Introduction

As usual, in early May, the domestic new energy vehicle brands in China announced their sales figures for the month. Under the repeated impact of the epidemic in China, including the shutdown of the two major domestic vehicle and parts production bases in Changchun and Shanghai, the entire automotive supply chain faced significant challenges. This has added even greater uncertainty to the ranking of domestic new energy vehicle brands which have already been in intense competition.

Leading the Pack: LeadingTech

LeadingTech was undoubtedly the biggest winner in the sales ranking for April. According to LeadingTech’s sales data, it sold 9,087 units in April, which not only represented a year-on-year growth of over 200%, but also helped it climb to the top spot in the ranking of domestic new energy vehicle brands for the first time. Although LeadingTech did not disclose the sales figures of its individual models, its T03 micro-car undoubtedly contributed significantly to its overall sales, and the C11, which was launched last year, has also began to gradually increase its terminal delivery volume.

LeadingTech’s focus on more entry-level models has enabled it to be relatively less affected during the period of tight supply chains. However, when the industry chain is still unable to cope in the short term, LeadingTech’s position may change in the next month or two. For LeadingTech, its main goal for this year is to improve its brand strength and seek to list on the Hong Kong stock exchange, thus finding a reliable financing platform for future development. Judging from their performance of continuous 200% growth year-on-year for 13 consecutive months, its next move is definitely worth our attention.

NIO and Ideals need to work harder to overcome the impact of the epidemic

NIO and Ideals need to work harder to overcome the impact of the epidemic

Despite ranking third in April, NIO’s delivery of 8813 cars and a year-on-year growth rate of 120% are impressive achievements. However, the company has to admit that the epidemic has had a certain impact on NIO as well. Like LI, NIO’s products are more geared towards the entry-level market, making it easier to attract a large number of consumers. Among the five new forces, NIO and LI are the only two companies that have not yet been listed. Therefore, NIO, like LI, needs to quickly complete its IPO on the Hong Kong stock market as part of its corporate strategy. The flagship sedan, the NIO S, is expected to be listed this year, which could not only help reverse NIO’s low positioning and product image, but also potentially reshape the high-end sedan market for domestic new forces.

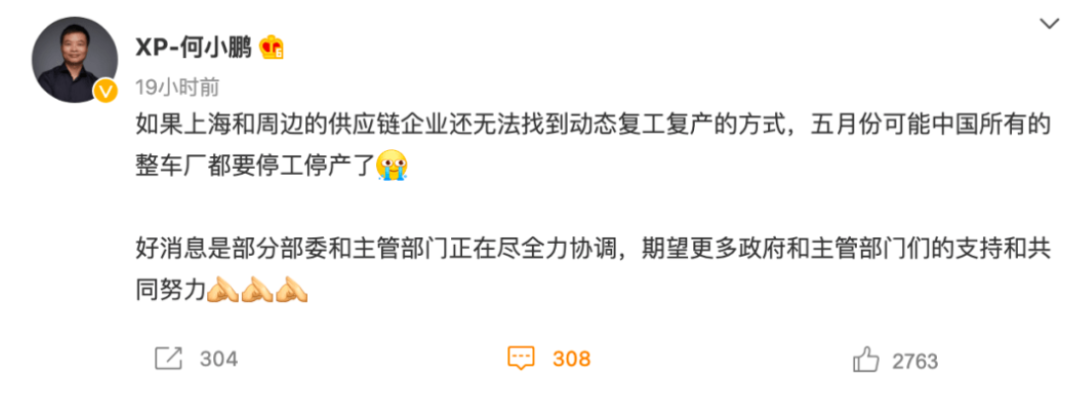

Pony.ai’s performance in April was moderate and there were no major problems. Although James Peng was the first person in China to raise concerns about how a failure to resume work in Shanghai could lead to disruptions in the national auto industry, the company delivered a total of 9002 cars in April, a year-on-year increase of 75%. However, with the depletion of parts inventory and the impact of the epidemic, Pony.ai’s production and delivery in April and May faced considerable difficulties. By vehicle model, the Pony P7 sold 3714 units, the P5 sold 3564 and the G3 series had a total sales of 1724 units.

This year is a critical year for Pony.ai, with the success of G9 being the key. Although Pony.ai’s R&D in Guangzhou has not been affected by strict lockdowns like those in Shanghai and Changchun, the company is not only concerned about the supply of parts in the later stages, but also about whether domestic car consumption can remain strong. If G9 sales are weak, the impact will not be limited to just one failed project.

Therefore, for domestic new forces like NIO and Pony.ai, it is even more necessary to overcome the impact of the epidemic, to increase investment in research and development, and to promote the development of smart electric vehicles.For NIO, its sales in April were somewhat disappointing, with only 5,074 vehicles delivered – a 28.5% drop year-on-year. It has been particularly impacted by the pandemic, with its Shanghai headquarters and research and development facilities, as well as the supply chain providing parts to its Hefei factory all having been shut down during the Long Yangtze River Delta outbreak. Unlike other startups, NIO is poised to launch several new products this year, including the ET7, ET5, and ES7 – all of which are based on the NT2.0 platform and will directly determine the company’s direction in China for the foreseeable future. Rumors have also circulated about a “betting agreement” between NIO and the Hefei government, making the impact of the pandemic on NIO all the greater. However, the one bright spot is that 693 units of the ET7 have been delivered, which is undeniably good news for NIO, which is currently in a difficult predicament. If the pandemic is not brought under control in time and it impacts the launch and delivery of the ET5, NIO’s situation this year is likely to deteriorate further, and founder Li Bin will need to plan for the worst.

Compared to other new energy vehicle manufacturers, IDEAL’s factory in Changzhou has also been hit particularly hard. In April, IDEAL delivered a total of 4,167 IDEAL ONEs, a year-on-year decrease of 24.7%. From the earliest chip shortages to the entire industrial chain today, IDEAL, which had high hopes of achieving the goal of delivering 10,000 vehicles per month with the IDEAL ONE, is now farther and farther away from its ambitious aspirations. In an environment where many brands including Landtu, AITO AITO, and NETA have all launched extended-range electric vehicles and with the cancellation of the green license plates slated for 2023, the sales prospects for the IDEAL ONE in the future are facing a significant question mark.

For IDEAL, the pandemic has also caused the planned launch event for the IDEAL L9 on April 16 to be postponed. As a full-size SUV, the IDEAL L9 is equipped with a 1.5T four-cylinder engine and a motor from the Great Wall Honeycomb Power, with a vehicle battery capacity of 44.5kWh and a comprehensive range of 1315km under full fuel and battery conditions.

With the goal of harvesting the last wave of China’s extended-range market by further enhancing the overall product strength, IDEAL is determined to succeed, but given the current situation with the supply chain in China, the company’s plan may still fall short.

Compared with the car sales situation in April, the sales data in May may be even worse. This is because the car industry in the Yangtze River Delta, including Shanghai, went through a month-long lockdown in April, and most vehicle manufacturers cannot prepare more than a month’s inventory of parts. In this situation, if the car industry, especially those second- and third-tier parts suppliers, cannot resume work and production as soon as possible, domestic vehicle manufacturers will face shutdowns in May. While we are paying attention to sales data, we also need to find ways to stimulate terminal demand. The decline in consumer power caused by the epidemic is a greater hidden danger than the decrease in production capacity. Compared with mainstream traditional car companies with deeper pockets, new forces in the car industry that have not yet emerged from the deficits are more eager to return to normal as soon as possible.

Compared with the car sales situation in April, the sales data in May may be even worse. This is because the car industry in the Yangtze River Delta, including Shanghai, went through a month-long lockdown in April, and most vehicle manufacturers cannot prepare more than a month’s inventory of parts. In this situation, if the car industry, especially those second- and third-tier parts suppliers, cannot resume work and production as soon as possible, domestic vehicle manufacturers will face shutdowns in May. While we are paying attention to sales data, we also need to find ways to stimulate terminal demand. The decline in consumer power caused by the epidemic is a greater hidden danger than the decrease in production capacity. Compared with mainstream traditional car companies with deeper pockets, new forces in the car industry that have not yet emerged from the deficits are more eager to return to normal as soon as possible.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.