New Energy Vehicles Going to Countryside —— A New Marketing Initiative

Written by: Leng Zelin

Edited by: Wang Pan

Multiple departments announced a joint decision to officially launch a new round of New Energy Vehicles (NEV) going to countryside initiative today. The activity will be held between May and December 2022 in several cities, including Shanxi, Gelly, Jiangsu, Zhejiang, covering more than 20 automakers and over 70 vehicle models.

Among them, there are traditional car companies and new forces, and popular models include NETA V/V Pro, Leapmotor C11/T03, BYD Dolphin/E2/Qin Plus EV, Ora cat/hao cat GT, etc., all of which are mainly concentrated under ¥200,000.

NEV going to countryside has always been an important driving force behind domestic NEV sales. According to data from the China Association of Automobile Manufacturers (CAAM), cumulative sales of NEV going to countryside models reached 1.068 million in 2021, a YoY growth of 169.2%. In 2021, total sales of NEVs were about 3.5 million, of which NEVs going to countryside accounted for about 30%.

As the country’s new energy charging and replacement facilities are mainly concentrated in the southeast coastal and first- and second-tier cities, the rural market can still account for 30% of sales under the premise of unbalanced charging facilities.

However, since the beginning of this year, affected by upstream supply chain raw material price increases and other factors, the NEV market has seen a collective price increase, and the suspension in April has further burdened some car companies. Therefore, the national and local governments are also actively launching relevant policies to stimulate consumption.

In addition to the “NEV going to countryside” mentioned above, there is also “a phased reduction of 60 billion yuan in the purchase tax on some passenger cars”. NEV models are exempt from purchase tax, and this policy is mainly for fuel vehicles. However, local government subsidies are mostly focused on NEVs.

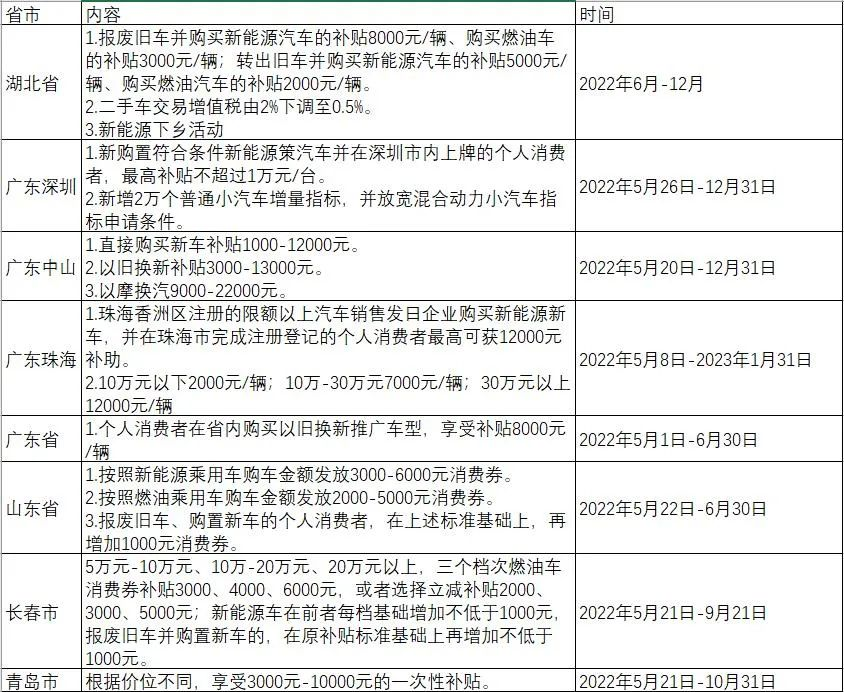

Guangzi Chuxing summarized the vehicle purchase policies of some provinces and cities recently, with subsidies ranging from ¥2,000 to over ¥10,000. Although most fuel and NEV models enjoy subsidies, the latter’s subsidies are relatively larger.

At the same time, in the 2022 national NEV subsidy policy, until the end of this year, the highest subsidy for pure electric models with a range of more than or equal to 300 kilometers and less than or equal to 400 kilometers (¥300,000 or less) is ¥9,100; for those with a range of more than or equal to 400 kilometers the highest subsidy is ¥12,600; and for plug-in hybrid models (including extended-range electric vehicles) with pure electric ranges of more than or equal to 50 kilometers under NEDC and WLTC ranges of more than or equal to 43 kilometers, the highest subsidy is ¥4,800.The combination of both can indeed qualify for a car purchase subsidy of up to 20,000 yuan, which offsets the increase in car prices to some extent.

As for the range anxiety issue, there is no need to worry too much. On the one hand, battery technology has become more stable in recent years, and the range of new models has been improved. On the other hand, the new infrastructure is also a focus of China’s economic development this year.

The new infrastructure refers to the 5G base station construction, new energy vehicle charging stations, big data centers, artificial intelligence, ultrahigh voltage and other related fields and industry chains.

The relevant policy measures issued today also clearly state that the investment, construction and operation mode of new energy vehicle charging stations (stations) will be optimized, and the full coverage of charging facilities in all residential areas and commercial parking lots will be gradually achieved, and the construction of charging stations (stations) in areas such as expressway service areas and passenger transport hubs will be accelerated.

Specifically, this year Chengdu will provide construction subsidies and operation subsidies to units with projects of charging and swapping facilities that meet the requirements.

Against the background of the grand infrastructure plan, not only the complementary energy system will be improved, but also fields related to vehicle-road collaboration, such as 5G and artificial intelligence, will experience rapid development. For example, Chengdu will complete the second phase of the intelligent transportation project and add 300 kilometers of vehicle-road cooperative demonstration roads by 2025.

Similarly, at the end of last month, the Intelligent Connected Vehicle Policy Pilot Area in Beijing also issued the “License for Unmanned Carrying of Passengers Testing”, allowing unmanned automatic driving passenger demonstrations on public roads.

However, most of the current autonomous driving schemes still rely on the intelligence of a single car. The main reason for this is that infrastructure construction is relatively slow. Obviously, with the current autonomous driving technology, single-car intelligence cannot achieve a full grasp and will also lead to the slowdown of the entire autonomous driving iteration speed.

Zhang Yaqin, academician of the Chinese Academy of Engineering and visiting professor of intelligent science at Tsinghua University, said in an interview: “Based on the industry’s general consensus, the safety requirements for autonomous driving must be at least one order of magnitude higher than that of human driving, reaching a level of 99.99999%. To achieve this safety goal, deep learning, vehicle-road collaboration technology are essential.”

In the context of the epidemic and the rise in the supply chain, automakers have generally been affected. However, this is not only a crisis, but also an opportunity.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.