Author: Zhu Yulong

Today, under the pressure of the global environment, Honda has also updated its latest global electrification strategy, which can be considered as correcting its stubbornness. In the next 10 years, Honda will invest JPY 8 trillion (about CNY 406.4 billion) in research and development funds to keep up with the historical trend of the automotive industry. By 2030, it will launch 30 pure electric vehicles in the global market with an annual output of more than 2 million units.

Overall, the following are clear from this update:

-

Honda adopts localized procurement strategies in various regions. It will cooperate with General Motors to produce batteries for the US market and rely on CATL in China. In Japan, it will team up with Nissan to select AESC since there is no alternative after Toyota’s alliance with Panasonic.

-

Honda will develop solid-state batteries and start trial production line in Q1 2024.

-

The main funds will be invested in the entire intelligentization field.

Honda’s Electrification Plan

Looking at the vehicle planning:

In the first stage from 2022 to 2050, products will be tailored to the characteristics of global regional markets:

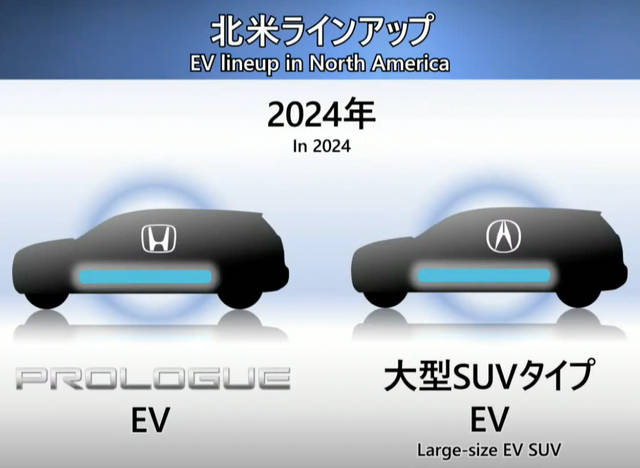

- North America: Two medium and large-sized EV models co-developed with General Motors will be released in 2024 (Honda brand: All-new Prologue SUV, Acura brand: EV SUV model).

-

China: 10 new EV models will be launched before 2027. Based on this guiding ideology, the competitiveness of these 10 cars feels quite limited.

-

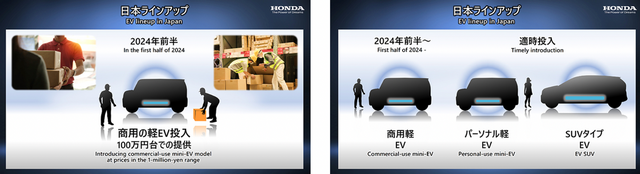

Japan: In early 2024, a mini-EV model priced at 1 million yen will be launched first, followed by personal-use mini electric cars and electric SUVs. This is consistent with the previous strategy for electric motorcycles, which will be discussed in detail in the second part.

# Honda Plans to Launch 30 Electric Vehicle Models Globally by 2030

# Honda Plans to Launch 30 Electric Vehicle Models Globally by 2030

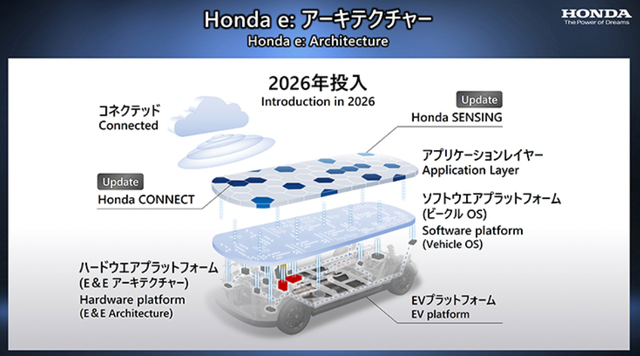

Honda plans to launch its proprietary electric vehicle (EV) platform starting from 2025-2030 and believes it is the time for the global popularisation of EVs. In 2026, Honda will start using the EV platform, Honda e: Architecture, which combines hardware and software platforms. Through an alliance with GM, Honda plans to introduce affordable EVs with competitive costs and range that are equivalent to gasoline-powered cars starting from North America in 2027. Honda plans to introduce 30 EV models worldwide by 2030, covering a full range of vehicles, from commercial mini EVs to flagship models, with an annual production volume exceeding 2 million units.

In China, Honda plans to establish dedicated EV factories in Guangzhou and Wuhan to manufacture EVs. According to the first wave of demand in North America, Honda also plans to set up a dedicated EV production line in that region. Honda’s battery selection strategy is as follows:

- For the North American market, Honda will purchase GM’s Ultium platform battery and establish a joint venture to produce batteries.

- For the Chinese market, Honda will cooperate with CATL.

- For the Japanese market, Honda will purchase batteries from Vision.

The demonstration production line of the all-solid-state battery is also planned to be launched in the spring of 2024, which will further strengthen the independent R&D of the next-generation battery. It will invest about JPY 43 billion (approximately RMB 2.19 billion), and the first model using the all-solid-state battery is planned to be launched in the second half of the five-year period from 2025 to 2030.

Since Honda has many products, the focus this time is on data services, product interconnectivity, and the chemical reactions generated after their interconnectivity. It also seeks to connect electric digital terminals, as well as the energy and information stored in products, to users and society. Honda has established a cross-disciplinary platform, enhanced human resources recruited externally, and seeks cross-industry cooperation, alliances, and investments in start-ups.

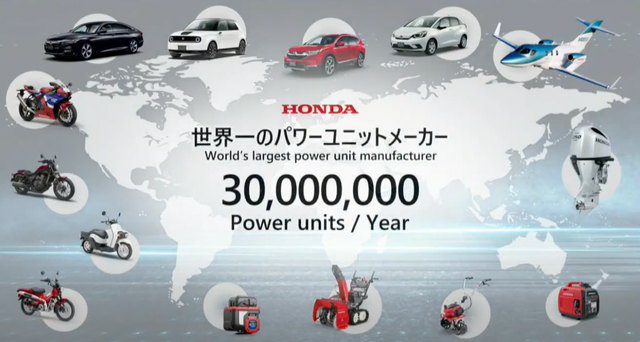

Actually, Honda’s cars do not make much money, but it does have its strengths in motorcycles, two-wheels, planes, etc., selling around 30 million units of powered products per year.

Honda’s Two-Wheeler Battery Swapping Strategy

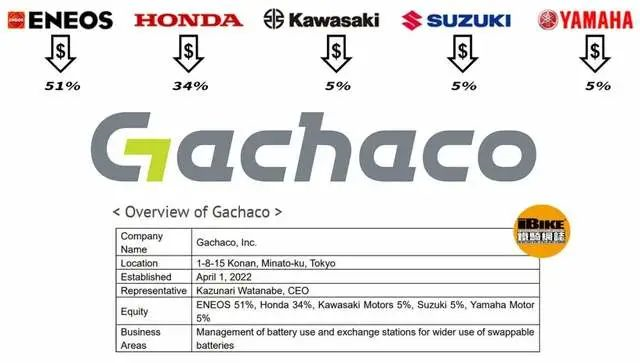

It’s interesting to see that recently, the four major Japanese motorcycle manufacturers, Honda, Kawasaki, Suzuki, and Yamaha, have teamed up with the oil company Eneos to jointly establish the Gachaco company operating an electric motorcycle battery-swapping station, and have unified the common specifications of the batteries. Eneos owns 51% of the shares, Honda 34%, and Kawasaki, Suzuki, and Yamaha each own 5%.

From the Japanese perspective, Honda is relatively fast in this field. Due to bypassing internal combustion engines, both mainland and Taiwan, China have developed rapidly, so Honda also has a strong sense of crisis.

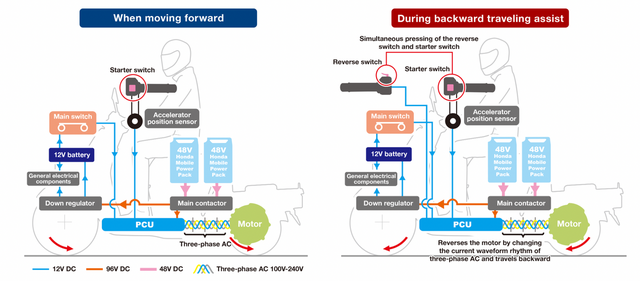

The system developed by Honda can use a 96V power system with each scooter integrating a 48V mobile power pack. The Power Control Unit (PCU) uses sensors to detect throttle opening and driving conditions. By using vector control, torque can be fine-tuned to extend the driving distance per charge.

Moreover, Honda is also gradually expanding to India and other regions. Overall, the development of electrification covers the entire energy sector: on the road, in the air, on the river and at sea.

Conclusion: I think it is now a matter of who turns faster. There is no reason not to turn quickly. The main point is to invest a large amount of resources, which is an inevitable choice.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.