Tesla’s 2022 Q1 Report Unveils Record-Highs Across the Board

Author: Rezz

On April 21, after the closing bell, Tesla unveiled its Q1 2022 earnings report. Here are the key takeaways from the report:

-

Revenue totaled $18.756 billion in Q1, exceeding expectations of $17.8 billion, and representing an 81% increase compared to the same period last year.

-

Automotive revenue was $16.86 billion, up 87% year-over-year.

-

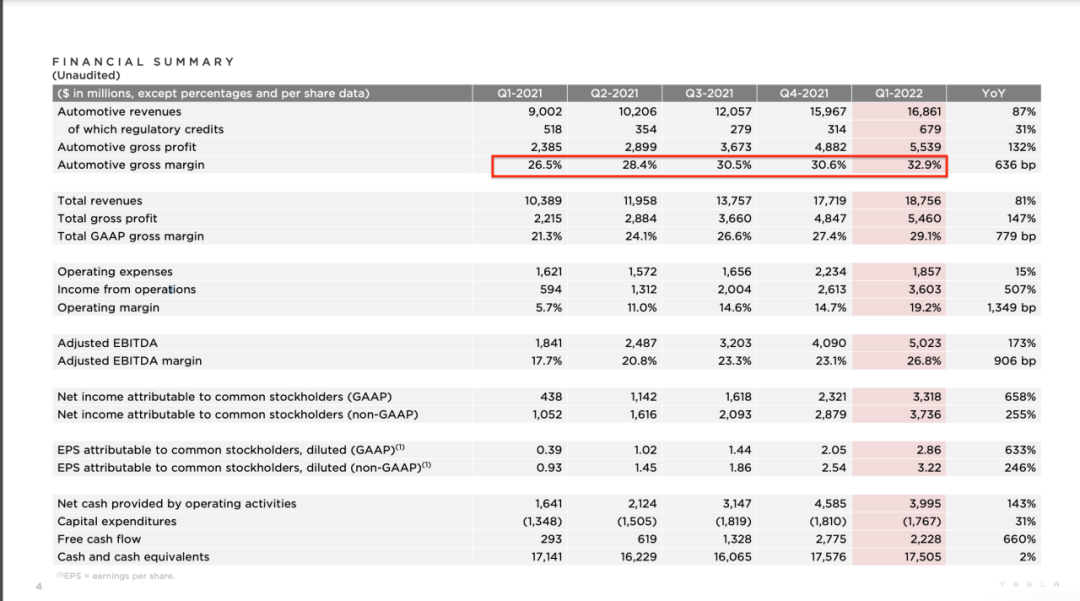

Gross margin for automotive sales reached a record high of 32.9%, while overall gross margin was 29.1% and operating gross margin was 19.2%. All three metrics reached historic highs.

-

Net income was $3.28 billion, a 607% year-over-year increase, compared to $464 million during the same period last year.

-

Net income attributable to common stockholders was $3.318 billion, a 658% year-over-year increase, compared to $438 million during the same period last year.

The most surprising figure is the red number in the chart below. Tesla’s automotive gross margin has been steadily increasing since Q1 of last year, growing from 26.5% to 28.4% to 30.5% to 30.6%, and now reaching 32.9% in Q1. This reflects Tesla’s ability to control costs and accelerate the “Matthew Effect”, making it more and more of a “money printing machine”. The only thing that can stop Tesla from making money at this point is itself.

It’s worth noting that Apple, which is considered a light-capital industry compared to automotive manufacturing, still manages a gross margin ranging from 30% to 40%. Considering that Tesla is a heavy asset industry that produces cars, reaching a gross margin that is close to Apple’s is already a remarkable achievement. Now we understand why Apple has been trying to enter the field of pure electric vehicles in recent years.

Production and Delivery

“Production increased by nearly 70% with a goal of achieving one-fifth of the annual target.”

Tesla also disclosed production and delivery data for the quarter:

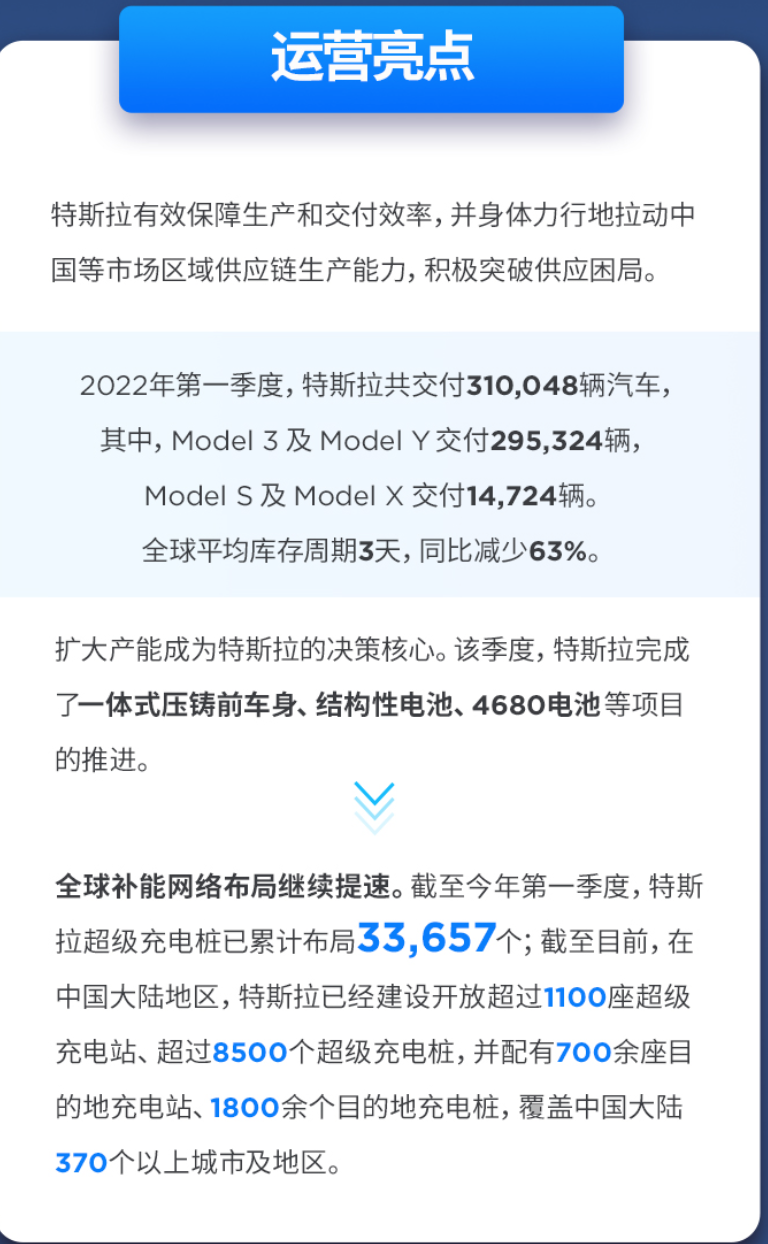

- Tesla delivered 310,048 vehicles in Q1, with Model 3 and Model Y accounting for 95% of deliveries.

-

Tesla produced 14,218 Model S and Model X cars in Q1, compared to none during the same period last year. Deliveries were 14,724 units, a 625% increase compared to the 2,030 units delivered during the same period last year.

-

In the first quarter of 2021, the production of Model 3 and Model Y reached 291,189 vehicles, showing a 61% increase compared with the 180,338 vehicles in the same period last year. The delivery number was 295,324 vehicles, up 62% from 182,847 vehicles in the same period last year.

Elon Musk said that Tesla is confident to grow by at least 50% on top of the 2021 production, reaching a production volume of 1.5 million vehicles. Due to the epidemic shutdown, the Shanghai factory lost about one month of output (about 60,000-70,000 vehicles).

Overall, Tesla’s total vehicle production in the first quarter was 305,407 vehicles, a 69% increase compared with the 180,338 vehicles in the same period last year; total vehicle deliveries were 310,048 vehicles, a 68% increase compared with the 184,877 vehicles in the same period last year.

Despite the good results, Tesla’s supply chain has silently lit up the red light.

Affected by the shortage of automotive semiconductors, port congestion and frequent power outages, rising raw material prices, and the Shanghai factory epidemic, Tesla’s global inventory turnover days were only 3 days in the first quarter, further shortening compared with 4 days in the previous quarter, and far below the industry average.

This has revealed the “problem” of Tesla’s high demand and short supply. Basically, it takes two or three days for each vehicle to be transported from the warehouse to the delivery center. Car owners who purchase vehicles directly choose to take the car immediately. The entire process is very fast, reflecting the efficiency of Tesla’s direct sales model.

Tesla said that the production speed of the newly built Austin and Berlin super factories will be affected by the successful launch of many new products and manufacturing technologies in these two new factories, and will also be affected by continued challenges related to the supply chain. Tesla pointed out that increasing plant capacity takes time and this is no exception for Austin and Berlin-Brandenburg factories.

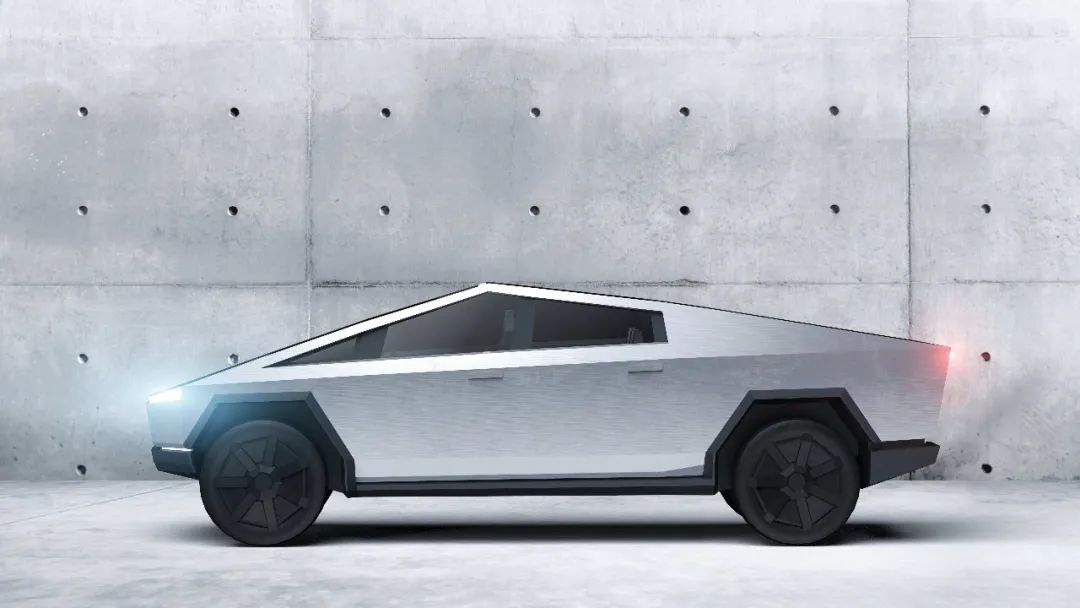

Tesla also stated that the company is making progress in the industrialization of CyberTruck electric pickup trucks, and plans to produce this model in the Austin factory, but before that, it needs to increase the production of Model Y vehicles.

In terms of automobile production, Tesla announced plans to quickly expand its manufacturing capabilities. The company’s delivery growth target remains unchanged for the next few years, with an expected annual growth rate of 50%, which will depend on equipment capacity, operational efficiency, and supply chain stability. With the supply chain being the main limiting factor, Tesla’s own factories have been operating at less than full capacity for several quarters, and this situation may continue into the remaining months of 2022.

As for the production ramping ability of the Berlin-Brandenburg factory in Germany, Musk’s confidence is good, but it remains to be seen and should not be too optimistic. Musk himself answered investors that it would take at least 9 to 12 months for the new factories to reach their peak production capacity, and it usually takes 12 months for Tesla’s new factories to reach the production capacity of over 5,000 cars per week. It’s also unknown how much the recently opened Texas Austin factory, which began mass production of the first 4680 battery Model Y on April 7, 2022, will contribute to the remaining 1.2 million production volume in the next 9 months.

As the main production base of Tesla, the Shanghai Gigafactory has now reached an annual production capacity of 750,000 vehicles after undergoing production line transformation that began at the end of last year. It’s a crucial time for Tesla to make a splash. However, the three-week shutdown starting on March 28 has raised questions about the production capacity of the Shanghai Gigafactory in Q2 or even the whole year.

During the Q&A session with investors, Musk himself remained optimistic about the impact of the Shanghai factory shutdown on Q2 and the possibility of achieving a production volume of 1.5 million vehicles throughout the year.

If the backlog of domestic Tesla orders continues to increase, I feel that many consumers who are waiting for their cars may turn to other new energy vehicle brands. After all, the competition in the Chinese new energy vehicle market is becoming more intense, and consumers will consider more factors when choosing cars. With the price and waiting time both on the rise, many people will slow down and carefully consider the car-buying process, thus becoming more rational.

Price hikes and sales growth coexist

Regarding the rise in raw material prices leading to a full range of price increases, the financial report also explained: “Tesla hopes to stop further price increases. The current prices have already taken into account the expected increases in supplier and logistics costs. If the costs do not rise, the prices may be slightly reduced“.

In other words, the continuous price increase within the past week is a prediction of the cost increase within the next eight months, and the gross profit margin can still exceed 32%. If raw material prices do not rise, it will still be easy to lower prices back and continue to “kill” the market.

It can be said that Tesla’s decision to control the cost of the supply chain is a perfect embodiment of Musk’s “great wisdom” in anticipation.

I noticed that domestic orders for Tesla Model 3/Y are already six months in waiting. If raw material prices stop increasing and the official website can further reduce prices, along with the supply of European markets from German factories to relieve the export supply pressure of Shanghai factory, maybe monthly sales in China will reach 60-70,000 in the second half of this year, which is a terrifying domination level.

Of course, price reduction is just my and many consumers’ wishful thinking. After all, unless Tesla’s production far exceeds the number of orders, they will not deliver even the orders with a waitlist of five to six months after the price increase. How can they allow consumers to get the updated 4680 version at a cheaper price as soon as possible?

Future Forecast of Technology

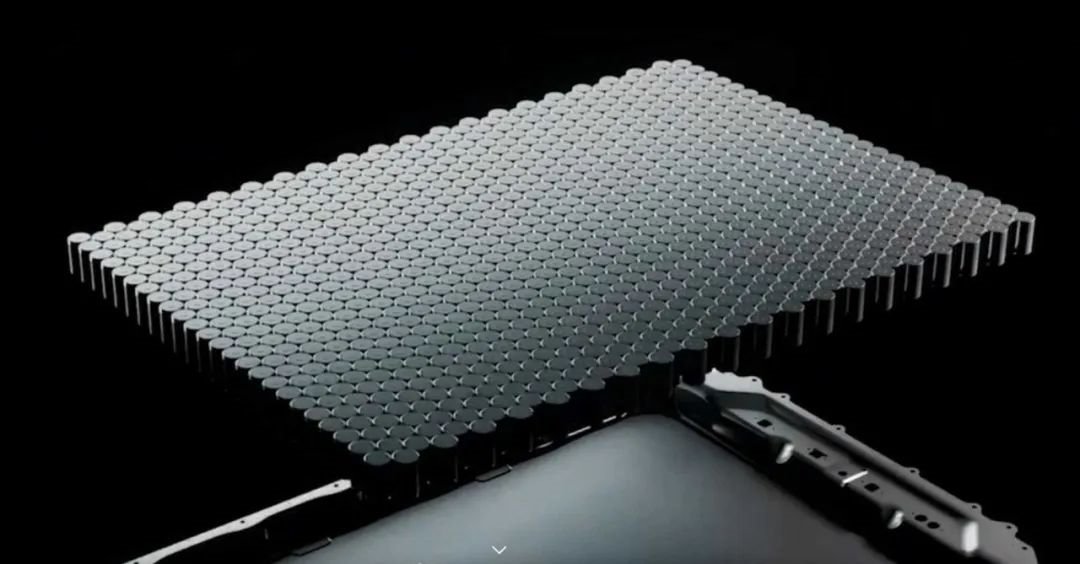

4680 Battery

In the financial report, Tesla stated that it will take several more years to develop Model 3 using the 4680 battery. The 4680 battery will reach the best level of existing products in the market later this year and surpass all market batteries next year. This month, American consumers can buy the Model Y with a 4680 battery, which is undoubtedly great news for consumers without an increase in price.

800V High Voltage Charging800V requires a certain amount of body volume. In small cars, the advantage is small and the cost is high, so Tesla is considering using 800V voltage for Cybertruck and Semi trucks. Tesla also predicts that switching from 400v to 800v can only save $100 per vehicle, so it is not a technology change that companies consider worth doing; the advantage is small but the cost is high. It requires a large number of new energy vehicles to be worthwhile for development, which is currently not yet widespread. However, in the long run, I think it is still necessary.

Environmental reuse

Tesla will recycle aluminum cast wheels from traditional gasoline cars and throw them into the furnace to produce the aluminum cast body of Model Y.

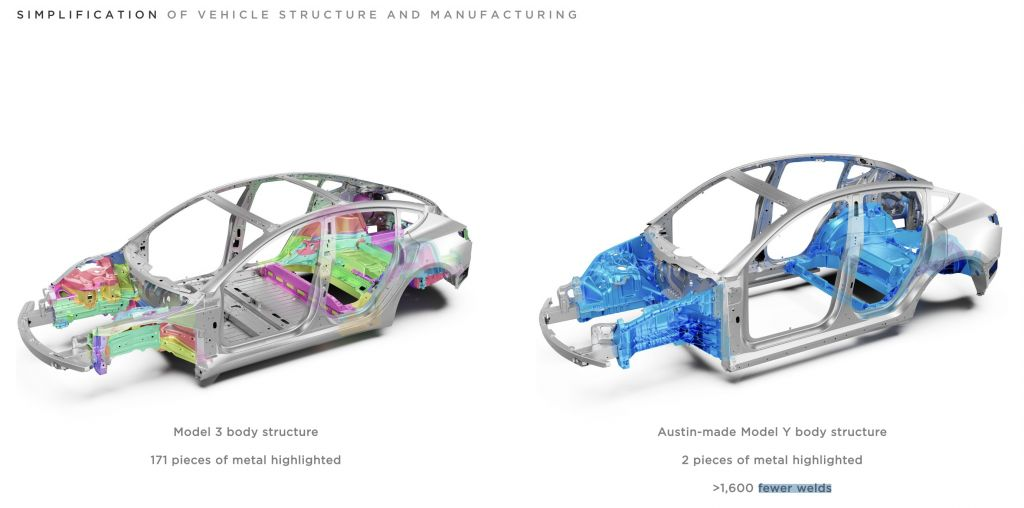

One-piece casting

The effect diagram of the one-piece casting of Model Y’s front and rear bodies produced by the Berlin factory is as follows. Compared with Model 3’s 171 parts, Y has one casting part before and after, reducing 1,600 welding points. It can be seen that Tesla is using more and more one-piece casting machines. The Model Y produced by the Shanghai Super Factory previously merged 70 parts into one, and the one-piece casting machine of the Berlin factory merged 171 parts into one. The future Cybertruck will have 25-30% fewer parts than traditional pickups.

Cash flow and Twitter acquisition

Regarding cash flow, Tesla Motors stated that the company has sufficient liquidity to provide funds for its product roadmap, long-term capacity expansion plans, and other expenses.

As expected, with such a high profit margin and continued growth, Tesla and Musk are increasingly becoming synonymous with financial strength. This can also explain why CEO Musk made remarks a few days ago, claiming that he could bid $43 billion to acquire Twitter, with the only purpose being to save an annual “director fee” of $3 million.

Here, all we can say is, it’s good to have money!Looks like Musk has intentions not only to expand Tesla’s production capacity and super factories, but also to expand its business territory. The joke about purchasing Twitter just to save on board fees seems just that – a joke. If Tesla were actually successful in a competitive bid to purchase Twitter, then it’s likely that the company could save more than $3 million in marketing costs. In terms of investment judgment, I choose to believe in Musk.

Who Can Compete with Tesla

Tesla has stated that although it is continuing to implement innovation to lower manufacturing and operating costs, over time the company expects its hardware-related profits to accelerate along with software-related profits.

In other words, Tesla’s automotive hardware gross profit margin will not remain stagnant at 32.9%. What we can expect is where the ceiling for the electric vehicle industry’s (EVA) gross profit margin is going to be set by Tesla.

Previously, XPeng Motors only dared to say that they would strived to achieve a 25% vehicle production gross margin rate by 2025. Therefore, 32.9% is already a very terrifying number that demonstrates the scale of Tesla’s profit margin and earning ability.

Of course, Musk is ultimately a businessman rather than a philanthropist. As profit margins continue to rise, Tesla has chosen to increase prices, leaving room for fluctuation in future prices of raw materials. As to whether prices can be reduced to the lowest level of 2021 this year, I think it depends on whether domestic new energy vehicle companies can withstand the pressure and whether Tesla can fight back.

After all, when subsidies end at the end of this year, even the cheapest Model 3 model from Tesla will exceed 300,000 RMB, and consumers will still have to bear the cost. Because there is still no domestic electric vehicle on the market in the price range of 300,000 to 400,000 RMB that can defeat Tesla in all aspects of product performance. This will make Tesla more and more confident in harvesting the wallets of more consumers.

So, I hope that our domestic new energy vehicle companies can bring more high-quality products, such as the long-awaited Chang’an Shenlan C385, BYD Hippopotamus, NETA S and other new cars that compete with the Model 3, to restrain Tesla’s momentum.

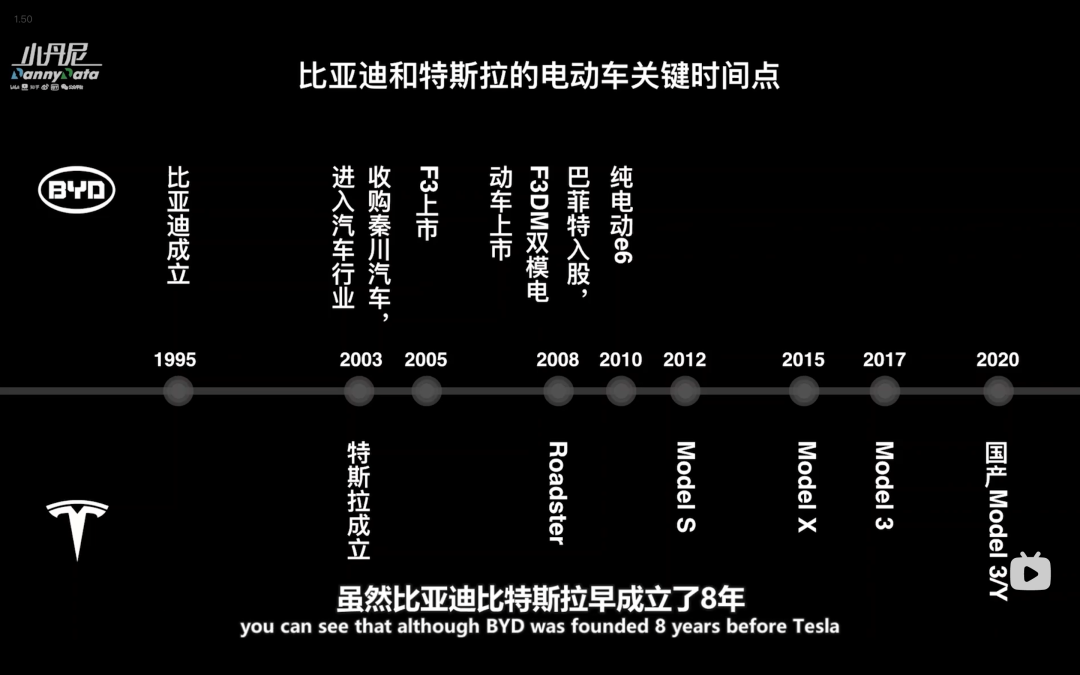

The sales volume of new cars in China in March revealed that Tesla Model Y sold 39,730 units, a year-on-year increase of 291.4%, while BYD’s Song is expected to compete with Tesla closely. In the first quarter, Tesla Model Y sold 74,681 units, a year-on-year increase of 354.8%. In terms of the total sales volume of new energy manufacturers in the first quarter, BYD lead the way with 282,686 units sold, a year-on-year increase of 26.4%, while Tesla ranked second with 108,300 units sold, a year-on-year increase of 10.1%. It can be seen that this year will be the first year for BYD to stop selling fuel vehicles, and it is also the white-hot stage of competition between BYD’s new energy and hybrid cars and Tesla. The time to compete head on has arrived.

The sales volume of new cars in China in March revealed that Tesla Model Y sold 39,730 units, a year-on-year increase of 291.4%, while BYD’s Song is expected to compete with Tesla closely. In the first quarter, Tesla Model Y sold 74,681 units, a year-on-year increase of 354.8%. In terms of the total sales volume of new energy manufacturers in the first quarter, BYD lead the way with 282,686 units sold, a year-on-year increase of 26.4%, while Tesla ranked second with 108,300 units sold, a year-on-year increase of 10.1%. It can be seen that this year will be the first year for BYD to stop selling fuel vehicles, and it is also the white-hot stage of competition between BYD’s new energy and hybrid cars and Tesla. The time to compete head on has arrived.

By understanding the background and entrepreneurial environment of the founders of the two electric vehicle giants – Musk and Wang Chuanfu, we can also see many differences in the motives of the two companies’ development choices.

Musk was educated in Europe and the United States, advocating free development, exploration and tapping into the potential of oneself or humanity. Therefore, his long-term goals have always been very ambitious, such as colonizing Mars, utilizing solar energy, and building rockets. Even creating Tesla was not solely for him. He just had a unique vision and acquired such an early pure electric vehicle company, which has since developed to what it is today.

Wang Chuanfu is a master entrepreneur who embodies Chinese traditional culture of being practical, diligent, and hardworking. Since 2005, he has been firmly committed to the research and development of battery technology, willing to invest heavily in the early stages, and even if there are subsidies, he dares not sell pure electric cars for more than 150,000 yuan. After more than a decade of development, both new energy vehicle giants have achieved good results. BYD’s average selling price is also getting higher and higher. The flagship model, Han, is confidently sold for over 300,000 yuan. I believe that we will see them on top this year.

The final surprise is not Model Q. Contrary to everyone’s expectations, the more entry-level model Model Q that everyone is looking forward to may not appear in the next few years.Disappointingly, the Cybertruck, which was originally scheduled to go into mass production in the second half of this year, will also have to wait until next year. After all, there are significant market access risks and policy uncertainties associated with producing a pickup truck model that is only popular in the United States, given the sustained growth of Model 3 and Model Y as cash cows. It is not difficult to understand that from the perspective of Musk’s business thinking, they will prioritize the production capacity towards Model 3 and Model Y.

In addition, during the conference call, it was mentioned that Tesla plans to make its Superchargers in the United States compatible with other brands of electric vehicles. At the same time, Musk is also very confident in the development of small robots and robotaxis. Of course, these are all more distant future prospects, and we cannot expect Tesla to make any other surprising performances at the moment, as its capabilities have already been widely recognized by the investment community and consumers.

It is like a stable and fast space giant ship heading towards Mars, and no one can stop its progress, including the pandemic and the global economic downturn.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.