Special Contributor | Zhu Yulong

Editor | Qiu Kaijun

March was a watershed for the power battery industry.

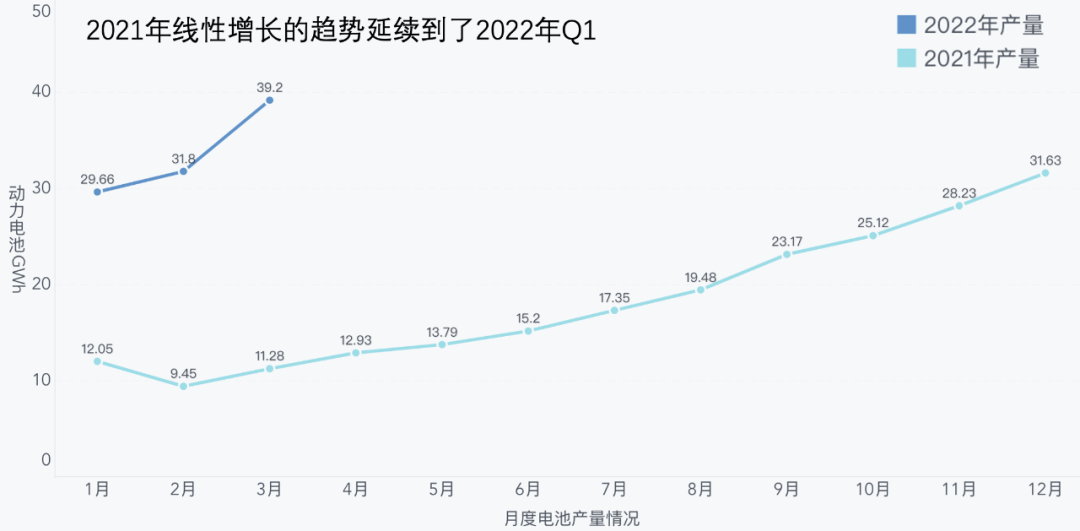

From the perspective of the industry itself, in March, China’s power battery production reached a new historical high of 39.2GWh, and the production of power batteries reached 100.6GWh in just one quarter, basically completing the volume of the previous year before 2020. This indicates strong demand for power batteries.

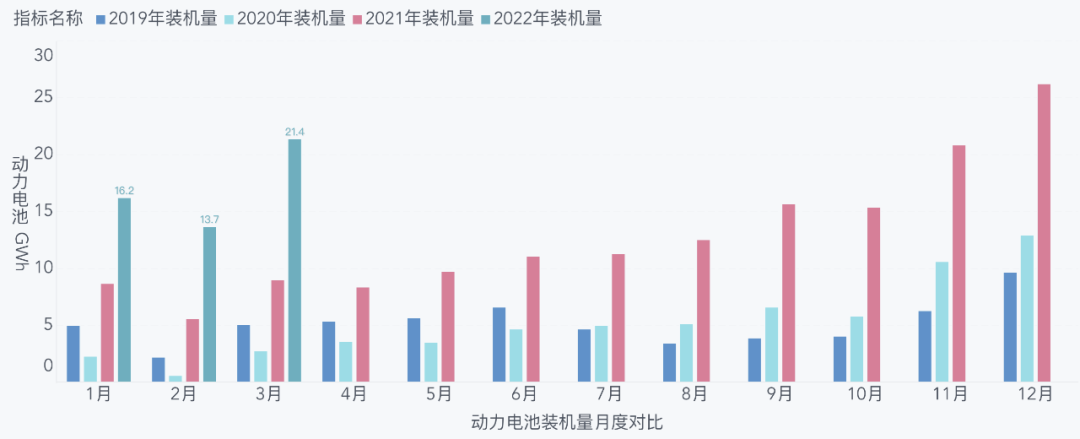

In terms of vehicle installation, the power battery installation in March was 21.4GWh, which is close to the peak of 26.22GWh in December 2022. This also shows that car manufacturers are accelerating the use of these batteries. However, the installation volume of 51.3GWh is still only half of the production volume of 100.6GWh.

Looking at mid- to short-term demand, the sudden outbreak of the pandemic and corresponding control measures have had a significant impact on subsequent developments.

According to the National Health Commission, there are currently 34 high-risk areas and 539 medium-risk areas in the country. During the past two months, different levels and ranges of lockdown measures have been implemented in the core regions of China’s passenger car sales.

In addition, the top 60 cities in China for passenger car sales in 2021 account for over 60\% of the country’s total passenger car sales. As many as 49 cities have various lockdown measures, accounting for over 80\%. These cities accounted for over 53\% of China’s passenger car market sales last year.

In practice, there are slight differences in lockdown measures across different regions, which have a profound impact on the production of the automobile industry and the purchase of cars by residents. From the current perspective, this is a turning point in the cycle, and the upward trend in prosperity will fluctuate somewhat. In plain language, the speed of power battery enterprise transfer to car enterprise warehouses will be further extended. But this will not affect the long-term development of power batteries.

In addition to analyzing the monthly data, some conclusions can be drawn from the analysis of power battery insurance data as follows:

1) From the perspective of overall production, the application of lithium iron phosphate is becoming more and more widespread, but the adoption of lithium iron phosphate by different vehicle series varies among automakers. From the perspective of foreign-funded automakers, Tesla is currently the only one that has adopted lithium iron phosphate on a large scale, and other joint ventures and foreign brands have not used it on a large scale. Among Chinese brands, in addition to BYD’s wide range of applications, Aiways and Ora also use lithium iron phosphate in their mid- to high-end models. In the A00 pure electric field, Wuling, Chery, and Changan are all taking big steps to use lithium iron phosphate batteries as a low-cost solution.2) In 2021, there was a price difference of approximately 0.1-0.15 RMB/Wh between lithium iron phosphate batteries and ternary batteries, especially considering that cylindrical lithium iron phosphate batteries were priced very low. As the overall price of power batteries increased by more than 30%, there still existed certain advantages in using lithium iron phosphate batteries to replace nickel-55 cells in high-voltage systems for cost effectiveness. In terms of new energy start-up companies, the demand growth for lithium iron phosphate batteries is still faster than nickel-cobalt-manganese ternary batteries. Additionally, for 400-500 km range vehicles, ternary batteries do not fully exhibit their unique characteristics. Currently, with sufficient CTP (cell-to-pack) arrangement space, lithium iron phosphate batteries have covered different ranges of endurance and have replaced original ternary battery models.

According to recent information from SNE, when discussing the next major order in 2024-2025, due to raw material price reasons, Korean battery companies will discuss with global automakers to increase the price of electric vehicle batteries by 30%-40%.

Of course, this matter, on the premise of the new round of orders in 2024-2025, needs to negotiate new long-term contracts with automakers. Global automakers believe that square batteries are safer, so they are urging Korean battery partners to replace soft-pack batteries currently in production with square batteries (in the future, the global trend could shift from soft-pack to square-shell stacked packaging technology, such as the long and short sword designs we have seen, and the designs that have not yet been officially released), as soft-pack batteries are more prone to swelling, thus making square-shell stack packaging the primary trend worldwide.

Power Battery Total Production Data

Looking at the data for the first quarter, there really is a reason to be optimistic.

In March, China’s production of power batteries totaled 39.2 GWh, an increase of 247.3% and 23.3% year-on-year and month-on-month, respectively.

In the first quarter, the cumulative production of power batteries reached 100.6 GWh, an increase of 206.9% year-on-year.

Seeing these numbers, there is no reason not to be pleased with the development of China’s power battery industry, especially after experiencing linear high growth in 2021, and even higher growth in 2022 based on this foundation.

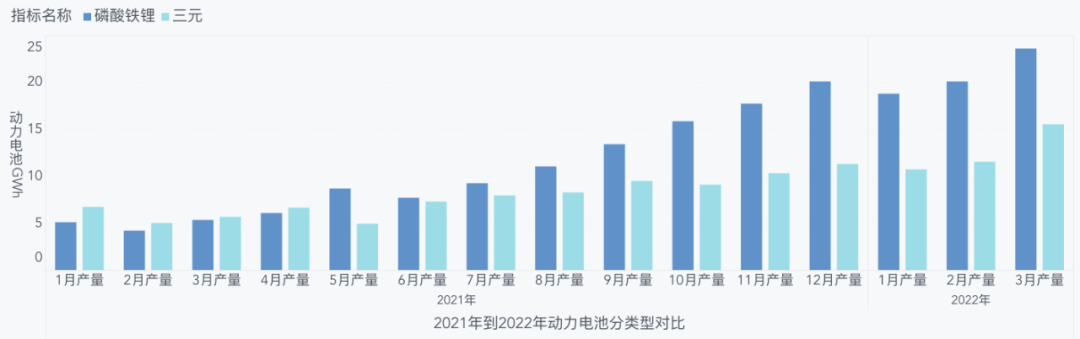

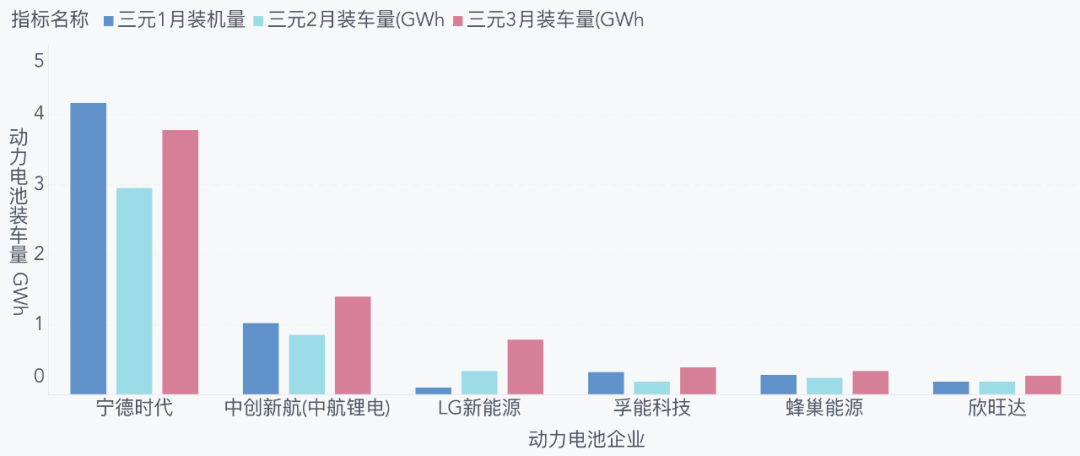

In terms of production, the weakness of ternary batteries is still apparent. Ternary batteries had a production of 15.6 GWh, while lithium iron phosphate batteries had 23.6 GWh, with ternary batteries accounting for only 39.7% and still decreasing. The growth rate year-on-year difference between ternary batteries (167.3%) and lithium iron phosphate batteries (332.9%) is more than double.The cumulative production of ternary batteries and lithium iron phosphate batteries in the first quarter were 38.0 GWh and 62.4 GWh respectively, with a proportion of 37.8% and 62.0%, and an increase of 113.7% and 317.2% respectively.

Production is a leading indicator and represents changes in subsequent demand. The growth rate of lithium iron phosphate is higher, reflecting the rapid expansion of several main enterprises, mainly including BYD and Tesla (CATL). This is driven by explosive models.

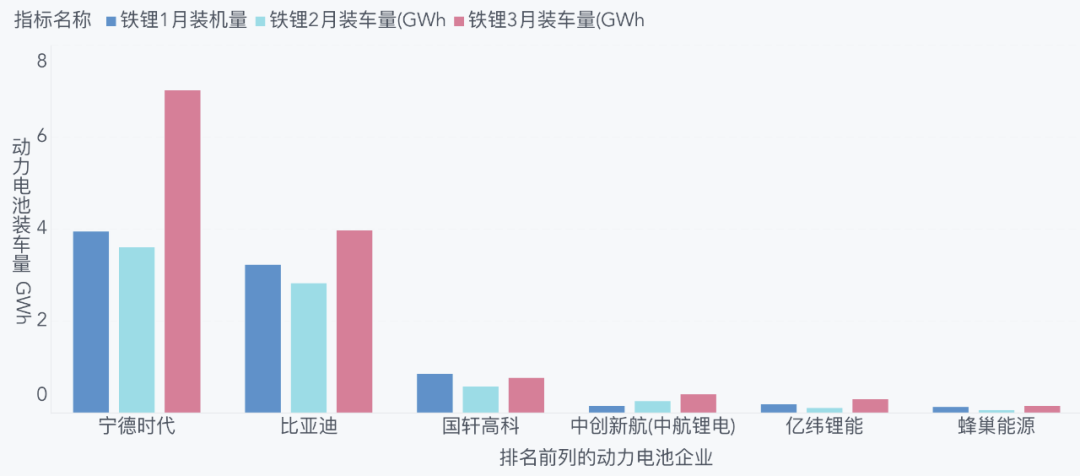

As for the amount of loaded batteries, the power battery loaded in March was 21.4 GWh, which has approached the demand data of the fourth quarter of last year. The cumulative load of ternary batteries is 8.2 GWh, accounting for 38.3% of the total load. The cumulative load of lithium iron phosphate batteries is 13.2 GWh, accounting for 61.6% of the total load.

The cumulative load of power batteries in the first quarter was 51.3 GWh, with ternary batteries accounting for 21.4 GWh or 41.7% of the total load, and lithium iron phosphate batteries accounting for 29.8 GWh or 58.2% of the total load. The hot demand for power batteries can be seen from the loaded data.

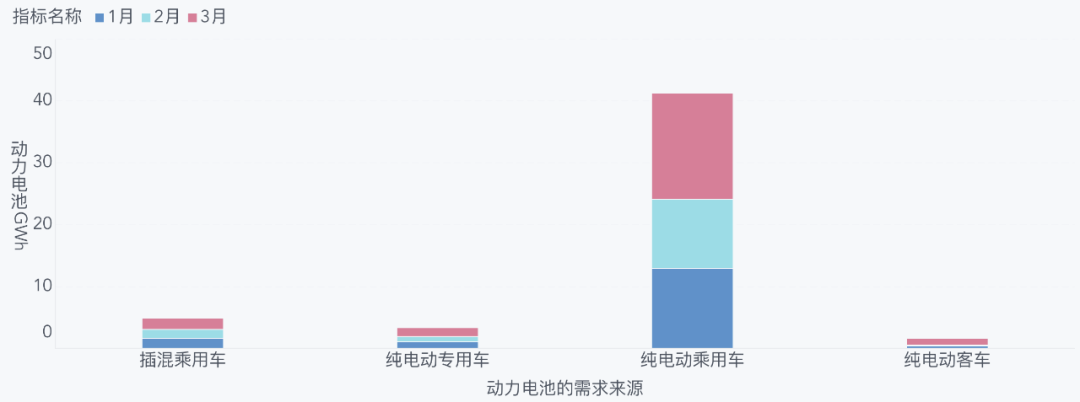

In the first quarter, pure electric passenger cars used the most batteries, with 41.24 GWh, accounting for 80.59%, followed by plug-in hybrid passenger cars with 4.91 GWh, accounting for 9.59%. Passenger cars now account for more than 90% of the demand for power batteries, while commercial buses and special vehicles account for 3.36 GWh and 4.91 GWh respectively.

Looking at the suppliers, although 39 power battery companies achieved loaded cars in March, the top 3, top 5, and top 10 power battery companies accounted for 16.8 GWh (78.3%), 18.5 GWh (86.4%), and 20.4 GWh (95.4%) respectively (that is, the remaining 29 companies only have less than 5% of the market).

This basically means that in the short term, only those who enter the top 10 have a chance to keep up, and the difference between the top 2 and the subsequent 3-10 is large. Only differentiated strategies can hold their position.Ignoring Tesla’s needs, BYD is already able to maintain a level of installation of lithium iron phosphate comparable to that of CATL. Meanwhile, other companies such as CALB, EVE Energy, and Gotion High-Tech are quickly increasing their shipments of lithium iron phosphate batteries.

In terms of investment in power batteries for ternary fields, the main players, in addition to CATL, are Zhonghuan Semiconductor, Funeng Technology, Gotion High-Tech, and Xinwanda.

Choice of suppliers from the perspective of automobile companies

In terms of vehicle models, Tesla and Chinese companies have been the fastest in deploying lithium iron phosphate batteries in passenger cars. The proportion of ternary batteries has been reduced to 2.39% for BYD, 6.26% for Wuling, 17.05% for Tesla, and 35.6% for Chery, 28.61% for Changan, while NIO’s pure ternary batteries are only at 42.88%.

The proportion of ternary batteries in March

For major emerging companies, as the supply of lithium iron phosphate batteries becomes more abundant, especially with the mass production of iron lithium batteries that support 500 kilometers of range, Tesla and NIO’s leading role in replacing iron lithium batteries will gradually increase due to the cost advantage.

As for battery selection, let’s take a look at XPENG and Aiways. The demand for these two companies is roughly around 1-1.5GWh per month, and they currently have three suppliers, with the first two being the main ones and the third being secondary. Both companies have chosen independent backups for fast-charging batteries, which is still relatively valuable for reference. Currently, CATL occupies approximately one-third of the supply for these two companies, while Zhonghuan Semiconductor has obtained over half of the order allocation due to their previous emphasis on ternary batteries.

March is a good time, but many friends may not be optimistic about the future. In fact, setbacks are normal.

March is a good time, but many friends may not be optimistic about the future. In fact, setbacks are normal.

The power battery industry really needs to make electric vehicle enterprises themselves capable of resisting subsidy reductions, fluctuations in parts and chip supplies and costs. Although it has made rapid progress in 2021, it is still relatively vulnerable. We still need to view its development dialectically. Its growth momentum is gratifying, for a sharp sword must be tempered.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.