Translation

Author | Cold ZeLin

Editor | Wang Pan

As of now, three leading new energy vehicle (NEV) companies, namely Li Auto, XPeng, and NIO have released their Q1 financial reports and disclosed part of their short-term product plans during conference calls. Although NIO’s Q1 financial report has not been released, some insights into its future direction have already been revealed during conference calls and through other movements.

As representative players in the NEV market, these three companies have all experienced their own challenges and setbacks before finding their own position in the market. Therefore, their insights and understanding of the NEV market are relatively deep.

From the product plans of these three companies, we may gain an understanding of the short-term direction and changes in the NEV market.

XPeng

XPeng will introduce only one new vehicle model, the G9, which will be launched in Q3 2022 and enter mass production in Q4 2022.

Although the price of the G9 has not been officially announced, XPeng’s Hong Kong Stock Exchange prospectus last year has already indicated the approximate price range. The starting price of the G9 will be lower than that of the XPeng P7 Wing version, of which the current price is 386,900 yuan.

Of course, the gimmick of the wing version means more than its actual significance. The versions more favored by consumers are still in the 230,000-300,000 yuan range. Therefore, the G9 is considered the first model of XPeng to be priced in the 300,000+ yuan range.

In addition, XPeng’s CEO He XPeng revealed plans to launch a new model on a newly developed B-class and C-class platform respectively in 2023. A variety of models will form a complete product matrix covering the 150,000-400,000 yuan price range.

Looking carefully at XPeng’s current product line, the four digits 3, 5, 7, and 9 represent SUV models and occupy the highest and lowest price ranges offered by XPeng. The 5 and 7 represent compact and midsize sedan models respectively.

As the current P7 is the main vehicle model for XPeng, it is highly probable that the C-class platform would introduce a mid-to-large-sized sedan to complement the G9 in the 300,000-400,000 yuan range, while the B-class platform might launch a midsize SUV to balance out the gap between the G3 and G9, and further enhance the position of XPeng’s SUVs in the market.

Meanwhile, XPeng has already implemented various functions based on LiDAR, such as VPA-L, ACC/LCC-L, etc. These functions have been loaded onto the compact sedan P5. Although the P7 may be upgraded to be equipped with LiDAR in the future, new models will undoubtedly have more advantages.

He XPeng’s own words also support this assumption, “The combined capabilities of the two new vehicles far exceed the capabilities of two P7s.”## Vision

Although He XPeng did not specify whether this capability is about sales, intelligence, or something else, he has placed such high expectations on the new model that it should not be inferior to the potential of the P7 as a whole. This is in line with the overall brand upgrades and the target guidance of a 25% mid-term gross profit margin for XPeng Motors.

LiAuto

Li Auto also launched a new car, the L9, which is the second model in the entire product line and will begin deliveries in the third quarter of this year.

In addition, during Li Auto’s first-quarter conference call, Li Auto CEO Li Xiang mentioned that three new models will be launched in 2023, including a fully new energy-powered vehicle, the first pure electric vehicle, and a medium-sized product priced between 200,000 to 300,000 yuan.

Since Li ONE is priced at around 330,000 yuan, and the new L9 is priced at 450,000 yuan or more, it means that Li Auto has not covered the 350,000 to 450,000 yuan price range. Therefore, this extended-range product should be a mid-to-large-sized six-seat SUV that previously appeared in spy photos, and may be named the L7.

Combining with an Ideal product planning map that circulated on the internet last year, X01 corresponds to L9, X02 corresponds to L7, S01, and S02 should correspond to the first pure electric vehicle and a medium-sized product priced between 200,000 to 300,000 yuan, which also conforms to the Ideal’s iPhone product combination strategy of launching a popular product in each 100,000 yuan price range.

The latter two are probably both high-voltage electric products as well.

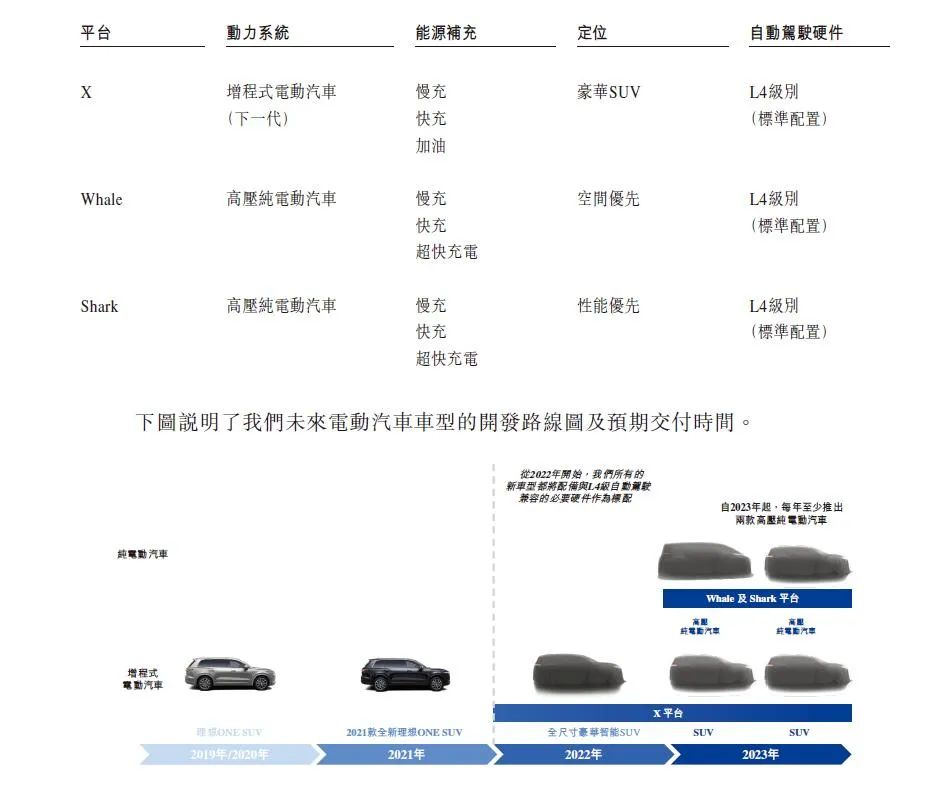

Ideal currently plans two high-voltage electric platforms, Whale and Shark. The former focuses on space, while the latter focuses on performance. Since the 300,000 yuan level already has the Ideal ONE, which is designed for family users, the 300,000 yuan level product should come from the performance-focused Whale platform. Meanwhile, the Shark platform is further exploring the 200,000 to 300,000 yuan price range, expanding the group of Ideal car owners.

After all, Li Xiang also stated in the conference call that by 2025, Li Auto’s core customers will still be families with children.

At the same time, as seen from the above analysis, Li Auto currently has no plans for sedan models.

If XPeng’s product planning is to invest in both SUV and sedan models in each well-defined price range, then Li Auto’s short-term planning should be summarized as investing in extended-range and pure electric models in each well-defined price range.

NIONIO’s product line is relatively complex. With the addition of the ET7, ET5, and ES7 models launched this year, there will be a total of 6 models available for sale, making this year a big year for NIO’s products.

However, on the one hand, the deliveries of ET5 and ET7 sedans have started while on the other hand, the introduction of the ES7 between the ES6 and ES8 SUV models has caused some disharmony in the overall product rhythm. The main reason is that NIO’s product launch rhythm was affected by the downturn in 2019. Therefore, it seems that the majority of NIO’s products are SUVs.

NIO’s product rhythm can be summarized as digging deep into the mid-to-large-sized SUV market while accelerating the capture of the sedan market share.

However, NIO has not yet revealed more about its product planning for 2023. But the sub-brand’s plan is progressing smoothly.

On May 10th of this year, the Hefei Economic Development Zone signed a cooperation agreement with NIO on the NeoPark New Bridge Smart Electric Vehicle Industrial Park Phase II and critical core component supporting projects, and will introduce new mid-to-high-end intelligent electric vehicle products under the NIO brand.

It was revealed that the brand will compete with car companies such as Tesla and Volkswagen. According to their pricing, NIO’s new brand is expected to be priced between CNY 200,000-350,000, which is consistent with NIO CEO William Li’s previous statement of USD 30,000-50,000.

In fact, the plans of these three car companies for this year are very similar. While continuing to explore existing markets, they are expanding outward. Whether it is XPeng’s B/C-level products, Ideal’s three new products, or NIO’s new brand, they are all targeting the CNY 200,000-350,000 price range. This market is a typical one that values cost-effectiveness.

According to China Passenger Car Association (CPCA) data, the penetration rate of new energy vehicles in April has reached 25.3%, which means that most early adopters and financially capable consumers have been covered. The average user will gradually enter the center of the new energy vehicle market.

Meanwhile, the replacement time for cars is relatively long. New energy vehicle startups want to further develop and not be caught up by traditional car companies, but they can never escape the mass market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.