Author: ZeLin Leng

Editor: Xianzhi Wu

Today, XPENG Motors released its first-quarter financial report data.

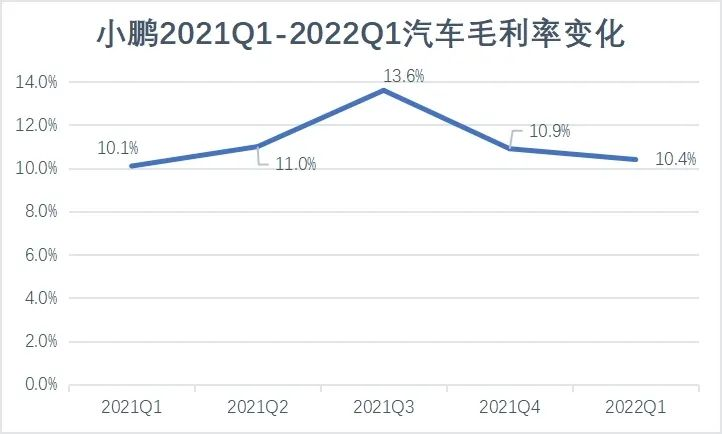

According to the report, XPENG’s total revenue for the first quarter was RMB 7.4549 billion, a year-on-year increase of 152.6%. Among them, the revenue from automobile sales in the first quarter was RMB 6.9988 billion, a year-on-year increase of 149%. The gross profit margin was 12.2%, which was the same as the previous quarter. The gross profit margin of the vehicle was 10.4%, compared to 10.9% in the previous quarter. The net loss for the first quarter was RMB 1.708 billion, an increase of about 116.2% year-on-year.

After the beginning of this year, the new energy market was not clear, and the subsidy policy was clarified as the last year for subsidies this year.

Compared with 2020, the new energy market has entered a high-speed growth stage. Most host factory vehicle gross profits have turned positive in the past two years, and the possibility of another delay was minimal. However, there have been recent media reports on the extension of subsidy policies under discussion by relevant departments. If policies can be implemented, it will be the best news for host factories since the beginning of the year.

However, the overall price increase of new energy vehicles and the unfriendly environment are undeniable.

Affected by the upstream raw material price increase, several car companies have adjusted their prices multiple times recently. XPENG Motors also increased its price twice in the first quarter under the pressure of the overall environment, while adjusting the overall number of vehicle models, hoping to stimulate consumer purchasing intentions through different vehicle configurations. Currently, the total number of P5/P7 models is as many as 32.

The last year before new car manufacturers are weaned does not seem to be peaceful, especially for XPENG, which was the new force champion last year.

In fact, among the suspended production and price increase trend of car companies, the most urgent speakers are XPENG Motors CEO He XPeng and Huawei Intelligent Automotive Solution BU CEO Yu Chengdong, one has a low gross profit margin and the other has just begun.

Hardware sales are blocked, and software fees are hopeless. Can XPENG G9 carry the burden this year?

Decline in Gross Profit Margin and Increase in R&D

Although XPENG Motors has maintained a good performance in the new energy market in the past year, its overall gross profit margin is still low among the three companies, including WM, NEO, and XPENG. The gross profit margin of WM in the first quarter is uncertain, but the gross profit margin of NEO’s vehicle continued to grow in the first quarter, reaching 22.4%.

XPENG’s overall gross profit margin in the first quarter was 10.4%, a slight decrease from the previous quarter, and still a considerable gap from WM and NEO. In the third quarter of last year, XPENG’s overall gross profit margin reached 13.6%. However, after the launch of P5 in the fourth quarter, the overall vehicle price was lower than that of P7, which lowered the overall gross profit margin to around 10%.The latest monthly delivery volume of XPeng P5 is 3564, accounting for nearly 40%. XPeng seems to have to rely on the higher-priced G9 to further improve its gross profit margin.

It is worth noting that since May 9th, the E/E+ version models of XPeng P5 and P7 have adjusted corresponding versions of intelligent assisted driving system software and upgrade services to standard configuration. Just a year ago, XPeng included XPILOT autonomous driving software into its revenue for the first time, creating revenue of 80 million yuan.

In the first quarter earnings conference call last year, He XPeng had high hopes for software realization: “I believe that the realization of XPILOT software will become our sustained income and profit source except for vehicle hardware sales.”

But recently, this prospect has become: “In order to popularize high-level intelligent assisted driving to more users, to speed up the development of intelligent driving, and to further expand the field of self-research…”

In the conference call, He XPeng believed that bundling hardware and software for charging is more effective, and may also consider charging according to time, mileage, software package + scenario service after launching higher-level automatic driving in the future.

This means that XPeng cannot expect to improve its gross profit margin and revenue through software in the short term, but the R&D investment that needs to be made cannot be reduced.

He XPeng once stated that XPeng Motors has accumulated R&D investments exceeding 9 billion yuan, and R&D investments in 2022 will exceed the sum of the past one or two years.

In the first quarter of this year, XPeng Motors’ R&D investment was 1.2213 billion yuan, a year-on-year increase of 128.2%. The total R&D investment of XPeng in the past two years was 5.84 billion yuan, which means that the average R&D investment for the next three quarters must be maintained at more than 1.54 billion yuan.

Although R&D expenses are generally on the rise, their proportion has been declining since the third quarter of last year, while XPeng’s sales expenses have consistently remained high.

The main reason for this is that XPeng’s market competition intensity is far greater than NIO and Ideal. Many models such as BYD Han, GAC Aion, and Tesla Model 3 have strong competitiveness in this market, and this trend of competition will become more intense with the maturity of the new energy market.

Apart from the recent BYD Hippo and Changan Shenlan C385, in the long run, NIO’s new brand and Ideal’s new models next year are also targeting this segment.

All of these force XPeng not to have obvious shortcomings in R&D and marketing.

Pursue high-end, reject cost-effectivenessLast year, XPeng completed its first ten-thousand-vehicle breakthrough for new forces and also rewrote the long-standing ranking of “We small vehicles”. Since then, it has achieved the lead for a long period of time.

It is worth noting that XPeng delivered 15,414 vehicles in March this year, and the delivery volume of P7 exceeded 9,000 units for the first time in a single month, and P7 also became the first new energy vehicle model to exceed 100,000 units in production.

In addition to the P7, XPeng’s P5 also contributed a lot to sales. Since its delivery began in the third quarter of last year, P5’s sales contribution to XPeng has rapidly increased, surpassing G3i in the first quarter of this year and accounting for 30% of XPeng’s delivery volume in that quarter.

However, the G3 series has not been prominent in XPeng’s product line all along, especially after the P7 appeared. For a while, in XPeng’s delivery volume tweets, the delivery volume of the G3 series was not mentioned directly.

On the one hand, from XPeng’s current product planning, it is in the rising stage of the brand. The G3 series has a lower pricing and belongs to an early model, and there is insufficient promotion of XPeng’s intelligent label.

On the other hand, at the end of last year, XPeng ended its OEM production model with Haima. The three models of P7, P5, and G3i are produced together in the Zhaoqing plant in Guangdong. As P7’s popularity remains high and sales rapidly increase, and P5 is the first model equipped with a lidar, it has important significance for XPeng’s XPILOT system iteration. Therefore, the production capacity that G3i can obtain is not as high as the other two models.

Currently, XPeng only has the Guangdong Zhaoqing plant in operation, with a planned annual capacity of 100,000 vehicles/year. The second-phase transformation has been completed and will be put into operation in June, while the Guangzhou and Wuhan plants will be put into operation at the end of 2022 and in 2023 respectively, which will ease this situation.

Although the sales volume of the G3 series is not high and cannot improve the overall gross margin, it still has strategic significance. On the one hand, product diversification is a relatively important indicator for mature car companies, otherwise they are prone to fall into the SUV predicament like Great Wall. Secondly, from the sales growth of waist-level forces, the current new energy market is getting rid of the “dumbbell-shaped” pattern and moving towards the center. G3i is one of the earliest model to occupy this position, which can make XPeng more flexible both up and down, which is beneficial for XPeng’s entire brand.- This year, same-level models such as NIO ET5, BYD Han DM-i, NETA S, Hippopotamus, and Changan Shenlan C385 have successively gone on sale. Following the law of the “hardware” equipment market, new models often have certain advantages, which may cause a certain impact on XPeng P7 and P5.

- However, unlike most new car-making companies, XPeng proves that sedans are its specialty. The new mid-to-large SUV G9 will be launched in June, with an estimated starting price of CNY 350,000, which exceeds XPeng’s upper limit and is a product that is relatively unknown in terms of brand and price range. Whether the brand and product have sufficient competitiveness still needs market validation.

- In the first quarter, XPeng has raised prices twice in a row. In January, affected by subsidy tapering, the after-subsidy prices of XPeng P7, P5, and G3i rose by CNY 4,800-5,400, CNY 4,800-5,400, and CNY 4,800-5,400 respectively. In March, affected by the continuous rise of upstream supply chain materials, XPeng raised prices again, with P7, P5, and G3i rising by CNY 10,100-32,600, CNY 13,200-15,600, and CNY 10,700-14,300 respectively. Recently, it also cancelled the rights of free charging and free charging piles.

- After multiple price increases in a row, will the consumer perception established by the newly-emerged new-energy market be broken?

- XPeng’s channel adopts a “direct sales + franchise” model. The rapid growth of XPeng’s sales last year was related to the rapid expansion of this model. The offline stores of XPeng grew by over 120% YoY last year. However, rapid expansion also exposes some management issues. Unlike Ideal and NIO’s full direct sales model, XPeng does not have 100% control over franchisees, and this uncertainty factor is also prone to problems in rapidly expanding organizations.

- In October last year, a XPeng dealership in Jiangsu Province was questioned to have “yin-yang contracts.” Consumers were asked to pay an additional CNY 7,000 for car delivery after they signed a purchase agreement and paid CNY 5,000 deposit. The sales manager of the store claimed that this involved new energy vehicle subsidy issues and stated that “this is a unified operation.” XPeng responded that “the misunderstanding of users was due to the unclear understanding of the relevant promotional policies by relevant personnel and will fulfill the contract commitment later.”Last year, Shanghai XPeng Automobile Sales and Service Co., Ltd., a subsidiary of XPeng Automobile, was fined RMB 100,000 by the Market Supervision Administration of Xuhui District for installing 22 face recognition cameras in five direct stores and two franchised stores from January to June 2021 to count and analyze customer flow data, violating relevant regulations.

In April of this year, XPeng Automobile was again fined RMB 3,000 by the Market Supervision Administration of Chaoyang District, Beijing for “suspected use of standard terms to restrict Beijing consumers’ rights to choose dispute resolution methods.” During the same period, news of “feudal superstition” activities at franchised stores was exposed.

These incidents reveal some flaws that have emerged in the rapid expansion of XPeng’s sales. However, as XPeng’s business is currently in a high-growth stage, all these problems are growth-related and not fatal. Once the sales growth stops in the future, as with Alibaba and Tencent today, all sorts of problems will be exposed. Fortunately, the entire new energy industry won’t end this high growth trend in the short term.

At a time when the entire industry is experiencing a certain low point, it may be a good opportunity to stop and review, eliminate roughness, and make up for shortcomings.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.