Author: Zhu Yulong

When I was tracking the 800V models of modern Kia, I found an interesting phenomenon. In March, the sales volume of two 800V models of modern Kia was 15,352, of which the sales volume of Ioniq 5 was 7,685 and that of EV6 was 6,806. Both cars sold more than 20,000 units in the first quarter worldwide. My question is, while 800V brings differentiation and reputation to modern Kia, does the limitation of battery and electric drive supply also limit the scale of supply to a certain extent?

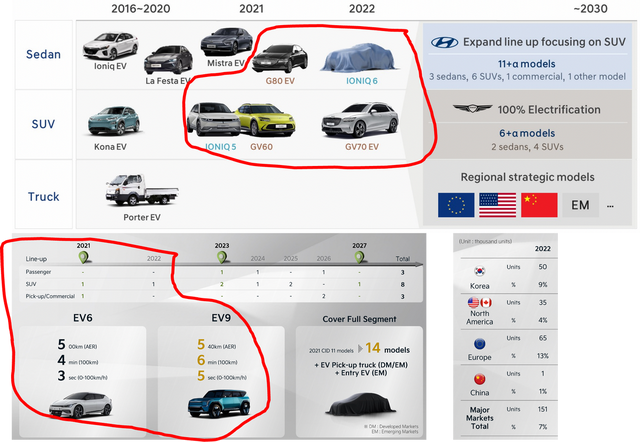

As shown in Figure 1 below, Hyundai’s new energy vehicle sales plan is 220,000 units, while Kia’s is 151,000 units (50,000 in South Korea, 35,000 in North America, 65,000 in Europe, and 1,000 in China).

Sales of 800V models

Sales by model

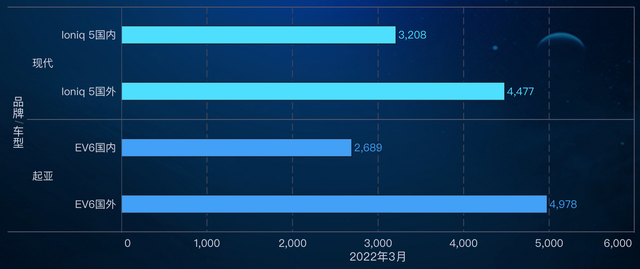

If we break down the data for March mentioned above, we can see:

-

Ioniq 5’s domestic sales in South Korea was 3,208 units.

-

Ioniq 5 exports were 4,477 units

-

EV6’s domestic sales in South Korea were 2,689 units

-

EV6 exports were 4,978 units

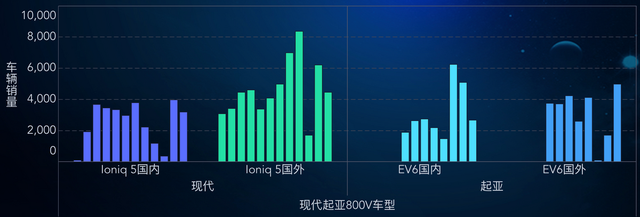

Looking at the overall data, Ioniq 5 started with 3,000 units in April 2021 and sold a total of 65,960 units in 2021 (an average of 7,322 units per month), while Q1 2022 sales were 20,002 units (an average of 6,667 units per month, and a decrease), which is not particularly ideal, especially since KONA EV has limited supply.

Kia’s EV6 sales started in August 2021, with a total of 29,450 units sold in 2021 (an average of 5,890 units per month) and 20,851 units sold in Q1 2022 (an average of 6,950 units per month).

My understanding is that both of these models, especially Ioniq 5, are subject to a certain chip supply problem, but the overall demand, especially for Ioniq 5, is limited in China.

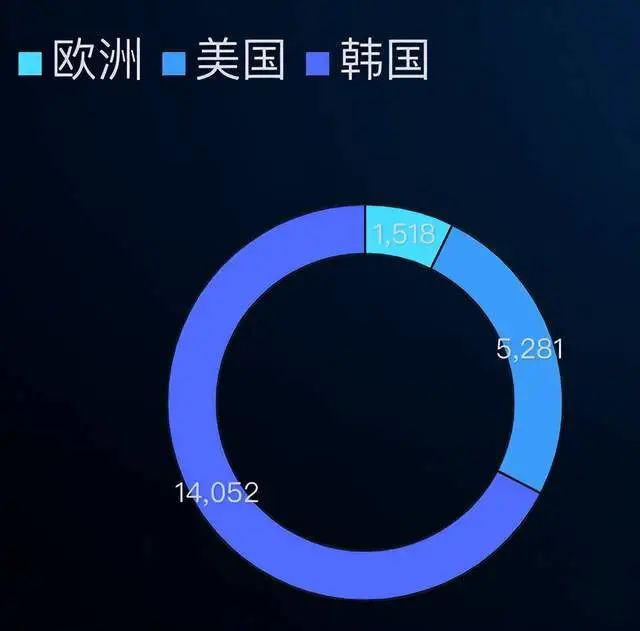

Sales by regionThe combined sales of Hyundai and Kia’s hybrid and electric cars in the first quarter of this year totaled 64,417 in Korea, a year-on-year increase of 9.4%, and electric vehicles accounted for 23.5% of the total domestic sales (273,762 units). The local quarterly sales of Ioniq 5 and Kia’s EV6 were 7,579 and 14,052 units, respectively. The most significant change is that Ioniq 5’s sales are picking up in the US, but in Europe, sales are somewhat mediocre, with sales in the three regions as follows:

- Korea 7579

- Europe 6179

- US 6244

I am particularly skeptical about why sales in Europe have dropped to only 2000 units per month. In fact, I am tracking the sales of various vehicle models in European countries, and the combat effectiveness of this Ioniq 5 is not as strong as imagined.

As for Kia’s situation, deliveries were made in the US first, with 5,281 units delivered in the first quarter, and deliveries in Europe only just began, with 1,518 units. That is to say, the overall performance of Hyundai-Kia’s two small cars, Kona EV and Niro EV, is still better than this 800V vehicle model.

Note: Niro EV sold 6,824 units in March without the burden of recalls. This car performed well in Europe, while Soul EV, with a shorter range, sold fewer units at 900.

What I mean is that Hyundai-Kia position the EMP platform as a dedicated platform, and the Ioniq 6 and EV9 in 2022 will be larger SUVs than before, but the increase in battery capacity is indeed limited. The G80 sedan, GV60, and GV70 are high-end brands, and whether the vehicle structure can achieve the expected sales of 350,000 units (approximately 70% of which will be EV, about 245,000 units) remains to be seen. If the 800V platform accounts for 65%, it is expected that Hyundai-Kia will sell 159,500 800V vehicle models in 2022. Currently, the situation in Q1 is 40,000 units, which is basically in line with the progress requirements.

The production schedule of 800V vehicle models

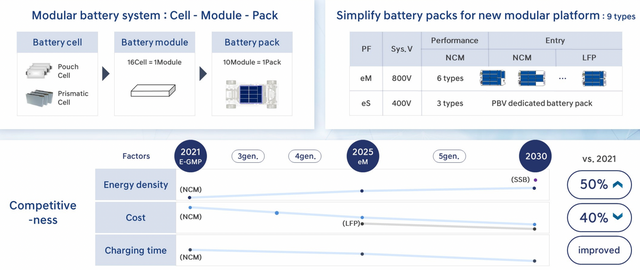

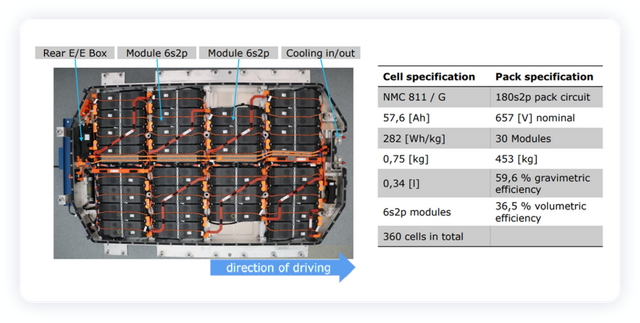

As Hyundai-Kia run on the eM 800V system, if they want to expand the use of the platform in large volumes, the structure of the existing multi-module system needs to be adjusted.- The Gen 3 battery system (2023) will introduce a structure of 16 battery cells on the new generation of vehicles, replacing the previous 36-module configuration of 180S2p with a 10-module structure of 160S.

- The Gen 4 battery system (2025) will start using CTP and adopt LFP battery for configuration.

Currently, it appears that the long-module schemes of SK and LG may be introduced first in 800V models next year. At this pace, the life cycle of this battery system will be less than three years, from April 2021 to mid-2023. The main reasons for this are twofold: insufficient energy for large vehicles and a higher material cost for the module structures.

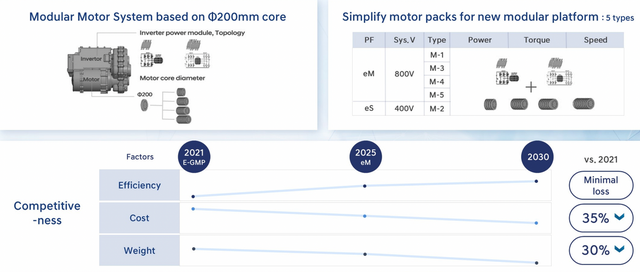

Due to the longer life of the drive system, eM suggests that it will be switched together with the Gen 4 battery system. As I understand it, the amount of SiC ordered by Hyundai is likely to follow the script, and it will be difficult to increase the quantity.

Conclusion: After the release of XPeng G9, we can compare the speed of large-scale production of this 800V SUV with that of Hyundai-Kia. In my opinion, before the introduction of low-cost battery solutions for large-scale or no large battery cells (LFP + fast charging), the difficulty of implementing the 800V battery system will remain high, and the overall usage will not increase as quickly as we hope.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.