Wanbo sent from the copilot temple

Intelligent car reference | WeChat public account AI4Auto

BYD’s April sales performance was a bit surprising:

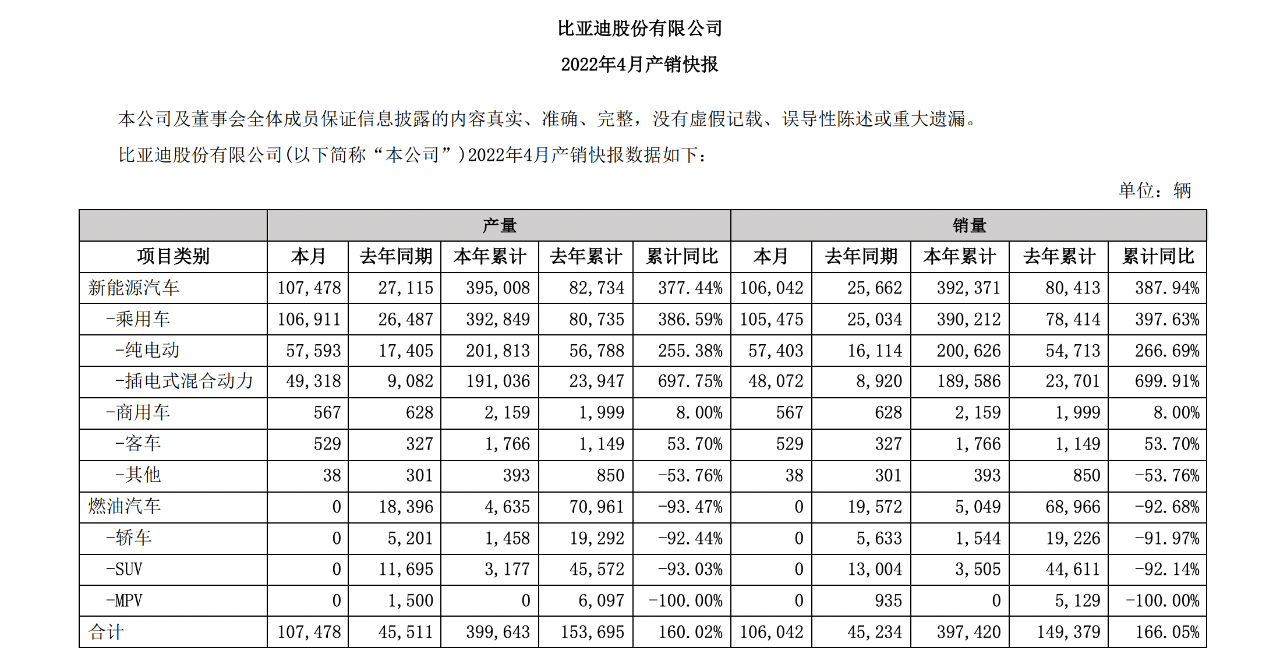

Sales of 106,042 vehicles, an increase of 134.4% year-on-year and an increase of 1% month-on-month, basically flat.

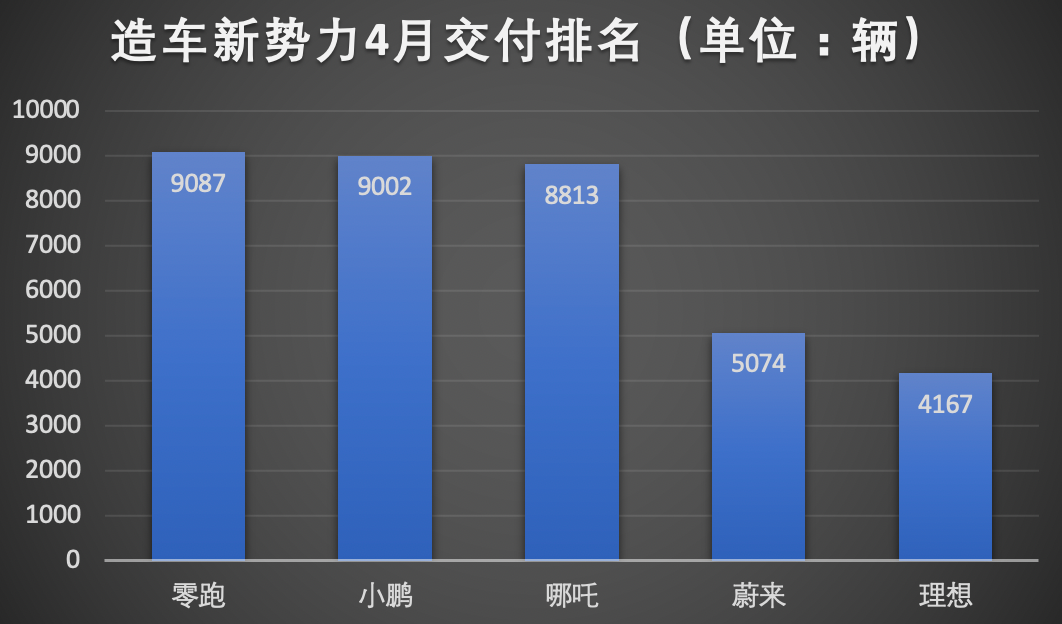

The reason why it was surprising was related to the “new forces in the automobile industry”. Affected by the epidemic, the new forces did not deliver many cars in April. The ideal car, which had the largest month-on-month decline, only delivered about 40% of the cars delivered in March.

Moreover, almost all of BYD’s models were leading in every price range in terms of sales performance in April.

So the question is clear:

How did BYD achieve sales growth against the trend during the epidemic?

Was BYD’s production and sales unaffected by the epidemic?

According to BYD’s production and sales report, the company sold 106,042 vehicles in April, an increase of 1% from the previous month and basically flat, and a year-on-year increase of 134.4%.

Among them, passenger car sales were 105,475, and pure electric passenger car sales were 57,403, accounting for 54.4% of passenger car sales.

On the production side, BYD produced 107,478 new vehicles in April, an increase of 1% from the previous month and a year-on-year increase of 136%.

From the perspective of growth, the data itself is not outstanding.

However, if the factor of epidemic prevention and control is taken into consideration, this level of production and sales has gained attention and discussion.

After all, just a few days ago, domestic new forces in the automobile industry simultaneously released delivery data, which all declined on a month-on-month basis. Especially for the leading new forces represented by NIO, XPeng, and Li Auto, the deliveries declined by about 50% and were severely hit.

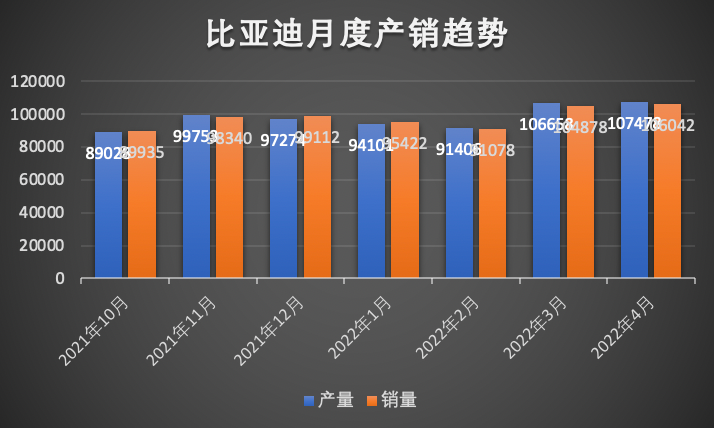

In contrast, BYD did not see a decline in both production and sales in April when the entire automobile industry was suffering from epidemic prevention and control and supply chain disruptions. Instead, there was even a small growth.

Combined with historical data, there is also a phenomenon:

BYD has the ability to cross the epidemic prevention and control period in terms of overall production and sales.

For example, in March of this year, an epidemic broke out in Shenzhen, where BYD’s headquarters is located. However, the company sold 104,878 vehicles and produced 106,658 vehicles in that month, both showing significant growth from the previous month.

And BYD’s another production center located in Xi’an also experienced an epidemic earlier, but from the data, the company’s production and sales were not affected much.

Under the epidemic situation, the supply chain of the automotive industry is unstable. However, BYD can still sit steadily on the summit.

How does BYD achieve this without being affected by the epidemic?

There are 2 reasons.

Firstly, BYD has a unique supply chain system. Those who are familiar with BYD should know that this company is not just an automaker.

In simple terms, BYD’s supply chain system is vertically integrated, and it can manufacture automotive components that it needs.

After entering the automotive industry, BYD began to lay out the entire automotive industry chain, from battery metal raw materials to automotive molds, IGBTs, and so on.

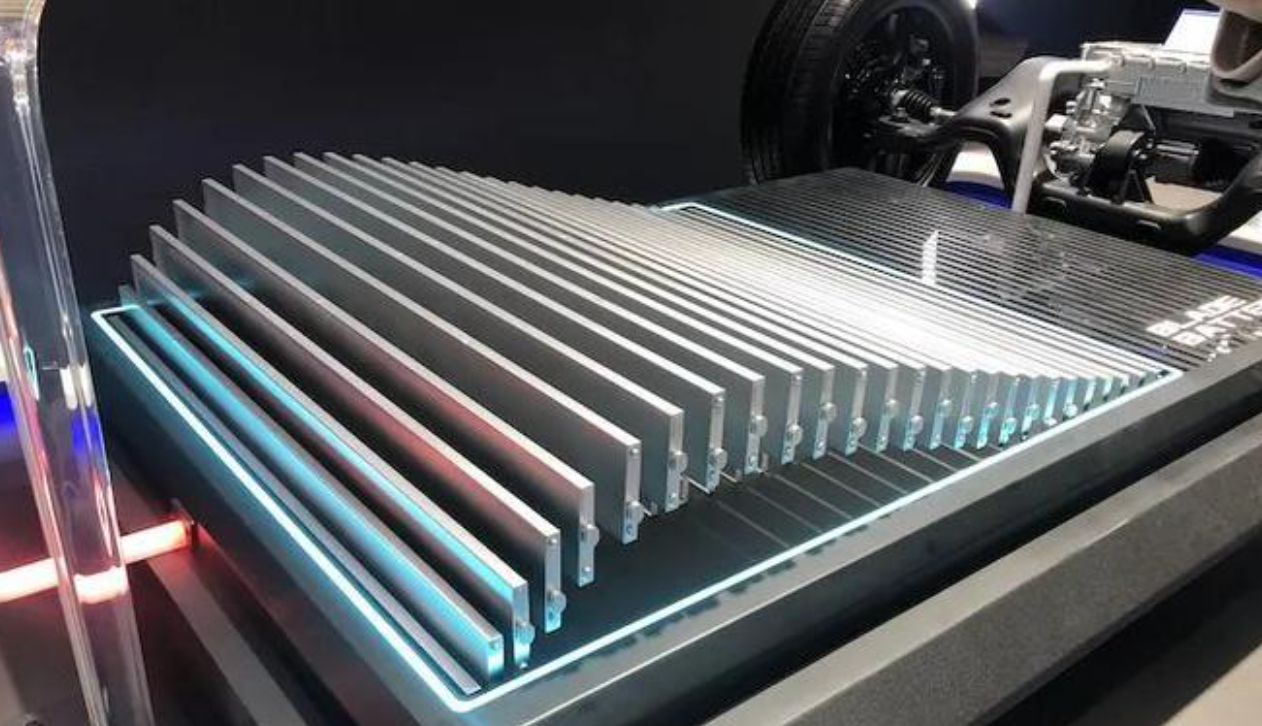

For example, the three core components of new energy vehicles: batteries, motors, and controllers, BYD has R&D and production capabilities, especially in the field of batteries. The blade battery, which is “never on fire”, has almost become BYD’s biggest label.

In the words of BYD’s founder Wang Chuanfu:

We can make batteries, motors, and controllers. Currently, there is only BYD in the world that can do all three.

In the field of chips, BYD established the Intelligent Control IC Department in 2002, and in 2020, it officially established BYD Semiconductor, whose main business is R&D and production of various integrated circuits including automotive chips.

You should know that when the auto industry talks about unstable supply chains now, it refers to the lack of chips and short supply of batteries, and BYD has its own R&D center and factories in these two most critical areas.

How extreme is BYD’s vertical integration?

The industry’s evaluation is: except for car tires and glass, BYD has almost all the independent R&D and production capabilities for core components.

Secondly, it is BYD’s industrial layout, that is, internal supply chain integration.

According to public information, BYD currently has 3 research institutes, which are responsible for R&D in the fields of electronic materials, automotive design, and energy storage technology.

On the industry side, BYD has established 7 industrial parks in China, integrating various links in automotive production, such as mold manufacturing and vehicle production.

For example, in BYD’s four major automobile production centers, Xi’an, Changsha, Shenzhen, and Changzhou, battery and chip factories can also be seen in these four cities or surrounding areas.This type of industry layout means that a small automotive supply system is formed by each automotive production center, and automotive components do not need to be transported across regions. That’s why it won’t affect the normal production of other factories even if a local area stops working due to certain factors, such as the shutdown caused by the COVID-19 outbreak in Shanghai. This also explains why BYD can maintain normal production and sales while the entire automotive industry is facing a supply chain crisis.

This model sounds familiar, doesn’t it? Yes, this is Tesla’s production model – from battery to the whole vehicle, everything is done in-house. By looking at it this way, it appears that Wang Chuanfu, the BYD founder, has already understood what Elon Musk regards as the “first principle” in production a long time ago.

One more thing

Lastly, let’s take a deeper look at BYD’s sales structure in April and discover the strength of BYD in the new energy vehicle field.

In terms of the sales of each model, if one word can be used to describe it, it would be “multi-blossoming.”

The BYD Song model family, with sales of 25,018 new vehicles in April, and the BYD Qin model family with sales of 23,520 new vehicles in April, together accounting for nearly half of BYD’s total sales, were the two models with sales exceeding 20,000 vehicles.

Sales of other models are as follows: 15,168 for BYD Yuan, 13,421 for BYD Han, 10,131 for BYD Tang and 12,040 for BYD Dolphin.

In terms of price, the BYD Tang is sold for around CNY 2 million, while the BYD Song is priced between CNY 1-2 million, the BYD Qin is sold for around CNY 1-1.5 million, and the starting price of both BYD Yuan and Dolphin is around CNY 1 million.

The high-end BYD Han is priced between CNY 2.1-3.3 million.

In summary, BYD has hot models with monthly sales of over 10,000 vehicles in the high-end market, mid-end market and the low-end market with a price of around CNY 1 million. According to data from insurance companies, the BYD Song, BYD Han, and the recently launched Dolphin all hold a lasting top-three ranking in their respective price ranges.

No other domestic automaker has reached this height except BYD. From this perspective, there’s no significant difference between BYD and Tesla, except for brand and intelligence perception. What do you think?

— Done —

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.