Author|Nie Yiyao

In 2022, it will be the 12th year since Beijing implemented the car license plate lottery system to restrict car purchases. With the increasing demand for cars and the unchanged policy, the difficulty of getting a “Beijing plate” has been jokingly referred to by netizens as “harder than climbing to heaven.”

How difficult is it to get a “Beijing plate”? The data speaks for itself.

According to the statistics released by the Beijing Municipal Office of the Management and Control of Small Passenger Car Quota, during the lottery on December 26th, 2021 for fuel vehicles, the household winning rate was 0.0193, with 193 out of 10,000 applicants winning; the personal winning rate was astonishingly low at 0.0027, with only 27 out of 10,000 individuals winning, with odds lower than those of the Chinese lottery game “Double Colour Ball.”

Due to the difficulty of obtaining a fuel vehicle license plate, more and more applicants have turned to new energy vehicle license plates. After all, the rules for queuing for new energy vehicle license plates only require waiting for time, which is much more reliable than the fuel vehicle license plates that rely entirely on “luck” for the lottery.

To meet this trend and promote the development of new energy vehicles, the quota for new energy vehicles in Beijing has been increased by 10,000 in 2022, from last year’s 60,000 to 70,000.

On May 26th, 2022, the allocation results of the new energy vehicle quota for this year in Beijing were announced, and the 70,000 new energy vehicle quotas will soon be released. This is a joyous event for the winners and an opportunity for car companies. Given the characteristics of the Beijing market, are all major car companies ready to welcome these 70,000 Beijing customers?

Which vehicle models will enjoy the “Beijing plate” cake?

The reason for the restriction of car purchases in Beijing determines that the “Beijing plate” cake in Beijing’s car market will not be too big. However, from the perspective of the allocation characteristics and scarcity of new energy vehicle quotas in Beijing, as well as the overall consumption power, the quality and profit of the “Beijing plate” cake will be quite attractive.

This year, the allocation of new energy vehicle quotas in Beijing shows several characteristics.

Firstly, it pays more attention to “car-free families” in terms of allocation proportion. This year, the total quota for new energy vehicle family and personal allocation is 63,600, of which the family quota is 44,520, accounting for 70%, and the personal quota is 19,080, accounting for 30%.

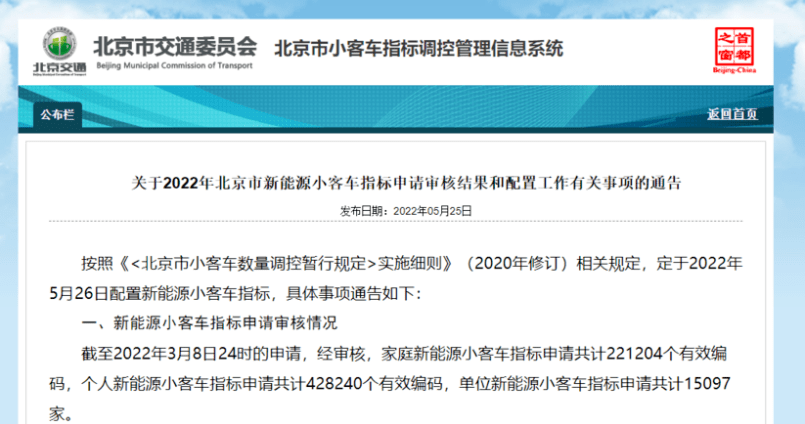

Next, the number of applications for both family and individual new energy vehicle license plates has significantly increased from the previous year. In 2021, the numbers of family and individual applications for new energy vehicle license plate allocation were 153,944 and 403,129 respectively. By 2022, these numbers have grown to 221,204 and 428,240. Thus, even with an additional 10,000 quota this year, the lottery ratio for new energy license plates is still “every 5 families compete for 1 quota” and “4 out of every 100 people win”. If calculated per 10,000 people, these figures are lower than last year.

Next, the number of applications for both family and individual new energy vehicle license plates has significantly increased from the previous year. In 2021, the numbers of family and individual applications for new energy vehicle license plate allocation were 153,944 and 403,129 respectively. By 2022, these numbers have grown to 221,204 and 428,240. Thus, even with an additional 10,000 quota this year, the lottery ratio for new energy license plates is still “every 5 families compete for 1 quota” and “4 out of every 100 people win”. If calculated per 10,000 people, these figures are lower than last year.

New energy license plates are becoming increasingly scarce and the waiting time for both families and individuals will only become longer. However, the demand trend is still growing.

From the above features, Beijing license plates are extremely rare, and many families without cars have a greater demand for them. Therefore, both individual and family customers will find it easier to purchase a car based on their own needs. Moreover, the budget for purchasing a car with the precious “Beijing License Plate” will correspondingly increase.

From the new energy vehicle sales in the Beijing market last year, models priced above 200,000 RMB were the most popular. In terms of brands, Tesla, BYD, Ideal, XPeng, NIO, GAC Aion, BAIC New Energy, GeometryAuto, and Volkswagen ID. series were more popular.

In terms of vehicle models, the top five new energy vehicle models sold in the Beijing market last year were Tesla Model Y, BYD Song PLUS EV, BYD Han EV, Tesla Model 3, and BYD Qin PLUS EV.

Ideal ONE, XPeng P7, and NIO ES6 followed closely behind. However, the Ideal ONE can only have a blue license plate in Beijing, indicating that extended-range plug-in hybrids and “dad cars” are also in high demand in the Beijing market.

This year, as major domestic and international auto brands and new entrants to the auto industry increase their investments in new energy vehicle research and development, a large number of mid- to high-end new energy vehicle models, including sedans, SUVs, and MPVs, have been launched. Consumers in Beijing, as well as China as a whole, now have more options. Although the 70,000 “Beijing License Plate” market is not large, car manufacturers will have to work harder to get a piece of the pie.

Are there enough charging stations?

In recent years, Beijing’s policy has heavily promoted new energy vehicles, especially electric vehicles. At the same time, how has the problem of charging stations and battery life been addressed?

Data shows that by the end of 2021, the number of new energy vehicles in Beijing has reached 507,000.

According to information released by the Beijing Municipal Commission of Urban Management, as of now, there are 230,000 electric vehicle charging stations and 159 battery-swapping stations in the city. The average service radius of public charging facilities for electric cars in the city’s plains is less than 5 kilometers.The above data shows that the current ratio of charging piles to vehicles in Beijing is 2.20:1, which is lower than the national average ratio (3.05:1). Generally speaking, the lower the ratio, the easier it is to charge. Therefore, the average ratio of 2.2 new energy vehicles per charging pile in Beijing is better than the national average charging experience.

However, many Beijing users still complain about problems such as “waiting in line for charging” and “difficulties in finding charging piles”. Where does the problem lie? Survey data shows that the public charging pile coverage rate in Beijing is very high, reaching more than 80%. However, the average utilization rate of charging piles in Beijing is very low, only about 25%, which means that 75% of the public charging piles are not used. At the same time, the time utilization rate of charging piles in Beijing is also very low, only 4.3%. On average, 95.7% of the time, charging piles are idle.

In fact, the proportion of DC fast charging piles in Beijing’s public charging piles is relatively high, and the proportion of direct current piles in the central urban area has reached 50%. This has tried to solve the problem of charging queues in terms of charging time.

Therefore, what needs to be solved as soon as possible is the problem of low average utilization rate of charging piles in Beijing, that is, the problem of mismatch between the distribution of charging piles and the demand for use in different regions. This problem needs to be improved.

In this regard, the “14th Five-Year Plan” planning outline of Beijing proposes to strive to build 700,000 charging piles and 74 hydrogen stations by 2025, and achieve an average service radius of less than 3 kilometers for public charging facilities for electric vehicles in plain areas.

A more intensive supplementary power facility network, coupled with more complete facility management, will be an important measure for the development of new energy vehicles in Beijing over the next three years.

Of course, the “14th Five-Year Plan” of Beijing also proposes to strive to achieve a cumulative ownership of 2 million new energy vehicles in the city by 2025.

By then, 700,000 charging piles will serve 2 million new energy vehicles, which will test the decision-making and ability of Beijing’s new energy vehicle charging and supplementary energy.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.