Author: Dayan

Recently, it is rumored that the joint venture vehicle of DJI and Baojun brand under SAIC-GM-Wuling, Baojun KiWi EV DJI version, is about to be delivered.

After DJI announced its entry into the field of driving assistance, the first self-developed driving assistance software system by DJI will soon be officially launched in the market and undergo market testing. For Baojun, with the support of DJI, the market appeal and intelligence level of relevant vehicles will undoubtedly be enhanced. For DJI, as its debut in the intelligent electric vehicle market, the first shot is of significant meaning.

Low-cost driving assistance functions become the biggest highlight

At the Shanghai Auto Show in April last year, Baojun KiWi EV DJI version was already debuted. The biggest highlight of this vehicle is that it comes with DJI’s intelligent driving controller hardware platform and system data closed-loop system, which can achieve Level 2 driving assistance functions, including adaptive cruise control, lane keeping, turn signal-controlled lane changing, intelligent obstacle avoidance, and autonomous parking functions.

From Baojun’s perspective, in the current domestic micro pure electric vehicle market, on the one hand, the same-door Wuling Hongguang MINI EV still has strong momentum, on the other hand, domestic independent brands, including Changan and Chery, have also entered the micro pure electric vehicle market under the influence of the MINI EV effect, making the competition in the entire sub-segment market increasingly fierce. In this situation, Baojun’s trick to reverse its sales slump is to deploy Level 2 driving assistance functions. By providing driving assistance products with lower entry thresholds to users, it will establish its own competitiveness in the micro electric vehicle market.

According to Baojun, currently, most domestic vehicles with driving assistance functions are priced at more than 150,000 yuan. Even if equipped with DJI’s driving assistance functions, we speculate that the price of Baojun KiWi EV DJI version will still be around 100,000 yuan with its current positioning and price. From Baojun’s perspective, with DJI’s brand and driving assistance system with higher cost-effectiveness as one of its selling points, it is not impossible to develop KiWi EV into a new popular vehicle. From the perspective of SAIC-GM-Wuling’s positioning, the higher configuration of Baojun brand than Wuling brand also helps to differentiate positioning between Baojun and Wuling brands, avoiding competition between products under the same company.

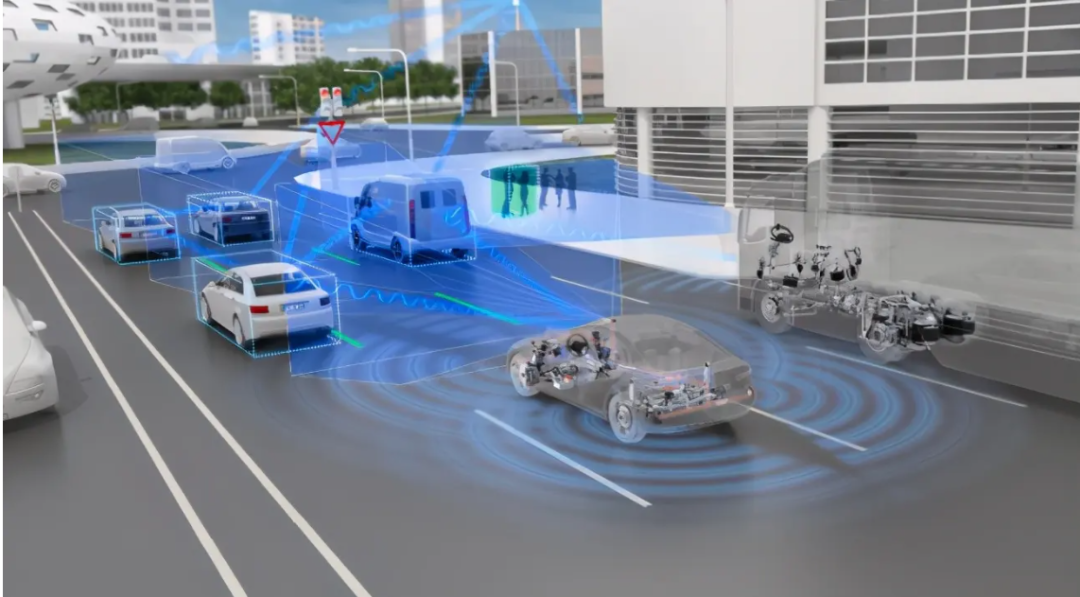

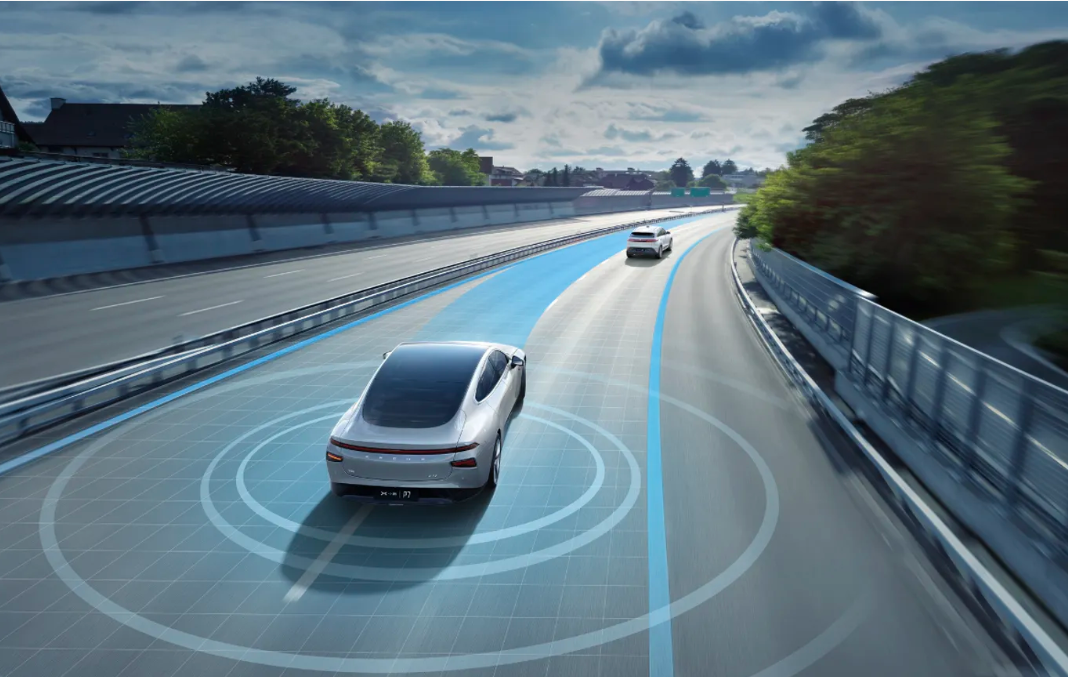

Creating a systematic driving assistance product systemIn the field of intelligent electric vehicles, DJI did not delve into car manufacturing. Instead, the focus is on developing driving assistant-related products. Their products are mainly adapted for urban expressways or highways. When entering the driving assistance mode, the vehicle can independently perform actions such as lane changing, overtaking, and entering or exiting ramps. For this reason, DJI has launched three products at once, namely the intelligent driving D80/D80+, intelligent driving D130/D130+, and intelligent parking P100/P1000.

From the naming convention, the intelligent driving D80 is a Level 2+ automatic driving system that can support speeds ranging from 0 to 80km/h. D80+ is based on D80 and added with a laser radar, driving behavior warning camera, and 4 panoramic (fish-eye) cameras to achieve a Level 3 automatic driving solution. As for D130/D130+, the maximum speed is adjusted to 130km/h, and P100/P1000 is designed for the last 100 meters/last 1000 meters parking scenarios.

It is worth mentioning that DJI has incubated a star enterprise called Livox Technology while developing their driving assistant system. Founded in 2016, Livox Technology specializes in solid-state LiDAR. The first domestically produced car model with a solid-state LiDAR used the HAP LiDAR owned by Livox Technology. With LiDAR-equipped new-generation intelligent electric vehicles becoming more and more popular in China, Livox Technology, which has already achieved mass production and installed products on vehicles, undoubtedly has a good prospects.

Start easy and progress gradually – DJI aims to achieve mass production

DJI has already accumulated a very strong foundation in the field of unmanned aerial vehicles. According to relevant data, DJI holds 85% of the global drone market share in terms of sales volume and has sales outlets in more than 100 countries and regions around the world.

For DJI, making driving assistant functions its next new battlefield has advantages in several aspects. On the one hand, on a technical level, driving assistant functions can be well connected with DJI’s existing technologies in unmanned aerial vehicle field. DJI’s perception, decision-making, planning technology, and intelligent hardware mass production capabilities can be seamlessly integrated into the driving assistant system. Compared to other companies that start from scratch in developing driving assistance/autonomous driving technology, DJI has a certain advantage in terms of development experience and cost control.On the other hand, the broad market prospect of intelligent electric vehicles is also very attractive. In the case of achieving a relatively high market share in the field of drones, intelligent electric vehicles can serve as the next business growth point for DJI.

Choosing mid-to-low-end models such as Baojun to directly enter the mass production market is a very wise move for DJI’s strategy.

Entering the automotive industry, the most important thing for DJI is the landing of products. Achieving a mass production project in a short period of time will still be of great help for DJI to obtain projects from other mainframe manufacturers in the future. In the case where L2 level driving assistance functions are becoming a standard configuration like ABS/ESP, combined with the huge domestic auto sales, the market prospect of DJI’s low-cost L2 level driving assistance system is still very broad. Achieving mass production as early as possible can play a positive role in spreading early development costs, as well as continuing to invest in research and development for future profits.

In addition, both driving assistance and high-level automated driving require accumulation of large amounts of data. The earlier mass production is achieved, the earlier relevant data can be accumulated. As all parties have reached an agreement that L4 level automated driving is a progressive process, in the future, algorithmic optimization and scene unlocking will still depend more on accumulated data. Deploying on mass-produced vehicles and operating a fleet to collect data are entirely conceptually different in terms of quantity.

Finally

As one of the few domestic technology companies that can achieve global leadership in their own advantage field, we indeed have reason to have greater expectations for DJI.

Outside of drones, DJI’s entry into the field of intelligent electric vehicles, relying on its technological accumulation in the field of drones, seeks greater breakthroughs and synergies in driving assistance/automated driving, in order to expand DJI’s territory. This may be DJI’s bigger ambition.

Looking at DJI’s actual operations, choosing an entry-level brand such as Baojun and building a low-cost driving assistance system fully displays DJI’s ambitions. From a larger perspective, for DJI, the Baojun KiWi EV is just a trial. DJI’s ambitions are probably no smaller than those of high-profile companies such as Huawei or other automated driving technology companies.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.