Karakush

In the Justice League, when The Flash met Batman for the first time, he asked:

Flash: What are your superpowers again?

Batman: I’m rich.

Nowadays, it seems that ordinary people also possess the same kind of financial power. And besides throwing money, they can hardly compete in interstellar combat.

For example, Volkswagen announced last year that it would become the “leader in the global electric vehicle market” by no later than 2025 and would invest 89 billion euros for this goal. In the first year of the five-year plan, the target was one million, but the actual results were: the group sold 452,900 electric vehicles throughout the year, up 97% from the previous year; compared with the current leader Tesla, which sold 936,000, up 87% from the previous year.

Some industry insiders believe that the relationship between the two is like one is running while the other is chasing, and the one with the scale advantage of traditional mainstream car companies will be fully reflected after the market inflection point.

Others believe that the difference between the two lies in the outdated concept of car manufacturing, which makes it difficult for them to produce products that meet market expectations. The root cause is still the rigid internal organizational mechanism that hinders enterprises from adapting to industry changes quickly.

Therefore, how big is Volkswagen’s winning edge? This is a question that needs to be viewed dialectically. The feedback of sales volume is lagging, and it is not sufficient to timely measure the current efforts of Volkswagen. Observing the three dynamic indicators of spending, R&D, and personnel expended may provide more guidance for its future development: scale, R&D, and personnel.

Lay Down the Crown

Scalability is often considered an advantage of traditional car companies, but today it seems that this is not the case.

Last November, the Financial Times reported that according to Bernstein, IHS, and EV-Volumes.com forecasts for the growth of electric vehicle production by six mainstream car groups, Volkswagen, Daimler, BMW, Stellantis, Ford, and General Motors, only Volkswagen is expected to approach or surpass Tesla by 2025.

This conclusion does not exclude the possibility that other mainstream car companies still have reservations about electric vehicles and are unwilling to eliminate fossil fuel vehicles too early for cash flow and profit margins, but it can also reflect the limit of their capacity to a certain extent.

The gap mainly comes from two aspects:

First, the existing scale of producing millions of traditional fuel cars annually cannot be directly converted into the scale of electric cars. Volkswagen currently has 120 factories worldwide, but only five are producing MEB platform electric vehicles:

If everything goes smoothly, three new electric vehicle factories will be put into operation this year, located in Emden and Hanover, Germany, and Chattanooga, USA.

Take the Emden factory as an example. Originally, it produced the Passat and Arteon (Volkswagen CC). Volkswagen invested €1 billion and started renovation in July 2020, which has now been transformed into a fully electric vehicle factory. The ID.4 will be put into production in May this year.

The core construction of the renovation is the new 50,000-square-meter electric vehicle assembly workshop, as well as extensive adjustments throughout the four major processes: the paint shop needs to renovate about 17 kilometers of conveyor belts, and a 6,000-square-meter “two-color hall” has also been added to spray the ID. series of floating roofs; the stamping workshop and body workshop need to expand by about 23,000 square meters; and high-level shelves and automated small parts warehouses need to be built, etc.

Power switch is clearly not just a simple replacement of parts and equipment. It requires a new production process, new supply chain, and new skill training, to pursue the eternal theme of manufacturing: improve efficiency and reduce costs.

As for what’s new and what’s not new, it is inevitably discovered: renovation is not as good as new construction.

As a matter of fact, Volkswagen also decided in March this year to invest €2 billion in a new factory in Wolfsburg, which will start construction in 2023 and put into production in 2026, producing the hope of the next generation – Trinity based on the SSP platform, a flagship electric sedan with the size of the Passat, a range of over 700 kilometers, and L4-level autonomous driving support.

The Trinity factory will use the latest manufacturing technology to compete with Tesla. In November last year, Diess pointed out in a conversation with workers that Tesla’s Berlin factory can produce an electric car in 10 hours, while Volkswagen’s Zwickau factory needs 30 hours to produce an ID.3 or ID.4. Diess hopes to shorten it to at least 20 hours this year.

The goal of Trinity is to achieve 10-12 hours at once. The key to cost reduction and efficiency improvement lies in fewer models, fewer parts, more automation, streamlined production lines, and a brand new logistics concept.Refer to Tesla. Its production lineup is very simple, with only four models. For most of 2021, only the Model 3/Y were produced in bulk. In contrast, the Volkswagen Group has more than 20 models.

At the same time, Tesla uses integrated casting technology to reduce the number of components. It reduced the 70 parts on the car body to just one, and shortened the welding and pressing time from two hours to 90 seconds. This greatly improves production efficiency and reduces fixed asset investment in part assembly. One giant casting machine can replace 300 welding and pressing robots, resulting in about a 20% cost savings.

For Volkswagen, this means a revolution in the production process.

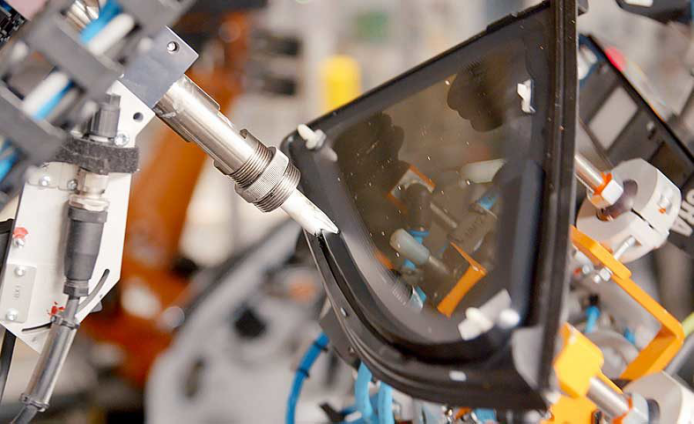

Everywhere on the traditional production line leads to waste. For example, in July last year, Volkswagen hired the engineering company Dürr to renovate its Zwickau factory. One of the bonding technologies enables the installation of side windows during transport. The traditional setting makes workers stop and go, spending a lot of time on each car. Dürr timed and arranged the installation process and used installation robots to guide the side windows to the adhesive tower to install in sync. The accuracy is down to the millimeter level, simplifying and slowing down the process.

Building an entirely new factory can be more efficient and thoroughly redesigned without being constrained by existing structures. Volkswagen urgently needs its electric car production model to transform its global manufacturing base.

Until the end of 2020, Volkswagen was still considering converting its main factory in Wolfsburg into a model factory. As Europe’s largest fuel car factory, Wolfsburg produces more than 800,000 vehicles annually. There is nothing more suitable than upgrading the plant to show the lighthouse in electric vehicle manufacturing. However, a year later, Volkswagen changed its mind, which may indicate that the transformation was not as easy as imagined. Since its establishment in 1938, the factory has operated almost in the same way for nearly 84 years, with only some orange robots added to the factory floor. The red brick on the factory’s exterior wall has been designated as a German industrial heritage and cannot be touched by factory workers.

Volkswagen pointed out that the decision to adopt a new construction plan is driven by the mid-term efficiency, and secondly, to avoid impacting the production of high-volume models such as Golf, Tiguan, and Touareg in the current main factory. Apparently, after investigation, Volkswagen believes that this approach can buy more time and space, gradually achieve modernization, and is a more feasible approach.In the long run, transforming all production capacities is inevitable. However, the difficulties in the short and medium term cannot be ignored, as it essentially involves the transfer from labor-intensive production to technology-intensive production with no natural advantages that can be inherited.

The second issue is the emergency supply chain security capability. The current supply chain problems (surprisingly) involve chips, pneumonia, and war, with society’s criticism constantly increasing. Shortages today, shortages tomorrow, a year passes by; shortages this year, shortages next year, a lifetime passes by…

Due to the ongoing Russia-Ukraine war, Leoni, the major wiring harness supplier located in western Ukraine, has been unable to deliver, leading to production disruptions at three Volkswagen electric car factories in Germany and the Czech Republic. Although the supply situation has stabilized as workers have returned to work during curfews and rocket attacks, it still affected Volkswagen’s postponed launch of the ID.5.

Another consequence is that the price of nickel metal in the batteries has surged to $50,000 per tonne due to Russia’s control of 20% of the high-grade nickel supply.

In addition, since March this year, the domestic epidemic has caused production cuts and stoppages at some of Volkswagen’s factories in China.

Some of these are force majeure events that have no solution and can only be dealt with using remaining stock; others have room for maneuver, such as chips. Tesla is a typical example of a company that is able to continue production despite chip shortages.

Last year, they were able to quickly use alternative chips to make up for the shortfall and maintain growth, thanks to their highly vertical integration. Compared to ordinary car manufacturers that rely on suppliers, Tesla designs more hardware and can directly modify things like circuit boards to accommodate alternative chips. They also write more of their own software and can rewrite code to match alternative chips in 2-3 weeks, thereby seizing more control.

The upstream industry chains follow the same pattern. Tesla’s investment in batteries is not to be mentioned again; earlier, it had already cooperated with nickel mining companies and production entities to establish independent nickel supplies that could withstand many market changes. They even purchased a nickel mine at the beginning of 2021. Just a few days ago, Musk also stated that due to the wild price of lithium, he is considering mining lithium mines himself.

Volkswagen is also moving in this direction. Last year, they held a “Power Day” that mimicked Tesla’s Battery Day, announcing plans to establish six large-scale battery factories in Europe with an annual production capacity of 240GWh. The progress is also rapid. In March this year, one of the selected locations was in Sagunto, Spain, with construction scheduled to start at the end of the year and production of the next-generation battery system in 2026, matching Seat’s Barcelona and Volkswagen’s Pamplona factories.The Volkswagen Group is now the largest shareholder of Swedish battery manufacturer Northvolt, and has placed an order of $ 14 billion at its factory in northern Sweden, while also acquiring its plant in Saarz Gitter, Germany. It is reported that the next factory may be built in Eastern Europe.

In China, in addition to investing in Guoxuan High-Tech, Volkswagen has recently signed a strategic cooperation memorandum of understanding with upstream industry chain companies Huayou Cobalt and Qinghai Salt Lake Industry Group to establish two joint ventures, ensuring the supply of raw materials and cost advantages.

Despite the challenges, the investment decision is consistent with industry trends and it can be seen that Volkswagen is building modern risk resistance capabilities in an orderly manner.

At the same time, Volkswagen is also changing its top-level design to improve the supply chain gap. Recently, Volkswagen revealed that it will cut 60% of diesel and gasoline vehicles from the European market over the next eight years, shifting its focus from sales and market share to quality and profit margins. This is a change at the business model level.

Last year was a year of stimulation for Volkswagen. Due to chip shortages, production decreased by 600,000, especially at the main factory in Wolfsburg, where production was less than expected at 330,000 vehicles, falling to the lowest level since 1958, when it was producing Beetles with less than half of the current production capacity. Even so, Volkswagen’s sales revenue increased by 12% year-on-year.

In the current situation, it seems that focusing energy and resources on producing higher-profit cars is better than the traditional logic of blindly making and selling cars. Volkswagen’s transformation costs are not cheap and highly dependent on its own cash flow, while the soaring cost of battery raw materials introduces uncertainties in the expected profitability of electric vehicles. Reducing models, lowering sales, and improving controllable profits are also considerations for financial security.

In the long run, sales and the number of electric vehicle models may no longer be the main consideration.

In an interview with The Verge early this year, Diess pointed out that the new opportunity for economies of scale in the future lies in software, and that 90% of car differentiation, competitiveness, and customer experience will depend on software. According to the plan, Volkswagen’s main profits in ten years will also come from software, autonomous driving, and mobility, the sum of which will exceed car sales revenue.

This is a good concept.

Surprise

There are currently not many products that prove Volkswagen’s research and development investment achievements, especially in software, which has always been unclear.

In fact, in February of this year, Manager Magazine reported that Volkswagen intends to acquire a small autonomous driving business unit under Huawei for billions of euros and that senior management has been in talks for months, involving a technology system that Volkswagen is not good at – which seems to confirm its status as being “not very capable” of independent research and development.

However, if Volkswagen can produce a miracle, the following areas may be high-energy warnings:

The first is the continuously increasing amount of money spent.Volkswagen is frequently updating its five-year plan. The latest version allocates a budget of 89 billion euros to electric vehicles and digitalization, which is over 50% of its total investment. Of this, 52 billion euros are for electric vehicles, an increase of over 50% compared to the previous plan, and 8 billion euros are for hybrids. Another 30 billion euros will be used for digitalization and autonomous driving, an increase of about 10% compared to the previous plan.

Although Alphabet, Google’s parent company, spends nearly $30 billion annually on R&D, Volkswagen is doing quite well in the automotive field.

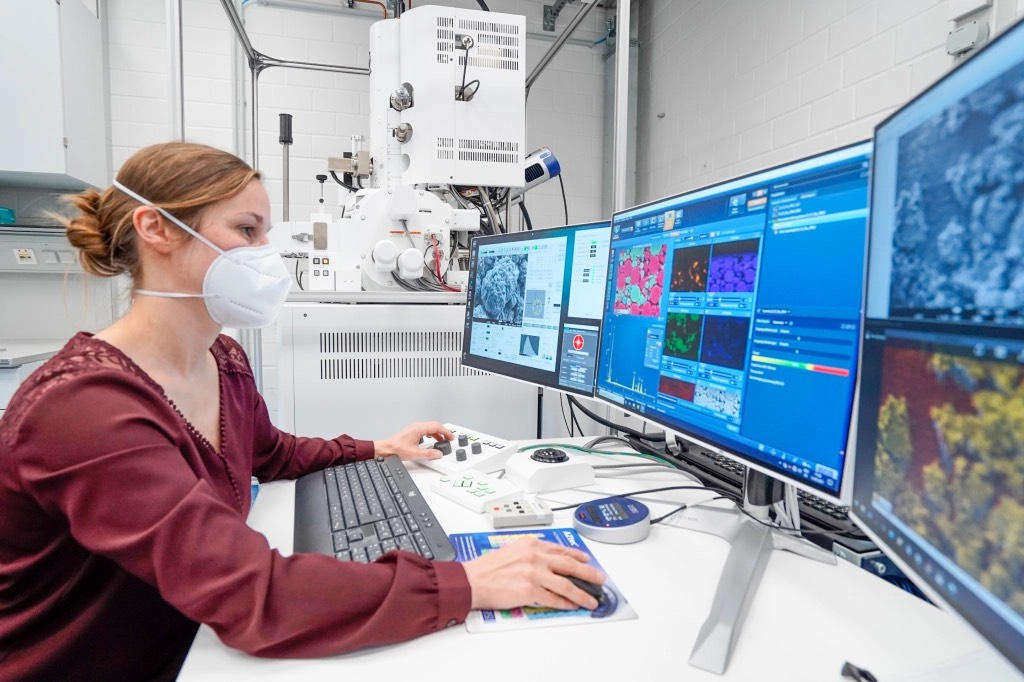

For example, during the 2021 fiscal year, Volkswagen’s R&D spending reached 15.6 billion euros, accounting for 7.6% of revenue, while Tesla’s R&D spending was $2.591 billion, accounting for 5% of revenue. (Although, on average per vehicle, Volkswagen is probably much lower).

Second, Volkswagen is changing its R&D process and organizational management.

Volkswagen claims to be focusing on systems and functions, rather than traditional components, making technical research and development a highly efficient system engineering process. This will reduce R&D time by 25%, and when the basic software architecture is ready, the entire vehicle project cycle will be shortened from 54 months to 40 months. Its Campus Sandkamp R&D center will be the core of this transformation, with Volkswagen investing 800 million euros and recruiting 4,000 employees.

Previously, Volkswagen also established its own software company, Cariad, with plans to develop a software platform and a new generation of end-to-end electronic architecture software stack 2.0 by 2025. Cariad is responsible for MEB software upgrades, in-vehicle operating systems, and L4 level autonomous driving. Diess became the head of this department this year.

This global software department already had 4,000 to 5,000 technical personnel in 2019 and plans to expand its team structure to over 10,000 this year through acquisitions or recruitment. However, whether having more people will facilitate a software technology leap forward is an open question.

Life is Tough

In terms of production, the definite problem is that there are not enough people.

As Volkswagen shifts toward electric cars, the number of components has been reduced from 2,000 to 200, and high levels of automation mean the company does not need a large number of workers. Over the past five years, Volkswagen has retired about 23,000 workers while adding 9,000 electric car jobs. It is expected that more engine workers will retire in the next decade, lowering the average age of workers from over 40 to over 20.

The challenge is to find enough eligible young people in their 20s to expand the workforce for electric vehicles.

And Volkswagen is training its own employees.

There are short-term training programs to improve specific professional skills as well as large-scale retraining programs that last up to 180 days and provide upward mobility opportunities. Skilled sheet metal workers have the chance to become vehicle engineering experts.

There are also long-term projects, such as the Wolfsburg Coding School, which receives approximately €2.2 million in annual funding and is headed by a former Google executive. Its goal is to train a new generation of engineers. Last year, more than 6,000 people applied for 450 spots, and graduates can still intern at Volkswagen after graduation.

Volkswagen has planned €200 million for the entire training program, involving various investment and cooperation projects. This is not only to supplement their own labor force, but also to enhance Wolfsburg’s industrial foundation in the long run.

Unions are gradually accepting this situation. Just two years ago, many people insisted that Wolfsburg should only focus on non-electric vehicles, but now people are proactively calling for change. Although there are still some minor disputes, such as the tense relationship between the Wolfsburg and Hanover factories last year, which led CEO Diess to cancel his trip to the US to meet with investors and go to the factory for negotiations.

Diess attributed his change of attitude to his electric vehicle buddy, Musk. The turning point came in December 2019 when Musk flew to Berlin and announced that he would build a European factory in Grünheide, which is only a 90-minute train ride from Wolfsburg. The Grünheide factory will be able to produce 500,000 electric vehicles per year and will also house “one of the largest battery factories in Europe and one of the largest in the world”!

This may be the first time Wolfsburg has truly felt that the times are changing.

This year, Tesla’s Berlin factory finally got off the ground after countless difficulties. However, Musk still struggles to find employees; the two factories are expected to require a total of 12,000 employees, but currently, there are only around 2,000 people working there. Although early production capacity does not require so many workers, slow hiring will also impede the ramp-up of production.

Therefore, the next competition will be in sales, production capacity, efficiency, and R&D, but first and foremost, in attracting talent.

This is the result of being competitive.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.