This article is authorized for reprinting from Chuxingyike, created by the Transportation Industry Group of “Caijing” magazine, written by Chen Yao.

Standardization and sharing become the development trend of power battery under the trillion-dollar swapping trend.

A new era of electric vehicle energy freedom is accelerating.

Following the official entry into the battery swapping field in January, Ningde Times’ EVOGO battery swapping service was officially launched on Xiamen Island on April 18. The first batch of four fast-swapping stations are located in Siming District, Huli District, and Haicang District of Xiamen, and it is expected to complete the construction of 30 fast-swapping stations on Xiamen Island by the end of this year, with one fast-swapping station within a radius of 3 kilometers.

EVOGO stations have the characteristics of small footprint, fast circulation, large capacity, and all-weather. The area of each standard station is approximately equivalent to three parking spaces, with 48 battery blocks stored inside. It only takes about 1 minute to complete the swapping of a single battery block. Furthermore, different versions of battery swapping stations can adapt to different regional climates.

According to the plan, Ningde Times’ EVOGO battery swapping brand will be launched in 10 cities first. Now, Xiamen has fired the first shot of the battery swapping, and in the future, under the comprehensive cooperation of Times Electric and its partners in technology, resources, and services, the swapping mode will expand nationwide.

With the help of Ningde Times, power batteries are developing towards standardization and sharing. After separation of the vehicle and the battery, the battery is no longer simply a component of the new energy vehicle, but an asset that is parallel to the entire vehicle. The value of its entire life cycle will create a new trillion-dollar market.

Revitalizing the Full Life Cycle of Batteries with Battery Swapping

The significance of the development of the swapping mode is beyond doubt, as it fundamentally solves the industry pain points of slow charging and difficult charging for new energy vehicles. With the rapid increase of the number of new energy vehicles in the future, the number of charging piles will become increasingly difficult to meet consumer demand.

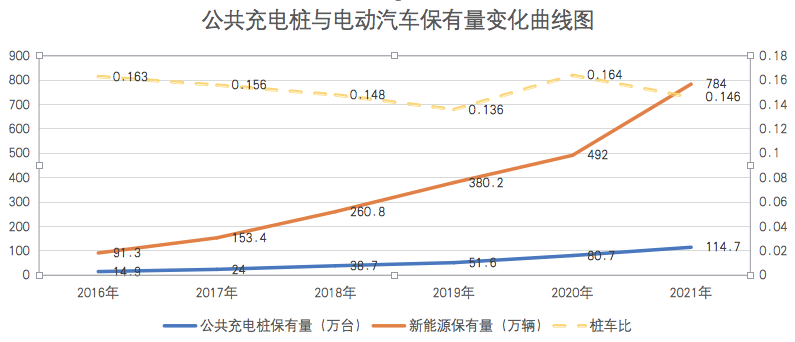

After analyzing the data on public charging piles and the number of new energy vehicles, it was found that except for a brief increase in pile-to-car ratio in 2020 (mainly due to the impact of the epidemic, the new energy market was blocked, and charging piles were listed as new infrastructure for explosive growth), the pile-to-car ratio has been in a downward trend in the past six years. On average, only 0.1 public charging pile can be allocated to each new energy vehicle.

This means that the construction of public charging piles has far fallen behind the development of new energy vehicles. On the other hand, the number of on-board charging piles is also unsatisfactory. According to data from the China Electric Vehicle Charging Infrastructure Promotion Alliance, in 2021, the number of on-board charging piles was only 597,000, accounting for 17% of the sales of new energy vehicles. Obviously, relying solely on charging will not be able to meet the demand for new energy vehicle power supply in the future. From the perspective of power supply efficiency, it is imperative to promote the implementation of the battery swapping mode.

Moreover, the significance of the battery swapping mode for new energy vehicles is far more than just solving the issue of range anxiety. The battery swapping system of electric vehicles stores and charges a large number of batteries, and uniformly dispatches them through a centralized charging station. It also provides battery replacement services inside the dispatching station, including power battery assembly, charging and replacement, maintenance, monitoring, and the hardest solved power battery recycling problem.

In short, the battery swapping system is a key link that connects the production end and the recycling and reuse end of power batteries.

With the charging and maintenance tasks handed over to the battery swapping station, the professional monitoring, care and management of power batteries are ensured. This allows to extend the battery life, and also provides protection for the most dangerous charging period for electric vehicles (currently, most battery self-ignition accidents occur during the charging period).

In addition, the benefits of the battery swapping mode go beyond the battery itself. On one hand, the popularization of the battery swapping mode is beneficial to the development of the ladder utilization of power batteries, and reduces the overall lifecycle cost of batteries. On the other hand, vehicle and battery separation can provide richer business models, such as buying a car and renting a battery, thereby lowering the threshold for purchase. From the perspective of car owners, the battery swapping mode means getting a safer, more convenient, and more valuable new energy vehicle.

The Trillion-Dollar Prospects of Battery Assetization

As of January 2022, CATL announced the launch of its battery swapping service brand “EVOGO,” and more and more industry insiders are recognizing and accepting the battery swapping mode.

During the “Two Sessions” this year, Li Shufu, the chairman of Geely Automobile (00175.HK), suggested that efforts should be made to accelerate the standardization and universalization of the battery swapping mode, further improve the relevant policies and regulations for the battery swapping models, optimize the announcement and certification system for the battery swapping models, and establish a separate certification system for vehicles and batteries under the separation of vehicle and battery.A new energy expert from CATL said to the author, “After CATL entered the battery swapping track, the width of the track was widened, and our business progress became smoother. Many partners, such as FAWS and GAC, took the initiative to discuss the development of battery swapping mode.”

The battery swapping trend has arrived, and the biggest feature of the swapping system is the monetization of batteries. The battery is no longer just a part of the new energy vehicle’s supply chain, but becomes an asset parallel to the whole vehicle, which is called the separation of the vehicle and the battery.

Compared with the current form where consumers still own the battery after making gradual payments, under the separation model, consumers have no ownership of the battery and only need to pay a monthly service fee. This not only greatly reduces the purchase cost of the first owner, but also provides more battery models for future selection.

Li Bin, the founder of NIO (NYSE: NIO), publicly said that the monetization of batteries is the most profitable business in the new energy vehicle industry, “even if a user spends 10,000 yuan on battery rental per year, assuming that more than 200 million vehicles in China are electric vehicles, the revenue generated is 2 trillion yuan, and only this business is a truly large business.”

CICC (China International Capital Corporation) estimates in the relevant research report that by 2025, the number of battery swapping stations will be about 12,500 to 51,900. In the long term, the country will need 550,000 passenger car swapping stations and 60,000 heavy-duty truck swapping stations, with a total equipment and power supply investment of 1.8 trillion yuan.

Currently, the industry chain that operates batteries throughout the entire life cycle is relatively blank, but its significance and market size are clear. The latest subsidy policy also clearly indicates that pure electric vehicles with a selling price of more than 300,000 yuan will not be subsidized, but the models with the swapping mode are excluded, demonstrating the important value of battery monetization.

The chocolate swapping block breaks the power battery standardization barrier

Swapping is not a new technology. As early as 2011, Liu Zhenya, then general manager of the State Grid, announced that the basic commercial operation mode of electric vehicles was determined to be mainly based on swapping, supplemented by charging, centralized charging, and unified distribution. Building charging and swapping stations near the substations can avoid the impact on the distribution network. In urban centers, battery centralized charging stations can be built relying on substations in the suburbs.

However, at that time, the “peak-shaving and valley-filling” model did not receive sufficient response from the industry, and most car manufacturers expressed their resistance to the swapping mode. The fundamental reason for this is that no one would think that the power battery could be standardized in the short term, and without standardized power batteries, swapping and sharing would not be possible.

Ten years later, CATL’s entry may break the deadlock of the difficulty in standardizing batteries.An indisputable fact is that, currently, no enterprise worldwide has greater influence on power batteries than Ningde Times. According to data from the China Automotive Power Battery Industry Innovation Alliance, in 2021, China’s cumulative installed capacity of power batteries reached 154.5 GWh, an increase of 142.8% year on year. Among them, the installed capacity of Ningde Times was 80.51 GWh, with a market share of 52.1%.

Looking at the overall installed capacity, Ningde Times dominates, but in terms of brand coverage, except for a few new energy vehicle companies such as BYD that are self-sufficient, the brand coverage of Ningde Times’ batteries is almost 100%. Without any unfavorable conditions, no carmaker would refuse Ningde Times.

In fact, EVOGO, launched by Ningde Times, is applicable to most vehicle models manufactured by most carmakers. Its core product for battery swapping, the chocolate battery swap block, can be adapted to new car models from 80% of already launched and future new energy vehicle platforms. The model range covers A00 to B, C-class passenger cars and logistics vehicles. The battery swap station is compatible with various branded models that use the aforementioned battery block. Meanwhile, the existing battery blocks support recharging via home chargers and fast chargers.

Nowadays, EVOGO has launched the first salvo of battery swapping in Xiamen. According to Ningde Times’ plan, 30 fast swapping stations will be completed in Xiamen by the end of this year, which means that one fast swapping station will be available within 3 km of service radius on Xiamen island. Currently, the minimum monthly rent for a chocolate battery swap block is CNY 399/block, and the rental price will be dynamically adjusted according to users’ different usage conditions. The service price of the fast swapping station is equivalent to that of fast charging, and will be dynamically adjusted based on factors such as site location and time period.

In the future, Ningde Times will work together with more partners to launch a “small green cycle” model and build “small green cycle” cities. At that time, the barrier of power battery standardization, which is difficult to unify among carmakers, will also be loosened due to the large-scale application of the chocolate battery swap block.

Greater Potential for Battery Banks as Power Battery Residual Value Increases

With the participation of Ningde Times, a gap has been opened up in the pain point of battery standardization; in the future, the barrier of the battery swapping system will lie in whether there is a battery bank that consumers trust to manage the batteries.

After the separation of the vehicle and the electric system, consumers will no longer have ownership of the power battery, but rather rent it, making the power battery a carrier of energy, with the real ownership of the battery belonging to the battery bank. Battery assembly, charging and swapping, maintenance, monitoring, and the most challenging issue of power battery recycling will all be the responsibility of the battery bank.Previously, Wang Chuanfu, Chairman of BYD (002594.SZ), had repeatedly objected to battery swapping mode. The biggest reason was that there was no reasonable commercial logic for battery swapping stations, making it an unprofitable industry that BYD was not interested in pursuing. However, the idea that battery swapping was not profitable was established during an era in which battery swapping systems were isolated from each other. At that time, it was indeed difficult to make a profit from battery swapping, but once a large-scale battery swapping system was formed and a battery bank for the entire life cycle operation of electric vehicles was established, there would be great commercial potential.

Putting aside the cost of battery swapping, just by looking at battery rental instead of purchasing from the point of view, a trillion-dollar market can be formed from basic rental fees, not to mention the profit from the hierarchical use and recycling of power batteries.

As mentioned earlier, power batteries in a battery swapping system are batteries with long life, easy disassembly, and easy detection. Their performance indicators during use can be monitored in real time to determine the health status of the battery. This means that the dream of hierarchical use of batteries has become a reality. Retired power batteries can be reused in many fields, such as low-speed vehicles, electric bicycles, and energy storage, by performing reformation and grading.

Finally, even when its residual value is depleted, a significant profit can still be obtained by disassembling and recycling precious metals. For example, relying on its subsidiary, Guangdong Bangpu, CATL has created an ecological closed loop of “battery production → use → hierarchical use → recycling and resource regeneration”, with a total recycling rate of precious metals reaching 99.3%.

It can be foreseen that with a leading company in the power battery industry as the driving force behind it, battery swapping, which was once difficult to implement, will undoubtedly become feasible. Battery swapping stations will also become an important hub in the future energy Internet, helping China achieve the great goal of “peak carbon emissions and carbon neutrality”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.