of the Xiaokang Crossover SF5, the BAIC ARCFOX Alpha S Huawei HI version, the AITO WENJIE M5, and the AVITA 11.

When we put together these models, we find that Huawei’s level of involvement is not the same every time.

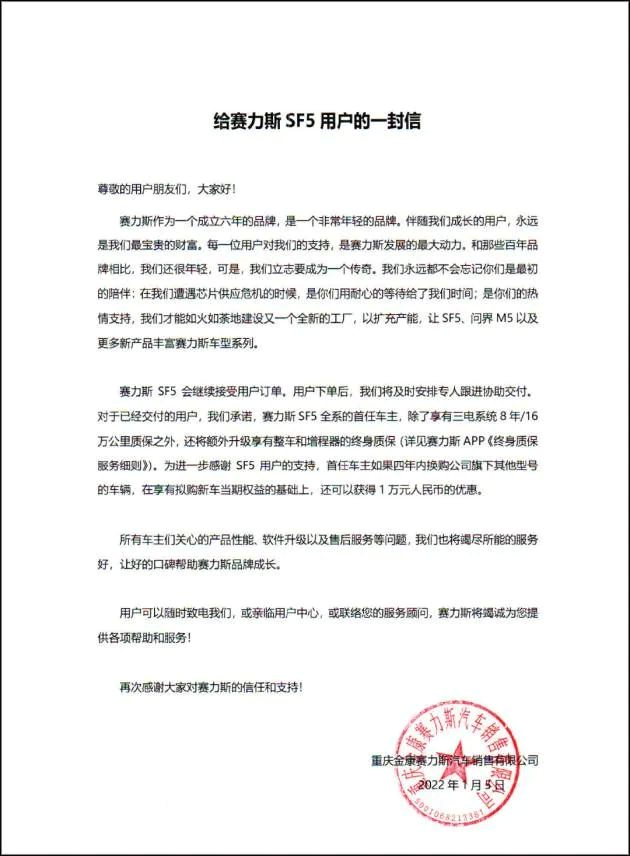

Xiaokang Crossover SF5 – Light Involvement

Huawei provides the HUAWEI DriveONE electric drive system, HUAWEI HiCar vehicle system, and HUAWEI SOUND sound system. The rest of the car is completed by Xiaokang.

BAIC ARCFOX Alpha S Huawei HI Version – Medium Involvement

The entire intelligent driving assist and cockpit system are built by Huawei, and the rest is completed by BAIC. The Alpha S Huawei HI version, which features three lidar sensors, was unveiled at the Guangdong-Hong Kong-Macau Greater Bay Area Auto Show. It is the first model to use the Huawei HI full-stack intelligent automotive solution and achieve advanced assisted driving in the city.

AITO WENJIE M5 – Deep Involvement

Huawei is fully involved in the design and manufacture of the WENJIE M5. Huawei provided support for the SF5 in terms of product styling, interior and exterior design, and brand marketing. Xiaokang is responsible for vehicle development, design, and manufacturing.

Arcfox Pro 11 – Heavily Involved

Based on the smart electric vehicle technology platform “C (Changan) H (Huawei) N (CATL)”, jointly developed by Changan Automobile, Huawei, and CATL. Huawei’s responsibilities mainly focus on intelligent auto digital architecture and 5 intelligent systems — intelligent driving, intelligent electric, intelligent cockpit, intelligent connected, and intelligent car cloud services.

The development roadmap of these models is very similar to “Jay Chou” and his “Secret” in the automobile version.

Musicians making movies have never been favored, but Jay Chou has musical literacy and boundless imagination, and his debut was a great success. Similarly, in the field of “cross-border” scripts, the automotive industry also has high industry barriers. But Huawei has received widespread praise for its automotive products thanks to the profound accumulation of information and communication technology. This trait was fully demonstrated in the Arcfox Pro 11.

However, at this stage, Huawei has only made an MV, and there is still a gap from making a movie. Fortunately, on the road of “cross-border car making”, ARCFOX has successively launched the ARCFOX Alpha S Huawei HI version, the WEY M5, and the Arcfox Pro 11. Looking at the relationship between these few models, Huawei’s car manufacturing is becoming more and more in-depth, and it seems more and more like they want to make their own cars.

What mode will Huawei finally choose?

Does this mean that Huawei will eventually embark on a road of independent car-making?

Strictly speaking, the above logic still has loopholes, because various modes do not have an absolute elimination relationship. Although the Xiaokang SF5 has experienced a brief stoppage, the official quickly dispelled doubts, stating that “the SF5 has not been discontinued or removed from sale, only the pre-sale has been suspended, and there is no vehicle source supply in the short term due to all delivery before the Spring Festival being sold out.”

So which one is Huawei’s ultimate choice?

Some people compare Huawei to automotive parts giant Magna. But if they plan to become a supplier of auto parts, they are too high-profile. As an auto parts giant, Magna can still make BMW, Mercedes-Benz, Jaguar and other automakers feel at ease in letting it produce cars on their behalf, and this is largely due to Magna’s low-key approach.

The most classic approach for auto parts suppliers is to have a high profile in the automaker circle but to keep a low profile and not seek publicity in the consumer circle, but this is clearly not “Huawei”.“`markdown

From an engineer’s perspective, my experience is:

Before the automaker changes its profit model and way of thinking, the joint development mode of Huawei and the automaker will encounter many problems. From an individual perspective, Huawei engineers may think that automaker engineers do not understand intelligent technology, and automaker personnel may think that Huawei does not understand car manufacturing. It is easy to encounter situations where both parties look down on each other, and there will be many fights at meetings.

Therefore, cooperation between the two parties must have a field of discourse with relatively balanced power, where both sides can respect each other’s professional capabilities. Huawei chose to cooperate with some brands that currently need to increase their voice and popularity, forming a complementary advantage to achieve a win-win situation to a certain extent.

In this regard, we have seen that Huawei has proposed the “HI Full-stack Smart Car Solution”, which is not as simple as providing parts for a car. If we compare a car to a person, it solves the problem similar to the human brain. We won’t talk about whether it has a soul or not, but it is definitely at the core.

This model is similar to an unfinished version of the Toyota model.

Speaking of Toyota, the Toyota Group has layouted three major parts suppliers in Japan Denso, Aisin Seiki, and Toyota Automatic Loom Works. They cover major automotive component technologies, allowing Toyota to have strong closed-loop capabilities for car manufacturing and also to let competitors gradually become dependent on them. It is said to be an unfinished version because Toyota is also a car manufacturing giant.

Having such great ambitions is naturally a good thing. However, as a company that has just entered the novice village, it is a long way to complete Toyota’s achievements.

At the present stage, I am more inclined to believe that this is a set of risk aversion strategies. There is more time to understand the automotive technology, not to put all the eggs in one basket. In the business of automotive investments that run into hundreds of billions, this is an excellent risk aversion method.

However, things have changed a bit for Huawei since the end of last year. For example, in a certain engineer group, they mentioned that they were recruiting professional engineers related to the car body. Although the recruitment statement is “working with the automaker, there must be a person in charge for each field,” delving into the subdivision fields of the car body (safety, NVH, car body accessories), it is evident that Huawei’s smart cockpit is not limited to the level of styling/interior design and is in-depth.

“`## Huawei Must Beware of Burning Out

Based on the recent news, there is some contradictory information regarding “except for traditional components such as the body and interior, Huawei participated in all key components of intelligent vehicles” and “Huawei may not want to make cars itself, but it will participate deeply.” Therefore, Huawei’s intention may be to participate deeply in the industry, whether or not it actually builds cars.

Whether it is building cars itself, designing and outsourcing production, or utilizing suppliers, there are successful and failed cases in the industry, which indicates that there is no right or wrong choice. However, what can be affirmed is that consuming too much passion is never a good thing.

So rather than discussing which approach Huawei should choose, we should also focus on the cards they hold. The technological advantages that Huawei is currently showing include:

- HUAWEI HiCar system for cars

- HUAWEI DriveONE electric drive system

- Intelligent driving system

- Automotive communication technology

These existing technological characteristics show that Huawei is keeping up with the pace of software-defined cars. The scope of Huawei’s blueprint is vast and beyond imagination.

However, we must be cautious as to how potent their technological blueprint will be. For example, Huawei’s ICA, ICA+ autonomous driving modes rely on high-precision maps, which have been demonstrated to be slow in map collection speed and controversy in data sharing on companies such as Here and Tesla.

Moreover, in late last year, Huawei proposed the wireless communication technology “Star Flash,” which is both a spotlight and a challenge.

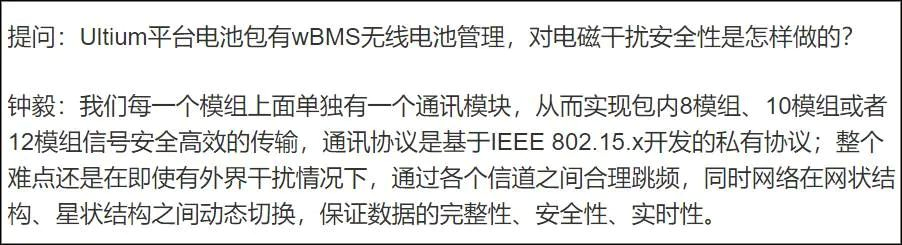

If “Star Flash” is implemented, it will be faster and more stable than Bluetooth and WiFi wireless connections. Its top applications in the smart car field include wireless battery management systems (wBMS), immersive in-car sound fields & noise reduction, 360-degree panoramic view, wireless interactive screens, etc.

This technology’s surprises are many. Last year, the General Motors’ wBMS technology caused quite a stir within the industry. According to the plan, Huawei will launch terminals in 2023. I look forward to their overcoming the electromagnetic signal interference problem at the level of automotive regulations and meeting the ASIL C (or even higher D) safety level requirements in the automotive industry.

In summary, Huawei has proposed many impressive technology plans, which, if realized, are indeed worth our enthusiasm. Therefore, I personally hope that Huawei will not be disturbed too much and focus on developing their technology.

Technology-based companies that enter the car manufacturing industry are rare, and one notable company is Apple. Compared with Apple’s hesitation, which has been limited to CarPlay and automotive patents for many years, Huawei is moving fast. Huawei took the route of parts suppliers at the beginning, which has relatively small risks and also provided time to become familiar with car manufacturing processes.

However, many cases directly demonstrate that it is not easy to both take the lead in critical technologies and avoid the high risks of car manufacturing. For example, Rivian, even with a major shareholder like Ford, announced at the end of last year that it would abandon its plan to jointly develop electric cars with Ford. The electric skateboard chassis technology they possess is quite remarkable and is also considered one of the important development models for future electric cars.

Therefore, in my opinion, I believe that Huawei’s main strategy will still be to manufacture their cars.

Of course, we can also consider an alternative, can Huawei follow the Toyota model?

That would be the ideal situation. However, Huawei clearly lacks the same profound accumulation and volume in the automotive industry. As for the future development, we will wait and see.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.